false000151567300015156732023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 02, 2023 |

Ultragenyx Pharmaceutical Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36276 |

27-2546083 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

60 Leveroni Court |

|

Novato, California |

|

94949 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 415 483-8800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

RARE |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, Ultragenyx Pharmaceutical Inc. issued a press release announcing its financial results for the three months ended September 30, 2023 (the “Press Release”). A copy of the Press Release is furnished herewith as Exhibit 99.1

The information set forth under Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Ultragenyx Pharmaceutical Inc. |

|

|

|

|

Date: |

November 2, 2023 |

By: |

/s/ Howard Horn |

|

|

|

Howard Horn

Executive Vice President, Chief Financial Officer, Corporate Strategy

(Principal Financial Officer) |

Exhibit 99.1

Contacts Ultragenyx Pharmaceutical Inc.

Investors

Joshua Higa

ir@ultragenyx.com

Media

Jeff Blake

media@ultragenyx.com

Ultragenyx Reports Third Quarter 2023 Financial Results and Corporate Update

Third quarter 2023 total revenue of $98.1 million, Crysvita® revenue of $74.9 million and Dojolvi® revenue of $16.6 million

Reaffirmed 2023 expected total revenue guidance between $425 million to $450 million, Crysvita revenue of $325 million to $340 million, and Dojolvi revenue of $65 million to $75 million

Presented positive updates on three lead clinical programs at Analyst Day in October

NOVATO, Calif. – November 02, 2023 – Ultragenyx Pharmaceutical Inc. (NASDAQ: RARE), a biopharmaceutical company focused on the development and commercialization of novel products for serious rare and ultrarare genetic diseases, today reported its financial results for the quarter ended September 30, 2023 and provided its financial guidance for the year.

"We're in a strong financial position due to growing demand for our commercial products, completion of our recent offering, and our disciplined expense and portfolio management," said Emil D. Kakkis, M.D., Ph.D., chief executive officer and president of Ultragenyx. "We've also made significant progress on our key clinical programs and highlighted new, interim data from UX143 for osteogenesis imperfecta, GTX-102 for Angelman syndrome, and UX701 for Wilson Disease at our Analyst Day in October demonstrating promising therapeutic potential in these larger indications with further updates to come in 2024."

Third Quarter 2023 Selected Financial Data Tables and Financial Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues (dollars in thousands), (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Crysvita |

|

|

|

|

|

|

|

|

|

|

|

Product sales |

$ |

19,200 |

|

|

$ |

13,184 |

|

|

$ |

57,318 |

|

|

$ |

34,980 |

|

Royalty revenue |

|

35,160 |

|

|

|

— |

|

|

|

64,221 |

|

|

|

— |

|

Non-cash royalty revenue |

|

20,543 |

|

|

|

5,373 |

|

|

|

42,695 |

|

|

|

15,634 |

|

Revenue in profit-share territory |

|

— |

|

|

|

51,348 |

|

|

|

69,705 |

|

|

|

148,121 |

|

Total Crysvita revenue |

|

74,903 |

|

|

|

69,905 |

|

|

|

233,939 |

|

|

|

198,735 |

|

Dojolvi |

|

16,553 |

|

|

|

13,274 |

|

|

|

47,347 |

|

|

|

39,200 |

|

Mepsevii |

|

5,633 |

|

|

|

6,045 |

|

|

|

22,552 |

|

|

|

15,839 |

|

Evkeeza |

|

963 |

|

|

|

— |

|

|

|

1,540 |

|

|

|

— |

|

Daiichi Sankyo |

|

— |

|

|

|

1,479 |

|

|

|

1,479 |

|

|

|

6,207 |

|

Total revenues |

$ |

98,052 |

|

|

$ |

90,703 |

|

|

$ |

306,857 |

|

|

$ |

259,981 |

|

Total Revenues

Ultragenyx reported $98.1 million in total revenue for the third quarter 2023, which represents 8% growth compared to the third quarter 2022. Third quarter 2023 Crysvita product sales, primarily in Latin America, were $19.2 million, which represents 46% growth compared to the same period in 2022 and 14% growth over the second quarter 2023. Third quarter 2023 also includes Crysvita royalty and non-cash royalty revenue in North America of $50.2 million, which was impacted by a decrease in channel inventory related to Kyowa Kirin Co., Ltd.’s (KKC) change from Ultragenyx labeled product to KKC’s labeled product as part of the transition of North America commercialization responsibilities for Crysvita from Ultragenyx to KKC. This one-time change occurred in the third quarter 2023, and the Company expects Crysvita channel inventories to increase to more normal levels at the end of the year. Third quarter 2023 non-cash royalty revenue in Europe was $5.5 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Financial Data (dollars in thousands, except per share amounts), (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Total revenues |

$ |

98,052 |

|

|

$ |

90,703 |

|

|

$ |

306,857 |

|

|

$ |

259,981 |

|

Operating expense: |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

10,987 |

|

|

|

8,631 |

|

|

|

33,158 |

|

|

|

23,001 |

|

Research and development |

|

157,245 |

|

|

|

237,297 |

|

|

|

487,892 |

|

|

|

534,981 |

|

Selling, general and administrative |

|

74,917 |

|

|

|

69,841 |

|

|

|

232,966 |

|

|

|

205,290 |

|

Total operating expense |

|

243,149 |

|

|

|

315,769 |

|

|

|

754,016 |

|

|

|

763,272 |

|

Net loss |

$ |

(159,649 |

) |

|

$ |

(245,106 |

) |

|

$ |

(483,449 |

) |

|

$ |

(555,588 |

) |

Net loss per share, basic and diluted |

$ |

(2.23 |

) |

|

$ |

(3.50 |

) |

|

$ |

(6.81 |

) |

|

$ |

(7.96 |

) |

Operating Expenses

Total operating expenses for the third quarter of 2023 were $243.1 million, including non-cash stock-based compensation of $34.9 million. In 2023, annual operating expenses are expected to

2

decrease compared to 2022, as the company manages headcount and increases operational leverage while executing on its high-value programs.

Net Loss

For the third quarter of 2023, Ultragenyx reported net loss of $159.6 million, or $2.23 per share basic and diluted, compared with a net loss for the third quarter of 2022 of $245.1 million, or $3.50 per share, basic and diluted.

Cash, Cash Equivalents and Marketable Debt Securities

Cash, cash equivalents, and marketable debt securities were $524.2 million as of September 30, 2023. This excludes net proceeds of $326.5 million from an underwritten public offering of common stock and pre-funded warrants that closed in October 2023.

2023 Financial Guidance

For the full year 2023, the company expects:

•Total revenue in the range of $425 million to $450 million

•Crysvita revenue in the range of $325 million to $340 million. This includes all regions where Ultragenyx will recognize revenue, including the royalties in Europe, which have been ongoing, and the royalties in North America, which began in April 2023.

•Dojolvi revenue in the range of $65 million to $75 million

•Net Cash Used in Operations to be around $425 million

Recent Updates and Clinical Milestones

UX143 (setrusumab) monoclonal antibody for Osteogenesis Imperfecta (OI): Phase 2 demonstrated 67% reduction in annualized fracture rate and continuous improvements in bone mineral density

At the American Society of Bone and Mineral Research 2023 Annual Meeting (ASBMR), interim data from the Phase 2 portion of the Phase 2/3 Orbit study were presented that demonstrated treatment with setrusumab significantly reduced incidence of fractures in patients with OI with at least 6 months of follow-up and continued to demonstrate ongoing and meaningful improvements in lumbar spine bone mineral density (BMD). As of the cut-off date on August 4, 2023 and following at least six months of treatment with setrusumab, the annualized fracture rate across all 24 patients in the Phase 2 portion of the study was reduced by 67%. The median annualized fracture rate of 0.72 in the two years prior to treatment was reduced to 0.00 (n=24, p=0.042) during the mean treatment duration period of nine months. As of the data cut-off, there were no treatment-related serious adverse events (SAEs) observed in the study. Additional longer-term Phase 2 data are expected in 2024.

Patients are being dosed in the late-stage clinical trials, Orbit and Cosmic, which evaluate setrusumab in pediatric and young adult patients with OI. The Phase 3 portion of the Orbit study is targeting to enroll up to 195 patients at more than 50 sites across 12 countries. The

3

Phase 3 Cosmic study is an active-controlled study evaluating the effect of setrusumab compared to intravenous bisphosphonate (IV-BP) therapy on annualized total fracture rate in patients aged 2 to <5 years. Cosmic is targeting to enroll approximately 65 patients at more than 20 global sites.

GTX-102 antisense oligonucleotide for Angelman syndrome: data from extension cohorts in Phase 1/2 study showed clinically meaningful improvements in multiple domains

In October 2023, interim data from the extension cohorts (Cohorts 4-7) in the ongoing Phase 1/2 for GTX-102 in Angelman syndrome were presented at an Analyst Day event. The data showed improvements across multiple domains compared to natural history data, where available, and clinical changes were associated with quantitative changes in EEG. Long-term data showed patients who stopped and restarted treatment reacquired previously gained developmental skills when they were re-dosed with the current regimen. As of the data cut-off, there have been no additional treatment-related SAEs, including lower extremity weakness, since November 2022.

Globally, sites are dosing patients in the expansion cohorts (Cohorts A-E), which will evaluate the same safety, pharmacokinetic, and efficacy measures as the extension cohorts. Data from at least 20 patients enrolled in the expansion cohorts, who have been on therapy for six months or more, are currently expected in the first half of 2024.

UX701 AAV gene therapy for Wilson Disease: Stage 1 of pivotal clinical study dosing patients; expect Stage 1 enrollment completion around the end of the year

In October 2023, interim data from the first dose cohort (5.0 x 10^12 GC/kg) in the ongoing Cyprus2+ study for UX701 in Wilson disease were presented at an Analyst Day event. The company announced four out of five patients in Cohort 1 had reductions in urinary copper and were tapering off of chelators and/or zinc therapy, including two of three earlier treated patients in the cohort that are now completely off standard of care therapy. As of the data cut-off, UX701 had been generally well-tolerated with no treatment-related SAEs.

Dosing in the second of three dose escalation cohorts in the pivotal study has been completed. The data safety monitoring board (DSMB) is scheduled to meet and will review the available safety data from Cohort 2 before making a recommendation on escalating to Cohort 3 of Stage 1 in this study. Stage 1 is currently on track to complete enrollment around the end of the year and these data are expected in the first half of 2024. During this stage, the safety and efficacy of UX701 will be evaluated and a dose will be selected for further evaluation in the pivotal, randomized, placebo-controlled stage of the study.

DTX401 AAV gene therapy for Glycogen Storage Disease Type Ia (GSDIa): Dosing in Phase 3 study complete

In May 2023, Ultragenyx announced the last patient had been dosed in the Phase 3 study. The 48-week study has fully enrolled patients eight years of age and older, randomized 1:1 to

4

DTX401 or placebo. The primary endpoint is the reduction in oral glucose replacement with cornstarch while maintaining glucose control. Phase 3 data are expected in the first half of 2024.

DTX301 AAV gene therapy for Ornithine Transcarbamylase (OTC) Deficiency: Phase 3 study dosing patients

Ultragenyx is randomizing and dosing patients in the ongoing Phase 3 study. The pivotal, 64-week study will include approximately 50 patients, randomized 1:1 to DTX301 or placebo. The primary endpoints are response as measured by removal of ammonia-scavenger medications and protein-restricted diet and change in 24-hour ammonia levels. Enrollment is currently expected to be completed in the first half of 2024.

Conference Call and Webcast Information

Ultragenyx will host a conference call today, Thursday, November 2, 2023, at 2 p.m. PT/5 p.m. ET to discuss the third quarter 2023 financial results and provide a corporate update. The live and replayed webcast of the call will be available through the company’s website at https://ir.ultragenyx.com/events-presentations. To participate in the live call, please register by clicking on the following link (https://edge.media-server.com/mmc/p/t97kpsfo), and you will be provided with dial-in details. The replay of the call will be available for one year.

About Ultragenyx

Ultragenyx is a biopharmaceutical company committed to bringing novel therapies to patients for the treatment of serious rare and ultrarare genetic diseases. The company has built a diverse portfolio of approved medicines and treatment candidates aimed at addressing diseases with high unmet medical need and clear biology, for which there are typically no approved therapies treating the underlying disease.

The company is led by a management team experienced in the development and commercialization of rare disease therapeutics. Ultragenyx’s strategy is predicated upon time- and cost-efficient drug development, with the goal of delivering safe and effective therapies to patients with the utmost urgency.

For more information on Ultragenyx, please visit the company's website at: www.ultragenyx.com.

Forward-Looking Statements and Use of Digital Media

Except for the historical information contained herein, the matters set forth in this press release, including statements related to Ultragenyx's expectations and projections regarding its future

5

operating results and financial performance, anticipated cost or expense reductions, the timing, progress and plans for its clinical programs and clinical studies, future regulatory interactions, and the components and timing of regulatory submissions are forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve substantial risks and uncertainties that could cause our clinical development programs, collaboration with third parties, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the uncertainty of clinical drug development and unpredictability and lengthy process for obtaining regulatory approvals, risks related to serious or undesirable side effects of our product candidates, the company’s ability to achieve its projected development goals in its expected timeframes, risks related to reliance on third party partners to conduct certain activities on the company’s behalf, our limited experience in generating revenue from product sales, risks related to product liability lawsuits, our dependence on Kyowa Kirin for the commercial supply of Crysvita, fluctuations in buying or distribution patterns from distributors and specialty pharmacies, the transition back to Kyowa Kirin of our exclusive rights to promote Crysvita in the United States and Canada and unexpected costs, delays, difficulties or adverse impact to revenue related to such transition, smaller than anticipated market opportunities for the company’s products and product candidates, manufacturing risks, competition from other therapies or products, and other matters that could affect sufficiency of existing cash, cash equivalents and short-term investments to fund operations, the company’s future operating results and financial performance, the timing of clinical trial activities and reporting results from same, and the availability or commercial potential of Ultragenyx’s products and drug candidates. Ultragenyx undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Ultragenyx in general, see Ultragenyx's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on August 4, 2023, and its subsequent periodic reports filed with the SEC.

In addition to its SEC filings, press releases and public conference calls, Ultragenyx uses its investor relations website and social media outlets to publish important information about the company, including information that may be deemed material to investors, and to comply with its disclosure obligations under Regulation FD. Financial and other information about Ultragenyx is routinely posted and is accessible on Ultragenyx’s Investor Relations website (https://ir.ultragenyx.com/) and LinkedIn website (https://www.linkedin.com/company/ultragenyx-pharmaceutical-inc-/mycompany/).

###

6

Ultragenyx Pharmaceutical Inc.

Selected Statement of Operations Financial Data

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

Product sales |

$ |

42,349 |

|

|

$ |

32,503 |

|

|

$ |

128,757 |

|

|

$ |

90,019 |

|

Royalty revenue |

|

55,703 |

|

|

|

5,373 |

|

|

|

106,916 |

|

|

|

15,634 |

|

Collaboration and license |

|

— |

|

|

|

52,827 |

|

|

|

71,184 |

|

|

|

154,328 |

|

Total revenues |

|

98,052 |

|

|

|

90,703 |

|

|

|

306,857 |

|

|

|

259,981 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

10,987 |

|

|

|

8,631 |

|

|

|

33,158 |

|

|

|

23,001 |

|

Research and development |

|

157,245 |

|

|

|

237,297 |

|

|

|

487,892 |

|

|

|

534,981 |

|

Selling, general and administrative |

|

74,917 |

|

|

|

69,841 |

|

|

|

232,966 |

|

|

|

205,290 |

|

Total operating expenses |

|

243,149 |

|

|

|

315,769 |

|

|

|

754,016 |

|

|

|

763,272 |

|

Loss from operations |

|

(145,097 |

) |

|

|

(225,066 |

) |

|

|

(447,159 |

) |

|

|

(503,291 |

) |

Change in fair value of equity investments |

|

(1,419 |

) |

|

|

(1,626 |

) |

|

|

(1,492 |

) |

|

|

(21,139 |

) |

Non-cash interest expense on liability related to the sale

of future royalties |

|

(17,665 |

) |

|

|

(14,505 |

) |

|

|

(48,676 |

) |

|

|

(27,141 |

) |

Other income, net |

|

5,182 |

|

|

|

2,378 |

|

|

|

15,755 |

|

|

|

3,130 |

|

Loss before income taxes |

|

(158,999 |

) |

|

|

(238,819 |

) |

|

|

(481,572 |

) |

|

|

(548,441 |

) |

Provision for income taxes |

|

(650 |

) |

|

|

(6,287 |

) |

|

|

(1,877 |

) |

|

|

(7,147 |

) |

Net loss |

$ |

(159,649 |

) |

|

$ |

(245,106 |

) |

|

$ |

(483,449 |

) |

|

$ |

(555,588 |

) |

Net loss per share, basic and diluted |

$ |

(2.23 |

) |

|

$ |

(3.50 |

) |

|

$ |

(6.81 |

) |

|

$ |

(7.96 |

) |

Weighted-average shares used in computing net loss per share,

basic and diluted |

|

71,664,493 |

|

|

|

70,054,173 |

|

|

|

70,987,801 |

|

|

|

69,834,037 |

|

7

Ultragenyx Pharmaceutical Inc.

Selected Activity included in Operating Expenses

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Non-cash stock-based compensation |

$ |

34,877 |

|

|

$ |

35,761 |

|

|

$ |

101,469 |

|

|

$ |

101,013 |

|

In-process research and development expense from

GeneTx acquisition |

|

— |

|

|

$ |

75,234 |

|

|

|

— |

|

|

$ |

75,234 |

|

UX143 clinical milestone |

|

— |

|

|

|

— |

|

|

$ |

9,000 |

|

|

|

— |

|

Ultragenyx Pharmaceutical Inc.

Selected Balance Sheet Financial Data

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

2023 |

|

|

2022 |

|

Balance Sheet Data: |

|

|

|

|

|

Cash, cash equivalents, and marketable debt securities |

$ |

524,165 |

|

|

$ |

896,732 |

|

Working capital |

|

345,210 |

|

|

|

622,689 |

|

Total assets |

|

1,238,140 |

|

|

|

1,545,444 |

|

Total stockholders' equity |

|

31,714 |

|

|

|

352,494 |

|

8

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

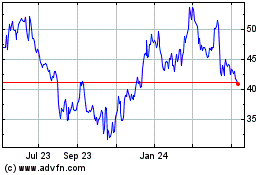

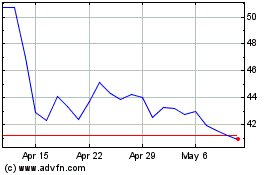

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Historical Stock Chart

From Apr 2024 to May 2024

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Historical Stock Chart

From May 2023 to May 2024