false0000718937STAAR SURGICAL CO00007189372023-09-142023-09-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 14, 2023

STAAR Surgical Company

(Exact Name of Registrant as Specified in Charter)

|

|

|

Delaware |

0-11634 |

95-3797439 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

25651 Atlantic Ocean Drive Lake Forest, California |

|

92630 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 626-303-7902

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common |

STAA |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1 933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Representatives of STAAR Surgical Company (the “Company”) will give presentations to investors on September 14, 2023 as part of its Investor's Day. A copy of the slide presentations they will share is furnished as Exhibit 99.1 to this Report and is incorporated herein by this reference. A taped replay of the Investor's Day event will be available at the “Investors” section of the Company’s website.

This information and the information contained in the presentation and press release shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report, and Exhibit 99.1 is not incorporated by reference into any filings of STAAR made under the Securities Act of 1933, as amended, whether made before or after the date of this Current Report, regardless of any general incorporation language in the filing unless specifically stated so therein.

Item 9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

STAAR Surgical Company |

|

September 14,2023 |

By: |

/s/ Tom Frinzi |

|

|

Thomas G. Frinzi |

|

|

President and Chief Executive Officer |

Exhibit 99.1

STAAR Surgical VISION 2026 STAAR Surgical Investor Day September14,2023 NASDAQ:STAA

Agenda Time EDT Topic Speaker 8:30 a.m. Welcome/Safe Harbor Brian Moore, Investor Relations Vision 2026: Achieving STAAR’s Global Growth Opportunity Tom Frinzi, Chair of the Board and CEO Extending EVO ICL’s Leadership Position Magda Michna, PhD Chief Clinical, Regulatory and Medical Affairs Officer China: Durable Growth in the Largest Refractive Market Globally Zheng Wang, MD Chief Medical Officer, Refractive Surgery, Aier Eye Hospital Group (China) 9:20 a.m. Q&A Session 19:30 a.m. BREAK 9:45 a.m. U.S. Refractive Market: From LASIK to Lens-Based Stephen Slade, MD (United States) Establishing EVO ICL as The First Choice for Doctors and Patients Warren Foust, Chief Operating Officer Scott Barnes, MD, Chief Medical Officer (Moderator) Frank Kerkoff, MD (Netherlands) Surgeon Panel: The Global EVO ICL Experience Stephen Slade, MD (United States) Blake Williamson, MD (United States) Zheng Wang, MD (China) Roger Zaldivar, MD (Argentina) 10:50 a.m. BREAK 11:05 a.m. Long Term Plan and Value Creation Patrick Williams, Chief Financial Officer Closing Remarks Tom Frinzi, Chair of the Board and CEO 11:20 a.m. Q&A Session 2 11:50 a.m. Investor Day Concludes SCAN FOR MORE INFORMATION STAAR SURGICAL 02

Forward Looking Statements and Non-GAAP Financial Measures All statements that are not statements of historical fact are forward-looking statements, including statements about any of the following: any financial projections (including sales), plans, strategies, and objectives of management for 2023 through 2026 or prospects for achieving such plans, expectations for sales, revenue, margin, expenses or earnings, and any statements of assumptions underlying any of the foregoing, including those relating to financial performance in the third quarter and fiscal years 2023 through 2026. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties related to the COVID-19 pandemic and related public health measures, as well as the factors set forth in the Company’s Annual Report on Form 10-K for the year ended December 30, 2022 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward-looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties include the following: global economic conditions; the impact of the COVID-19 pandemic on markets; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before approval, or to take enforcement action; international trade disputes; and the willingness of surgeons and patients to adopt a new or improved product and procedure. This presentation includes supplemental Non-GAAP financial information, which STAAR believes investors will find helpful in understanding its operating performance. Non-GAAP financial measures are in addition to, not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Please refer to the Company’s Form 8-K filed on August 2, 2023, which is on file with the Securities and Exchange Commission, concerning the use of Non-GAAP Financial Measures and the applicable reconciliation tables. STAAR SURGICAL 03

VISION 2026 Achieving STAAR’s Global Growth Opportunity TOM FRINZI Chair of the Board and CEO STAAR Surgical Company STAAR SURGICAL 04

Vision 2026 / Exciting Global Growth The first Choice for Doctors and Patients Seeking Visual Freedom STAAR SURGICAL 05

Vision 2026 / Growth Foundation 1 Invest in Largest Market Opportunities 2 Drive EVO ICL Awareness 3 Enhance Surgeon Support and Education 4 Introduce New Products 5 Create a High Performance Organization STAAR SURGICAL 06

Vision 2026 / Double-Digit Sales CAGR Approximately 15% TO Approximately 20% ANNUAL GROWTH RANGE Y/Y 3-Year Sales CAGR (2024-2026) Approximately 15% Approximately $500 To $550 MILLION Fiscal 2026 Sales TARGET SALES MODEL STAAR SURGICAL 07

Select Growth Markets (3-Year CAGR, 2020-2022) Our History of 15%+ Global ICL Sales Growth CANADA +20% NETHERLANDS +19% KOREA +24% BELGIUM +15% UNITED STATES +28% ITALY +21% CHINA +32% JAPAN +40 FRANCE +28% HONG KONG +27% EGYPT +26% INDIA +19% MEXICO +16% THAILAND +59% MALAYSIA +31% VIETNAM +18% SINGAPORE +60% SOUTH AFRICA +15% AUSTRALIA +15% STAAR SURGICAL 08

Our Large Market Opportunity Global Myopia Epidemic Today: Every third person in the world 2050: Every other person in the world * Normal Myopia Billions of People Myopia High Myopia 6.0 5.0 4.0 3.0 2.0 1.0 0.0 4.9 4.1 3.4 2.6 2.0 1.4 2000 2010 2020 2030 2040 2050 *BHVI, adapted from Holden et al. 2016 Ophthalmology. 36% of studies defined high myopia as -6.0D or more.. Key Factors with Myopia Genetic Predisposition Environmental Factors MYOPIA STAAR SURGICAL 09

Non-Surgical Myopia Correction Options Myopia Management May reduce, but does not eliminate Myopia Glasses Limits certain activities and lifestyles Contact Lenses May cause dry eyes STAAR SURGICAL 10

Surgical Myopia Correction Options Laser Vision Correction in Decline Refractive Procedures Laser Vision Correction (LASIK, PRK, SMILE) Lens-Based (EVO ICL) 2009 Japan Laser Vision Correction Procedures Down From 2008 Peak 75% U.S. Laser Vision Correction Procedures Down From 2008 Peak 50% 2022 LASIK Quality of Life collaboration Project march 25, 2011 comes Devices Retractive Errors NEI In October 2009, the FDA the National Eye Institute, and the Department of launched the LASIK Quality of Life Collaboration Project. This Project examines patient-reported outcomes (PROs) following LASIK, a surgical procedure intended to reduce a person's dependence on glasses or contact lenses A PRO is a report of a condition experienced by the patient and reported by the patient, not the health care provider. 2022 FDA NEWS RELEASE FDA Seeks to Improve Patient Communication on LASIK Benefits and Risks Through Issuance of Draft Guidance STAAR SURGICAL 11

STAAR SURGICAL

Achieving STAAR’s Global Growth Opportunity Investing in the Largest Markets Top 15 Refractive Procedure Markets China U.S. 34% 17% of 4.5M Estimated of 4.5M Estimated Procedures in Procedures in 2023 2023 Top 15 Markets 83% of 4.5 Estimated Procedures in 2023 U.S. 764,183 South Korea 250,073 India 212,675 Germany 111,393 Japan 110,698 Canada 88,717 UK 86,862 Mexico 76,189 France 70,805 Egypt 70,805 Brazil 137,733 Spain 84,183 Italy 72,775 Turkey 70,770 China 1,497,972 STAAR SURGICAL 13

Achieving STAAR’s Global Growth Opportunity Investing in Fastest Growing Markets 2024E-2026E China U.S. ROW India South Korea Japan +462,441 Expected Procedure Growth Global Procedures expected to grow from 4.5M to 5.0M* *Market Scope STAAR Custom Model, August 23, 2023. 349,573 56,406 45,523 30,047 28,237 15,572 STAAR SURGICAL 14

Milestone Sales Achievements TOTAL ICLs SOLD… STAAR expects to sell more 1M 2M 3M 6M ICLs in the next three years 1999 2Q19 2Q22 1Q24E 4Q26E (2024 2026) than the first 25 years of ICL sales combined. 20 YEARS 3 YEARS < 2 YEARS VISION 2026 STAAR SURGICAL 15

Robust Product Pipeline Presbyopia EVO VIVA™ Sphere and Toric Injectors ACCUJECT Ordering System STELLA EVO+CHINA Next Gen EVO Internal R&D and Partnerships STAAR SURGICAL 16

Creating a High Performance Organization VISION Exciting Global Growth The first Choice for Doctors and Patients Seeking Visual Freedom Corporate Values Voice of Customer Voice of Employees Facts and Data Driven Organizaion VITAL FEW PROJECTS AND INVESTMENTS THE ORGANIZATION STRUCTURE & TEAM TO EXECUTE STAAR SURGICAL 17

The STAAR Team / Up Next… STAAR’s Proprietary EVO ICL Technology Robust Product Pipeline Increasing Surgeon Support and Education Continuing EVO ICL’s Global Growth APAC, EMEA, Americas Driving EVO ICL Awareness Commercial Initiatives to Accelerate Growth Operational Excellence and Scale to Sell Millions of EVOs Annually STAAR’s Financial Strength Target Sales and Operating Model Financial Discipline Magda Michna, PhD Warren Foust Patrick Williams STAAR SURGICAL 18

VISION 2026 Extending EVO ICL’s Leadership Position MAGDA MICHNA, PHD Chief Clinical, Regulatory and Medical Affairs Officer STAAR Surgical Company STAAR SURGICAL 19

The Collamer® Difference Robust Product Pipeline Surgeon Support and Education 01 02 03 STAAR SURGICAL 20

EVO ICL – The Collamer® Difference Collamer® Collamer is a proprietary lens material created and used exclusively by STAAR®. The Collamer material is bonded with UV absorbing chromophore into a copolymer that offers UV protection. Collagen Collagen is the main structural protein in the extracellular matrix found in the body's various connective tissues. It is the most abundant protein in mammals, making up from 25% to 35% of the whole-body protein content. Collagen forms the structural component of tendons, ligaments, bones and joints. Safety and Effectiveness Proven track record of sound scientific evidence supporting performance and safety of EVO: Two pivotal US clinical trials determined the safety and performance of the ICL in >500 patients. 200+ ICL Clinical Papers 1% Global MDR rate past six quarters4 32% 200/629 eyes in U.S. EVO FDA study had 3D to 6D SE. 2, 3 2 3% U.S. MDR rate on FDA MAUDE database (past six quarters) is consistent with early EVO experience in other countries Company Logo4

The EVO ICL Advantage: A Disruptive Technology 22 Sharp, clearvision No removal of corneal tissue Bio-Compatible Quiet in the Eye Excellent vision at night Does not cause dry eye syndrome Quick procedure and recovery Removable by a surgeon Protection from UV rays Additive Company Logo

Only One Phakic Intraocular Lens (IOL) Is Collamer EVO ICL – Posterior Chamber / Collamer Other Phakic IOLs Posterior chamber the narrow space behind the iris Cachet Lens – Anterior Chamber / Acrylic and in front of the natural crystalline lens Due to concerns about endothelial cells loss in a group of 1323 eyes implanted, the manufacturer voluntarily discontinued the production of this Collamer, A unique biocompatible material intraocular lens in 2014. Approaching 3M+ lenses sold Verisyse Artisan Lens – Anterior Chamber / Acrylic vs. 25 Year history of safety and effectiveness IPCL V2.0 Lens – Posterior Chamber / Acrylic EYECRYL™ Lens – Posterior Chamber / Acrylic 99.4% of EVO patients surveyed would choose EVO again* Eyebright Lens – Posterior Chamber / Acrylic * Packer, The Implantable Collamer Lens with a central port: review of the literature, Clinical Ophthalmology, 2018. + Approx. 16 Other Phakic IOLs Company Logo

STAAR Listens The Voice of Our Global Customers Current State 93% Global Surgeon Willingness to Recommend (N=907, April 13, 2023) Two Survey Questions What do you recommend STAAR do to increase your adoption of our ICLs? If STAAR could improve one or two important things, what would you recommend?” Our Opportunity Marketing/Consumer Awareness Faster Delivery/Supply Order Process/Product Availability TRAINING ON LENS SIZE SELECTION Pre-Op Measurement More Lens Sizes 24 Company Logo

Robust Product Pipeline Presbyopia EVOVIVA™ Sphere and Toric Injectors ACCUJECT Ordering System STELLA EVO+ CHINA Next Gen EVO Internal R&D and Partnerships Company Logo

Product Pipeline: Presbyopia EVO VIVA EVO VIVA™ is an extended depth of focus (EDoF) lens Surgeon training and education on lens and patient selection are critical variables for success Expands EVO ICL family of lenses to early presbyopes ages 45-55 Removable and saves crystalline lens Expanded commercialization post ESCRS An innovative Implantable Collamer® Lens for the correction/reduction of myopia with presbyopia 26 Company Logo

Product Pipeline: Lens Delivery Devices ACCUJECT Injector System Voice of customer Partnered w/ Medicel – a global leader in injector systems Custom designed injector system for EVO/EVO+ ICLs Launch strategy begins in US then global expansion PHASE 1 User Loaded Injector 2024 PHASE 2 Pre-loaded Injector 2026 Company Logo

Product Pipeline: ICL Planning and Ordering System Stella Optimized User Interface and Workflow Patient Management Intuitive Calculator Order Management Inventory / Lens Reservations Upgrade replacement for OCOS online calculator and ordering system Significant time savings for customers estimated at up to 15 minutes per patient Development roadmap includes integration with widely used biometer and diagnostic devices, e.g. Pentacam Launch 2024 Company Logo 28

Product Pipeline: A New Lens for the World’s Largest Refractive Market EVO+ ICL in China Expanded optic lenses for patients with larger pupils Allows customer segmentation TARGET 2025 Company Logo 29

Product Pipeline Next Generation EVO Lenses Internal R&D + partnerships to develop next generation EVO ICL Intermediate Lens Sizes Collamer 2.0 Customized lenses Company Logo 30

Surgeon Support and Education Benchmark and leverage international expertise to support surgeon journey in the US Peer to Peer Peer to Peer Medical Education Medical Investigator Knowledge Education Programs Publications Initiated Trials Sharing staar surgical 31

CHINA: Durable Growth in the Largest Refractive Market Globally ZHENG WANG, MD Aier Eye Hospital Group Shanghai, China STAAR SURGICAL 32

Refractive Surgery in China–the Big Data Wang Zheng, MD EYE Aier EVO ICL International Summit EYE AIER EYE HOSPITAL STAAR SURGICAL The 2ndAier EVO ICL International Summit

EVO ICL Aier EVO ICL International Summit Myopia: The Present Situation EYE AIER EYE HOSPITAL STAAR SURGICAL Myopia prevalence in Asia is higher than Europe and US. China has reached 48.5%, the highest prevalence of myopia in Asia Race (Tay‘s)All Ages Chinese 48.5% Eurasian 34.7% Indians 30.4% Malays 24.5% Source: Archives of Ophthalmology, Aug 2008; Singapore Medical Journal, Dec1993 The 2ndAier EVO ICL International Summit

EVO ICL Aier EVO ICL International Summit EYE AIER EYE HOSPITAL STAAR SURGICAL Refractive Surgery Penetration Rate Myopia prevalence in Asia is higher than Europe and US. While LVC per 1k population in China is only 0.7 while Western Europe reached 1.3 and USA 2.6. Market Scope: 2021 Refractive Surgery Market Report Laser Vision Correction Procedures by Country and Annual Rate Region Country Population (M) % of Global Population LVC per 1k Population United States 335.0 4.30% 2.6 Western Europe Germany 80.0 1.0% 1.3 France 68.1 0.9% 1.1 United Kingdom 66.1 0.9% 1.3 Italy 62.5 0.8% 1.2 Spain 50.3 0.6% 1.6 Other W. Europe 89.3 1.1% 1.3 Total Western Europe 416.2 5.4% 1.3 Japan 125.1 1.6% 0.4 Other Wealthy Nations Korea, South 52.0 0.7% 3.8 Canada 38.0 0.5% 2.3 Saudi Arabia 34.7 0.4% 1.2 Austria 25.8 0.3% 1.1 Other Wealthy 89.3 1.2% 1.4 Total OWN 263.5 3.4% 2.0 Wealthy National Total 1139.8 14.7% 1.8 China 1397.9 18.0% 0.7 India 1340.5 17.3% 0.1 Market Scope: 2021 Refractive Surgery Market Report Laser Vision Correction Procedures by Country and Annual Rate Region Country Population (M) % of Global Population LVC per 1k Population Latin America Brazil 213.1 2.7% 0.7 Mexico 130.0 1.7% 0.6 Columbia 49.5 0.6% 0.5 Argentina 45.9 0.6% 0.4 Peru 32.2 0.4% 0.2 Venezuela 29.1 0.4% 0.0 Other LA 146.6 1.90% 0.2 Total LA 646.3 8.30% 0.5 Rest of World Indonesia 269.1 3.50% 0.1 Pakistan 238.3 3.10% 0.0 Poland 38.2 0.50% 0.4 Russia 141.5 1.80% 0.5 Thailand 69.1 0.90% 0.8 Philippines 110.8 1.40% 0.2 Eygpt 106.5 1.40% 0.8 Vietnam 99.5 1.30% 0.3 Turkey 82.5 1.10% 0.9 Other ROW 2086.3 26.90% 0.0 Total ROW 3241.7 41.70% 0.1 Source: Market Scope: 2021 Refractive Surgery Market Report

EVO ICL Aier EVO ICL International Summit EYE AIER EYE HOSPITAL STAAR SURGICAL Big Data Report in Aier Group Research Period 2018-2021 Research Population Refractive surgery patients in Aier China and Clínica Baviera Research Data Valid Data 1,830,981 eyes/ 931,071 patients Research Region Mainland China Spain Italy Germany Austria EVO ICL The 2nd Aier EVO ICL International Summit

EVO ICL Aier EVO ICL International Summit EYE AIER EYE HOSPITAL STAAR SURGICAL EVO ICL The 2nd Aier EVO ICL International Summit Surgical Volume 700,000 600,000 500,000 400,000 300,000 200,000 100,000 2018 2019 611,920 311,935 250,099 61,836 407,874 340,122 67,752 499,252 433,677 65,575 526,503 85,417 Aier China & Europe Aier China Aier Europe

EVO ICL Aier EVO ICL International Summit EYE AIER EYE HOSPITAL STAAR SURGICAL EVO ICL The 2nd Aier EVO ICL International Summit Seasonality Trends Aier China Aier Europe 1月 2月 3月 4月 5月 6月 7月 8月 9月 10月 11月 12月 1月 2月 3月 4月 5月 6月 7月 8月 9月 10月 11月 12月 Jan. Feb. March April May June July Aug. Sept. Oct. Nov. Dec. Jan. Feb. March April May June July Aug. Sept. Oct. Nov. Dec. 2018年 2019年 2020年 2021年月Average均 2018年 2019年 2020年 2021年月Average

EVO ICL Aier EVO ICL International Summit EYE AIER EYE HOSPITAL STAAR SURGICAL EVO ICL The 2nd Aier EVO ICL International Summit Patient Age Average Age> 40 y/o Aier China 25.5 3.6% Aier Europe 33.3 21.7% Percentage of Patient Age >40 8 6.7 6 3.8 3.2 3.0 4 % 2 0 First-tier cities New first-tier cities Second-tier cities Third and fourth-tier cities

EVO ICL Aier EVO ICL International Summit EYE AIER EYE HOSPITAL STAAR SURGICAL EVO ICL The 2nd Aier EVO ICL International Summit Gender Male Female Aier China 57.5% 42.5% Aier Europe 49.7%50.3% Aier China Aier Europe 77.7 22.3 76.4 23.7 34.8 65.2 27.6 72.4 29.0 71.0 36.3 63.7 41.6 58.5 41.2 58.8 57.8% 42.2% 54.6% 45.4% 50.0% 50.0% 49.6% 50.4% 48.1% 51.9% 46.8% 53.2% 48.4% 51.6% 49.0% 51.0% <20 20-24 25-29 30-34 35-39 40-44 45-49 ≥50 <20 20-24 25-29 30-34 35-39 40-44 45-49 ≥50 Male Fem Male Fem

Aier EVO ICL International Summit Degree of Refractive Error EYE AIER EYE HOSPITAL STAAR® SURGICAL Low Myopia (below -3D) Moderate Myopia (-3 to -6D) High Myopia (-6 to -10D) Extreme Myopia (above -10D) Aier China 13.3% 53.7% 29.8% 3.1% Aier Europe (Clinica Baviera) 40.1% 41.0% 11.6% 1.3% EVO ICL The 2nd Aier EVO ICL International Summit

Aier EVO ICL International Summit Growth ICL Volume in Aier Group EYE AIER EYE HOSPITAL STAAR® SURGICAL 2014 2015 2016 2017 2018 2019 2020 2021 2022 Approval of V4c (EVO) 36% 68% 85% 82% 45% 31% 22% 17% CAGR in the past 4 years: LVC: 18.6% ICL: 28.0% EVO ICL The 2ndAier EVO ICL International Summit

Aier EVO ICL International Summit Surgery Type EYE AIER EYE HOSPITAL STAAR® SURGICAL Year Low Myopia (below -3D) Moderate Myopia (-3 to -6D) High Myopia (-6 to -10D) Extreme Myopia (above -10D) NO.1 NO.2 NO.1 NO.2 NO.1 NO.2 NO.1 NO.2 2021 SMILE 46.6% LASIK 46.2% SMILE 46.8% LASIK 45.4% LASIK 52.8% ICL 23.3% ICL 93.6% LASIK 6.0% 2018-2020 LASIK 56.2% SMILE 35.1% LASIK 51.9% SMILE 38.8% LASIK 55.9% SMILE 21.0% ICL 49.7% LASIK 31.7% EVO ICL The 2ndAier EVO ICL International Summit

Aier EVO ICL International Summit ICL Trends EYE AIER EYE HOSPITAL STAAR® SURGICAL Year Low to moderate myopic ICL surgery 2021 2.9% 2018 1.5% ICL CGAR(Y2018-Y2021) 31.23% 57.69% 0% 10% 20% 30% 40% 50% 60% 70% 1st & 2ndtier cities 3rd & 4th tier cities First and second-tier cities ICL Portion, 27.05% Laser Surgery Portion, 72.95% Third and forth-tier cities ICL Portion, 15.56% Laser Surgery Portion,… EYE AIER EYE HOSPITAL STAAR® SURGICAL

UCVAonDay1 81.79% (80.88%in2018-2020) UCDA(post-op) ≥BCVA(pre-op) ICL87.6% LASIK85.7% SMILE78.4%

Surgical Outcomes (ICL) UCVA 100 87.6 94.4 95.9 96.1 96.0 93.5 proportion(%)80 60 40 20 0 1 Day 1 Week 1 Month 3 Months 6 Months 12 Months

Refractive Stability ICL LASIK SMILE Pre-op -8.49D -5.11D -4.49D Post-op 1M -0.00D 0.07D 0.01D Post-op 12M -0.12D -0.09D -0.10D 2 0 -2 -4 -6 -8 -10 pre-operation -4.49 -5.11 -8.49 0.01 1month -0.01 -0.04 -0.09 0.12 3 months 12 ICL LASIK SMILE months

Aier Study of ICL on Low to Moderate Myopia • 731 Consecutive eyes which also suitable for LVC • 5 centers • Age 18-50 y/o (mean, 25.5±6.0) • Preop MRSE: -5.23±1.27D – Sphere -4.56±1.25D, Cylinder 1.27±1.17D • Preop CDVA: 1.0 or better • Target refraction: Plano • 447 non-toric • 284 toric (cyl >0.75D) • Refractions, VA, Vault, IOP, Scatter, ECD, HOA • Followup > 1 y

Efficacy & Predictability MRSE: 93.98% 100.00% • Preop -5.23±1.27D (-6.0 to 0.75) 80.00% • Postop: +0.13±0.13D (-0.63 to 0.50) 60.00% ±0.50D 99.31% 40.00% ±1.00D 100% 20.00% 0.00% 0.34% 4.99% 0.34% 0.34% 0.00% 0.00% 2yearspostop Chart

Postop Cylinder Distribution • Preop: 1.27±1.17D (0 to 4.50) • Postop: 0.25±0.25D (0 to 0.75) 100 All Eyes 50 % 0 0 to 0.25D 0.26 to 0.50 0.51 to 1.00 >1.01D DD 100 80 60 40 20 0 <0.25 <0.50 <1.00 <1.50 2yearspostop

Efficacy & Safety 术前BCVA Postop UCVA Postop UCVA Preop BCVA 100.0% 4.6% 95.4% 71.7% 29.4% 99.6% 99.0% 99.0% 99.7% 100% 100% 90% 90% 80% 80% 70% 70% 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% <1.0 ≥1.0 ≥1.2 ≥1.5 ≥1.5 ≥1 ≥0.8 ≥0.6 ≥0.5 0.0% 88.1% 96.2% 29.4% 95.6%

Efficacy & Safety 100% 80% 60% 40% 20% 0% 0.1% Postop UCVA vs. preop BCVA 较 44.6% 32.8% 20.7% 1.7% 2Y Postop UCVA vs Preop BCVA -2lines-1line+1line+2linesequal +2lines-2lines-1line+1lineunchanged Efficacy Index 1.25 Safety Index 1.23 0.0%0.9% 15.0% 61.4% 22.8% 00.20.40.60.81术较BCVAchanges-2lines-1line+1line+2linesequal+2lines-2lines-1line+1lineunchanged

Visual Quality Qualityofvisioncomparison-0.100.10.20.30.40.50.6PreopPostopPreopPostopRMShcomasphericalICLSMILE

ScatterICLLASIKSMILEPreopOSIPostopOSI1.00.70.30.60.71.9ICLLASIKSMILEPreopOSIPostopOSI1.00.70.30.60.71.9

SafetyParameters IOP (mmHg) 0 5 10 15 IOP preop 1D 1W 1M 3M 6M 12M 0 200 400 800 1000 150-1100 64-1200 149-1260 130-1030 100-1160 110-1040 1D 1W 1M 3M 6M 12M Vault ECD 2000 2200 2400 2600 2800 3000 3200 preop 1M 12M -3.4% Stable IOP, vault, and endothelial cell density Wide variance in vaulting

Complications • No vision threatening complications • Improper sizing requiring ICL exchange 1.37% –ICL oversize: 6/731 (0.8%) –ICL undersize: 4/731 (0.5%) • Cataract: 0% Bar graph

Summary • The refractive surgery market in China is far from saturation • There’re some interesting characteristics of Chinese market • The surgical results are good and still improving in Aier hospitals • ICL is very promising in low and moderate myopic eyes Company Logo

Thankyou…Company Logo

59Q&ASession1 Company Logo

15-MinuteBreakCompany Logo

61 U. S. REFRACTIVEMARKET: From LASIK to Lens-Based STEPHEN SLADE, MD Slade & Baker Vision Houston, TX STAARSURGICAL

EVO: Technology, Surgeon, Patient Stephen G. Slade MD, FACS September 14, 2023 Alcon, J&J, B&L, STAAR, Apple, Novartis, RxSight, CorneaGen, Vialase, Luminex Glaukos, EyeBrain, Surgilum, Occumetrics, LensTec, Allotex, Omega Ophthalmics, Presbyopia Therapies

-1991 First LASIK in US -1996 FDA Lasik Approval – 2005 FDA ICL Approval -Courses, Papers, Texts Early Adoption

Picking Winners Is it unique, elegant? Do I believe in the product? Do I want this for my patients? Does it meet an unmet need, commercial potential?

Lesson Learned from LASIK: UCVA Drives Satisfaction Schallhorn, AECOS 2016 UCVA 20/X40 67% 58% 46% 40% 33% 29% 36% 42% 41% 40% 4% 6% 12% 19% 27% 0% 20% 40% 60% 80% 100% 12.5 16 20 25 40 Very Satisfied Satisfied Dissatisfied or Neither N=12,936 20/

Post UCVA Equal To Or Better Than Pre % of Cases *Targeted For Emmetropia (± 0.5D) BSCVA 0 10 20 30 40 50 60 60% 55% 59% 47% 56% 58% 1wk 1mo.3mos.6mos.12mos. 52% 24mos. 36 mos.

97% 99% 99% 99% 99% 98% 98% 99% 100% 80% Stability 60% 40% 100% 20% 80% 0% Preop 1wk 1mo 3mos 6mos 12 mos 24 mo 60% 40% 20% 0% Preop 7.0 6.0 5.0 4.0 3.0 Additive 2.0 1.0 0.0 Preop 1Wk 1Mo 3Mos 6Mos 12Mos 24Mos 36Mos 1wk 1mo 3mos 6mos 12mos 24mos 36mos 0% 81% 85%86%85%85% 83%81% 8.0 9.0 10.0 11.0 12.0

Surgeon’s Perspective Fast, straightforward procedure Not dose dependent Plays well with others Office OR?

Patient’s Perspective! Wow Factor Average 20/30 at 1 hour Not visible, Removable Intact, No large incision Elective Surgery

Thank you!

Image VISION 2026 Establishing EVO ICL as The First Choice for Doctors and Patients WARREN FOUST Chief Operating Officer STAAR Surgical Company STAAR SURGICAL 71

01 EVO ICL Global Growth Driving EVO ICL Awareness 02 03 Commercial initiatives to Accelerate Growth 04 Operational Excellence and Scale to Sell Millions of EVOs Annually STAAR SURGICAL 72

EVO ICL TM ICL China STAAR SURGICAL

APAC: STAAR is Achieving Broad-based Geographic Growth and Share Gains Bar Graph ICL Sales by Country Refractive Procedure Market Share, 2022 $ Millions China Japan South Korea Rest of APAC 250.00 200.00 150.00 100.00 50.00 2018 2019 2020 2021 2022 CHINA JAPAN SOUTH KOREA ~20% ~50% ~15% Growth Variables High myopia prevalence 34% Level of STAAR investment APAC EVO ICL adoption by Sales CAGR largest hospital chains (2018-2022) STAAR SURGICAL 74

EMEA: Progress Despite Macroeconomic Headwinds Bar Graph ICL Sales by Country Refractive Procedure Market Share, 2022 $ Millions Spain Germany Great Britain European Distributors SPAIN GERMANY ~15% ~8% Growth Variables Economic weakness 9% Distributor vs. Direct EMEA Level of STAAR investment Sales CAGR Other macroeconomic 2018 2019 2020 2021 2022 (2018-2022) factors - 5.00 10.00 15.00 20.00 25.00 30.00 STAAR SURGICAL 75

Americas: Opportunity Abounds ICL Sales by Country $ Millions United States Canada Latin America 25.00 20.00 15.00 10.00 5.00 – 2018 2019 2020 2021 2022 Refractive Procedure Market Share, 2022 22% Americas UNITED STATES < 5% Sales CAGR (2018-2022) Growth Variables Myopia prevalence Level of STAAR investment Economy STAAR SURGICAL 76

Driving EVO ICL Awareness, Our Marketing Works... STAAR SURGICAL 77

Will Levis hos EVO ICL lenses. STAAR SURGICAL EVOICL

Building Consumer Trust in EVO Safety and Efficacy Partnership includes: Joe & Kevin Jonas 36 Stop Tour sponsorship, Chose EVO ICL EVO ICL video ad played before every concert 8+ social posts on @JoeJonas, @KevinJonas, and @JonasBrothers social accounts (IG, TT, FB, TW) Reaching their 80M social media followers 12 month ad campaign rights via paid social, programmatic display, video, connected tv STAAR SURGICAL EVOICL 79

KEVIN+ JOE JONAS upgrade their vision KEVIN+ JOE JONAS upgrade their vision

Impact of Investments in EVO ICL Awareness and Digital Marketing Delivering Unique Visitors to U.S. Doctor Finder (EVOICL.com) Joe Jonas Campaign Launch 343,996 628,556 647,221 995,389 1,879,577 1,660,986 83,212 266,279 318,608 179,529 343,996 628,556 Q1 '22 v '21 Q2 '22 v '21 Q3 '22 v '21 Q4 '22 v '21 Q1 '23 v '22 Q2 '23 v '22 staar surgical EVOicl 81

Impact of Investments in EVO ICL Awareness and Digital Marketing - Past Six Quarters vs. Prior Year Period Significant Increase in U.S. Doctor Finder Searches Joe Jonas Campaign Launch 2,517 19,404 18,824 24,705 16,662 31,644 10,288 123,959 19,404 194,765 24,705 205,155 1Q21 v. 1Q22 2Q21 v. 2Q22 3Q21 v. 3Q22 4Q21 v. 4Q22 1Q22 v. 1Q23 2Q22 v. 2Q23 staar surgical EVOicl 82

Marketing investments EVO ICL Patient Journey is Too Often Incomplete (Current) Discovery / Awareness Research / Interest Inquiry Action DIGITAL MARKETING Social Media ads Display ads YouTube / CTV ads Native ads Audio-only platforms ads SEM/SEO Public Relations ORGANIC SOCIAL MEDIA: EVO WEBSITE SCHEDULES APPOINTMENT WITH DOCTOR NOT A CANDIDATE < (-3.0) DOCTOR CONVERTS TO LASIK / PRK GETS EVO ICL staar surgical EVOicl 83

Process Improvements + Commercial Initiatives staar surgical EVOicl 84

Commercial Initiative Partnering with Best-In-Class Call Center to Complete EVO ICL Patient Discovery Discovery / Awareness Research / Interest Inquiry Action DIGITAL MARKETING Social Media ads Display ads YouTube / CTV ads Native ads Audio-only platforms ads SEM/SEO Public Relations ORGANIC SOCIAL MEDIA: EVO WEBSITE EVO ADVISOR PROGRAM Potential Patient fully vetted- qualifies(>- 3.0), understands cost, all questions answered STAAR books appointment directly with clinic CONSUMER GETS EVO staar surgical EVOicl 85

Commercial Initiative Increasing Knowledge of STAAR’s Customers to Optimize Segmentation GOAL: Best serve meet/exceed each unique customer’s needs and drive EVO ICL utilization U.S. EVO ICL Customers 400+ Practices 600+ Surgeons 300K+ $450M+ Annual U.S. Refractive Procedures U.S. Refractive Procedure Revenue Profits Patient Prices $1,821 Patient Prices EVO Incremental Profit Contribution 47% Practices have Owned Ambulatory Surgery Center (ASC) ALL SURGICAL SETTINGS OBS is $2,785 89% EVO Premium EVO ICL $8,680 vs. LVC $4,688 Surgical Setting 20% Practices have Office-Based Sterile Surgical Suite (OBS) 47% Practices have Owned Ambulatory Surgery Center (ASC) Other Qualitative and Quantitative Variables Surgeon Competence and Confidence in Performing EVO ICL Procedure Same Day Bilateral Practice Spends Money on Refractive Marketing staar surgical EVOicl 86

Drive EVO ICL Adoption PRE-OPERATIVE Eye measurement and lens size selection INTRA-OPERATIVE Surgery POST-OPERATIVE Patient follow-up and understanding outcomes Territory Manager Practice Development Clinical Applications Specialist STAAR recently established a structure and foundation for a World Class Training and Education Organization Goal: Increase Surgeon Confidence and EVO ICL Utilization + One Document to Surgeon Customer on How STAAR will Provide Support and Education staar surgical EVOicl 87

Commercial Initiative Executing U.S. Pilots with Significant EVO ICL Growth Commitments Pilots Tailored for the U.S. Refractive Market MARKET SHARE OF QUALIFIED PATIENTS OBS CONSTRUCTION/ DEVELOPMENT New Ways to Partner with Our Customers EQUIPMENT/ PROCUREMENT The number of pilots, pace of learnings and potential broader implementation are contemplated in STAAR’s 18-24 month U.S. growth inflection timeline, i.e., 4Q24 or 1H25, as provided on June 6, 2023 staar surgical EVOicl 88

Operational Excellence and Scale ... staar surgical EVOicl 89

Operational Excellence We Are Delivering Our Lenses to Surgeons and Patients Faster in 2023 SERVICE LEVEL Spheric ~100% Toric 81% TORIC MADE TO ORDER LENSES (MTO) Number of Open MTO Lenses Change from January 11, 2023 to August 31, 2023 60% Days Outstanding MTO Lenses 13% 87% 81% 19% Outstanding 0 to 21 Days Outstanding > 21+ Days January 11, 2023 August 31, 2023 staar surgical EVOicl 90

91 Existing and Planned Capacity Manufacturing Capacity to Support $800M+ Annual Sales Existing and Planned through 2026 Capacity Expansion Monrovia, CA UNITS DOLLARS @$525/UNIT 600,000 800,000 1,200,000 1,600,000 1,600,000 2022 2023E 2024E 2025E 2026E $315,000,000 $420,000,000 $630,000,000 $840,000,000 $840,000,000 2022 2023E 2024E 2025E 2026E Vision 2026: 1.6 Million Vision 2026: $840 Million

Happy EVO ICL Patients and Surgeons!

Surgeon Panel: The Global EVO ICL Experience SCOTT D. BARNES, MD Chief Medical Officer STAAR Surgical (Moderator) ZHENG WANG, MD Aier Eye Hospital Group FRANK KERKOFF, MD FYEO Medical BLAKE WILLIAMSON, MD Williamson Eye Center STEPHEN SLADE, MD Slade & Baker Vision ROGER ZALDIVAR, MD Instituto Zaldivar STAAR SURGICAL 93

15-Minute Break 15-Minute Break STAAR SURGICAL

95 VISION 2026 Long Term Planand Value Creation PATRICK WILLIAMS Chief Financial Officer STAAR Surgical Company STAAR SURGICAL

96 01 02 03 STAAR’s Financial Strength Target Sales and Operating Model Financial Discipline STAAR SURGICAL

97 Fiscal 2023 Outlook 3Q23 Sales Approximately $80M FY23 Sales Approximately $320M $325M FY23 Gross Margin Approximately 78% FY23 CapEx Approximately $26M STAAR SURGICAL

98 We Know You Have Many Investment Choices Small and Mid Cap Public Company Universe Market Caps $300M to $10 Billion All Sectors N = 2771 Healthcare Sector N=394 STAAR SURGICAL

99 We Know You Have Many Investment Choices Small and Mid Cap Public Company Universe Market Caps $300M to $10 Billion ALL All Sectors N = 2771 Healthcare Sector N = 394 Positive GAAP Earnings All Sectors N = 1665 60% Healthcare Sector N = 95 24% STAAR SURGICAL

100 We Know You Have Many Investment Choices Small and Mid Cap Public Company Universe Market Caps $300M to $10 Billion ALL All Sectors N = 2771 Healthcare Sector N = 394 Positive GAAP Earnings All Sectors N = 1665 60% Healthcare Sector N = 95 24% 15% Sales Growth Consensus All Sectors N = 171 6% Healthcare Sector N = 19 5% STAAR SURGICAL

All Roads Lead to STAAR All Sectors NASDAQ: STAA Healthcare Sector N = 171 N=19 101 6% 5% Staar surgical Staar surgical

Vision 2026 / Double-Digit Sales Cagr Approximately 15% To Approximately 20% An Nu Al Gro Wt H Ran Ge Y /Y 3-Year Sales Cagr (2024-2026) Approximately $500 To $550 Million Fiscal 2026 Sales 102 Target Sales Model Staar Surgical

Target operating model – sales sensitivities 2024-2026 apac 15% to 20% 3-year cagr china ~20% emea 10% to 15% 3-year cagr americas 25% to 30% 3-year cagr u.s. 30% to 50% pace of evo icl adoption down the diopter curve (evo icl owning -6d and above refractive vision correction) country mix (direct vs. Hybrid/distributor) success of u.s. Initiatives success of initiatives introduced in other markets globally macroeconomic environment (particularly emea) a diopter is a unit of measurement of the refractive power of a lens. -8.9 d average spheric icl sold 2022 -20d -19d -18d -17d -16d -15d -14d -13d -12d -11d -10d -9d -8d -7d -6d -5d -4d -3d staar surgical 103

Vision 2026 / Double-Digit GAAP Operating Margin Approximately Approximately TO 12% 16% ANNUAL OPERATING MARGIN GAAP OPERATING MARGIN (2024 2026) Approximately $60 TO $90 MILLION TARGET OPERATING MARGIN Fiscal 2026 Operating Income 104 Staar Surgical

Vision 2026 / Target Operating Model – Additional Details 15% Sales Growth CAGR Scenario through FY2026E + ~$180M + ~700bps Sales $ Growth Operating Margin Expansion FY 2023 Outlook FY 2026E Change From FY23 Outlook FY 2026E Change From FY23 Outlook Growth Scenario 15% CAGR 20% CAGR Sales $323M $500M +$177M $550M +$227M Gross Margin 78% 81% +300bps 81% +300bps OpEx 73% 69% (400bps) 65% (800bps) TARGET SALES AND OPERATING MODEL Operating Income 5% 12% +700bps 16% +1100bps G&A 23% 22% (100bps) 20% (300bps) S&M 36% 35% (100bps) 35% (100bps) R&D 14% 12% (200bps) 10% (400bps) Tax Rate 25%-30% - 25% 30% - 105 Staar Surgical

STAAR Demonstrates Strong Sales Growth (in millions) $101 $129 $141 $213 $270 $323 500 $550 Growth Inflection + Year 1 GAAP Profitability Temporary COVID-19 Impact Vision 2026 2018 2019 2020 2021 2022 2023 Outlook 2024E 2025E 2026E 106 Staar Surgical

STAAR Knows How to Expand Operating Margin Vision 2026 16% 12% 15% 15% 8% 5% 5% 4% 2017 % 2018 2019 2020 2021 2022 2023 Outlook 2024E 2025E 2026E (4%) * Initial sales outlook provided prior to COVID on January 13, 2020, was for sales mid-point of $177 million or +18% Y/Y Growth for 2020. CAGR of 28% for 2019-2022. ** Outlook raised to $345M ICL sales and $348M total net sales on May 3, 2023. 107 Staar Surgical

STAAR Knows How to Generate Cash (in millions) ADJUSTED EBITDA EX. SBC BALANCE SHEET CASH CapEx Expected to be approximately $20-$30M Annually $226 $200 75 $110 $153 $120 $104 $67 $61 $50 $26 $23 $16 $19 2018 2019 2020 2021 2022 2023 Outlook 2024E 2025E 2026E 2017 2018 2019 2020 2021 2022 * Initial sales outlook provided prior to COVID on January 13, 2020, was for sales mid-point of $177 million or +18% Y/Y Growth for 2020. CAGR of 28% for 2019-2022. ** Outlook raised to $345M ICL sales and $348M total net sales on May 3, 2023. 108 Staar Surgical

TARGET SALES AND OPERATING MARGIN Profitable & 15%+SalesGrowthTop5% Staar Surgical SALES Approximately 15% to Approximately 20% ANNUAL GROWTH RANGE Y / Y 3-Year Sales CAGR (2024-2026) Approximately $500 TO $550 MILLION Fiscal 2026 Sales OPERATING MARGIN Approximately 12% to 16% ANNUAL OPERATING MARGIN GAAP OPERATING MARGIN (2024 2026) Approximately $60 TO $90 MILLION TARGET SALES AND OPERATING MARGIN 109 Staar Surgical

Closing Remarks TOM FRINZI Chair of the Board and CEO STAAR Surgical Company 110 Staar Surgical

Closing Remarks TOM FRINZI Chair of the Board and CEO STAAR Surgical Company 110 Staar Surgical Evergreen and Refreshed as Data and Voice of Customer Dictates… 01 Increase surgeon support and education 2023 02 Presbyopia (Viva™) 2023 03 Faster production/Increased capacity to deliver our lenses to customers faster 2023 04 Simplify our ICL ordering process (New Stella ordering system) 2024 05 New lens delivery devices globally (New Accuject/Global injector program) 2024 06 US Growth 2024 07 EVO+ in China (New to China) 2025 111 Staar Surgical

Select Growth Markets (3-Year CAGR, 2020-2022) STAAR is a Global Growth Company CANADA +20% NETHERLANDS +19% KOREA +24% BELGIUM +15% UNITED STATES +28 ITALY +22% CHINA +32% JAPAN +40% FRANCE +28% HONG KONG +27% EGYPT +26% INDIA +19% THAILAND +59% MALAYSIA +31% MEXICO +16% SINGAPORE +60% VIETNAM +18% AUSTRALIA +15% SOUTH AFRICA +15% 112 Staar Surgical

Emerging Markets and Rapidly Growing Middle Class and Wealthy STAAR Will Also Invest in the Next Stages of Growth UNITED STATES 340 Million Population CHINA 1.4 Billion Population INDIA 1.4 Billion Population MEXICO 128 Million Population BRAZIL 216 Million Population INDONESIA 278 Million Population The Data Among the 80 million new MACs [middle-class and affluent consumer], over 70% of this group will be from tier-3 cities and below, making lower-tier cities an increasingly important part of the market… Our research also shows that even during the relatively difficult last few years, Chinese consumers demonstrated a strong desire to trade up and an increased willingness to pay a premium for quality across product categories. - BCG, The Next Chapter in China’s Consumer Story, June 22, 2023 Consider these numbers. The middle class is the fastest-growing major segment of the Indian population in both percentage and absolute terms, rising at 6.3 percent per year between 1995 and 2021. It now represents 31 percent of the population and is expected to be 38 percent by 2031 and 60 percent in 2047 - Economic Times, How the Middle Class will Play the Hero in India’s Rise, July 9, 2023 113 Staar Surgical

Planning for Billion Dollar Annual Sales Milestone Post 2026 Project Roadrunner Will Ultimately Support $1B+ Annual Sales CapEx through 2026 fully captured in 3-Year plan Phased additional Arizona manufacturing allows over $1 Billion Annual Sales TARGET 2028 114 Staar Surgical

Vision 2026 IT’S OUR TIME… IT’S EVO’S TIME! Staar Surgical

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

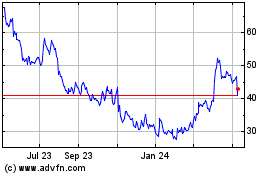

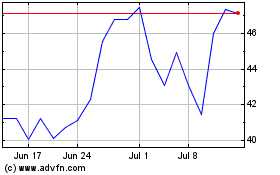

STAAR Surgical (NASDAQ:STAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

STAAR Surgical (NASDAQ:STAA)

Historical Stock Chart

From Apr 2023 to Apr 2024