United Security Bancshares Announces Stock Repurchase Plan

February 25 2004 - 11:24AM

PR Newswire (US)

United Security Bancshares Announces Stock Repurchase Plan FRESNO,

Calif., Feb. 25 /PRNewswire-FirstCall/ -- Dennis R. Woods,

President and Chief Executive Officer of United Security Bancshares

, http://www.unitedsecuritybank.com/ , announced today that the

Board of Directors approved a plan to repurchase, as conditions

warrant, up to 276,500 shares of the Company's common stock on the

open market or in privately negotiated transactions. The repurchase

plan represents approximately 5.00% of the Company's currently

outstanding common stock. The duration of the program is open-ended

and the timing of purchases will depend on market conditions. The

Board approved a similar repurchase plan in 2001 consisting of

280,000 shares. Concurrent with the approval of the new repurchase

plan, the Board canceled the remaining 64,577 shares under the

earlier repurchase plan. Woods stated, "This stock repurchase

program is being implemented to provide management with an

additional tool to optimize the Company's use of equity capital and

enhance shareholder value. United Security Bancshares' strong

capital position and considerable allowance for loan loss reserve

supports this new program." United Security Bancshares is the

holding company for United Security Bank which operates seven

branches and four loan centers in Fresno and Madera counties. The

Bank will open its eighth branch in March 2004 in downtown Fresno

and expects to open its ninth and tenth offices in April after

completing a merger with Taft National Bank. Forward-Looking

Statements This news release contains forward-looking statements

about the company for which the company claims the protection of

the safe harbor provisions contained in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are based

on management's knowledge and belief as of today and include

information concerning the company's possible or assumed future

financial condition, and its results of operations, business and

earnings outlook. These forward-looking statements are subject to

risks and uncertainties. A number of factors, some of which are

beyond the company's ability to control or predict, could cause

future results to differ materially from those contemplated by such

forward-looking statements. These factors include (1) changes in

interest rates, (2) significant changes in banking laws or

regulations, (3) increased competition in the company's market, (4)

other-than-expected credit losses, (5) earthquake or other natural

disasters impacting the condition of real estate collateral, (6)

the effect of acquisitions and integration of acquired businesses,

(7) the impact of proposed and/or recently adopted changes in

regulatory, judicial, or legislative tax treatment of business

transactions, particularly recently enacted California tax

legislation and the subsequent Dec. 31, 2003, announcement by the

Franchise Tax Board regarding the taxation of REITs and RICs; and

(8) unknown economic impacts caused by the State of California's

budget issues. Management cannot predict at this time the severity

or duration of the effects of the recent business slowdown on our

specific business activities and profitability. Weaker or a further

decline in capital and consumer spending, and related recessionary

trends could adversely affect our performance in a number of ways

including decreased demand for our products and services and

increased credit losses. Likewise, changes in deposit interest

rates, among other things, could slow the rateof growth or put

pressure on current deposit levels. Forward-looking statements

speak only as of the date they are made, and the company does not

undertake to update forward-looking statements to reflect

circumstances or events that occur after the date the statements

are made, or to update earnings guidance including the factors that

influence earnings. DATASOURCE: United Security Bancshares CONTACT:

Dennis R. Woods, +1-559-248-4928, for United Security Bancshares

Web site: http://www.unitedsecuritybank.com/

Copyright

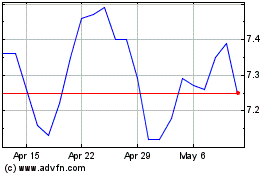

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Apr 2024 to May 2024

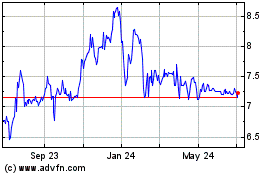

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From May 2023 to May 2024