As filed with the Securities and Exchange Commission on August 5, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REZOLUTE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| |

Nevada

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

|

27-3440894

(I.R.S. Employer

Identification No.)

|

|

275 Shoreline Drive, Suite 500

Redwood City, CA 94065

(650) 206-4507

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Nevan Elam

Chief Executive Officer

275 Shoreline Drive, Suite 500

Redwood City, CA 94065

Telephone: (650) 206-4507

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Anthony W. Epps

Dorsey & Whitney LLP

1400 Wewatta St #400

Denver, CO 80202

(303) 629-3400

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| |

Large accelerated filer

☐

|

|

|

Smaller reporting company

☒

|

|

| |

Accelerated Filer

☐

|

|

|

Emerging growth company

☐

|

|

| |

Non-accelerated filer

☒

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 5, 2024

PROSPECTUS

Up to 4,500,000 Shares of Common Stock and

This prospectus relates to the resale of 4,500,000 shares of Common Stock, par value $0.001 per share (“Common Stock”) of Rezolute, Inc. by certain selling stockholders named herein (the “Selling Stockholders”) consisting of, (i) 1,500,000 shares of Common Stock, (ii) 610,404 shares of Common Stock and (iii) 2,389,596 shares of Common Stock issuable upon the exercise of pre-funded warrants (the “Warrants”) of the Company.

The Warrants were issued pursuant to the securities exchange agreement dated March 8, 2024 between the Company and certain Selling Stockholders. The Warrants have an exercise price of $0.001 per share. We may receive proceeds from the exercise of the Warrants if the Warrants are exercised on a cash basis. 610,404 shares of Common Stock covered by this prospectus were issued a certain Selling Stockholder upon the partial exercise of the Warrants.

Certain shares of the Common Stock was issued pursuant to the securities purchase agreement dated June 25, 2024 and July 5, 2024, respectively, between the Company and certain Selling Stockholders. We will not receive any proceeds from the sale of any shares of Common Stock by the Selling Stockholders pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the shares of Common Stock. The Selling Stockholders may sell the shares of Common Stock offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under the caption “Plan of Distribution.” The shares of Common Stock may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices.

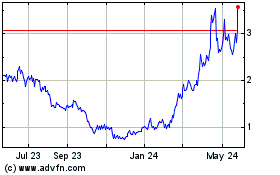

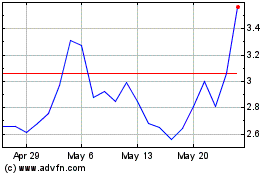

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “RZLT”. On July 26, 2024, the last reported sale price for our Common Stock was $4.68 per share. Each prospectus supplement to this prospectus will indicate if the securities offered thereby will be listed on any securities exchange.

Investing in our securities involves risks. You should carefully review the risks and uncertainties described under the heading “Risk Factors” beginning on page 11 of this prospectus, any applicable prospectus supplement or any related free writing prospectus, and in any documents incorporated by reference herein or therein before investing in our securities.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

20

|

|

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus or in any related free writing prospectus filed by us with the Securities and Exchange Commission (“SEC”). We and the Selling Stockholders have not authorized anyone to provide you with any information or to make any representation not contained in this prospectus. We and the Selling Stockholders do not take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell or an offer to buy securities in any jurisdiction where offers and sales are not permitted. The information in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of securities. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in the prospectus.

Neither we nor the Selling Stockholders have done anything that would permit a public offering of the securities or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside of the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find Additional Information.”

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the Common Stock being offered.

Unless the context indicates otherwise, as used in this prospectus, the terms “Rezolute,” “we,” “us,” “our,” and “our business” refer to Rezolute, Inc. and its subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and the documents incorporated by reference herein, contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995, and are based on management’s current expectations. These forward-looking statements can be identified by the use of forward-looking terminology, including, but not limited to, “believes,” “may,” “will,” “would,” “should,” “expect,” “anticipate,” “seek,” “see,” “confidence,” “trends,” “intend,” “estimate,” “on track,” “are positioned to,” “on course,” “opportunity,” “continue,” “project,” “guidance,” “target,” “forecast,” “anticipated,” “plan,” “potential” and the negative of these terms or comparable terms.

Various factors could adversely affect our operations, business or financial results in the future and cause our actual results to differ materially from those contained in the forward-looking statements, including those factors discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” or otherwise discussed in our Annual Report on Form 10-K for the fiscal year ended June 30, 2023, our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024, and in our other filings made from time to time with the SEC after the date of this prospectus.

For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please see the documents that we have filed with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents and reports filed from time to time with the SEC.

All subsequent forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We are not under any obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

PROSPECTUS SUMMARY

We are developing transformative therapies for devastating rare and chronic metabolic diseases. Our lead compound, RZ358, is a fully human monoclonal antibody for the treatment of hypoglycemia resulting from excessive secretion of insulin or insulin-like substances such as IGF-2 (“hyperinsulinism” or “HI”). The antibody counteracts excess insulin receptor activation thereby improving hypoglycemia. We have commenced a global Phase 3 study (“sunRIZE”) for congenital HI, an ultra-rare pediatric and genetic form of HI. In addition, through our expanded access program (“EAP”), U.S. physician-investigators have been administering RZ358 on a compassionate use basis for the management of hypoglycemia resulting from hyperinsulinism associated with tumors (“tumor HI”). We are also developing RZ402, a small molecule selective and potent plasma kallikrein inhibitor (“PKI”), as a potential oral therapy for the chronic treatment of diabetic macular edema (“DME”).

Our primary objectives for the first half of 2024 are to complete the Phase 2 study for RZ402 to enable announcement of topline results in May 2024, as well as to continue site activation and increase patient enrollment for sunRIZE to enable completion of enrollment by the end of this calendar year. Primary objectives for the second half of 2024 are to continue site activation and increase patient enrollment for sunRIZE to enable completion of enrollment by the end of this calendar year.

RZ358 for congenital hyperinsulinism (“cHI”)

cHI

cHI is the most common cause of recurrent and persistent hypoglycemia in children. Individuals with cHI typically present with signs or symptoms of hypoglycemia shortly after birth. Hypoglycemia can result in significant brain injury and death if not recognized and managed appropriately. Additionally, recurrent, or cumulative, hypoglycemia can lead to progressive and irreversible damage over time, including serious and devastating brain injury, seizures, neuro-developmental problems, feeding difficulties, and significant impact on patient and family quality of life. Treatment options for individuals include treatment with diazoxide or glucagon, carbohydrate supplements or off label administration of somatostatin analogues. In cases that are unresponsive to medical management, surgical removal of the pancreas may be required. In those with diffuse disease where the whole pancreas is affected, a near-total pancreatectomy can be undertaken, although ongoing medical treatment of hypoglycemia is generally required for several years after surgery, and patients will eventually develop insulin-dependent diabetes. cHI occurs in one in 28,000 live births in the U.S., and we estimate that in the U.S. alone the addressable market for cHI is more than 1,500 individuals.

sunRIZE Phase 2b Study

In our Phase 2 RIZE study of RZ358 in patients with cHI ages two and older, nearly all participants achieved significant improvement in hypoglycemia across multiple endpoints, including the primary and key secondary endpoints planned for the sunRIZE study. At doses and exposures planned for sunRIZE, RZ358 was generally safe and well-tolerated, and resulted in median improvements in hypoglycemia of up to ~90% at top doses. Furthermore, a clinically-relevant threshold of ≥25% hypoglycemia correction was observed.

sunRIZE is currently not being studied in the U.S. because of partial clinical holds (“PCHs”) imposed by the FDA’s Office of Cardiology, Hematology, Endocrinology and Nephrology-Division of Diabetes, Lipid Disorders, and Obesity (“Division”). As part of the preclinical program for RZ358, Sprague Dawley rats (“SD rats”) demonstrated a microvascular injury in liver sinusoidal endothelial cells (“LSECs”) at potentially clinically relevant doses and exposures (“rat findings”). Consequently, the Division mandated PCHs that prevent us from dosing participants under the age of 12 and restrict us from dosing participants above the lowest dose studied to date, 3mg/kg.

sunRIZE Phase 3 Study

In December 2023, we initiated sunRIZE, a randomized, double-blind, placebo-controlled, parallel arm evaluation of RZ358 in participants with cHI who are not adequately responding to standard-of-care medical therapies. We plan to enroll approximately 56 participants ages three months and above from up to approximately 20 clinical trial sites in more than 15 countries in Europe, the Middle East, Asia and North America, and to complete enrollment by the end of calendar year 2024, to enable announcement of topline results in mid-2025.

RZ358 Ongoing Studies and Development

We do not believe that the rat findings are relevant to humans particularly since no adverse liver findings were observed in monkey toxicology studies at significantly higher RZ358 dose levels (up to 90 mg/kg tested), with drug levels that were more than 8 times higher than those that showed toxicity in SD rats and more than 5 times higher than the top human doses. Moreover, in our clinical studies conducted to date there have been no liver findings, including at the highest human doses that have been administered. While the precise mechanism of liver microvascular injury in SD rats remains unknown, we believe that the SD rat may be hypersensitive to exaggerated pharmacology and severely impaired insulin signaling with RZ358, due to its baseline predisposition to obesity, metabolic syndrome, insulin resistance, and over-dependence on the liver for insulin signaling and glucose handling. Notably, individuals who suffer with cHI are the opposite of insulin resistant as they have excessive insulin activity.

As part of our effort to investigate the mechanism of toxicity in SD rats, we have retained advisement from a former senior FDA pharmacology-toxicology official and we have partnered with a research group with LSEC expertise. In the second half of 2023, we conducted additional in-vivo and in-vitro non-clinical studies to enhance our understanding of the mechanism of toxicity in SD rats and its potential relevance to humans, including experiments in SD rat LSECs and another toxicology study in an additional rodent species. We have been unable to reproduce or characterize the toxicity observed in SD rat toxicology studies in our LSEC experiments and we therefore believe that the mechanism of toxicity cannot be characterized in-vitro. Importantly, we conducted a CD-1 mice toxicology study to determine if we could reproduce rat findings in a different rodent species. CD-1 mice were administered significantly higher dose levels of

RZ358 (up to 120 mg/kg tested) with drug levels that were more than 20 times higher than those that caused the SD rat findings and substantially higher than human doses. No adverse liver findings were observed in this study at any dose level.

To continue along these lines of evaluating and demonstrating the likelihood that liver findings are specific to SD rats and irrelevant to human patients, we then undertook another toxicology study in a different strain of rat. In the first half of 2024, we conducted and recently completed an in-vivo toxicology study in brown Norway rats, using SD rats as a positive control. Early results show that at the highest tested dose of 40 mg/kg, there were no observed liver abnormalities in the brown Norway rat strain. Notably, the 40 mg/kg dose is more than four times the dose that causes liver injury in SD rats. We expect to have final data tabulations and a report for this study completed in the third quarter of 2024 and believe that the Norway rat study further suggests that liver toxicity is specific to the SD rat and not relevant otherwise, based on the absence of findings in other rat strains, other rodent species (“CD-1 mice”), primates, or our clinical trials in humans to date. We are conducting additional in-vitro studies and plan to incorporate those studies along with the Norway rat toxicity study into a complete response to the PCHs to be submitted to the Division in the third quarter of 2024. Nonetheless, there can be no assurance that the Division will agree to modify or remove the PCHs.

Regardless of U.S. trial sites in our current Phase 3 study, we believe data from sunRIZE will be sufficient for a potential submission to FDA for approval for RZ358 for cHI if the study meets its efficacy objectives, with an acceptable safety profile.

RZ358 has received Orphan Drug Designation in the U.S. and European Union for the treatment of cHI, as well as Pediatric Rare Disease Designation in the U.S., a prerequisite for a request for a Rare Pediatric Disease Priority Review Voucher upon Biologics License Application submission. Based on the RIZE clinical trial outcomes and the substantial unmet medical need, RZ358 was subsequently granted a priority medicines designation by the European Medicines Agency and an Innovation Passport designation by the UK Innovative Licensing and Access Pathway Steering Group for the treatment of cHI in October 2023.

RZ358 for tumor hyperinsulinism (“HI”)

Tumor HI

Tumor HI may be caused by two distinct types of tumors: islet cell tumors (“ICTs”) and non-islet cell tumors (“NICTs”), both of which lead to hypoglycemia due to excessive activation of the insulin receptor. Insulinomas are the most common type of functional ICT and mediate hypoglycemia through excessive insulin production. NICTs are generally associated with relatively large, solid tumors such as hepatocellular carcinoma, fibrosarcoma and mesothelioma, and can cause hypoglycemia by producing and secreting insulin-like paraneoplastic substances such as IGF-2 or related variants that bind to and activate the insulin receptor. This form of hypoglycemia can occur in more than 15 different tumor types, 60% of which are malignant, including hepatocellular carcinoma.

Current therapies for insulinomas and NICTs can be grouped into two main categories: (a) tumor directed de-bulking therapies (e.g. surgery, chemotherapy, radiotherapy), which may indirectly and/or eventually lead to decreased levels of circulating insulin and/or insulin-like substances, and therefore control HI and related hypoglycemia; and/or (b) medical therapies that directly treat HI and the associated hypoglycemia. Tumor-directed therapies do not directly treat hypoglycemia caused by insulinomas or NICTs. In many cases, tumor-directed therapies are administered concurrently with medical therapies for hypoglycemia and in other cases successful treatment of hypoglycemia often enables the initiation and/or continuation of tumor-directed therapies, as indicated. During the period from diagnosis to surgical treatment, or if surgery is contraindicated or refused, medical treatments are often necessary to directly manage the HI and hypoglycemia induced by the tumor. Additionally, chronic medical management of refractory hypoglycemia is often necessary for patients who cannot be cured by surgery, such as those with extensive disease of the pancreas, multi-focal insulinomas, inoperable or unresectable benign or malignant insulinomas, metastatic insulinomas, non-pancreatic insulinomas, or NICT hypoglycemia resulting from a variety of other tumors.

A significant unmet need exists for treatment options with improved efficacy and tolerability as normalization of glucose levels is crucial to ensure patients are fit to receive cancer treatment and to reduce mortality. Unfortunately, some patients are unresponsive to the current standard of care medical therapies for tumor HI and experience debilitating hypoglycemia that is otherwise untreatable. Currently available medical therapies are directed at reducing or eliminating insulin production and/or secretion from tumors, which may be challenging when the tumor is differentiated or dysregulated, and therefore not responding to usual control mechanisms for suppressing insulin production. In some cases, commonly utilized somatostatin analog therapies may even worsen hypoglycemia due to suppression of glucagon. Therefore, currently available medical therapies directed at suppressing insulin production may have limited effectiveness in tumor HI.

The total addressable market for the combined indications causing tumor HI is estimated to be approximately 4,500 patients in the U.S. alone, including approximately 1,500 with ICT hypoglycemia and approximately 3,000 with NICT hypoglycemia. We believe this addressable market represents a greater than $1 billion market opportunity.

Expanded Access Program

RZ358 has been shown to counteract excessive insulin action downstream, at the insulin-receptor on target organs. The unique mechanism of action of RZ358 makes the therapy a potential universal treatment for any form of hyperinsulinism, including tumor HI.

We maintain the EAP for a variety of HI indications for the purpose of making RZ358 available on a compassionate use basis when available therapeutic options have failed, and an individual’s hypoglycemia is unmanageable. In the fourth quarter of 2022, we received and approved an EAP request from Dr. Mary Elizabeth Patti, Director of the Hypoglycemia Clinic at the Harvard Medical School and Beth Israel Medical Center-affiliated Joslin Diabetes Center, for a patient with intractable hypoglycemia caused by a metastatic insulinoma. Dr. Patti received a single patient investigational new drug (“IND”) approval from the Division to treat the patient with RZ358. Dr. Patti reported that the patient safely achieved correction of hypoglycemia with RZ358, enabling the patient to wean off continuous intravenous dextrose and several other medications for hypoglycemia, leave the hospital after a prolonged stay, and resume receiving concurrent treatment for cancer with tumor-directed therapies. The patient remained on RZ358 for more than a year until he eventually passed away due to progression of his underlying malignant/metastatic insulinoma.

We have received and approved requests to date for single patient use of RZ358 in patients with tumor HI caused by metastatic insulinomas and other insulin secreting metastatic cancer (cervical). In the U.S., these requests have all been approved by the Division. These patients have been refractory to usual standard of care therapies for chronic management of hypoglycemia and required continuous high volume/concentration intravenous dextrose or nutritional infusion and were hospitalized and in life-threatening or hospice-bound condition because of uncontrollable hypoglycemia. Further treatment with tumor-directed therapies (e.g., embolization, radiotherapy, chemotherapy) was often deferred as a result of the debilitating hypoglycemia.

Generally, dosing for tumor HI patients has been either 6 mg/kg or 9 mg/kg every 1 – 2 weeks. In all cases to date, RZ358 has led to substantial improvement in hypoglycemia and has been well tolerated. Within a relatively short period of time after administration of RZ358, continuous intravenous dextrose was discontinued and hospitalized patients were able to be discharged and receive maintenance RZ358 doses on an outpatient basis, with durable benefit. In most cases, other background medical therapies for hypoglycemia were able to be weaned or stopped, and patients were able to resume tumor-directed therapies for treatment of their underlying cancer. Patients with metastatic tumor HI often have underlying hepatic injury (abnormal enzymes) at baseline due to hepatic metastases or previous tumor-directed treatments (e.g., partial liver resection or embolization). The patients with hepatic injury that have been treated under the EAP have not exhibited any indication of hepatic toxicity with the use of RZ358.

Evaluation of a Clinical and Regulatory Development Path

In January 2024, we had a Type B pre-IND meeting with the Division to discuss a potential IND application and a clinical and regulatory development strategy for tumor HI. The Division acknowledged

the unmet need as well as the potential therapeutic benefit of RZ358 as demonstrated by the cases under the EAP as well as the efficacy demonstrated in previous clinical experience in cHI. The Division is aligned with us that it would be warranted to study RZ358 in an IND-opening late-stage (registrational) clinical trial, which we are currently evaluating as a development program and second rare disease indication for RZ358. This study could simultaneously include both ICT and NICT patients with tumor HI.

To further validate the utility of RZ358 in treating hyperinsulinism and hypoglycemia resulting from NICT, we also conducted in-vitro experiments which demonstrated that RZ358 can blunt signaling of IGF-2 at the insulin receptor. We believe that this is additional proof of mechanism and concept for RZ358 as a potential universal treatment for hyperinsulinism, due to its novel mechanism of action at the insulin receptor.

In addition to other factors that impact a decision and timing of initiation of a new development program, we are not resourced to support an additional late stage registrational study. While we are optimistic about the positive impact RZ358 is already having on the lives of tumor HI patients, there can be no assurance that we will expand its pipeline to include tumor HI as a new indication for RZ358 nor can there be any assurance that such a program will be successful in a registrational study to support commercial approval for use of RZ358 in tumor HI by FDA or other regulatory authorities worldwide.

RZ402 for DME

DME

Diabetic retinopathy (“DR”) affects approximately one third of adults with diabetes and is the leading cause of vision loss in the working age population. DME is a severe, systemic, vision-threatening complication of DR characterized by swelling of the retina and thickening of the macula, the part of the eye that is responsible for high-resolution vision. There are an estimated 22 million DME patients worldwide and over 1 million in the U.S. alone, representing a potential addressable market of over $1.5 billion. Anti-vascular growth factor (“anti-VEGF”) injections into the eye are the current standard of care for DME, requiring continued administration over long periods of time to preserve vision. Due to their invasive route of administration and occasional serious side effects, there is a tendency to delay treatment until later in the disease course, and long-term compliance with eye injection regimens can be difficult for patients. In addition, only 40 – 50% of DME patients are responsive to the anti-VEGF treatment, which results in overall undertreatment and suboptimal vision outcomes in DME patients.

The contact-activation kallikrein-kinin system promotes increased vascular permeability and inflammation via key downstream mediators, including bradykinin, and activation of the intrinsic pathway of coagulation. Pathophysiologic upregulation of this system has been linked to a variety of diseases which are characterized by vascular dysfunction, including DME.

We believe that an oral PKI therapy is the ideal approach for targeting a systemic vascular disease such as DME. An oral PKI would be a non-invasive approach that allows for earlier disease intervention, directly impacts the site of disease and therapeutic target, and could be used alone or in tandem with anti-VEGF injections, which could potentially lead to better clinical outcomes overall.

Phase 2 Study

In December 2022, we initiated a Phase 2 U.S. multi-center, randomized, double-masked, placebo-controlled, parallel-arm study to evaluate the safety, efficacy, and pharmacokinetics of RZ402 administered as a monotherapy over a 12-week treatment period in participants with DME who are naïve to, or have received limited anti-VEGF injections. The study population is comprised of DME patients with mild to moderate non-proliferative DR, experiencing compromised vision. Eligible participants were randomized equally, to one of three RZ402 active treatment arms at doses of 50, 200, and 400 mg, or a placebo control arm, to receive study drug once daily for 12-weeks, before completing a four-week follow-up. Topline results were announced on May 21, 2024.

RZ402 met both primary endpoints of change in macular edema (“CST”) and a good safety profile.

•

CST improved significantly at all RZ402 dose levels compared to placebo (up to approximately 50 microns; p=0.02)

•

Continued downward trajectory in CST over course of study and at end of treatment

•

No significant difference between RZ402 dose levels, though response was largest at the 200 mg dose

•

Sub-analysis by DME severity (CST ≥400 microns) indicates an improvement of approximately 75 microns at the 200 mg dose

•

CST declined in most patients who received the 200 mg dose of RZ402, including clinically significant improvements from baseline in more than 20% of participants, compared to none in placebo, with high rates of worsening

•

RZ402 was safe and well-tolerated

•

Adverse events (“AEs”) were generally mild and rates were comparable to placebo

•

Three participants experienced serious AEs which were all judged by the Investigator as unrelated to study drug

•

No ocular adverse effects that are typically seen with intravitreal injections

•

Electrocardiograms, vitals, and safety labs were unremarkable

•

Target concentrations were exceeded at all three dose levels and continue to support once daily oral dosing

Secondary and Additional Observations

•

No significant improvements in Best Corrected Visual Acuity compared to placebo

•

In-line with expectations for a study of this duration

•

Observed improvements in CST would predict visual improvements in a longer duration study

•

Five RZ402 treated participants at 200 mg (20%) experienced a 1-step improvement in Diabetic Retinopathy Severity Score (“DRSS”) compared to one participant in placebo

THE OFFERING

Securities Offered by the Selling Stockholders:

4,500,000 shares of Common Stock, consisting of, (i) 1,500,000 shares of Common Stock, (ii) 610,404 shares of Common Stock and (iii) 2,389,596 shares of Common Stock issuable upon the exercise of the Warrants

We will not receive any proceeds from the sale of Common Stock in this offering. However, we may receive proceeds from the exercise of the Warrants by the selling stockholder to the extent they are exercised for cash. In the event we receive proceeds from the cash exercise of the Warrant, we intend to use the aggregate net proceeds from such exercise for general corporate purposes, including working capital. See the sections titled “Use of Proceeds” for additional information.

Investing in our securities involves a high degree of risk. Please read the information contained in and incorporated by reference under the heading “Risk Factors” beginning on page [•] of this prospectus supplement and the other information included in, or incorporated by reference into, this prospectus supplement for a discussion of certain factors you should carefully consider before deciding to invest in our securities.

Our common shares are listed on Nasdaq under the symbol “RZLT”. There is no established public trading market for the Warrants, and we do not expect a market to develop. We do not intend to list the Warrants on Nasdaq or any other national securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited.

RISK FACTORS

Investing in our securities involves a risk of loss. Before investing in our securities, you should carefully consider the risk factors described under “Risk Factors” in our Annual Report on Form 10-K filed with the SEC for the most recent year, in any applicable prospectus supplement and in our filings with the SEC, including our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, together with all of the other information included in this prospectus and any prospectus supplement and the other information incorporated by reference herein and therein. These risks are not the only ones facing us. Additional risks not currently known to us or that we currently deem immaterial also may impair or harm our business and financial results. Statements in or portions of a future document incorporated by reference in this prospectus, including, without limitation, those relating to risk factors, may update and supersede statements in and portions of this prospectus or such incorporated documents. Please also refer to the section entitled “Special Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

All of the shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for its own account. We will not receive any of the proceeds from these sales.

We will receive up to an aggregate of approximately $3,000 from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes.

DESCRIPTION OF TRANSACTION WITH THE SELLING STOCKHOLDERS AND WARRANTS

On March 8, 2024, we entered into a securities exchange agreement (the “Exchange Agreement”) with certain Selling Stockholders to which we exchanged an aggregate of 3,000,000 shares of Common Stock owned by the Selling Stockholder, for pre-funded warrants to purchase an aggregate of 3,000,000 shares of common stock (subject to adjustment in the event of stock splits, recapitalizations and other similar events affecting common stock), with an exercise price of $0.001 per share. The Warrants do not entitle the holders thereof to any voting rights or any of the other rights or privileges to which holders of Common Stock are entitled. Pursuant to the Exchange Agreement, we are required to file this resale registration statement with the SEC to register for resale of the Common Stock within 120 days from the closing date of the transaction contemplated by the Exchange Agreement. We will receive up to an aggregate of approximately $3,000 from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. On July 24, 2024, the Warrants were partially exercised on a cashless basis for 610,273 shares.

On June 25, 2024, we entered into a securities purchase agreement with certain Selling Stockholders (the “Purchasers”), relating to a private placement, pursuant to which we agreed to sell to the Purchasers 1,500,000 shares of Common Stock at a purchase price of $4.00 per share (the “Private Placement”). In connection with the Private Placement, we entered into a registration rights agreement with the Purchasers, pursuant to which we are required to file this resale registration statement with the SEC to register for resale of the Common Stock within 30 days of receipt of funds. We will be obligated to pay certain liquidated damages to the Purchasers if we fail to file this registration statement when required, fails to cause this registration statement to be declared effective by the SEC when required, of if we fail to maintain the effectiveness of this registration statement. The Private Placement closed on July 5, 2024. The gross proceeds of the Private Placement to the Company were approximately $6.0 million.

DESCRIPTION OF CAPITAL STOCK

General

This prospectus describes the general terms of our capital stock. For a more detailed description of our capital stock, you should read the applicable provisions of the Nevada Revised Statutes (the “NRS”), our amended and restated articles of incorporation (our “Articles of Incorporation”) and our amended and restated bylaws (our “Bylaws”).

Common Stock

Our Articles of Incorporation provides authority for us to issue up to 100,000,000 shares of common stock, par value $0.001 per share. As of July 26, 2024 there were 55,356,931 shares of our common stock outstanding. Under the NRS, stockholders generally are not personally liable for our debts or obligations solely as a result of their status as stockholders. Our outstanding shares of common stock are, and any shares offered by this prospectus will be, when issued and paid for, fully paid and nonassessable.

Holders of our common stock are entitled to one vote per share on all matters submitted to our stockholders for a vote. There are no cumulative voting rights in the election of directors. Our shares of common stock are entitled to receive such dividends as may be declared and paid by our Board of Directors out of funds legally available therefor and to share ratably in the net assets, if any, of Rezolute upon liquidation. Our stockholders have no preemptive rights to purchase any shares of our capital stock. Our Articles of Incorporation provides that the Eighth Judicial District Court of Clark County, Nevada shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim for breach of a fiduciary duty owed by any of our directors, officers, employees or agents to us or our stockholders, (iii) any action asserting a claim arising pursuant to any provision of the NRS Chapters 78 or 92A, our Articles of Incorporation or our Bylaws or (iv) any action asserting a claim governed by the internal affairs doctrine. Notwithstanding this exclusive forum provision, the exclusive forum provision shall not preclude or contract the scope of exclusive federal or concurrent jurisdiction for actions brought under the Exchange Act or the Securities Act, or the respective rules and regulations promulgated thereunder.

Pre-Funded Warrants

In addition to Common Stock, we have issued pre-funded warrants to purchase common stock. As of July 26, 2024, the number of pre-funded warrants outstanding were exercisable into 14,409,967 shares of our Common Stock.

Transfer Agent and Registrar

The transfer agent of our Common Stock is Issuer Direct Corporation. Its address is One Glenwood Avenue, Suite 1001, Raleigh, NC 27306.

SELLING STOCKHOLDERS

This prospectus covers the resale by the selling stockholders identified below of 4,500,000 shares of common stock, including 3,000,000 issuable upon the exercise of the Warrants. The 3,000,000 shares issuable upon the exercise of the Warrants were issued on March 8, 2024. For additional information regarding the Warrants, see “Description of Transaction and Selling Stockholders and Warrants” above.

The 1,500,000 remaining shares were issued on July 5, 2024 in connection with the Private Placement. For additional information regarding the Private Placement, see “Description of Transaction and Selling Stockholders and Warrants” above. The following table sets forth the number of shares of our common stock beneficially owned by the selling stockholders on July 25, 2024 and after giving effect to this offering.

The table below lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the Selling Stockholders. The second column lists the number of shares of common stock beneficially owned by each Selling Stockholder, based on its ownership of the shares of common stock and warrants, as of July 26, 2024 assuming exercise of the warrants held by the Selling Stockholders on that date, without regard to any limitations on exercises. The third column lists the shares of common stock being offered by this prospectus by Selling Stockholders.

This prospectus generally covers the resale of the maximum number of shares of Common Stock and common stock issuable upon exercise of the Warrants, determined as if the outstanding warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment, without regard to any limitations on the exercise of the warrants. The fourth column assumes the sale of all of the shares offered by the Selling Stockholders pursuant to this prospectus.

Under the terms of the Warrants, a Selling Stockholder may not exercise the warrants to the extent such exercise would cause such Selling Stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 19.99% (or 9.99%) of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the warrants which have not been exercised. The number of shares in the second and third columns, and the percentage ownership in the fourth column, do not reflect this limitation. The Selling Stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

|

Name of Selling Stockholder

|

|

|

Number of

Shares of

Common Stock

Owned Prior

to Offering

|

|

|

Maximum Number of

Shares of Common

Stock to be Sold

Pursuant to this

Prospectus

|

|

|

Number of

Shares of

Common Stock

Owned

After Offering

|

|

|

Percentage of

Shares Owned

After the

Offering(1)(2)

|

|

|

Handok, Inc.(3)

|

|

|

|

|

7,192,617 |

|

|

|

|

|

1,250,000 |

|

|

|

|

|

5,942,617 |

|

|

|

|

|

10.7% |

|

|

|

Genexine Inc.(4)

|

|

|

|

|

2,076,019 |

|

|

|

|

|

250,000 |

|

|

|

|

|

1,826,019 |

|

|

|

|

|

3.30% |

|

|

|

Nantahala Capital Partners Limited Partnership(5)

|

|

|

|

|

1,221,417 |

|

|

|

|

|

610,404 |

|

|

|

|

|

611,013 |

|

|

|

|

|

1.1% |

|

|

|

NCP RFM LP(6)

|

|

|

|

|

999,359 |

|

|

|

|

|

533,689 |

|

|

|

|

|

465,670 |

|

|

|

|

|

* |

|

|

|

Blackwell Partners LLC – Series A(7)

|

|

|

|

|

3,537,282 |

|

|

|

|

|

1,855,907 |

|

|

|

|

|

1,681,375 |

|

|

|

|

|

3.04% |

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

*

Represents ownership of less than 1%.

(1)

Applicable percentage ownership is based on 55,356,931, shares of our common stock outstanding as of July 26, 2024.

(2)

Assumes the sale of all shares of common stock offered in this prospectus.

(3)

Voting and investment authority over shares of Common Stock owned by Handok, Inc. is held by the board of directors of Handok, Inc. The address of the stockholder is 132, Teheran-Ro, Gangman Gu, Seoul, Republic of Korea.

(4)

Voting and investment authority over shares of Common Stock owned by Genexine Inc. is held by the

board of directors of Genexine Inc. The address of the stockholder is 700 Daewangpangyo-ro Korea Bio-Park, Building B, Bundang-gu, Seongnam-si, Gyeonggi-do 463-400, Republic of Korea.

(5)

Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of the stockholder is 130 Main St. 2nd Floor New Canaan, CT 06840.

(6)

Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of the stockholder is 130 Main St. 2nd Floor New Canaan, CT 06840.

(7)

Nantahala Capital Management, LLC is a Registered Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or any other purpose. Wilmot Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive power over the shares held by the selling stockholder. The warrants are subject to a beneficial ownership limitation of 9.99%, which such limitation restricts the selling stockholder from exercising that portion of the warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of the stockholder is 280 South Mangum Street, Suite 210 Durham, NC 27701.

PLAN OF DISTRIBUTION

Each Selling Stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the principal Trading Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling securities:

•

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

settlement of short sales;

•

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

a combination of any such methods of sale; or

•

any other method permitted pursuant to applicable law.

The Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of our common stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Financial Industry Regulatory Authority, or FINRA, Rule 5110; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the date that all shares of Common Stock covered by this propsectus (i) have been sold, thereunder or pursuant to Rule 144, or (ii) may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 and without the requirement for the Company to be in compliance with the current public information requirement under Rule 144, as determined by the counsel to the Company pursuant to a written opinion letter to such effect, addressed and acceptable to the Transfer Agent and the affected holders The Company shall telephonically request effectiveness of a Registration Statement as of 5:00 p.m. (New York City time) on a Trading Day. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

At the time a particular offer of securities is made, if required, a prospectus supplement will be distributed that will set forth the number of securities being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

LEGAL MATTERS

Certain legal matters in connection with the offered securities will be passed upon for us by Dorsey & Whitney LLP, Denver, Colorado. Any underwriters or agents will be represented by their own legal counsel, who will be identified in the applicable prospectus supplement.

EXPERTS

Plante & Moran, PLLC has audited our consolidated financial statements included in our Annual Report on Form 10-K for the years ended June 30, 2023 and 2022, which are incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Plante & Moran, PLLC’s report, given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, are also available for download, free of charge, as soon as reasonably practicable after these reports are filed with, or furnished to, the SEC, at our website at www.rezolutebio.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

As permitted by SEC rules, this prospectus does not contain all of the information we have included in the registration statement and the accompanying exhibits and schedules we file with the SEC. You may refer to the registration statement, exhibits and schedules for more information about us and the securities. The registration statement, exhibits and schedules are available through the SEC’s website or at its public reference room.

INCORPORATION BY REFERENCE

In this prospectus, we “incorporate by reference” certain information that we file with the SEC, which means that we can disclose important information to you by referring you to that information. The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information. The following documents or information have been filed by us with the SEC and are incorporated by reference into this prospectus (other than, in each case, documents or information that are or are deemed to have been furnished rather than filed in accordance with SEC rules, including disclosure furnished under Items 2.02 or 7.01 of Form 8-K):

•

•

the Company’s Quarterly Reports on Form 10-Q for the quarter ended September 30, 2023, filed on November 13, 2023, for the quarter ended December 31, 2023 filed on February 13, 2024, and for the quarter ended March 31, 2024 filed on May 15, 2024;

•

•

the description of the Company’s common stock, par value $0.001 per share, as contained in Item 1 of Amendment No. 1 to the Registration Statement on Form 8-A/A filed on June 21, 2021, under the Exchange Act, including any amendment or report filed under the Exchange Act for the purpose of updating such description.

All documents and reports that we file with the SEC (other than, in each case, documents or information that are or are deemed to have been furnished rather than filed in accordance with SEC rules) under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to in this prospectus as the “Exchange Act,” from the date of this prospectus until the completion of the offering under this prospectus shall be deemed to be incorporated by reference into this prospectus. Unless specifically stated to the contrary, none of the information we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K that we may from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus. The information contained on or accessible through any websites, including our website, is not and shall not be deemed to be incorporated by reference into this prospectus.

You may request a copy of these filings, other than an exhibit to these filings unless we have specifically included or incorporated that exhibit by reference into the filing, at no cost, by writing or telephoning us at the following address:

Rezolute, Inc.

275 Shoreline Drive, Suite 500

Redwood City, CA 94065

(650) 206-4507

Any statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement, or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The following table sets forth expenses payable by us in connection with the issuance and distribution of the securities being registered pursuant to this registration statement.

| |

SEC registration fee

|

|

|

|

$ |

2,979 |

|

|

| |

Legal fees and expenses

|

|

|

|

|

25,000 |

|

|

| |

Accounting fees and expenses

|

|

|

|

|

15,000 |

|

|

| |

Miscellaneous

|

|

|

|

|

10,000 |

|

|

| |

Total

|

|

|

|

$ |

52,979 |

|

|

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our officers and directors are indemnified under Nevada law, our amended and restated Articles of Incorporation, as amended, and our amended and restated bylaws, as amended, against certain liabilities. Our amended and restated Articles of Incorporation, as amended, require us to indemnify our directors and officers to the fullest extent permitted by the laws of the State of Nevada in effect from time to time.

Pursuant to our amended and restated Articles of Incorporation, as amended, and our amended and restated bylaws, as amended, each person who was or is made a party or is threatened to be made a party to or is otherwise involved in any action, suit or proceeding, by reason of the fact that he is or was a director or an officer of the Company or is or was serving at the request of the Company as a director, officer, or trustee of another enterprise, (hereinafter an “lndemnitee”), whether the basis of such proceeding is alleged action in an official capacity as a director, officer or trustee or in any other capacity while serving as a director, officer or trustee, shall be indemnified and held harmless by the Company to the fullest extent permitted by the Nevada Revised Statutes, as the same exists or may hereafter be amended, against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such Indemnitee in connection therewith; provided, however, that, except as otherwise provided in our amended and restated Articles of Incorporation, we shall not be required to indemnify or advance expenses to any such Indemnitee in connection with a proceeding initiated by such Indemnitee unless such proceeding was authorized by the Board of Directors of the Company. However, Nevada Revised Statutes 78.138 currently provides that, except as otherwise provided in the Nevada Revised Statutes, a director or officer shall not be individually liable to us or our stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that (i) the presumption established by Nevada Revised Statutes 78.138(3) has been rebutted, (ii) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties as a director or officer, and (iii) such breach involved intentional misconduct, fraud or a knowing violation of the law.

In addition, an lndemnitee shall also have the right to be paid by the Company the expenses (including attorney’s fees) incurred in defending any such proceeding in advance of its final disposition; provided, however, that, if Nevada Revised Statutes requires, an advancement of expenses incurred by an Indemnitee in his capacity as a director or officer shall be made only upon delivery to the Company of an undertaking, by or on behalf of such Indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal that such lndemnitee is not entitled to be indemnified for such expenses.

No director shall be personally liable to us or our stockholders for any monetary damages for breaches of fiduciary duty as a director; provided that this provision shall not eliminate or limit the liability of a director, to the extent that such liability is imposed by applicable law, (i) for any breach of the director’s duty of loyalty to the Company or our stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under Section 174 or successor provisions of the Nevada Revised Statutes; or (iv) for any transaction from which the director derived a personal benefit.

No amendment to or repeal of this provision shall apply to or have any effect on the liability or alleged liability of any director for or with respect to any acts or omissions of such director occurring prior to such amendment or repeal. If the Nevada Revised Statutes is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Company shall be eliminated or limited to the fullest extent permitted by Nevada Revised Statues, as so amended.

Section 78.7502 of the Nevada Revised Statutes permits a corporation to indemnify, pursuant to that statutory provision, a present or former director, officer, employee or agent of the corporation, or of another entity or enterprise for which such person is or was serving in such capacity at the request of the corporation, who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, except an action by or in the right of the corporation, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred in connection therewith, arising by reason of such person’s service in such capacity if such person (i) is not liable pursuant to Section 78.138 of the Nevada Revised Statutes, or (ii) acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to a criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. In the case of actions brought by or in the right of the corporation, however, no indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes may be made for any claim, issue or matter as to which such person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Any discretionary indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes, unless ordered by a court or advanced to a director or officer by the corporation in accordance with the Nevada Revised Statutes, may be made by a corporation only as authorized in each specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances. Such determination must be made (1) by the stockholders, (2) by the board of directors by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding, (3) if a majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders, by independent legal counsel in a written opinion, or (4) if a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion.

Section 78.751 of the Nevada Revised Statutes further provides that indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under our amended and restated Articles of Incorporation, as amended, or any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, for either an action in the person’s official capacity or an action in another capacity while holding office, except that indemnification, unless ordered by a court pursuant to Section 78.7502 of the Nevada Revised Statutes or for the advancement of expenses, may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals, to be liable for intentional misconduct, fraud or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

As permitted by the Nevada Revised Statutes, we have entered into indemnity agreements with each of our directors and executive officers. These agreements, among other things, require us to indemnify each director and officer to the fullest extent permitted by law and advance expenses to each indemnitee in connection with any proceeding in which indemnification is available.

We have an insurance policy covering our officers and directors with respect to certain liabilities, including liabilities arising under the Securities Act of 1933, as amended, or the Securities Act, or otherwise.

See also the undertakings set out in response to Item 17 herein.

ITEM 16. EXHIBITS

EXHIBITS

| |

Exhibit

No.

|

|

|

Description

|

|

|

Registrant’s

Form

|

|

|

Date

Filed

|

|

|

Exhibit

Number

|

|

|

Filed

Herewith

|

|

| |

2.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

| |

4.1

|

|

|

|

|

|

8-K

|

|

|

6/21/21

|

|

|

3.3

|

|

|

|

|

| |

4.2

|

|

|

|

|

|

10-K

|

|

|

9/15/21

|

|

|

3.4

|

|

|

|

|

| |

4.3

|

|

|

|

|

|

8-K

|

|

|

3/14/24

|

|

|

4.1

|

|

|

|

|

| |

5.1

|

|

|

Opinion of Dorsey & Whitney LLP (to be supplied by amendment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

23.1

|

|

|

Consent of Dorsey & Whitney LLP (to be included in Exhibit 5.1 and supplied by amendment).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

23.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

| |

24

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

| |

107

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

ITEM 17. UNDERTAKINGS

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)