Current Report Filing (8-k)

July 31 2020 - 8:56AM

Edgar (US Regulatory)

SYNAPTICS Inc DE false 0000817720 0000817720 2020-07-31 2020-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

July 31, 2020

Date of Report (Date of earliest event reported)

SYNAPTICS INCORPORATED

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

DELAWARE

|

|

000-49602

|

|

77-0118518

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1251 McKay Drive

San Jose, California 95131

(Address of Principal Executive Offices) (Zip Code)

(408) 904-1100

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $.001 per share

|

|

SYNA

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On July 31, 2020, Synaptics Incorporated (the “Company”) completed the previously announced merger of Falcon Merger Sub, Inc., a Washington corporation and a wholly owned subsidiary of the Company (“Merger Sub”) with and into DisplayLink Corporation, a Washington corporation (“DisplayLink”), with DisplayLink continuing as the surviving corporation and a wholly owned subsidiary of the Company (the “Merger”). The Company completed the Merger pursuant to the terms of the Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, Merger Sub, DisplayLink, certain holders of equity securities of DisplayLink that become parties to the Merger Agreement by execution of a Joinder Agreement (the “Sellers”) and Shareholder Representative Services LLC, a Colorado limited liability company, solely in its capacity as the representative, agent and attorney-in-fact for the Sellers. The aggregate consideration for the Merger consisted of $305 million in cash, subject to purchase price adjustments at the closing and post-closing.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, which is expected to be filed with the Company’s next quarterly report in accordance with the rules and regulations of the Securities and Exchange Commission.

|

Item 7.01

|

Regulation FD Disclosure.

|

On July 31, 2020, the Company issued a press release announcing the completion of the Merger and related matters. The press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 7.01 and in the accompanying Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(a) Financial Statements of Businesses Acquired. The financial statements required under this Item 9.01(a) will be filed by the Company pursuant to an amendment to this Form 8-K not later than 71 days after the date that this report on Form 8-K is required to be filed.

(b) Pro Forma Financial Information. The pro forma financial information required under this Item 9.01(b) will be filed by the Company pursuant to an amendment to this Form 8-K not later than 71 days after the date that this report on Form 8-K is required to be filed.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed by the undersigned, thereunto duly authorized.

|

|

|

Synaptics Incorporated

|

|

|

|

/s/ John McFarland

|

|

John McFarland

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

July 31, 2020

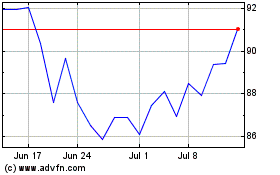

Synaptics (NASDAQ:SYNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

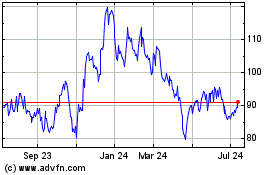

Synaptics (NASDAQ:SYNA)

Historical Stock Chart

From Apr 2023 to Apr 2024