- Amended Statement of Ownership (SC 13G/A)

February 14 2011 - 6:08AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

13G

(Rule

13d-102)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULES 13d-1 (b), (c) AND (d)

AND

AMENDMENTS THERETO FILED PURSUANT TO 13d-2 (b)

(Amendment

No. 2)*

Common

Stock, $0.001 par value

(Title of

Class of Securities)

(Date of

Event Which Requires Filing of this Statement)

Check the

appropriate box to designate the rule pursuant to which this Schedule is

filed:

o

Rule

13d-1(b)

o

Rule

13d-1(c)

x

Rule

13d-1(d)

*The

remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to

be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the

Notes).

(Continued

on following pages)

|

CUSIP No:

87874R100

|

Page 2 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Polaris Venture Partners III,

L.P. (“PVP III”)

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

200,440

shares, except that (i) Polaris Venture Management Co. III, L.L.C. (“PVM

III”), the general partner of PVP III, may be deemed to have sole power to

vote these shares, and (ii) Jonathan A. Flint (“Flint”), a managing member

of PVM III, may be deemed to have shared power to vote these shares,

Terrance G. McGuire (“McGuire”), a managing member of PVM III, may be

deemed to have shared power to vote these shares, and Alan G. Spoon

(“Spoon”), a managing member of PVM III, may be deemed to have shared

power to vote these shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

200,440

shares, except that (i) PVM III, the general partner of PVP III, may be

deemed to have sole power to dispose of these shares, and (ii) Flint, a

managing member of PVM III, may be deemed to have shared power to dispose

of these shares, McGuire, a managing member of PVM III, may be deemed to

have shared power to dispose of these shares, and Spoon, a managing member

of PVM III, may be deemed to have shared power to dispose of these

shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

200,440

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

0.47

%

|

|

12

|

TYPE

OF REPORTING

PERSON*

PN

|

|

CUSIP No:

87874R100

|

Page 3 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Polaris Venture Partners

Entrepreneurs’ Fund III, L.P. (“PVP Entrepreneurs III”)

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

51,941

shares, except that (i) PVM III, the general partner of PVP Entrepreneurs

III, may be deemed to have sole power to vote these shares, and (ii)

Flint, a managing member of PVM III, may be deemed to have shared power to

vote these shares, McGuire, a managing member of PVM III, may be deemed to

have shared power to vote these shares, and Spoon, a managing member of

PVM III, may be deemed to have shared power to vote these

shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

51,941

shares, except that (i) PVM III, the general partner of PVP Entrepreneurs

III, may be deemed to have sole power to dispose of these shares, and (ii)

Flint, a managing member of PVM III, may be deemed to have shared power to

dispose of these shares, McGuire, a managing member of PVM III, may be

deemed to have shared power to dispose of these shares, and Spoon, a

managing member of PVM III, may be deemed to have shared power to dispose

of these shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

51,941

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

0.

12

%

|

|

12

|

TYPE

OF REPORTING

PERSON*

PN

|

|

CUSIP No:

87874R100

|

Page 4 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Polaris Venture Partners

Founders’ Fund III, LP (“PVP Founders III”)

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

31,629 shares

,

except that (i) PVM III, the general partner of PVP Founders III, may be

deemed to have sole power to vote these shares, and (ii) Flint, a managing

member of PVM III, may be deemed to have shared power to vote these

shares, McGuire, a managing member of PVM III, may be deemed to have

shared power to vote these shares, and Spoon, a managing member of PVM

III, may be deemed to have shared power to vote these

shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

31

,629 shares,

except that (i) PVM III, the general partner of PVP Founders III, may be

deemed to have sole power to dispose of these shares, and (ii) Flint, a

managing member of PVM III, may be deemed to have shared power to dispose

of these shares, McGuire, a managing member of PVM III, may be deemed to

have shared power to dispose of these shares, and Spoon, a managing member

of PVM III, may be deemed to have shared power to dispose of these

shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

31

,629

|

|

10

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9)

EXCLUDES

CERTAIN SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

0.07

%

|

|

12

|

TYPE

OF REPORTING

PERSON* PN

|

|

CUSIP No:

87874R100

|

Page 5 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Polaris Venture Management Co.

III, L.L.C. (“PVM III”)

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

284

,010 shares

, of

which 2

00,440

shares

are directly owned by PVP III,

51,941 shares

are directly owned by PVP Entrepreneurs III, and 31,629

shares

are

directly owned by PVP Founders III,

except that Flint, a

managing member of PVM III (which is general partner of PVP III, PVP

Entrepreneurs III, and PVP Founders III and may be deemed to have sole

power to vote these shares), may be deemed to have shared power to vote

these shares, McGuire, a managing member of PVM III, may be deemed to have

shared power to vote these shares, and Spoon, a managing member of PVM

III, may be deemed to have shared power to vote these

shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

284

,010 shares

, of

which 2

00,440

shares

are directly owned by PVP III,

51,941 shares

are directly owned by PVP Entrepreneurs III, and 31,629

shares

are

directly owned by PVP Founders III, except that Flint, a managing member

of PVM III (which is general partner of PVP III, PVP Entrepreneurs III,

and PVP Founders III and may be deemed to have sole power to vote these

shares), may be deemed to have shared power to dispose of these shares,

McGuire, a managing member of PVM III, may be deemed to have shared power

to dispose of these shares, and Spoon, a managing member of PVM III, may

be deemed to have shared power to dispose of these

shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

284

,010

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

0

.67

%

|

|

12

|

TYPE

OF REPORTING

PERSON* OO

|

|

CUSIP No:

87874R100

|

Page 6 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Polaris Venture Partners IV, L.P.

(“PVP IV”)

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

3,

014,764

shares

, except

that (i) Polaris Venture Management Co. IV, L.L.C. (“PVM IV”), the general

partner of PVP IV, may be deemed to have sole power to vote these shares,

and (ii) Flint, a managing member of PVM IV, may be deemed to have shared

power to vote these shares, McGuire, a managing member of PVM IV, may be

deemed to have shared power to vote these shares, and Spoon, a managing

member of PVM IV, may be deemed to have shared power to vote these

shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

3,

014,764

shares

, except

that (i) PVM IV, the general partner of PVP IV, may be deemed to have sole

power to dispose of these shares, and (ii) Flint, a managing member of PVM

IV, may be deemed to have shared power to dispose of these shares,

McGuire, a managing member of PVM IV, may be deemed to have shared power

to dispose of these shares, and Spoon, a managing member of PVM IV, may be

deemed to have shared power to dispose of these shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

3,

014,764

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

7.07%

|

|

12

|

TYPE

OF REPORTING

PERSON* PN

|

|

CUSIP No:

87874R100

|

Page 7 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Polaris Venture Partners

Entrepreneurs’ Fund IV, L.P. (“PVP Entrepreneurs IV”)

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

54,561

shares

, except

that (i) PVM IV, the general partner of PVP Entrepreneurs IV, may be

deemed to have sole power to vote these shares, and (ii) Flint, a managing

member of PVM IV, may be deemed to have shared power to vote these shares,

McGuire, a managing member of PVM IV, may be deemed to have shared power

to vote these shares, and Spoon, a managing member of PVM IV, may be

deemed to have shared power to vote these shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

54,561

shares

, except

that (i) PVM IV, the general partner of PVP Entrepreneurs IV, may be

deemed to have sole power to dispose of these shares, and (ii) Flint, a

managing member of PVM IV, may be deemed to have shared power to dispose

of these shares, McGuire, a managing member of PVM IV, may be deemed to

have shared power to dispose of these shares, and Spoon, a managing member

of PVM IV, may be deemed to have shared power to dispose of these

shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

54,561

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

0.13%

|

|

12

|

TYPE

OF REPORTING

PERSON* PN

|

|

CUSIP No:

87874R100

|

Page 8 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Polaris Venture Management Co.

IV, L.L.C. (“PVM IV”)

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

3,069,325

shares

, of

which

3,

014,764

shares

are

directly owned by PVP IV, and

54,561

are

directly owned by PVP Entrepreneurs IV,

except that Flint, a

managing member of PVM IV (which is general partner of PVP IV and PVP

Entrepreneurs IV and may be deemed to have sole power to vote these

shares), may be deemed to have shared power to vote these shares, McGuire,

a managing member of PVM IV, may be deemed to have shared power to vote

these shares, and Spoon, a managing member of PVM IV, may be deemed to

have shared power to vote these shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

3,069,325

shares

, of

which

3,

014,764

shares

are

directly owned by PVP IV, and

54,561

are

directly owned by PVP Entrepreneurs IV,

except that Flint, a

managing member of PVM IV (which is general partner of PVP IV and PVP

Entrepreneurs IV and may be deemed to have sole power to vote these

shares), may be deemed to have shared power to dispose of these shares,

McGuire, a managing member of PVM IV, may be deemed to have shared power

to dispose of these shares, and Spoon, a managing member of PVM IV, may be

deemed to have shared power to dispose of these shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

3,069,325

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

7.20%

|

|

12

|

TYPE

OF REPORTING

PERSON* OO

|

|

CUSIP No:

87874R100

|

Page 9 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Alan G. Spoon

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA

|

|

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

3

,

360,358 shares,

of which (i) Spoon owns 7,023 directly (of which 4,523 are

shares of common stock and 2,500 are options to purchase shares

of common stock), and (ii) 200,440 shares are directly owned by PVP III,

51,941

are

directly owned by PVP Entrepreneurs III, 31

,629

shares

are

directly owned by PVP Founders III,

3,0

14

,

764

shares

are

directly owned by PVP IV,

and 54,561

shares

are

directly owned by PVP Entrepreneurs IV, except that, PVM III, as the

general partner of PVP III, PVP Entrepreneurs III and PVP Founders III,

may be deemed to have sole power to vote PVP III’s shares, PVP

Entrepreneurs III’s shares, and PVP Founders III’s shares (collectively,

the “Fund III Shares”), and PVM IV, as general partner of PVP IV and PVP

Entrepreneurs IV, may be deemed to have sole power to vote the PVP IV

shares and PVP Entrepreneurs IV shares (collectively the “Fund IV

Shares”), Flint, as a managing member of PVM III and PVM IV, may be deemed

to have shared power to vote the Fund III Shares and the Fund IV Shares,

and McGuire, as a managing member of PVM III and PVM IV, may be deemed to

have shared power to vote the Fund III Shares and the Fund IV

Shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

3

,360,358 shares,

of which (i) Spoon owns 7,023 directly (of which 4,523 are

shares of common stock and 2,500 are options to purchase shares

of common stock), and (ii) 200,440 shares are directly owned by PVP III,

51,

941

are directly

owned by PVP Entrepreneurs III, 31

,

629

shares

are

directly owned by PVP Founders III,

3,014,764

shares

are

directly owned by PVP IV,

and 5

4

,

56

1 shares

are

directly owned by PVP Entrepreneurs IV, except that, PVM III, as the

general partner of PVP III, PVP Entrepreneurs III and PVP Founders III,

may be deemed to have sole power to dispose of the Fund III Shares, and

PVM IV, as general partner of PVP IV and PVP Entrepreneurs IV, may be

deemed to have sole power to dispose of Fund IV Shares, Flint, as a

managing member of PVM III and PVM IV, may be deemed to have shared power

to dispose of the Fund III Shares and the Fund IV Shares, and McGuire, as

a managing member of PVM III and PVM IV, may be deemed to have shared

power to dispose of the Fund III Shares and the Fund IV

Shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

3

,

360,358

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

7

.88%

|

|

12

|

TYPE

OF REPORTING

PERSON* IN

|

|

CUSIP No:

87874R100

|

Page 10 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Terrance G.

McGuire

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA

|

|

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

3

,

353,335 shares,

of which 200,440 shares are directly owned by PVP III,

51,941

are

directly owned by PVP Entrepreneurs III, 31,629

shares

are

directly owned by PVP Founders III,

3,0

14

,

764

shares

are

directly owned by PVP IV,

and 54,561

shares

are

directly owned by PVP Entrepreneurs IV, except that, PVM III, as the

general partner of PVP III, PVP Entrepreneurs III and PVP Founders III,

may be deemed to have sole power to vote the Fund III Shares, and PVM IV,

as general partner of PVP IV and PVP Entrepreneurs IV, may be deemed to

have sole power to vote the Fund IV Shares, Flint, as a managing member of

PVM III and PVM IV, may be deemed to have shared power to vote the Fund

III Shares and the Fund IV Shares, and Spoon, as a managing member of PVM

III and PVM IV, may be deemed to have shared power to vote the Fund III

Shares and the Fund IV Shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

3

,353,335

shares,

of which

200,440

shares

are directly owned by PVP III,

51,

941

are directly

owned by PVP Entrepreneurs III, 31

,

629

shares

are

directly owned by PVP Founders III,

3,0

14

,

764

shares

are

directly owned by PVP IV,

and 5

4

,

56

1 shares

are

directly owned by PVP Entrepreneurs IV, except that, PVM III, as the

general partner of PVP III, PVP Entrepreneurs III and PVP Founders III,

may be deemed to have sole power to dispose of the Fund III Shares, and

PVM IV, as general partner of PVP IV and PVP Entrepreneurs IV, may be

deemed to have sole power to dispose of the Fund IV Shares, Flint, as a

managing member of PVM III and PVM IV, may be deemed to have shared power

to dispose of the Fund III Shares and the Fund IV Shares, and Spoon, as a

managing member of PVM III and PVM IV, may be deemed to have shared power

to dispose of the Fund III Shares and the Fund IV

Shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

3

,

353

,

335

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

7.86%

|

|

12

|

TYPE

OF REPORTING

PERSON* IN

|

|

CUSIP No:

87874R100

|

Page 11 of

18

|

|

1

|

NAME

OF REPORTING PERSON

SS

OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Jonathan A.

Flint

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

o

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA

|

|

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY EACH REPORTING

PERSON

WITH

|

5

|

SOLE

VOTING POWER

3

,

353

,

335 shares,

of

which 200,440 shares are directly owned by PVP III,

51,941

are

directly owned by PVP Entrepreneurs III, 31

,629

shares

are

directly owned by PVP Founders III,

3,0

14,764

shares

are

directly owned by PVP IV,

and 54,561

shares

are

directly owned by PVP Entrepreneurs IV, except that, PVM III, as the

general partner of PVP III, PVP Entrepreneurs III and PVP Founders III,

may be deemed to have sole power to vote the Fund III Shares, and PVM IV,

as general partner of PVP IV and PVP Entrepreneurs IV, may be deemed to

have sole power to vote the Fund IV Shares, McGuire, as a managing member

of PVM III and PVM IV, may be deemed to have shared power to vote the Fund

III Shares and the Fund IV Shares, and Spoon, as a managing member of PVM

III and PVM IV, may be deemed to have shared power to vote the Fund III

Shares and the Fund IV Shares.

|

|

|

6

|

SHARED

VOTING POWER

See

response to row 5

|

|

|

7

|

SOLE

DISPOSITIVE POWER

3

,

353

,

335

shares,

of

which 200,440 shares are directly owned by PVP III,

51,

941

are directly

owned by PVP Entrepreneurs III, 31

,

629

shares

are

directly owned by PVP Founders III,

3,0

14

,

764

shares

are

directly owned by PVP IV,

and 5

4

,

56

1 shares

are

directly owned by PVP Entrepreneurs IV, except that, PVM III, as the

general partner of PVP III, PVP Entrepreneurs III and PVP Founders III,

may be deemed to have sole power to dispose of the Fund III Shares, and

PVM IV, as general partner of PVP IV and PVP Entrepreneurs IV, may be

deemed to have sole power to dispose of the Fund IV Shares, McGuire, as a

managing member of PVM III and PVM IV, may be deemed to have shared power

to dispose of the Fund III Shares and the Fund IV Shares, and Spoon, as a

managing member of PVM III and PVM IV, may be deemed to have shared power

to dispose of the Fund III Shares and the Fund IV

Shares.

|

|

|

8

|

SHARED

DISPOSITIVE POWER

See

response to row 7

|

|

9

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING

PERSON

3

,

353

,

335

|

|

10

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (9)

EXCLUDES CERTAIN

SHARES*

o

|

|

11

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 9

7.86%

|

|

12

|

TYPE

OF REPORTING

PERSON* IN

|

|

CUSIP No:

87874R100

|

Page 12 of

18

|

|

ITEM

1(A).

|

NAME OF

ISSUER

|

|

ITEM

1(B).

|

ADDRESS OF ISSUER’S

PRINCIPAL EXECUTIVE OFFICES

|

|

|

117

Kendrick Street, Suite 800

|

|

|

Needham,

MA 02494, United States

|

|

ITEM

2(A).

|

NAME OF PERSONS

FILING

|

|

|

PVP

III, PVP Entrepreneurs III, PVP Founders III, PVM III, PVP IV, PVP

Entrepreneurs IV, PVM IV, Flint, McGuire, and Spoon. The

foregoing entities and individuals are collectively referred to as the

“Reporting Persons.”

|

|

|

Flint,

McGuire and Spoon, are the sole managing members of (i) PVM III (the sole

general partner of PVP III, PVP Entrepreneurs III and PVP Founders III),

and (ii) PVM IV (the sole general partner of PVP IV and PVP Founders

IV). To the extent feasible, PVP Entrepreneurs III and PVP

Founders III invest alongside PVP III and PVP Entrepreneurs IV invests

alongside PVP IV.

|

|

ITEM

2(B).

|

ADDRESS OF PRINCIPAL

OFFICE

|

The address for each of the Reporting

Persons is:

c/o

Polaris Venture Partners

1000

Winter Street

Waltham,

MA 02451

|

|

Flint

, McGuire and Spoon are

United

States

citizens

. PVP III, PVP Entrepreneurs III, PVP Founders

III, PVP IV and PVP Entrepreneurs IV are limited partnerships organized

under the laws of the State of Delaware. PVM III and PVM IV are

limited liability companies organized under the laws of the State of

Delaware.

|

|

ITEM

2(D).

|

TITLE OF CLASS OF

SECURITIES AND CUSIP NUMBER

|

|

|

Common

Stock, $0.001 par value per share

|

87874R100

|

CUSIP No:

87874R100

|

Page 13 of

18

|

|

|

The

approximate percentages of Common Stock reported as beneficially owned by

the Reporting Persons are based upon 42,652,132 shares of Common Stock

outstanding as of October 29, 2010, as reported on TechTarget, Inc.’s Form

10-Q for the quarterly period ended September 30,

2010.

|

|

|

The

following information with respect to the ownership of the ordinary shares

of the issuer by the Reporting Persons filing this Statement is provided

as of December 31, 2010:

|

|

(a)

|

Amount beneficially

owned

:

|

|

|

See

Row 9 of cover page for each Reporting

Person.

|

|

|

See

Row 11 of cover page for each Reporting

Person.

|

|

(c)

|

Number of shares as to

which such person has

:

|

|

(i)

|

Sole power to vote or

to direct the vote

:

|

|

|

See

Row 5 of cover page for each Reporting

Person.

|

|

(ii)

|

Shared power to vote

or to direct the vote

:

|

See Row 6

of cover page for each Reporting Person.

|

(iii)

|

Sole power to dispose

or to direct the disposition

of

:

|

See Row 7

of cover page for each Reporting Person.

|

(iv)

|

Shared power to

dispose or to direct the disposition

of

:

|

|

|

See

Row 8 of cover page for each Reporting

Person.

|

|

ITEM

5.

|

OWNERSHIP OF FIVE

PERCENT OR LESS OF A CLASS

|

|

ITEM

6.

|

OWNERSHIP OF MORE THAN

FIVE PERCENT ON BEHALF OF ANOTHER

PERSON

.

|

|

|

Under

certain circumstances set forth in the limited partnership agreements of

PVP III, PVP Entrepreneurs III, PVP Founders III, PVP IV, and PVP

Entrepreneurs IV, and the limited liability company agreements of PVM III

and PVM IV, the general and limited partners or members of each such

entity, as applicable, may be deemed to have the right to receive

dividends from, or the proceeds from, the sale of shares of the issuer

owned by each such entity of which they are a partner or member, as

applicable.

|

|

ITEM

7.

|

IDENTIFICATION AND

CLASSIFICATION OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING

REPORTED ON BY THE PARENT HOLDING

COMPANY

|

|

CUSIP No:

87874R100

|

Page 14 of

18

|

|

ITEM

8.

|

IDENTIFICATION AND

CLASSIFICATION OF MEMBERS OF THE

GROUP

.

|

|

ITEM

9.

|

NOTICE OF DISSOLUTION

OF GROUP

.

|

|

CUSIP No:

87874R100

|

Page 15 of

18

|

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that

the information set forth in this statement is true, complete and

correct.

Date:

February 11, 2011

|

|

POLARIS

VENTURE PARTNERS III, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. III, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE PARTNERS ENTREPRENEURS’ FUND III, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. III, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE PARTNERS FOUNDERS’ FUND III, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. III, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE MANAGEMENT CO. III, L.L.C.

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE PARTNERS IV, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. IV, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

CUSIP No:

87874R100

|

Page 16 of

18

|

|

|

|

|

|

|

POLARIS

VENTURE PARTNERS ENTREPRENEURS’ FUND IV, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. IV, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE MANAGEMENT CO. IV, L.L.C.

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

JONATHAN

A. FLINT

|

|

|

|

|

|

By:

|

*

|

|

|

|

Jonathan

A. Flint

|

|

|

|

|

|

|

TERRANCE

G. MCGUIRE

|

|

|

|

|

|

By:

|

*

|

|

|

|

Terrance

G. McGuire

|

|

|

|

|

|

|

ALAN

G. SPOON

|

|

|

|

|

|

By:

|

*

|

|

|

|

Alan

G. Spoon

|

|

*By:

/s/ John

Gannon

|

|

|

|

Name:

John

Gannon

|

|

|

|

Attorney-in-Fact

|

|

|

[This Schedule 13G was

executed pursuant to a Power of Attorney. Note that copies of

the applicable Powers of Attorney are already on file with the appropriate

agencies.]

|

CUSIP No:

87874R100

|

Page 17 of

18

|

EXHIBIT

I

Pursuant to Rule 13d-1(k)(1) under the

Securities Exchange Act of 1934, the undersigned hereby agree that only one

statement containing the information required on Schedule 13G need be filed with

respect to ownership by each of the undersigned of shares of Common Stock of

TechTarget, Inc.

This Agreement may be executed in any

number of counterparts, each of which shall be deemed an original.

Date: February

11, 2011

|

|

POLARIS

VENTURE PARTNERS III, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. III, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE PARTNERS ENTREPRENEURS’ FUND III, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. III, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE PARTNERS FOUNDERS’ FUND III, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. III, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE MANAGEMENT CO. III, L.L.C.

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE PARTNERS IV, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. IV, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

CUSIP No:

87874R100

|

Page 18 of

18

|

|

|

POLARIS

VENTURE PARTNERS ENTREPRENEURS’ FUND IV, L.P.

|

|

|

|

|

|

By:

|

Polaris

Venture Management Co. IV, L.L.C.

|

|

|

|

|

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

POLARIS

VENTURE MANAGEMENT CO. IV, L.L.C.

|

|

|

|

|

|

By:

|

*

|

|

|

|

Managing

Member

|

|

|

|

|

|

|

JONATHAN

A. FLINT

|

|

|

|

|

|

By:

|

*

|

|

|

|

Jonathan

A. Flint

|

|

|

|

|

|

|

TERRANCE

G. MCGUIRE

|

|

|

|

|

|

By:

|

*

|

|

|

|

Terrance

G. McGuire

|

|

|

|

|

|

|

ALAN

G. SPOON

|

|

|

|

|

|

By:

|

*

|

|

|

|

Alan

G. Spoon

|

|

*By:

/s/ John

Gannon

|

|

|

|

Name:

John

Gannon

|

|

|

|

Attorney-in-Fact

|

|

|

[This Schedule 13G was

executed pursuant to a Power of Attorney. Note that copies of

the applicable Powers of Attorney are already on file with the appropriate

agencies.]

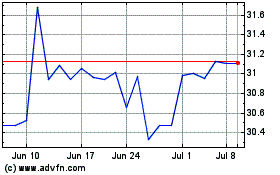

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Aug 2024 to Sep 2024

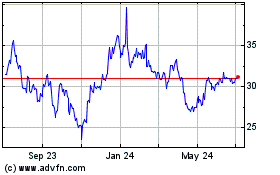

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Sep 2023 to Sep 2024