PHILADELPHIA, Oct. 19 /PRNewswire-FirstCall/ -- Republic First

Bancorp, Inc. (NASDAQ:FRBK), (the "Company") the holding company

for Republic First Bank (PA), today reported third quarter 2007

earnings of $1.2 million or $.12 per diluted share, compared to

$2.4 million or $.23* per diluted share for the same quarter in

2006. Average loans outstanding increased 13% in third quarter 2007

compared to third quarter 2006. The $.11 per share reduction in

earnings in third quarter 2007 compared to third quarter 2006

primarily reflected the following reductions: $.07 per share due to

an increase in the provision for loan losses, $.06 per share from

the combination of higher rates on deposits and lower rates on

loans due to an increase in non-performing loans, and $.01 in

one-time costs related to staff reductions. These factors were

partially offset by a favorable $.03 per share from loan growth.

For third quarter 2007, interest income increased $1.7 million to

$17.7 million from $16.0 million for third quarter 2006. The

increase was due primarily to the increase in average loans

outstanding, partially offset by the reduction of interest income

from the increase in non-performing loans. For third quarter 2007,

interest expense increased $2.2 million to $9.9 million from $7.7

million for third quarter 2006. The rate on total interest bearing

deposits increased 55 basis points to 4.74% in third quarter 2007

compared to 4.19% for the same period in 2006. Net interest income

for third quarter 2007 of $7.8 million was $523,000 less than the

third quarter of 2006 as a result of the above factors. Third

quarter net interest margin was 3.30% compared to the 4.03%

recorded in the third quarter of 2006. The reduction was due

primarily to the 55 basis point increase in the rate on total

interest bearing deposits and the increase in non-performing loans

from $10.0 million at September 30, 2006 to $25.4 million at

September 30, 2007. The Company has historically resolved problem

loans with nominal loss. The $8.8 million increase in non-accruals

from June 30, 2007 to September 30, 2007 resulted from loans to a

single customer of $13 million which are well secured with real

estate and losses are not anticipated. Since June 30, 2007, the

Company has reduced existing non-accrual loans by $4 million

without loss. With the $.07 per share increase in the provision for

loan losses, the Company has increased the allowance for loan

losses to total loans ratio to 1.04%. Management believes the loan

loss reserve is adequate at current levels based upon charge-off

history and monthly analysis of problem loans. Harry Madonna,

Chairman and Chief Executive Officer, stated, "The spike in

non-performing loans was caused by a default on three loans to

related borrowers. The loans were performing loans for over two

years and the reason for the default was an alleged fraud by the

borrowers involving unrelated loans from other banks. The loans in

question are well collateralized by ongoing businesses and real

estate, including a large waterfront property located on the New

Jersey shore. We do not expect any losses from the loans. Due to

the downturn in the housing market, in an abundance of caution, we

have increased our loan loss reserves. The third quarter numbers

also include severance costs of employee reductions to assure that

the Bank is operating in an efficient manner." Total shareholders'

equity stood at $78.4 million with a book value per share of $7.59

at September 30, 2007, based on outstanding common shares of

approximately 10.3 million. The Company continues to be well

capitalized. Republic First Bank (PA) is a full-service,

state-chartered commercial bank, whose deposits are insured by the

Federal Deposit Insurance Corporation (FDIC). The Bank provides

diversified financial products through its eleven offices located

in Abington, Ardmore, Bala Cynwyd, Plymouth Meeting, Media and

Philadelphia, Pennsylvania and Voorhees, New Jersey. The Company

may from time to time make written or oral "forward-looking

statements", including statements contained in this release and in

the Company's filings with the Securities and Exchange Commission.

These forward-looking statements include statements with respect to

the Company's beliefs, plans, objectives, goals, expectations,

anticipations, estimates, and intentions that are subject to

significant risks and uncertainties and are subject to change based

on various factors, many of which are beyond the Company's control.

The words "may", "could", "should", "would", "believe",

"anticipate", "estimate", "expect", "intend", "plan", and similar

expressions are intended to identify forward-looking statements.

All such statements are made in good faith by the Company pursuant

to the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. The Company does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by or on behalf of the Company. *

Prior year earnings per share amounts were restated to reflect the

10% stock dividend paid April 17, 2007. Republic First Bancorp,

Inc. Condensed Income Statement (Dollar amounts in thousands except

per share data) (unaudited) Three Months Ended Nine Months Ended

September 30 September 30 2007 2006 2007 2006 Net Interest Income

$7,804 $8,327 $22,879 $25,822 Provision for Loan Losses 1,282 -

1,425 1,374 Non-interest Income 760 874 2,155 2,833 Non-interest

Expenses 5,488 5,503 15,766 15,666 Provision for income taxes 558

1,263 2,535 3,982 Net Income $1,236 $2,435 $5,308 $7,633 Diluted

EPS $0.12 $0.23 (1) $0.50 $0.72 (1) Republic First Bancorp, Inc.

Condensed Balance Sheet (Dollar amounts in thousands) (unaudited)

Assets September 30, December 31, September 30, 2007 2006 2006

Federal Funds Sold and Other Interest Bearing Cash $65,976 $63,673

$98,322 Investment Securities 91,291 109,176 83,237 Commercial and

Other Loans 841,774 792,060 761,803 Allowance for Loan Losses

(8,791) (8,058) (7,934) Other Assets 49,869 51,973 44,916 Total

Assets $1,040,119 $1,008,824 $980,344 Liabilities and Shareholders'

Equity: Transaction Accounts $359,310 $385,950 $368,121 Time

Deposit Accounts 410,579 368,823 374,870 FHLB Advances and Trust

Preferred Securities 179,776 165,909 151,980 Other Liabilities

12,082 13,408 13,306 Shareholders' Equity 78,372 74,734 72,067

Total Liabilities and Shareholders' Equity $1,040,119 $1,008,824

$980,344 (1) Prior year earnings per share has been restated for

the 10% stock dividend paid April 17, 2007. Republic First Bancorp,

Inc. September 30, 2007 (unaudited) At or For the At or For the

Three Months Ended Nine Months Ended September September September

September Financial Data: 30, 2007 30, 2006 30, 2007 30, 2006

Return on average assets 0.50 % 1.13 % 0.73 % 1.24 % Return on

average equity 6.29 % 13.66 % 9.21 % 15.01 % Share information:

Book value per share $7.59 $7.16 (1) $7.59 $7.16 (1) Actual shares

outstanding at period end, net of treasury shares (416,311 and

275,611 shares, respectively) 10,319,000 10,442,000 (1) 10,319,000

10,442,000 (1) Average diluted shares outstanding 10,598,000

10,724,000 (1) 10,698,000 10,685,000 (1) (1) Prior year share

information has been restated for the 10% stock dividend payable

April 17, 2007. Republic First Bancorp, Inc. September 30, 2007

(Dollars in thousands) (unaudited) Credit Quality Ratios: September

30, December 31, September 30, 2007 2006 2006 Non-accrual and loans

accruing, but past due 90 days or more $25,435 $6,916 $9,972

Restructured loans - - - Total non-performing loans 25,435 6,916

9,972 Other real estate owned 42 572 499 Total non-performing

assets $25,477 $7,488 $10,471 Nine Months Twelve Months Nine Months

Ended Ended Ended September 30, December 31, September 30, 2007

2006 2006 Allowance for Loan Losses Balance at beginning of period

$8,058 $7,617 $7,617 Charge-offs: Commercial and construction 1,028

601 445 Tax refund loans - 1,286 1,286 Consumer 2 - - Total

charge-offs 1,030 1,887 1,731 Recoveries: Commercial and

construction 81 37 35 Tax refund loans 256 927 639 Consumer 1 - -

Total recoveries 338 964 674 Net charge-offs 692 923 1,057

Provision for loan losses 1,425 1,364 1,374 Balance at end of

period $8,791 $8,058 $7,934 Non-performing loans as a percentage of

total loans 3.02% 0.87% 1.31% Non-performing assets as a percentage

of total assets 2.45% 0.74% 1.07% Allowance for loan losses to

total loans 1.04% 1.02% 1.04% Allowance for loan losses to total

non-performing loans 34.56% 116.51% 79.56% Republic First Bancorp,

Inc. September 30, 2007 (Dollars in thousands) (unaudited)

Quarter-to-Date Average Balance Sheet Three months ended Three

months ended September 30, 2007 September 30, 2006 Interest-Earning

Average Average Assets: Average Yield/ Average Yield/ Balance

Interest Cost Balance Interest Cost Commercial and other loans

$837,417 $16,209 7.68 % $742,420 $14,868 7.95 % Investment

securities 89,042 1,329 5.97 59,736 915 6.13 Federal funds sold

10,817 139 5.10 18,524 248 5.31 Total interest- earning assets

937,276 17,677 7.48 820,680 16,031 7.75 Other assets 40,513 36,593

Total assets $977,789 $17,677 $857,273 $16,031 Interest-bearing

liabilities: Interest-bearing deposits $642,651 $7,675 4.74 %

$582,072 $6,078 4.19 % Borrowed funds 162,268 2,198 5.37 114,227

1,626 5.65 Interest-bearing liabilities 804,919 9,873 4.87 696,299

7,704 4.39 Non-interest and interest-bearing funding 885,565 9,873

4.42 775,241 7,704 3.94 Other liabilities: 14,266 11,309 Total

liabilities 899,831 786,550 Shareholders' equity 77,958 70,723

Total liabilities & shareholders' equity $977,789 $857,273 Net

interest income $7,804 $8,327 Net interest margin 3.30 % 4.03 %

Republic First Bancorp, Inc. September 30, 2007 (Dollars in

thousands) (unaudited) Year-to-Date Average Balance Sheet Nine

months ended Nine months ended September 30, 2007 September 30,

2006 Interest-Earning Average Average Assets: Average Yield/

Average Yield/ Balance Interest Cost Balance Interest Cost

Commercial and other loans $819,243 $47,166 7.70 % $714,695 $42,773

8.00 % Investment securities 98,571 4,232 5.72 48,300 1,991 5.50

Federal funds sold 14,424 543 5.03 25,039 900 4.81 Total interest-

earning assets 932,238 51,941 7.45 788,034 45,664 7.75 Other assets

39,029 36,940 Total assets $971,267 $51,941 $824,974 $45,664

Interest-bearing liabilities: Interest-bearing deposits $662,307

$23,368 4.72 % $576,972 $16,281 3.77 % Borrowed funds 139,188 5,694

5.47 86,603 3,561 5.50 Interest-bearing liabilities 801,495 29,062

4.85 663,575 19,842 4.00 Non-interest and interest-bearing funding

879,997 29,062 4.42 746,806 19,842 3.55 Other liabilities: 14,184

10,194 Total liabilities 894,181 757,000 Shareholders' equity

77,086 67,974 Total liabilities & shareholders' equity $971,267

$824,974 Net interest income $22,879 $25,822 Net interest margin

3.28 % 4.38 % DATASOURCE: Republic First Bancorp, Inc. CONTACT:

Paul Frenkiel, CFO of Republic First Bancorp, Inc., +1-215-735-4422

ext. 5255

Copyright

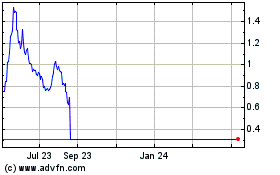

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

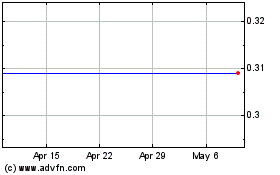

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024