TechTarget, Inc. (NASDAQ: TTGT) today announced financial

results for the three months ended September 30, 2011.

“Despite the continued challenging macro-economic conditions, we

are pleased to report revenue is up 18% and adjusted EBITDA is up

39% for the third quarter,” said Greg Strakosch, CEO of TechTarget.

“The investments that we have made in our new Activity

Intelligence™ product platform and direct international operations

continue to pay off.”

Total Q3 2011 revenues increased 18% to $25.9 million compared

to Q3 2010. Q3 2011 online revenue increased by 15% to $21.8

million compared to Q3 2010. Online revenues represented 84% of

total Q3 2011 revenues. Q3 2011 events revenue increased by 32% to

$4.1 million compared to Q3 2010 and represented 16% of total Q3

2011 revenues.

Adjusted EBITDA (earnings before interest, other income and

expense, income taxes, depreciation, and amortization, as further

adjusted to eliminate stock-based compensation) for Q3 2011

increased 39% to $5.4 million compared to $3.9 million for Q3

2010.

Total gross profit margin increased for Q3 2011 to 73%, compared

to 72% for Q3 2010. Online gross profit margin increased for Q3

2011 to 75%, compared to 74% for Q3 2010. Events gross profit

margin increased for Q3 2011 to 64%, compared to 63% for Q3

2010.

Net income was $1.0 million for Q3 2011 compared to a net loss

of $0.6 million in Q3 2010. Adjusted net income (net income

adjusted to eliminate amortization, stock-based compensation

expense and the related income tax impact of these charges) for Q3

2011 was $2.6 million compared to $2.1 million for Q3 2010. Net

income per basic share for Q3 2011 was $0.03 compared to a net loss

per basic share of $0.01 for Q3 2010. Adjusted net income per share

(adjusted net income divided by adjusted weighted average diluted

shares outstanding) for Q3 2011 was $0.06 compared to $0.05 for Q3

2010.

The Company’s balance sheet and financial position remain

strong. As of September 30, 2011, the Company’s cash, cash

equivalents and investments totaled $56.3 million, working capital

is $60.4 million, and the Company has no outstanding bank debt.

Recent Company Highlights

- Announced the release of TechTarget

Social Engage™, an innovative new social media platform that

enables technology buyers to collaborate with other buyers

simultaneously across different online media. Dell was the first

customer to take advantage of this platform for their “The power to

do more” campaign.

- Announced the launch of three new

websites aimed at the cloud market. The sites are:

SearchCloudProvider.com™. SearchCloudSecurity.com™ and

SearchCloudStorage.com™. These new sites build on the Company’s

existing portfolio of cloud and virtualization media by targeting

the specific areas of cloud computing that are experiencing the

most rapid growth and are in need of the most resources. These

sites complement the existing properties in the TechTarget cloud

and virtualization portfolio which include:

SearchCloudComputing.com™, SearchServerVirtualization.com™,

SearchVirtualDesktop.com™, SearchVirtualStorage.com™ and

BrianMadden.com™.

- Was the official media sponsor for the

fifth consecutive year at VMworld for the “Best of VMworld” Award

program in Las Vegas in September and for the second consecutive

year in Copenhagen in October.

Financial Guidance

In the fourth quarter of 2011, the Company expects total

revenues to be within the range of $28.7 million to $30.1 million;

online revenues within the range of $26.0 million to $27.0 million;

events revenues within the range of $2.7 million to $3.1 million

and adjusted EBITDA to be within the range of $8.5 million to $9.5

million.

Conference Call and Webcast

TechTarget will discuss these financial results in a conference

call at 5:00 p.m. (Eastern Time) today (November 9, 2011).

Supplemental financial information and prepared remarks for the

conference call will be posted to the Investor Information section

of our website simultaneously with this press release.

NOTE: The prepared

remarks will not be read on the conference call. The conference

call will include only brief remarks followed by questions and

answers.

The public is invited to listen to a live webcast of

TechTarget’s conference call, which can be accessed on the Investor

Relations section of our website at

http://investor.techtarget.com/. The conference call can also be

heard via telephone by dialing 888-679-8035 (US callers) or

617-213-4848 (International callers) ten minutes prior to the

call and referencing participant pass code 70165315 for both

domestic and international callers. Participants may pre-register

for the call at:

https://www.theconferencingservice.com/prereg/key.process?key=PKY9Y7T7L.

Pre-registrants will be issued a pin number to use when dialing

into the live call which will provide quick access to the

conference by bypassing the operator upon connection. (Due to the

length of the above URL, it may be necessary to copy and paste it

into your Internet browser’s URL address field. You may also need

to remove an extra space in the URL if one exists.)

For those investors unable to participate in the live conference

call, a replay of the conference call will be available via

telephone beginning November 9, 2011 at 8:00 p.m. ET through

December 9, 2011 at 11:59 p.m. ET. To listen to the replay, dial

888-286-8010 and use the pass

code 52553994. International callers should dial

617-801-6888 and also use the pass code 52553994 to listen to the

replay. The webcast replay will also be available for replay on

http://investor.techtarget.com/ during the same period.

Non-GAAP Financial Measures

This release and the accompanying tables include a discussion of

adjusted EBITDA, adjusted EBITDA margin, adjusted net income and

adjusted net income per share, all of which are non-GAAP financial

measures which are provided as a complement to results provided in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”). The term “adjusted EBITDA”

refers to a financial measure that we define as earnings before net

interest, other income and expense, income taxes, depreciation and

amortization, as further adjusted to exclude stock-based

compensation and restructuring charges. The term “adjusted EBITDA

margin” refers to a financial measure which we define as adjusted

EBITDA as a percentage of total revenues. The term “adjusted net

income” refers to a financial measure which we define as net income

adjusted for amortization, stock-based compensation and

restructuring charges, as further adjusted for the related income

tax impact of the adjustments. The term “adjusted net income per

share” refers to a financial measure which we define as adjusted

net income divided by adjusted weighted average diluted shares

outstanding. These non-GAAP measures should be considered in

addition to results prepared in accordance with GAAP, but should

not be considered a substitute for, or superior to, GAAP results.

In addition, our definition of adjusted EBITDA, adjusted EBITDA

margin, adjusted net income and adjusted net income per share may

not be comparable to the definitions as reported by other

companies. We believe adjusted EBITDA, adjusted EBITDA margin,

adjusted net income and adjusted net income per share are relevant

and useful information because it provides us and investors with

additional measurements to compare the Company’s operating

performance. These measures are part of our internal management

reporting and planning process and are primary measures used by our

management to evaluate the operating performance of our business,

as well as potential acquisitions. The components of adjusted

EBITDA include the key revenue and expense items for which our

operating managers are responsible and upon which we evaluate their

performance. In the case of senior management, adjusted EBITDA is

used as one of the principal financial metrics in their annual

incentive compensation program. Adjusted EBITDA is also used for

planning purposes and in presentations to our board of directors.

Adjusted net income is useful to us and investors because it

presents an additional measurement of our financial performance,

taking into account depreciation, which we believe is an ongoing

cost of doing business, but excluding the impact of certain

non-cash expenses and items not directly tied to the core

operations of our business. Furthermore, we intend to provide these

non-GAAP financial measures as part of our future earnings

discussions and, therefore, the inclusion of these non-GAAP

financial measures will provide consistency in our financial

reporting. A reconciliation of these non-GAAP measures to GAAP is

provided in the accompanying tables.

Forward-Looking Statements

Certain matters included in this press release may be considered

to be “forward-looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995.

Those statements include statements regarding the intent, belief or

current expectations of the Company and members of our management

team. All statements contained in this press release, other than

statements of historical fact, are forward-looking statements,

including those regarding: guidance on our future financial results

and other projections or measures of our future performance; our

expectations concerning market opportunities and our ability to

capitalize on them; and the amount and timing of the benefits

expected from acquisitions, from new products or services and from

other potential sources of additional revenue. Investors and

prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking

statements. These statements speak only as of the date of this

press release and are based on our current plans and expectations,

and they involve risks and uncertainties that could cause actual

future events or results to be different than those described in or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, those relating to:

market acceptance of our products and services; relationships with

customers, strategic partners and our employees; difficulties in

integrating acquired businesses; and changes in economic or

regulatory conditions or other trends affecting the Internet,

Internet advertising and information technology industries. These

and other important risk factors are discussed or referenced in our

Annual Report on Form 10-K filed with the Securities and

Exchange Commission, under the heading “Risk Factors” and

elsewhere, and any subsequent periodic or current reports filed by

us with the SEC. Except as required by applicable law or

regulation, we do not undertake any obligation to update our

forward-looking statements to reflect future events or

circumstances.

About TechTarget

TechTarget, Inc. (www.techtarget.com) (NASDAQ: TTGT) is a

leading global technology media company with over 100

technology-specific websites, 10 million registered members, and

more than 10 years of groundbreaking accomplishments. Our extensive

editorial and vendor-sponsored content fulfills the needs of tech

pros looking for in-depth coverage of technology topics throughout

their buying process and positions us to meet the needs of

technology marketers targeting qualified technology audiences.

Outside of North America, TechTarget runs 23 websites and has

offices in London, Mumbai and Beijing.

(C) 2011 TechTarget, Inc. All rights reserved.

TechTarget and the TechTarget logo are registered trademarks of

TechTarget. SearchCloudProvider.com, SearchCloudComputing.com,

SearchServerVirtualization.com, SearchCloudSecurity.com,

SearchCloudStorage.com, SearchVirtualDesktop.com,

SearchVirtualStorage.com, BrianMadden.com and TechTarget Social

Engage are trademarks of TechTarget. All other trademarks are the

property of their respective owners.

TECHTARGET, INC. Consolidated Statements of

Operations (in $000's, except per share amounts)

Three Months EndedSeptember

30,

Nine Months EndedSeptember

30,

2011 2010 2011 2010 (Unaudited)

Revenues: Online $ 21,763 $ 18,878 $ 66,294 $ 58,065 Events

4,129 3,123 10,266 10,052 Total revenues

25,892 22,001 76,560 68,117 Cost of revenues: Online(1) 5,547 4,921

16,873 15,043 Events(1) 1,488 1,149 3,607

3,459 Total cost of revenues 7,035 6,070

20,480 18,502 Gross profit 18,857 15,931 56,080

49,615 Operating expenses: Selling and marketing(1) 10,182 8,984

28,997 27,815 Product development(1) 1,874 2,087 5,690 6,623

General and administrative(1) 3,105 3,567 10,362 11,671

Restructuring charge — — 384 — Depreciation 692 592 2,001 1,759

Amortization of intangible assets 955 1,126

3,030 3,401 Total operating expenses 16,808 16,356 50,464

51,269 Operating income (loss) 2,049 (425 ) 5,616 (1,654 ) Interest

income, net 20 79 32 270 Income (loss)

before provision for income taxes 2,069 (346 ) 5,648 (1,384 )

Provision for income taxes 1,106 266 2,942

1,122 Net income (loss) $ 963 $ (612 ) $ 2,706 $ (2,506 )

Net income (loss) per common share: Basic $ 0.03 $ (0.01 ) $ 0.07 $

(0.06 ) Net income (loss) per common share: Diluted $ 0.02 $ (0.01

) $ 0.07 $ (0.06 ) Weighted average common shares outstanding:

Basic 38,511 43,209 38,261 42,878

Weighted average common shares outstanding: Diluted 40,008

43,209 40,578 42,878

(1) Amounts include stock-based

compensation expense as follows:

Cost of online revenues $ 65 $ (38 ) $ 197 $ 136 Cost of events

revenues 22 23 64 69 Selling and marketing 1,149 1,708 3,389 5,172

Product development 111 104 317 420 General and administrative 361

785 1,687 3,369

TECHTARGET, INC. Reconciliation of

Net Income (Loss) to Adjusted EBITDA (in $000’s)

For the Three Months

EndedSeptember 30,

For the Nine Months

EndedSeptember 30,

2011 2010 2011 2010 (Unaudited)

Net income (loss) $ 963 $

(612 )

$ 2,706 $ (2,506 )

Interest income, net (20 ) (79 ) (32 ) (270 ) Provision for income

taxes 1,106 266 2,942 1,122 R Restructuring charge - - 384 -

Depreciation 692 592 2,001 1,759 Amortization of intangible assets

955 1,126 3,030 3,401

EBITDA

3,696 1,293 11,031

3,506 Stock-based compensation expense 1,708

2,582 5,654 9,166

Adjusted EBITDA $

5,404 $ 3,875 $ 16,685 $

12,672

TECHTARGET, INC.

Reconciliation of Net Income (Loss) to

Adjusted Net Income and Net Income (Loss) per Diluted Share

to

Adjusted Net Income per Share (in $000's, except per

share amounts)

For the Three Months

EndedSeptember 30,

For the Nine Months

EndedSeptember 30,

2011 2010 2011 2010 (Unaudited)

Net income (loss) $ 963 $

(612 )

$ 2,706 $ (2,506 )

Amortization of intangible assets 955 1,126 3,030 3,401

Restructuring charge - - 384 - Stock-based

compensation expense 1,708 2,582 5,654 9,166 Impact of income taxes

(1,028 ) (1,002 ) (3,481 ) (3,115 )

Adjusted net income $ 2,598 $

2,094 $ 8,293 $ 6,946

Net income (loss) per diluted share $ 0.02

$ (0.01 )

$ 0.07 $ (0.06

) Weighted average diluted shares outstanding

40,008 43,209 40,578

42,878 Adjusted net income per share

$ 0.06 $ 0.05 $ 0.20

$ 0.15 Adjusted weighted average diluted shares

outstanding 40,008 45,459

40,578 45,029 Options, warrants and restricted

stock, treasury method included in adjusted weighted average

diluted shares above - 2,250 - 2,151

Weighted average diluted shares outstanding

40,008 43,209 40,578

42,878 TECHTARGET, INC. Financial Guidance

for the Three Months Ended December 31, 2011 (in $000's)

For the Three MonthsEnded

December 31, 2011

Range Revenues $ 28,700 $

30,100 Adjusted EBITDA $ 8,500

$ 9,500 Depreciation, amortization and stock-based

compensation $ 3,325 $ 3,325 Interest and other income, net $ 20 $

20 Provision for income taxes $ 2,650 $ 3,160

Net income

$ 2,545 $ 3,035

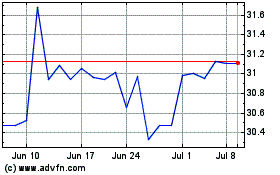

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From May 2024 to Jun 2024

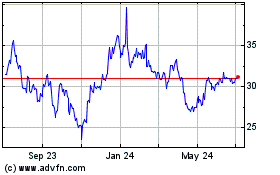

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jun 2023 to Jun 2024