false000178774000017877402023-07-242023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 24, 2023 |

Tivic Health Systems, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41052 |

81-4016391 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

25821 Industrial Blvd., Suite 100 |

|

Hayward, California |

|

94545 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 888 276-6888 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

TIVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed in that Current Report on Form 8-K filed by Tivic Health Systems, Inc. (the “Company”) with the Securities and Exchange Commission on January 27, 2023, the Company received a notification letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, because the closing bid price for the Company’s common stock was below $1.00 per share for 30 consecutive trading days, the Company is not currently in compliance with the minimum bid price requirement for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Marketplace Rule 5550(a)(2) (the “Minimum Bid Price Requirement”). In accordance with Listing Rule 5810(c)(3)(A), the Company was provided 180 calendar days, or until July 25, 2023, to regain compliance with the Minimum Bid Price Requirement.

On July 24, 2023, as expected, the Company received a new notification letter from the Listing Qualifications Department of Nasdaq notifying the Company that, as of July 21, 2023, the Company’s common stock had a closing bid price of $0.10 or less for ten consecutive trading days and that, consistent with Nasdaq Listing Rule 5810(c)(3)(A)(iii), the Staff has determined to delist the Company’s common stock from the Nasdaq Capital Market. The notice further provides that the Company has until July 31, 2023 to appeal the Staff’s decision.

On July 27, 2023, the Company submitted a request for a hearing before a Nasdaq Hearings Panel (“Panel”) to appeal the Staff’s delisting determination, which was granted and the hearing has been scheduled to occur on September 21, 2023. While the appeal process is pending, the suspension of trading of the Company’s common stock will be stayed and the Company’s common stock will continue to trade on the Nasdaq Capital Market until the hearing process concludes and the Panel issues a written decision. However, there are no assurances that an extension will be granted or that a favorable decision will be obtained from the Panel.

Item 7.01 Regulation FD Disclosure.

On July 28, 2023, the Company issued a letter to stockholders from Jennifer Ernst, the Company’s chief executive officer, addressing the Nasdaq letter and the Company’s plans to address the deficiencies and to regain compliance with the Nasdaq continued listing requirements. A copy of that press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”), and is incorporated herein by reference.

The information set forth under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Forward-Looking Statements

This Current Report, including Exhibit 99.1 attached hereto, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes,” “will” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Current Report, including Exhibit 99.1 attached hereto, or hereafter, including in other publicly available documents filed with the Securities and Exchange Commission, reports to the stockholders of the Company and other publicly available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to, the risks set forth herein and in such other documents filed with the Securities and Exchange Commission, each of which could adversely affect our business and the accuracy of the forward-looking statements contained herein. Our actual results, performance or achievements may differ materially from those expressed or implied by such forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TIVIC HEALTH SYSTEMS, INC. |

|

|

|

|

Date: |

July 28, 2023 |

By: |

/s/ Jennifer Ernst |

|

|

|

Name: Jennifer Ernst

Title: Chief Executive Officer |

Exhibit 99.1

PRESS RELEASE

Letter from the CEO of Tivic Health, Jennifer Ernst.

Tivic Health CEO Provides Additional Information regarding the Company’s Current Report on Form 8-K

SAN FRANCISCO – July 28, 2023 – Tivic Health® Systems, Inc. (“Tivic”, Nasdaq: TIVC), a health tech company that develops and commercializes bioelectronic medicine, today issued the following letter from the CEO, Jennifer Ernst, providing additional information regarding the company’s current report on Form 8-K filed with the SEC this afternoon.

Dear Investors and Stakeholders in Tivic,

As CEO of Tivic Health, I feel it is my duty to provide clarity to investors regarding the information included in the Current Report on Form 8-K we filed with the SEC today, pertaining to a Notice of Delisting. I have every confidence that this matter will be resolved by mid-August and wish to share the following information to assist investors.

This afternoon, Tivic filed a Current Report on Form 8-K stating have received a notification letter from the Listing Qualifications Department of Nasdaq. Pursuant to Nasdaq Listing Rule 5810(c)(3)(A)(iii), the Staff has determined to delist the company’s common stock from the Nasdaq Capital Market as a result of the common stock closing at a price of $0.10 or below for ten consecutive trading days.

First, I want to note that we anticipated receipt of this mandatory formal notice from Nasdaq and have taken steps to resolve the issue by mid-August.

We have requested a hearing to appeal the determination, which has been granted and scheduled for September 21, 2023. While the appeal process is pending, the suspension of trading will be stayed, and our common stock will continue to trade on the Nasdaq Capital Market.

Following is a summary of the steps that led to the receipt of this notification and the actions we have taken to resolve the deficiency:

•In January 2023, Tivic was notified by Nasdaq that the closing price of our common stock was below $1.00 for 30 consecutive trading days, and Tivic was provided a 6-month grace period to regain compliance with Nasdaq minimum bid price requirements.

•At the annual meeting of stockholders convened on June 6, 2023, and adjourned in part to June 14, 2023, the Tivic Board of Directors recommended a measure authorizing the Board to enact a reverse stock split in order to remedy the minimum bid price deficiency.

•Approximately 87% of the votes received at the annual stockholder meeting, or approximately 14 million shares, voted in favor of the measure. Unfortunately, the measure required a favorable vote from a majority of the shares of Tivic’s outstanding common stock.

•Given the limited votes received in response to proxy solicitations, the votes in favor amounted to approximately 47% of Tivic’s issued and outstanding shares.

•Therefore, the measure did not pass and we began taking additional steps to regain compliance with the Nasdaq rules.

•On July 10, 2023, following the annual stockholder meeting, the company closed a public offering of its securities, in connection with which, investors in the offering contractually agreed to vote in favor of a similar reverse stock split measure at an upcoming special stockholder meeting.

Looking ahead, the company’s special stockholder meeting has been set for August 11, 2023, at 10:00 AM Pacific (1:00 PM Eastern). Proxies have been mailed out, and we strongly urge all investors to vote in favor of the reverse split authorization, consistent with ISS guidance on the proxy.

We are confident that, with the contractually obligated votes, we will secure sufficient support at the special stockholder meeting to approve the reverse stock split measure. This would then allow us to implement a reverse stock split and regain compliance with the Nasdaq rules shortly after the stockholder meeting. Although no guarantees can be offered, this process is well underway and will allow us to regain compliance well in advance of the September hearing date.

Maintaining our NASDAQ listing is our top priority. Throughout this process, our management, board of directors, and company counsel have been working tirelessly to protect our Nasdaq listing. We have also been actively communicating with Nasdaq at each critical stage, and we anticipate a quick resolution to this issue as we move past receipt of the mandatory notification.

Meanwhile, we have taken several other measures to fortify Tivic's position. We have undertaken a reduction in force, conducted internal restructuring, and bolstered our leadership team with experts experienced in public company turnaround, M&A, and growth.

Our mission at Tivic Health - to fight disease, enhance health, and increase the vibrancy of life through the advancement of bioelectronic medicine - remains stronger than ever. The core of this mission guides us as we continue to evaluate ways to create and enhance new shareholder value.

I am sincerely grateful for the commitment that our extended team and investors have shown, especially during challenging times.

Specifically, I want to thank our team, our legal counsel, our extensive network of collaborators and champions, our key contacts at Nasdaq, as well as the investors that have remained bullish on the company even through our difficult times. These are the battles worth fighting as we work to deliver an increasing array of therapeutic solutions that address unmet clinical needs.

In conclusion, I reiterate our confidence in regaining our good standing with Nasdaq and look forward to resolving this matter in an expedient fashion.

With deepest gratitude,

Jennifer Ernst

CEO, Tivic Health

About Tivic

Tivic is a commercial health tech company advancing the field of bioelectronic medicine. Tivic’s patented technology platform leverages stimulation on the trigeminal, sympathetic, and vagus nerve structures. Tivic’s non-invasive and targeted approach to the treatment of inflammatory chronic health conditions gives consumers and providers drug-free therapeutic solutions with high safety profiles, low risk, and broad applications. Tivic’s first commercial product ClearUP is an FDA approved, award-winning, handheld bioelectronic sinus device. ClearUP is clinically proven, doctor-recommended, and is available through online retailers and commercial distributors. For more information visit http://tivichealth.com @TivicHealth

Forward-Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Tivic Health Systems, Inc.’s current expectations and are subject to inherent uncertainties, risks, and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: our receipt of sufficient votes to approve a reverse stock split at the upcoming special meeting of stockholders; Nasdaq’s acceptance of our appeal and grant of additional time to regain compliance with the minimum bid price requirement; the effectiveness of the reverse stock split; the company’s financial condition; market,

economic and other conditions; macroeconomic factors, including inflation; and unexpected costs, charges or expenses that reduce Tivic’s capital resources. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Tivic’s actual results to differ from those contained in the forward-looking statements, see Tivic’s filings with the SEC, including, its Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 31, 2023, under the heading “Risk Factors”; as well as the company’s subsequent filings with the SEC. Forward-looking statements contained in this press release are made as of this date, and Tivic Health Systems, Inc. undertakes no duty to update such information except as required by applicable law.

Media Contact:

Kayleigh Westerfield

Kayleigh.Westerfield@tivichealth.com

Investor Contact:

Hanover International, Inc.

ir@tivichealth.com

v3.23.2

Document And Entity Information

|

Jul. 24, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 24, 2023

|

| Entity Registrant Name |

Tivic Health Systems, Inc.

|

| Entity Central Index Key |

0001787740

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-41052

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-4016391

|

| Entity Address, Address Line One |

25821 Industrial Blvd.,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Hayward

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94545

|

| City Area Code |

888

|

| Local Phone Number |

276-6888

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

TIVC

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

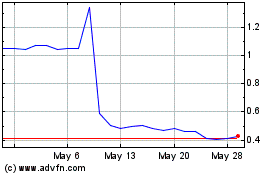

Tivic Health Systems (NASDAQ:TIVC)

Historical Stock Chart

From Apr 2024 to May 2024

Tivic Health Systems (NASDAQ:TIVC)

Historical Stock Chart

From May 2023 to May 2024