Verint Receives Notification From Nasdaq Due to Late Filing of Form 10-Q

June 16 2006 - 8:00AM

Business Wire

Verint Systems Inc. (Nasdaq: VRNT) ("Verint" or the "Company")

today announced that the Company received a letter on June 13, 2006

from The Nasdaq Stock Market indicating that the Company's failure

to file with the Securities and Exchange Commission the Company's

Quarterly Report on Form 10-Q for the period ended April 30, 2006

on the required date could serve as an additional basis for the

delisting of Verint's securities from Nasdaq, under Nasdaq

Marketplace Rule 4310(c)(14). Nasdaq Marketplace Rule 4310(c)(14)

requires the Company to make on a timely basis all filings with the

Securities and Exchange Commission, as required by the Securities

Exchange Act of 1934, as amended. Verint did not file its Quarterly

Report on Form 10-Q for the fiscal quarter ended April 30, 2006 on

the required filing date for the reasons previously announced by

Verint relating to the ongoing investigation by a special committee

of the Board of Directors of Comverse Technology, Inc.

("Comverse"), the 57% stockholder of Verint, of Comverse's stock

option practices and its preliminary conclusion that the actual

dates of measurement for certain past awards granted by Comverse

differed from the recorded grant dates for such awards, and the

potential impact of such stock option practices on Verint's

Financial Statements. As previously disclosed by Verint, due to the

delay in the filing of Verint's Annual Report on Form 10-K for the

fiscal year ended January 31, 2006, as well as Verint's failure to

file a Current Report on Form 8-K/A, which would have amended the

Current Report on Form 8-K dated January 9, 2006 to include the

financial information required by Form 8-K in connection with the

January 9, 2006 acquisition by Verint of MultiVision Intelligence

Surveillance Limited's networked video security business, Verint

had received a Staff Determination Letter from The Nasdaq Stock

Market indicating that Verint's securities were subject to

delisting, unless Verint requested a hearing before the Nasdaq

Listing Qualifications Panel. Verint requested a hearing and

presented its plan to regain compliance with Nasdaq's filing

requirement at an in-person hearing before the Nasdaq Panel. The

Nasdaq Panel has not yet issued a decision as a result of that

hearing. Verint intends to submit to the Nasdaq Panel, within the

permissible timeframe, its plan to file the Form 10-Q for the

quarterly period ended April 30, 2006. It is expected that the

Nasdaq Panel's hearing decision will address the late Form 8-K, the

late Form 10-K and late Form 10-Q filings referenced above.

However, there can be no assurance that the Nasdaq Panel will grant

Verint's request for continued listing on Nasdaq. About Verint

Systems Inc. Verint(R) Systems Inc., headquartered in Melville, New

York, is a leading provider of analytic software-based solutions

for security and business intelligence. Verint software, which is

used by over 1,000 organizations in over 50 countries worldwide,

generates actionable intelligence through the collection, retention

and analysis of voice, fax, video, email, Internet and data

transmissions from multiple communications networks. Verint is a

subsidiary of Comverse Technology, Inc. (NASDAQ: CMVT). Visit us at

our website www.verint.com. Note: Certain statements concerning

Verint's future revenues, earnings per share, results or prospects

are "forward-looking statements" under the Private Securities

Litigation Reform Act of 1995. There can be no assurances that

forward-looking statements will be achieved, and actual results

could differ materially from forecasts and estimates. Important

risks, uncertainties and other important factors that could cause

actual results to differ materially include, among others:

potential impact on Verint's financial results related to

Comverse's creation of a special committee of the Board of

Directors of Comverse to review matters relating to grants of

Comverse stock options, including but not limited to, the accuracy

of the stated dates of Comverse option grants and whether Comverse

followed all of its proper corporate procedures and the results of

the Comverse special committee's review; the effect of Verint's

failure to timely file all required reports under the Securities

Exchange Act of 1934, and the resultant potential delisting of

Verint's common stock from Nasdaq; introducing quality products on

a timely basis that satisfy customer requirements and achieve

market acceptance; lengthy and variable sales cycles create

difficulty in forecasting the timing of revenue; integrating the

business and personnel of CM Insight; risks associated with

significant foreign operations, including fluctuations in foreign

currency exchange rates; aggressive competition in all of Verint's

markets, which creates pricing pressure; integrating the business

and personnel of MultiVision, including implementation of adequate

internal controls; managing our expansion in the Asia Pacific

region; risks that Verint's intellectual property rights may not be

adequate to protect its business or that others may claim that

Verint infringes upon their intellectual property rights; risks

associated with integrating the business and employees of Opus and

RP Sicherheissysteme GMBH; risks associated with Verint's ability

to retain existing personnel and recruit and retain qualified

personnel in all geographies in which Verint operates; decline in

information technology spending; changes in the demand for Verint's

products; challenges in increasing gross margins; risks associated

with changes in the competitive or regulatory environment in which

Verint operates; dependence on government contracts; expected

increase in Verint's effective tax rate; perception that Verint

improperly handles sensitive or confidential information; inability

to maintain relationships with value added resellers and systems

integrators; difficulty of improving Verint's infrastructure in

order to be able to continue to grow; risks associated with

Comverse Technology, Inc. controlling Verint's business and

affairs; and other risks described in filings with the Securities

and Exchange Commission. All documents are available through the

SEC's Electronic Data Gathering Analysis and Retrieval system

(EDGAR) at www.sec.gov or from Verint's website at www.verint.com.

Verint makes no commitment to revise or update any forward-looking

statements except as otherwise required by law. Verint, the Verint

word mark, Actionable Intelligence, Powering Actionable

Intelligence, STAR-GATE, RELIANT, NEXTIVA, LORONIX, SmartSight,

Lanex and ULTRA are trademarks of Verint Systems Inc. Other names

may be trademarks of their respective owners.

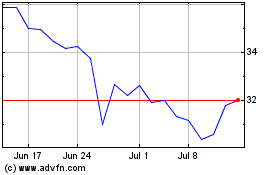

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From May 2024 to Jun 2024

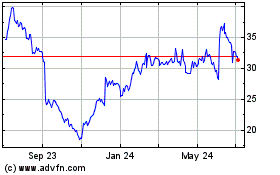

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2023 to Jun 2024