Steve Madden (Nasdaq: SHOO), a leading designer and marketer of

fashion footwear and accessories for women, men and children, today

announced financial results for the fourth quarter and year ended

December 31, 2010.

- Fourth quarter net sales increased

15.4% to $161.0 million.

- Wholesale sales increased 17.7% while

retail sales rose 10.1%, with comparable store sales up 14.1% for

the fourth quarter.

- Operating margin was 17.0% of sales in

the fourth quarter of 2010, compared with operating margin of 15.0%

in the same period of 2009.

- Fourth quarter net income increased

30.0% to $17.6 million, or $0.62 per diluted share, compared to

$13.6 million, or $0.49 per diluted share, in the prior year's

fourth quarter.

Edward Rosenfeld, Chairman and Chief Executive Officer,

commented, "The fourth quarter marked a positive conclusion to an

exciting and impressive year for our Company. Steve and his design

team continued to deliver inspired, trend-right merchandise,

enabling us to record double-digit sales growth in both our

wholesale and retail divisions despite the tough comparisons from a

year ago. The strong sales growth, combined with increased

licensing royalty income and careful management of expenses, led to

a 30% increase in net income for the quarter. As we look ahead, we

will remain focused on maintaining momentum in our core business

while continuing to diversify our business by developing our newer

brands, expanding our international footprint and growing our

accessories and licensing businesses.”

Fourth Quarter 2010 Results

Fourth quarter net sales were $161.0 million compared to $139.5

million reported in the comparable period of 2009. Net sales from

the wholesale business were $115.8 million compared to $98.4

million in the fourth quarter of 2009, with particular strength in

our international business as well as Madden Girl. New businesses,

including Madden, Material Girl and Big Buddha, also contributed to

the growth, as did the transition of two of the Company's mass

merchant customers from a buying agency model to a wholesale model.

Retail net sales grew 10.2% to $45.3 million compared to $41.1

million in the fourth quarter of the prior year despite a smaller

store base. Same store sales for the fourth quarter of 2010

increased 14.1% following a 7.0% increase in last year’s fourth

quarter.

Gross margin was 43.2% in the fourth quarter of 2010, compared

to 44.1% in the same period last year. Gross margin in the

wholesale business was 35.7% as compared to 37.9% in the prior

year's fourth quarter, due primarily to (i) the inclusion of mass

merchant revenue in the net sales line; (ii) an increased mix of

international sales; and (iii) lower margin in the Steven division.

Retail gross margin increased to 62.5% from 58.7% in the comparable

period of the prior year, benefitting from increased full-price

selling and reduced discounting as compared to the fourth quarter

of 2009.

Operating expenses as a percent of sales for the fourth quarter

of 2010 were 29.1% versus 31.8% in the same period of the prior

year, due to leverage on increased sales.

Operating income for the fourth quarter of 2010 increased to

$27.3 million, or 17.0% of sales, compared with operating income of

$21.0 million, or 15.0% of sales, in the same period of 2009.

Net income for the fourth quarter of 2010 increased 30.0% to

$17.6 million, or $0.62 per diluted share, compared to $13.6

million, or $0.49 per diluted share, in the prior year's fourth

quarter.

During the fourth quarter of 2010, the Company opened one

full-price store and one outlet store.

Full Year 2010 Results

For the full year ended December 31, 2010, net sales increased

26.2% to $635.4 million compared to $503.6 million in fiscal

2009.

Net income totaled $75.7 million, or $2.68 per diluted share,

for the year ended December 31, 2010, compared to $50.1 million, or

$1.82 per diluted share, in fiscal 2009.

The Company opened 3 stores and closed 8 underperforming stores

during 2010, ending the year with 84 retail locations, including

the Internet store.

At the end of the year, cash, cash equivalents and marketable

securities totaled $193.8 million.

Arvind Dharia, Chief Financial Officer, commented, "We are

pleased to have ended 2010 with a healthy balance sheet which

provides us with a strong financial foundation to support our

future growth initiatives."

Company Outlook

For the year ending December 31, 2011, the Company expects net

sales to increase 20% - 22%. Excluding the transition of two

businesses – a mass merchant private label business and the

Olsenboye footwear business – from the commission income line to

the net sales line on the income statement, the Company expects net

sales to increase 10% - 12% during the year ending December 31,

2011. Diluted EPS is expected to be in the range of $3.00 to $3.10.

Capital expenditures are planned to be approximately $10 million in

2011 as compared to $3.4 million in 2010. The Company plans to open

6 to 8 stores and to close between 5 and 7 locations in 2011.

Conference Call Information

As previously announced, interested stockholders are invited to

listen to the fourth quarter earnings conference call scheduled for

today, Tuesday, February 22, 2011, at 8:30 a.m. Eastern Time. The

call will be broadcast live over the Internet and can be accessed

by logging onto http://www.stevemadden.com. An online archive of

the broadcast will be available within one hour of the conclusion

of the call and will be accessible for a period of 30 days

following the call. Additionally, a replay of the call can be

accessed by dialing 877-870-5176, passcode 6951979, and will be

available until March 22, 2011.

About Steve Madden

Steve Madden designs, sources and markets fashion-forward

footwear and accessories for women, men and children. In addition

to marketing products under its owned brands including Steve

Madden, Steven by Steve Madden, Madden Girl, Betsey Johnson,

Betseyville and Big Buddha, the Company is the licensee of various

brands, including Olsenboye for footwear, handbags and belts,

Elizabeth and James, l.e.i. and GLO for footwear and Daisy Fuentes

for handbags. The Company also designs and sources products under

private label brand names for various retailers. The Company's

wholesale distribution includes department stores, specialty

stores, luxury retailers, national chains and mass merchants. The

Company also operates 81 retail stores (including the Company's

online store). The Company licenses certain of its brands to third

parties for the marketing and sale of certain products, including

for ready-to-wear, outerwear, intimate apparel, cold weather

accessories, eyewear, hosiery, jewelry, fragrance and bedding and

bath products.

Safe Harbor

This press release and oral statements made from time to time by

representatives of the Company contain certain “forward looking

statements as that term is defined in the federal securities laws.

The events described in forward looking statements may not occur.

Generally these statements relate to business plans or strategies,

projected or anticipated benefits or other consequences of the

Company's plans or strategies, projected or anticipated benefits

from acquisitions to be made by the Company, or projections

involving anticipated revenues, earnings or other aspects of the

Company's operating results. The words "may," "will," "expect,"

"believe," "anticipate," "project," "plan," "intend," "estimate,"

and "continue," and their opposites and similar expressions are

intended to identify forward looking statements. The Company

cautions you that these statements concern current expectations

about the Company’s future results and condition and are not

guarantees of future performance or events and are subject to a

number of uncertainties, risks and other influences, many of which

are beyond the Company's control, that may influence the accuracy

of the statements and the projections upon which the statements are

based. Factors which may affect the Company's results include, but

are not limited to, the risks and uncertainties discussed in the

Company's Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K filed with the Securities and

Exchange Commission. Any one or more of these uncertainties, risks

and other influences could materially affect the Company's results

of operations and condition and whether forward looking statements

made by the Company ultimately prove to be accurate and, as such,

the Company's actual results, performance and achievements could

differ materially from those expressed or implied in these forward

looking statements. The Company undertakes no obligation to

publicly update or revise any forward looking statements, whether

as a result of new information, future events or otherwise.

STEVEN MADDEN,

LTD AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

DATA

(In thousands, except per share amounts)

Quarter Ended Year

Ended

Dec 31, 2010 Dec 31, 2009 Dec

31, 2010 Dec 31, 2009

(Unaudited)

(Unaudited)

(Unaudited)

Net sales $ 161,028 $ 139,511 $ 635,418 $ 503,550 Cost of

sales 91,468 78,048 359,564 287,361 Gross profit 69,560 61,463

275,854 216,189

Commission and licensing fee income,

net

4,629 3,935 22,629 19,928 Operating expenses 46,865 44,420 176,859

157,149 Income from operations 27,324 20,978 121,624 78,968

Interest and other income, net 1,306 569 4,233 1,821 Income before

provision for income taxes 28,630 21,547 125,857 80,789 Provision

for income taxes 11,005 7,992 50,132 30,682 Net income $ 17,625 $

13,555 $ 75,725 $ 50,107 Basic income per share $

0.63 $ 0.50 $ 2.74 $ 1.85 Diluted income per share $ 0.62 $ 0.49 $

2.68 $ 1.82 Weighted average common shares outstanding -

Basic 27,822 27,257 27,651 27,068 Weighted average common shares

outstanding - Diluted 28,468 27,858 28,295 27,485

STEVEN MADDEN,

LTD AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET DATA

(In thousands)

As of

Dec 31, 2010 Dec 31, 2009

(Unaudited)

Cash and cash equivalents $ 66,151 $ 69,266

Marketable securities (current & non

current)

127,606 85,684 Receivables, net 70,948 58,605 Inventories 39,557

30,453 Other Current Assets 20,122 15,074 Property and equipment,

net 20,791 23,793 Goodwill and intangible, net 81,275 31,029 Other

assets 21,246 12,955 Total Assets $ 447,696 $ 326,859

Accounts payable $ 37,089 $ 24,544 Other current liabilities 34,342

27,818 Contingent payment liability 12,372 - Long term liabilities

6,595 6,710 Stockholders' equity 357,298 267,787 Total liabilities

and stockholders' equity $ 447,696 $ 326,859

STEVEN MADDEN,

LTD AND SUBSIDIARIES

CONSOLIDATED CASH FLOW DATA

(In thousands)

Year Ended

Dec 31, 2010 Dec 31,

2009

(Unaudited)

Net cash provided by operating activities $ 86,873 $ 64,342

Investing

Activities

Purchase of property and equipment (3,424 ) (3,399 )

Purchase / sales of marketable securities

(net)

(42,571 ) (49,722 ) Advance payment on contingent liability (1,628

)

-

Purchase of notes receivable (7,004 )

-

Acquisitions, net of cash acquired

(40,602

) (5,776 ) Net cash

used in investing activities (95,229 ) (58,897 )

Net cash provided (used) in financing

activities

5,241 (25,767 ) Net decrease in cash and cash equivalents

(3,115 ) (20,322 ) Cash and cash equivalents at the

beginning of the year 69,266 89,588 Cash and cash

equivalents at the end of the period $ 66,151 $ 69,266

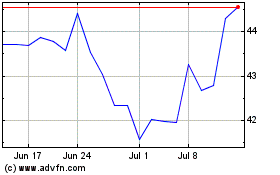

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Aug 2024 to Sep 2024

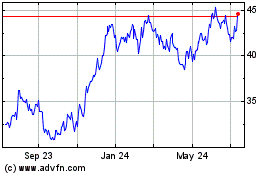

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Sep 2023 to Sep 2024