FALSE000109269912/31333 South Seventh StreetSuite 1000MinneapolisMinnesotaNasdaq Global Market00010926992024-05-162024-05-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

May 16, 2024

Date of report (Date of earliest event reported)

SPS COMMERCE, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34702 | | 41-2015127 |

| (State of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

333 South Seventh Street, Suite 1000 Minneapolis, Minnesota | | 55402 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(612) 435-9400

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | SPSC | The Nasdaq Stock Market LLC

(Nasdaq Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 16, 2024, the Compensation and Talent Committee of the Board of Directors of SPS Commerce, Inc. (the "Company") designated Kimberly Nelson, the Company’s Executive Vice President and Chief Financial Officer, as a participant in the SPS Commerce, Inc. Executive Management Team Severance Plan (the “Severance Plan”). In connection with such designation, the Amended and Restated Executive Severance and Change in Control Agreement between the Company and Ms. Nelson was terminated.

The Severance Plan provides for certain payments and benefits to participants in the event of certain specified terminations of employment, including a termination of employment in connection with a change in control of the Company. Payments and benefits under the Severance Plan are conditional upon the execution of release and continued compliance with applicable restrictive covenant agreements.

As more specifically set forth in the Severance Plan, each participant is entitled to receive certain severance benefits in the event the participant’s employment is terminated by the Company other than for Cause (as defined in the Severance Plan) or by the participant for Good Reason (as defined in the Severance Plan) (such types of terminations, a “Qualifying Severance Event”). If a Qualifying Severance Event occurs prior to a Change in Control (as defined in the Severance Plan), the Company will pay the participant: (i) one times the participant’s annualized base salary; (ii) one times the participant’s target annual incentive bonus on a pro-rata basis; and (iii) an amount equal to 12 months of premium costs for health, dental and vision coverage. If a Qualifying Severance Event occurs on or within 12 months following a Change in Control, the Company will pay the participant: (i) 1.5 times the participant’s annualized base salary; (ii) 1.5 times the participant’s target annual incentive bonus on a pro-rata basis; and (iii) an amount equal to 18 months of premium costs for health, dental and vision coverage.

The foregoing description of the Severance Plan is a summary, does not purport to be complete and is qualified in its entirety by reference to the Severance Plan, which is attached as Exhibit 10.1 to this report and is incorporated herein by reference.

Item 5.03. Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year.

As reported below in Item 5.07, on May 16, 2024, the stockholders of the Company approved an amendment to the Company's Ninth Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation") to allow for exculpation of officers, as permitted by Delaware Law (the "Amendment"). The Amendment, which was included as Item 4 in the Company's proxy statement for its 2024 Annual Meeting of Stockholders filed with the Securities and Exchange Commission, became effective on May 16, 2024 upon filing of a Certificate of Amendment to the Certificate of Incorporation ("Certificate of Amendment") with the Secretary of State of the State of Delaware.

A copy of the Company's Amended and Restated Certificate of Incorporation is attached as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On May 16, 2024, the Company held its 2024 Annual Meeting of Stockholders and the Company's stockholders voted on the following matters:

1.Election of Directors

The following nominees were elected to serve as directors for a term that will last until the Company’s 2025 Annual Meeting of Stockholders or until his or her successor is duly elected and qualified. The voting with respect to the election of directors was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nominee | | Votes For | | Votes Against | | Abstain | | Broker Non-Votes |

| Chad Collins | | 34,047,800 | | | 238,521 | | | 32,151 | | | 1,049,044 | |

| James Ramsey | | 32,663,535 | | | 1,622,490 | | | 32,447 | | | 1,049,044 | |

| Marty Reaume | | 32,881,892 | | | 1,404,241 | | | 32,339 | | | 1,049,044 | |

| Tami Reller | | 34,082,110 | | | 204,041 | | | 32,321 | | | 1,049,044 | |

| Philip Soran | | 33,216,447 | | | 1,069,458 | | | 32,567 | | | 1,049,044 | |

| Anne Sempowski Ward | | 32,706,926 | | | 1,577,711 | | | 33,835 | | | 1,049,044 | |

| Sven Wehrwein | | 32,072,702 | | | 2,213,276 | | | 32,494 | | | 1,049,044 | |

2. Ratification of the Selection of KPMG LLP as Independent Auditor for the Year Ending 2024

The Company’s stockholders ratified the appointment of KPMG LLP to serve as the independent auditor for the year ending December 31, 2024 by voting as follows:

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstain | | Broker Non-Votes |

| 33,461,859 | | | 1,891,680 | | | 13,977 | | | — | |

3. Advisory Approval of the Compensation of Named Executive Officers

The Company’s stockholders approved, on an advisory basis, the compensation of the Company’s named executive officers by voting as follows:

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstain | | Broker Non-Votes |

| 32,966,036 | | | 1,335,629 | | | 16,807 | | | 1,049,044 | |

4. Approval of an Amendment to the Ninth Amended and Restated Certificate of Incorporation of SPS Commerce, Inc. to allow for exculpation of officers as permitted by Delaware Law

The Company's stockholders approved the proposal to amend the Company's Ninth Amended and Restated Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware Law by voting as follows:

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstain | | Broker Non-Votes |

| 30,395,221 | | | 3,889,778 | | | 33,473 | | | 1,049,044 | |

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Exhibit |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SPS COMMERCE, INC. |

| | | |

| | | |

Date: May 16, 2024 | By: | /s/ KIMBERLY NELSON |

| | | Kimberly Nelson |

| | | Executive Vice President and Chief Financial Officer |

| | | |

TENTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

SPS COMMERCE, INC.

The undersigned, Kimberly Nelson, the Chief Financial Officer of SPS Commerce, Inc., a Delaware corporation, (the “Corporation”), hereby certifies that:

(1) The name of the Corporation is SPS Commerce, Inc. The Corporation was previously known as SPS Merger Sub, Inc. and was incorporated on April 17, 2001.

(2) The Certificate of Incorporation of this Corporation is hereby amended and restated in its entirety to read as set forth in Exhibit A attached hereto, and that such Tenth Amended and Restated Certificate of Incorporation shall supersede the Ninth Amended and Restated Certificate of Incorporation.

(3) The Tenth Amended and Restated Certificate of Incorporation attached hereto as Exhibit A has been approved by the board of directors of the Corporation pursuant to Section 141(f) of the General Corporation Law of the State of Delaware (the “DGCL”).

(4) The Tenth Amended and Restated Certificate of Incorporation attached hereto as Exhibit A has been adopted pursuant to Sections 242 and 245 of the DGCL.

IN WITNESS WHEREOF, I have subscribed my name this May 16, 2024.

/s/ KIMBERLY NELSON

Kimberly Nelson

EVP and Chief Financial Officer

TENTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

SPS COMMERCE, INC.

ARTICLE 1

NAME

The name of the Corporation is SPS Commerce, Inc.

ARTICLE 2

REGISTERED OFFICE

The address of the Corporation’s registered office in the State of Delaware is c/o Corporation Trust Center, 1209 Orange Street, Wilmington, Delaware 19801, located in New Castle County. The name of the Corporation’s registered agent for service of process at such address is The Corporation Trust Company.

ARTICLE 3

PURPOSE

| | | | | |

| 3.1 | PURPOSES. The Corporation will have general business purposes in accordance with the laws of the State of Delaware. |

| 3.2 | POWERS. The Corporation will have and may exercise all the powers granted or available under the laws of the State of Delaware and laws amendatory thereof and supplementary thereto, including all powers necessary or convenient to effect any or all of the business purposes for which the Corporation is incorporated. |

ARTICLE 4

STOCK

| | | | | |

| 4.1. | AUTHORIZED CAPITAL STOCK. The Corporation shall be authorized to issue 115,000,000 shares of capital stock, of which 110,000,000 shares shall be shares of common stock, par value $0.001 per share (the “Common Stock”), and 5,000,000 shares shall be shares of preferred stock, par value $0.001 per share (the “Preferred Stock”). |

| 4.2 | COMMON STOCK. Except as otherwise provided by law or by the resolution or resolutions adopted by the board of directors of the Corporation designating the rights, power and preferences of any series of Preferred Stock, the Common Stock shall have the exclusive right to vote for the election of directors and for all other purposes. All shares of Common Stock will be voting shares and will be entitled to one vote per share. |

| 4.3 | PREFERRED STOCK RIGHTS. Shares of Preferred Stock may be issued from time to time in one or more series. The board of directors of the Corporation is hereby authorized by resolution or resolutions to fix the voting rights, if any, designations, powers, preferences and the relative, participation, optional or other rights, if any, and the qualifications, limitations or restrictions thereof, of any unissued series of Preferred Stock; and to fix the number of shares constituting such series, and to increase or decrease the number of shares of any such series (but not below the number of shares thereof then outstanding). |

ARTICLE 5

BOARD OF DIRECTORS

| | | | | |

| 5.1 | NUMBER OF DIRECTORS. Except as otherwise provided by the resolution or resolutions adopted by the board of directors of the Corporation designating the rights, powers and preferences of any series of Preferred Stock, the number of directors of the Corporation shall be fixed, and may be increased or decreased from time to time, exclusively by the board of directors. |

| 5.2 | NO WRITTEN BALLOT. Unless and except to the extent that the Bylaws of the Corporation shall so require, the election of directors of the Corporation need not be by written ballot. |

ARTICLE 6

BY-LAWS

In furtherance and not in limitation of the powers conferred by the laws of the State of Delaware, the board of directors of the Corporation is expressly authorized to make, alter, and repeal the by-laws of the Corporation, subject to the power of the stockholders of the Corporation to alter or repeal any by-law whether adopted by them or otherwise.

ARTICLE 7

AMENDING THE CERTIFICATE OF INCORPORATION

The Corporation reserves the right at any time from time to time to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, and any other provisions authorized by the laws of the State of Delaware at the time in force may be added or inserted, in the manner now or hereafter prescribed by law. All rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to this Certificate of Incorporation in its present form or as hereafter amended are granted subject to the right reserved in this Article.

ARTICLE 8

DIRECTOR AND OFFICER LIABILITY; INDEMNIFICATION AND INSURANCE

| | | | | | | | |

| 8.1 | ELIMINATION OF CERTAIN LIABILITY OF DIRECTORS. The personal liability of the directors and officers of the Corporation shall be eliminated to the fullest extent permitted by law. No amendment, modification or repeal of this Article, adoption of any provision in this Certificate of Incorporation, or change in the law or interpretation of the law shall adversely affect any right or protection of a director or officer of the Corporation under this Article 8 with respect to any act or omission that occurred prior to the time of such amendment, modification, repeal, adoption or change. |

| 8.2 | INDEMNIFICATION. |

| (a) | Right to Indemnification. Each person who was or is made a party or is threatened to be made a party to or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter a “proceeding”), by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans, whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended (but, in the case of any such amendment, to the fullest extent permitted by law, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than said law permitted the Corporation to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, fines, amounts paid or to be paid in settlement, and excise taxes or penalties arising under the Employee Retirement Income Security Act of 1974) reasonably incurred or suffered by such person in connection therewith and such indemnification shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of his or her heirs, executors and administrators; provided, however, that, except as provided in paragraph (b) below, the Corporation shall indemnify any such person seeking indemnification in connection with a proceeding (or part thereof) initiated by such person only if such proceeding (or part thereof) was authorized by the board of directors of the Corporation. The right to indemnification conferred in this Article shall be a contract right and shall include the right to be paid by the Corporation the expenses incurred in defending any such proceeding in advance of its final disposition; provided, however, that, if the General Corporation Law of the State of Delaware requires, the payment of such expenses incurred by a director or officer in his or her capacity as a director or officer (and not in any other capacity in which service was or is rendered by such person while a director or officer, including, without limitation, service to an employee benefit plan) in advance of the final disposition of a proceeding, shall be made only upon delivery to the Corporation of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director or officer is not entitled to be indemnified under this Article or otherwise. The Corporation may, by action of the board of directors, provide indemnification to employees and agents of the Corporation with the same scope and effect as the foregoing indemnification of directors and officers. |

| | | | | | | | |

| (b) | Right of Claimant to Bring Suit. If a claim under paragraph (a) above is not paid in full by the Corporation within thirty days after a written claim has been received by the Corporation, the claimant may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim and, if successful in whole or in part, the claimant shall be entitled to be paid also the expense of prosecuting such claim. It shall be a defense to any such action (other than an action brought to enforce a claim for expenses incurred in defending any proceeding in advance of its final disposition where the required undertaking, if any is required, has been tendered to the Corporation) that the claimant has not met the standards of conduct which make it permissible under the General Corporation Law of the State of Delaware for the Corporation to indemnify the claimant for the amount claimed, but the burden of proving such defense shall be on the Corporation. Neither the failure of the Corporation (including its board of directors, independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such action that indemnification of the claimant is proper in the circumstances because he or she has met the applicable standard of conduct set forth in the General Corporation Law of the State of Delaware, nor an actual determination by the Corporation (including its board of directors, independent legal counsel, or its stockholders) that the claimant has not met such applicable standard of conduct, shall be a defense to the action or create a presumption that the claimant has not met the applicable standard of conduct. |

| (c) | Non-Exclusivity of Rights. The right to indemnification and the payment of expenses incurred in defending a proceeding in advance of its final disposition conferred in this Article shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, provision of the Certificate of Incorporation (as it may be amended from time to time), Bylaw, agreement, vote of stockholders or disinterested directors or otherwise. |

| 8.3 | INSURANCE. The Corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any such expense, liability or loss, whether or not the Corporation would have the power to indemnify such person against such expense, liability or loss under the General Corporation Law of the State of Delaware. |

ARTICLE 9

NO CONSENT OF STOCKHOLDERS IN LIEU OF MEETING

The stockholders of the Corporation may not act by written consent in lieu of meeting.

SPS COMMERCE, INC.

EXECUTIVE MANAGEMENT TEAM SEVERANCE PLAN

I. INTRODUCTION

SPS Commerce, Inc. (together with any of its Affiliates or successors (including following any Change in Control), the “Company”) has established the SPS Commerce, Inc. Executive Management Team Severance Plan (the “Plan”) to provide certain severance pay and other benefits to eligible executive management-level employees of the Company whose employment terminates under certain covered circumstances. The Company, in its complete and sole discretion, will determine who is an eligible employee under the Plan.

This Plan supersedes and replaces any policy, plan or practice that may have existed in the past regarding the payment of severance pay and other benefits, other than pursuant to the terms of any equity or equity-based award agreements, to Participants.

This document is both the “Plan document” and the “Summary Plan Description” for the Plan.

II. ELIGIBILITY FOR SEVERANCE PAY AND BENEFITS

All executive management employees designated by the Compensation & Talent Committee of the Board Company’s Board of Directors (“Compensation & Talent Committee”) as eligible to be a participant in the Plan are eligible to participate in the Plan. An employee becomes a participant (“Participant”) as of the first business date after (i) such employee is first classified by the Compensation & Talent Committee as eligible to be a Participant, (ii) the eligible employee has signed an At-Will/Confidentiality Agreement Regarding Certain Terms and Conditions of Employment (or similarly titled agreement) in a form approved by the Compensation & Talent Committee (the “Restrictive Covenants Agreement”) (unless such requirement is waived in writing by the Compensation & Talent Committee), (iii) the eligible employee has satisfied any other conditions established by the Compensation & Talent Committee to become a Participant and (iv) if applicable, the employee agrees to waive any then-effective cash severance or separation benefits under any existing agreement with the Company. A Participant will cease to be a Participant in this Plan when such employee ceases to be designated, in writing, by the Compensation & Talent Committee as a Participant in the Plan.

III. SEVERANCE EVENTS

In general, if a Participant complies with all provisions and requirements of this Plan, then the Participant will receive severance pay and other benefits under this Plan if the Participant experiences a Qualifying Severance Event while a Participant under this Plan.

“Affiliate”. For purposes of this Plan, “Affiliate” has the same meaning given to that term in the Equity Plan.

“Cause”. For purposes of this Plan, “Cause” has the same meaning given to that term in the Equity Plan.

“Change in Control”. For purposes of this Plan, “Change in Control” has the same meaning given to that term in the Equity Plan.

“Code”. For purposes of this Plan, “Code” means the Internal Revenue Code of 1986, as amended, and the regulations and guidance thereunder.

“Disability”. For purposes of this Plan, “Disability” has the same meaning given to that term in the Equity Plan.

“Equity Plan”. For purposes of this Plan, “Equity Plan” means the most recently adopted and currently effective SPS Commerce, Inc. equity incentive plan, as amended from time to time.

“Good Reason”. For purposes of this Plan, “Good Reason” means the occurrence of any of the following events, in each case without the Participant’s consent: (i) a material reduction in the Participant’s annual base salary, (ii) a material reduction in the Participant’s employment authority, duties or responsibilities, or (iii) a relocation of the Participant’s primary work location by more than 50 miles, provided that (A) if the Participant’s primary work location is the Participant’s personal residence, this clause (iii) shall not apply; and (B) if the Participant works remotely, then neither the Participant’s relocation to remote work or back to the office from remote work will be considered a relocation of such Participant’s primary work location for purposes of this definition, provided that with regard to events described in (i) and (ii), the Participant first gives notice of the event giving rise to Good Reason to the Company within 90 days of the first occurrence of the event, and provided further that upon giving notice the Participant provides the Company 30 days in which to remedy the event, and the Participant terminates employment within 180 days of the first occurrence of such an event.

“Qualifying Severance Event”. For purposes of this Plan, “Qualifying Severance Event” means (i) Participant experiences a Termination Date (A) prior to the first Change in Control to occur after the Plan is adopted, or (B) on the date of the first Change in Control to occur after the Plan is adopted or within 12 months after such Change in Control occurs, and (ii) Participant’s employment is terminated (A) at the initiative of the Company other than for Cause or (B) by the Participant for Good Reason.

“Termination Date”. For purposes of this Plan, “Termination Date” means, with respect to any Participant, the date on which such Participant’s “separation from service” has occurred for purposes of Section 409A of the Code.

Timely Release Required. Regardless of the reason for a Participant’s termination of employment, a Participant will not be eligible for any severance pay or benefits under this Plan unless the Participant signs a release in a form determined by the Company after the Participant’s employment with the Company actually terminates, timely delivers such signed release form to the Company and does not rescind the release during any period during which rescission is permissible. The release will be considered timely if it is delivered to the Company within 45 days after the Termination Date. A Participant may obtain a copy of the current release form at any time by contacting the Company’s Chief Human Resources Officer. However, the Company will determine the contents of the release form, and may revise it from time to time as appropriate to deal with particular severance situations. As such, the release form a Participant will be required to sign to receive severance pay and other benefits under the Plan may differ from any release form the Participant previously received.

The release will generally include provisions addressing a full release of all claims the Participant may have against the Company and related individuals and entities (to the full extent permitted under applicable law) and provisions concerning the Participant’s ongoing compliance with the Participant’s Restrictive Covenants Agreement and with any other non-disclosure of confidential information, assignment of intellectual property, non-competition or non-solicitation obligations the Participant has with respect to the Company, including those obligations that survive the termination of the Participant’s employment with the Company. Severance pay and other benefits under this Plan will be paid only after any period for rescinding the release has expired. If a Participant violates any provisions of the release, the Company will no longer be required to pay such Participant any remaining severance pay and other benefits due to the Participant under this Plan.

Ineligibility for Benefits. Notwithstanding anything in the Plan to the contrary, severance pay and other benefits under this Plan will not be paid or provided to any Participant in any of the following circumstances:

•The Participant is offered another comparable position with the Company (or the successor/ purchasing entity following the first Change in Control to occur after the Plan is adopted) and the Participant refuses to accept or continue employment in that position, other than resigning for Good Reason.

•The termination of the Participant’s employment with the Company (or the successor/purchasing entity following first Change in Control to occur after the Plan is adopted) is for any reason other than: (i) at the initiative of the Company other than for Cause, or (ii) by the Participant for Good Reason.

•The Participant’s termination of employment occurs after the date on which the Participant has provided notice to the Company of Participant’s retirement (regardless of the actual last day of Participant’s employment with the Company after the date such notice has been provided).

•The Participant’s termination of employment is due to death, Disability, or failure to return to work for the Company following a leave of absence, layoff or any other period of authorized absence from the Company.

•The Participant’s Termination Date occurs more than 12 months after the first Change in Control to occur after the Plan is adopted, whether such termination is at the initiative of the Participant or the Company and regardless of the reason for such termination of the Participant’s employment with the Company.

•The Participant’s termination of employment with the Company does not qualify as a “separation from service” under Section 409A of the Code.

•The Participant refuses to sign the release form prepared by the Company, the release is not timely signed, or the Participant rescinds the release before it becomes final.

•The Participant breaches any provisions included in the release form prepared by the Company or any provisions included in the Restrictive Covenants Agreement.

•The Participant is not a Participant under this Plan at the time of termination of employment.

IV. SEVERANCE PAY AND OTHER BENEFITS

A Participant who experiences a Qualifying Severance Event and who otherwise qualifies for severance pay and other benefits under the Plan will be entitled to the severance pay and other benefits described below.

Qualifying Severance Event Before a Change in Control:

The Company will pay the Participant (or the Participant’s estate, if the Participant dies after having a Qualifying Severance Event but before receiving the following amount): (i) an amount equal to one (1) times the Participant’s annualized base salary as of the Participant’s Termination Date (or an amount equal to one (1) times the Participant’s annualized base salary as of immediately prior to a material reduction in Participant’s annualized base salary by the Company if the Participant resigns for Good Reason as a result of such material reduction), less applicable withholdings and payable in substantially equal installments in accordance with the Company’s regular payroll schedule commencing with the first normal payroll date of the Company following the Termination Date and continuing for 12 months thereafter, provided that any installments that would have been paid during the 60 day period immediately following the Termination Date shall be held by the Company until the first payroll date occurring more than 60 days after the Termination Date, plus (ii) an amount equal to one (1) times the Participant’s target annual incentive bonus as of the Participant’s Termination Date, multiplied by a fraction, the numerator of which is the number of days the Participant was employed by the Company during the fiscal year in which the Termination Date occurs and the denominator of which is 365, less applicable withholdings and payable in a lump sum on the Company’s first payroll date occurring more than 60 days after the Termination Date (but no later than 75 days after the Termination Date).

In addition, the Company will make a taxable lump sum cash payment, less applicable withholdings, within 60 days after the Termination Date, equal to the amount of the premium costs for health, dental and vision coverage that the Company paid during the last full month of the Participant’s employment, multiplied by 12. Provided that the Participant otherwise qualifies for severance benefits under this Plan, this payment will be made whether or not the Participant elects COBRA coverage.

Qualifying Severance Event on the Date of a Change in Control or Within 12 Months After a Change in Control:

The Company will pay the Participant (or the Participant’s estate, if the Participant dies after having a Qualifying Severance Event but before receiving the following amount): (i) an amount equal to 1.5 times the Participant’s annualized base salary as of the Participant’s Termination Date (or an amount equal to 1.5 times the Participant’s annualized base salary as of immediately prior to a material reduction in Participant’s annualized base salary by the Company if the Participant resigns for Good Reason as a result of such material reduction), plus (ii) an amount equal to 1.5 times the Participant’s target annual incentive bonus as of the Participant’s Termination Date, multiplied by a fraction, the numerator of which is the number of days the Participant was employed by the Company during the fiscal year in which the Termination Date occurs and the denominator of which is 365. The total severance amount, less applicable withholdings, with be paid in a lump sum on the Company’s first payroll date occurring more than 60 days after the Termination Date (but no later than 75 days after the Termination Date).

In addition, the Company will make a taxable lump sum cash payment, less applicable withholdings, within 60 days after the Termination Date, equal to the amount of the premium costs for health, dental and vision coverage that the Company paid during the last full month of the Participant’s employment, multiplied by 18. Provided that the Participant otherwise qualifies for severance benefits under this Plan, this payment will be made whether or not the Participant elects COBRA coverage.

Section 409A

Although the Company does not guarantee the tax treatment of any payments or benefits under this Plan, this Plan is intended to provide for payments and benefits that are exempt from, or that comply with, the requirements of Code Section 409A, and accordingly, to the maximum extent permitted, this Plan should be interpreted and administered to be in compliance therewith. Each payment or benefit made pursuant to this Plan shall be deemed to be a separate payment for purposes of Code Section 409A. In addition, payments or benefits pursuant to this Plan shall be exempt from the requirements of Code Section 409A to the maximum extent possible as “short-term deferrals” pursuant to Treasury Regulation Section 1.409A-1(b)(4), as involuntary separation pay pursuant to Treasury Regulation Section 1.409A-1(b)(9)(iii), and/or under any other exemption that may be applicable, and this Plan shall be construed accordingly. To the extent that any amounts payable under this Plan are required to be delayed under Code Section 409A in order to avoid an excise tax imposed under Code Section 409A(a)(1)(B), such amounts are intended to be and should be considered for purposes of Code Section 409A as separate payments from the amounts that are not required to be delayed. Notwithstanding anything herein to the contrary, if any Participant is considered a “specified employee” (as defined in Treasury Regulation Section 1.409A-1(i)) as of the Termination Date, then no payments of deferred compensation subject to Code Section 409A and payable due to such Participant’s separation from service shall be made under this Plan before the first business day that is six months after the Termination Date (or upon the Participant’s death, if earlier) (the “Specified Period”). Any deferred compensation payments that would otherwise be required to be made to a Participant during the Specified Period will be accumulated by the Company and paid to the Participant on the first day after the end of the Specified Period. The foregoing restriction on the payment of amounts to a Participant during the Specified Period will not apply to the payment of employment taxes.

Section 280G

If any payment or benefit to be paid or provided to a Participant under this Plan, taken together with any payments or benefits otherwise paid or provided to such Participant by the Company or any corporation that is a member of an “affiliated group” (as defined in Section 1504 of the Code without regard to Section 1504(b) of the Code) of which the Company is a member (the “other arrangements”), would collectively constitute a “parachute payment” (as defined in Section 280G(b)(2) of the Code), and if the net after-tax amount of such parachute payment to such Participant is less than what the net after-tax amount to such Participant would be if the aggregate payments and benefits otherwise constituting the parachute payment were limited to three times such Participant’s “base amount” (as defined in Section 280G(b)(3) of the Code) less $1.00, then the aggregate payments and benefits otherwise constituting the parachute payment shall be reduced to an amount that shall equal three times such Participant’s base amount, less $1.00. Should such a reduction in payments and benefits be required, then the Company shall achieve the necessary reduction in such payments and benefits by first reducing or eliminating the portion of the payments and benefits that are payable in cash and then by reducing or eliminating the non-cash portion of the payments and benefits, in each case in reverse order beginning with payments and benefits which are to be paid or provided the furthest in time from the date of the Company’s determination. A net after-tax amount shall be determined by taking into account all applicable income, excise and employment taxes, whether imposed at the federal, state or local level, including the excise tax imposed under Section 4999 of the Code.

Withholdings

Cash severance payments under this Plan are subject to all applicable withholding due on any severance pay and other benefits, including state and federal income tax withholding and FICA and Medicare tax withholding.

Termination of Severance Pay and Benefits

All severance pay and other benefits payable under this Plan will be terminated if the Company determines that the Participant has violated the Participant’s ongoing obligations with respect to non-disclosure of confidential information, assignment of intellectual property, non-competition and non-solicitation, including those obligations under the Participant’s Restrictive Covenants Agreement and any other agreement with the Company that survive the termination of the Participant’s employment with the Company.

V. AMENDMENT AND TERMINATION OF THE PLAN

Except as provided below, the Company reserves the right in its discretion to amend or terminate this Plan, or to alter, reduce, or eliminate any severance benefit, practice or policy hereunder, in whole or in part, at any time and for any reason without the consent of or notice to any employee or any other person having any beneficial interest in this Plan. Such action may be taken by the Compensation & Talent Committee, or by any other individual or committee to whom such authority has been delegated by the Compensation & Talent Committee.

However, during the 12-month period following the first Change in Control to occur after the Plan is adopted, the Plan may not be amended, terminated or otherwise altered to reduce the amount (or negatively change the terms) of any severance benefit that becomes payable to a Participant who was a Participant in the Plan on the day prior to date of such Change in Control. In addition, if a Change in Control occurs within the 6-month period following the effective date of an amendment to terminate the Plan or otherwise reduce the amount (or negatively alter the terms) of any severance benefit under the Plan, such amendment (or portion of such amendment) will become null and void upon the Change in Control and upon such Change in Control the Plan will automatically revert to the terms in effect prior to the adoption of said amendment. This Plan will automatically terminate on the 12-month anniversary of the first Change in Control to occur after the Plan is adopted.

Notwithstanding the above limitations, the Plan may be amended at any time (and such amendment will be given affect) if such amendment is required to bring the Plan into compliance with applicable law, including but not limited to Code Section 409A (and the regulations or other applicable guidance thereunder).

VI. SUBMITTING CLAIMS FOR BENEFITS

Normally, the Company will determine an employee’s eligibility and benefit amount on its own and without any action on the part of the terminating Participant, other than returning the release form. The severance benefits will begin on the first payroll date occurring more than 60 days after the Termination Date, provided that any installments that would have been paid during the 60-day period immediately following the Termination Date shall be held by the Company until the first payroll date occurring more than 60 days after the Termination Date, provided that the release has been timely signed and becomes irrevocable.

Formal Claims for Benefits. If the Participant thinks the Participant is entitled to benefits but have not been so notified by the Company, if the Participant disagree with a decision made by the Company, or if the Participant has any other complaint regarding the Plan that is not resolved to the Participant’s satisfaction, the Participant or the Participant’s authorized representative may submit a written claim for benefits. The claim must be submitted to the Company’s Chief Human Resources Officer (or, if such claim is being submitted by the Company’s Chief Human Resources Officer, to the Compensation & Talent Committee) within six months after the date the Participant terminated employment. Claims received after that time will not be considered.

The Company will ordinarily respond to the claim within 90 days of the date on which it is received. However, if special circumstances require an extension of the period of time for processing a claim, the 90-day period can be extended for an additional 90 days by giving the Participant written notice of the extension, the reason why the extension is necessary, and the date a decision is expected.

The Company will give the Participant a written notice of its decision if it denies the Participant’s claim for benefits in whole or in part. The notice will explain the specific reasons for the decision, including references to the relevant plan provision upon which the decision is based, with a description of any additional material or information necessary for the Participant to perfect the Participant’s claim, and the procedures for appealing the decision.

Appeals. If the Participant disagree with the initial claim determination, in whole or in part, the Participant or the Participant’s authorized representative can request that the decision be reviewed by filing a written request for review with the Company’s Chief Human Resources Officer (or, if such Participant is the Company’s Chief Human Resources Officer, by filing a written request for review with the Compensation & Talent Committee) within 60 days after receiving notice that the claim has been denied. The Participant or the Participant’s representative may present written statements describing reasons why the Participant believe the claim denial was in error, and should include copies of any documents the Participant want us to consider in support of the Participant’s appeal. The Participant’s claim will be decided based on the information submitted, so the Participant should make sure that the Participant’s submission is complete. Upon request to the Company, the Participant may review all documents we considered or relied on in deciding the Participant’s claim. (The Participant may also receive copies of these documents free of charge.)

Generally, the decision will be reviewed within 60 days after the Company receives a request for review. However, if special circumstances require a delay, the review may take up to 120 days. (If a decision cannot be made within the 60-day period, the Participant will be notified of this fact in writing.) The Participant will receive a written notice of the decision on the appeal, which will explain the reasons for the decision by making specific reference to the Plan provisions on which the decision is based.

Limitations Period. The claims procedure above is mandatory. If a Participant has completed the entire claims procedure and still disagrees with the outcome of the Participant’s claim, the Participant may commence a civil action under § 502(a) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Participant must commence such civil action within one year of the date of the final denial, or the Participant will waive all rights to relief under ERISA.

VII. PLAN ADMINISTRATION

The following information relates to the administration of the Plan and the determination of Plan benefits.

Type of Plan: The Plan is a welfare benefit plan providing for severance benefits.

Employer/Plan Administrator: The Company is the “Employer” and “Plan Administrator” of this Plan. Communications to the Company regarding the Plan should be addressed to:

SPS Commerce, Inc.

333 South Seventh Street

Suite 1000

Minneapolis, MN 55402

Attention: Chief Human Resources Officer or Chair, Compensation & Talent Committee

As Plan Administrator, the Company has complete and final discretionary authority to interpret the provisions of the Plan and to determine which employees are eligible to participate and eligible for Plan benefits, the requirements to receive severance pay and other benefits, and the amount of those benefits. The Company also has authority to correct any errors that may occur in the administration of the Plan, including recovering any overpayment of benefits from the person who received it.

Employer Identification Number: 41-2015127

Plan Year: The calendar year. The first Plan Year is a short Plan Year, starting on the date the Plan was initially adopted and ending on December 31, 2023.

Agent for Service of Legal Process: Legal process regarding the Plan may be served on the Company at the address listed above.

Funding: Unfunded; benefits are paid solely from the Company’s general assets.

Assignment of Benefits; Cash Severance Payment Upon Death Following a Qualifying Severance Event: A Participant cannot assign the Participant’s benefits under this Plan to anyone else, and the Participant’s benefits are not subject to attachment by the Participant’s creditors. The Company will not pay any cash severance pay under this Plan to anyone other than the Participant (or to the Participant’s estate, if the Participant dies after having a Qualifying Severance Event but before receiving the complete severance amount payable to the Participant up to the date of the Participant’s death).

Governing Law: This Plan, to the extent not preempted by ERISA or any other federal law shall be governed by and construed in accordance with, the laws of the State of Minnesota. The parties expressly consent that any action or proceeding relating to this Plan or any release or other agreement entered into with respect to this Plan will only be brought in the federal courts located in the State of Minnesota and that any such action or proceeding be heard without a jury.

Employment Rights: Establishment of the Plan shall not be construed to in any way modify the parties’ at-will employment relationship, or to give any employee the right to be retained in the Company’s service or to any benefits not specifically provided by the Plan. The right of an employer to terminate the employment relationship of an employee (or to accelerate the termination date) will not in any way be affected by the terms of this Plan or any release.

Successor/Purchasing Entity: For the avoidance of doubt, references in this Plan to the “Company” include, after a Change in Control or other corporate transaction, the successor to the Company or purchasing entity.

Plan Number: 509

VIII. STATEMENT OF ERISA RIGHTS

Participants in this Plan are entitled to certain rights and protections under the Employee Retirement Income Security Act of 1974 (ERISA). ERISA provides that all plan participants shall be entitled to:

Receive Information About Your Plan and Benefits

Examine, without charge, at the Plan Administrator’s office all documents governing the plan and, if applicable, a copy of the latest annual report (Form 5500 Series) required to be filed by the plan with the U.S. Department of Labor.

Obtain, upon written request to the Plan Administrator, copies of documents governing the operation of the plan and copies of the latest annual report (Form 5500 Series), if any required, and current summary plan description. The administrator may make a reasonable charge for the copies.

Prudent Actions by Plan Fiduciaries

In addition to creating rights for plan participants ERISA imposes duties upon the people who are responsible for the operation of the employee benefit plan. The people who operate your plan, called “fiduciaries” of the plan, have a duty to do so prudently and in the interest of you and other plan participants and beneficiaries. No one, including your employer, or any other person, may fire you or otherwise discriminate against you in any way to prevent you from obtaining a severance benefit or exercising your rights under ERISA.

Enforce Your Rights

If your claim for a severance benefit is denied or ignored, in whole or in part, you have a right to know why this was done, to obtain copies of documents relating to the decision without charge, and to appeal any denial, all within certain time schedules.

Under ERISA, there are steps you can take to enforce the above rights. For instance, if you request a copy of plan documents or the latest annual report from the plan and do not receive them within 30 days, you may file suit in a Federal court. In such a case, the court may require the Plan Administrator to provide the materials and pay you up to $110 a day until you receive the materials, unless the materials were not sent because of reasons beyond the control of the administrator. If you have a claim for benefits which is denied or ignored, in whole or in part, you may file suit in a state or Federal court. If it should happen that plan fiduciaries misuse the plan's money, or if you are discriminated against for asserting your rights, you may seek assistance from the U.S. Department of Labor, or you may file suit in a Federal court. The court will decide who should pay court costs and legal fees. If you are successful, the court may order the person you have sued to pay these costs and fees. If you lose, the court may order you to pay these costs and fees, for example, if it finds your claim is frivolous.

Assistance with Your Questions

If you have any questions about your plan, you should contact the Plan Administrator. If you have any questions about this statement or about your rights under ERISA, or if you need assistance in obtaining documents from the Plan Administrator, you should contact the nearest office of the Employee Benefits Security Administration, U.S. Department of Labor, listed in your telephone directory or the Division of Technical Assistance and Inquiries, Employee Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue N.W., Washington, D.C. 20210. You may also obtain certain publications about your rights and responsibilities under ERISA by calling the publications hotline of the Employee Benefits Security Administration.

AGREEMENT TO TERMINATE AMENDED AND RESTATED EXECUTIVE SEVERANCE AND CHANGE IN CONTROL AGREEMENT

This Agreement to Terminate Amended and Restated Severance and Change in Control Agreement (the “Termination Agreement”) is entered into effective as of the date set forth on the signature page hereto (the “Effective Date”) by and between SPS Commerce, Inc. (the “Company”), and Kimberly Nelson (“Executive”).

RECITALS

A. The Company and Executive previously entered into an Amended and Restated Executive Severance and Change in Control Agreement (the “Severance Agreement”).

B. The Company has adopted the SPS Commerce, Inc. Executive Management Team Severance Plan (the “Plan”), and has informed Executive that Executive will be designated as a Participant (as defined in the Plan) subject to Executive executing this Termination Agreement and otherwise satisfying the conditions to become and remain a Participant under the Plan.

C. The Company desires to terminate the Severance Agreement and continue to employ Executive after the Effective Date, and Executive desires to accept such continued employment and to terminate the Severance Agreement effective as of the Effective Date.

AGREEMENT

NOW, THEREFORE, for good and valuable consideration, including without limitation each of the Company and Executive giving up their respective rights and obligations under the Severance Agreement, the receipt and sufficiency of which are hereby acknowledged, the Company and Executive agree as follows:

1. Termination of Severance Agreement. The Severance Agreement is hereby terminated effective as of the Effective Date.

2. Certain Acknowledgements. Executive is continuing employment with the Company and acknowledges that Executive is not eligible for, or entitled to receive, any severance payments or benefits under the Severance Agreement as of or after the Effective Date.

3. Governing Law. All matters relating to the interpretation, construction, application, validity and enforcement of this Termination Agreement will be governed by the laws of the State of Minnesota without giving effect to any choice or conflict of law provision or rule, whether of the State of Minnesota or any other jurisdiction, that would cause the application of laws of any jurisdiction other than the State of Minnesota.

4. Jurisdiction and Venue. Executive and the Company consent to jurisdiction of the courts of the State of Minnesota and/or the federal courts, District of Minnesota, for the purpose of resolving all issues of law, equity, or fact, arising out of or in connection with this Termination Agreement. Any action involving claims of a breach of this Termination Agreement must be brought in such courts. Each party consents to personal jurisdiction over such party in the state and/or federal courts of Minnesota and hereby waives any defense of lack of personal jurisdiction. Venue, for the purpose of all such suits, will be in Hennepin County, State of Minnesota.

5. Entire Agreement. This Termination Agreement contains the complete agreement between the parties hereto with respect to the matters covered herein and supersedes all prior agreements and understandings between the parties hereto with respect to such matters; provided, however, this Termination Agreement does not terminate or otherwise modify the At-Will/Confidentiality Agreement Regarding Certain Terms and Conditions of Employment previously executed by Executive, which shall remain in full force and effect in accordance with its terms.

6. Counterparts. This Termination Agreement may be executed in one or more counterparts, each of which will be deemed to be an original copy of this Termination Agreement and all of which, when taken together, will be deemed to constitute one and the same agreement. The exchange of copies of this Termination Agreement and of signature pages by facsimile transmission or other electronic means shall constitute effective execution and delivery of this Termination Agreement as to the parties and may be used in lieu of the original Termination Agreement for all purposes. Signatures of the parties transmitted by facsimile or other electronic means shall be deemed to be their original signatures for any purposes whatsoever.

**[Signature Page to Follow]**

IN WITNESS WHEREOF, the parties hereto have caused this Termination Agreement to be duly executed and delivered as of the date below.

COMPANY

By: /s/ CHAD COLLINS

Name: Chad Collins

Title: Chief Executive Officer

Date: May 16, 2024

EXECUTIVE

By: /s/ KIMBERLY NELSON

Name: Kimberly Nelson

Title: EVP and Chief Financial Officer

Date: May 16, 2024

v3.24.1.1.u2

Cover

|

May 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

SPS COMMERCE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34702

|

| Entity Tax Identification Number |

41-2015127

|

| Entity Address, Address Line One |

333 South Seventh Street

|

| Entity Address, Address Line Two |

Suite 1000

|

| Entity Address, City or Town |

Minneapolis

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55402

|

| City Area Code |

612

|

| Local Phone Number |

435-9400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

SPSC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001092699

|

| Current Fiscal Year End Date |

--12-31

|

| Document Period End Date |

May 16, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

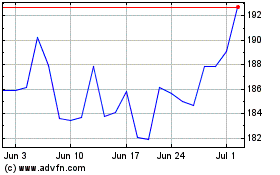

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From May 2024 to Jun 2024

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Jun 2023 to Jun 2024