Current Report Filing (8-k)

December 20 2019 - 5:01PM

Edgar (US Regulatory)

TRACTOR SUPPLY CO /DE/false000091636500009163652019-12-202019-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 20, 2019 (December 17, 2019)

Tractor Supply Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

000-23314

|

13-3139732

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

5401 Virginia Way, Brentwood, Tennessee 37027

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (615) 440-4000

|

|

|

|

|

Not Applicable

|

|

Former name or former address, if changed since last report

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 ((§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [☐]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [☐]

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.008 par value

|

|

TSCO

|

|

NASDAQ Global Select Market

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously reported in the Current Report on Form 8-K filed by Tractor Supply Company (the “Company”) on December 6, 2019, the Company intended to enter into a transition agreement with Gregory A. Sandfort (“Executive”), the Company’s Chief Executive Officer, in order to set forth the rights and obligations of the Company and Executive in connection with the retirement of Executive and appointment of Harry A. Lawton III (“Mr. Lawton”) as Executive’s successor.

On December 17, 2019 (the “Effective Date”), the Company entered into the transition agreement (the “Transition Agreement”) with Executive, who will continue to serve as the Company’s Chief Executive Officer until January 12, 2020. Pursuant to the Transition Agreement, Executive has agreed to continue his employment with the Company in the capacity of a Strategic Advisor during the period (the “Employment Transition Period”) from January 13, 2020 until February 29, 2020 (the “Employment Termination Date”) and to serve as a Consultant to the Company during the period (the “Consultation Transition Period”) from March 1, 2020 to August 31, 2020 (the “Consulting Termination Date”) in order to assist in the orderly transition of his responsibilities to Mr. Lawton.

Unless the Board affirmatively determines in good faith that Executive has not complied with the terms of the transition plan in all material respects during the Employment Transition Period, Executive shall be entitled to the benefits provided in connection with Executive’s retirement pursuant to the Second Amended and Restated Employment Agreement, dated August 22, 2019, by and between the Company and Executive (the “Employment Agreement”) as of the Employment Termination Date which include the following:

•Any unpaid Base Salary (as defined in the Employment Agreement) and benefits to be paid or provided to Executive through the Employment Termination Date;

•A lump sum payment, in cash, equal to the estimated cost of procuring for the Executive and his dependents: life, disability, accident and health insurance benefits for a period of two (2) years following the Employment Termination Date;

•Any other unpaid benefits to which Executive is otherwise entitled under any other plan, policy or program of the Company (including any retirement plan) applicable to Executive as of the Employment Termination Date, in accordance with the terms of such plan, policy or program;

•All then outstanding options to acquire stock of the Company and all then outstanding restricted shares of stock and restricted stock units of the Company held by the Executive shall be fully vested, and all performance share units, performance-based restricted stock and performance-based restricted stock units will vest according to the terms of the applicable award agreement; and

•Any vested options held by Executive shall remain exercisable until the earlier of (a) the third anniversary of the Employment Termination Date (except in the case of Executive’s death during such period, in which event the options shall be exercisable until the earlier of the second anniversary of the date of Executive’s death and the third anniversary of the Employment Termination Date) and (b) the otherwise applicable normal expiration date of such option.

During the Employment Transition Period, Executive shall continue to receive his base salary that was in effect on the Effective Date. Executive shall also receive any bonus earned by Executive under the Company’s 2019 bonus plan and a pro-rata portion of any bonus earned under the Company’s 2020 bonus plan through January 12, 2020. During the Consulting Transition Period, Executive shall receive a monthly consulting fee of $52,083.

The foregoing description of the Transition Agreement is qualified in its entirety by reference to the Transition Agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

10.1 Transition Agreement, dated December 17, 2019, by and between Tractor Supply Company and Gregory A. Sandfort.

104 The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tractor Supply Company

|

|

|

|

|

|

|

|

December 20, 2019

|

|

By:

|

/s/ Kurt D. Barton

|

|

|

|

|

Name: Kurt D. Barton

|

|

|

|

|

Title: Executive Vice President - Chief Financial Officer and Treasurer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

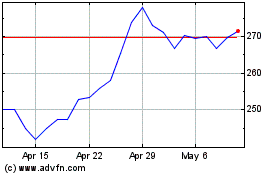

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024