Relay Therapeutics, Inc. (Nasdaq: RLAY), a clinical-stage precision

medicine company transforming the drug discovery process by

combining leading-edge computational and experimental technologies,

today reported second quarter 2024 financial results and corporate

highlights.

“In the second quarter, we made important progress continuing to

advance our clinical programs, which we believe has positioned us

well for multiple data readouts later this year. Additionally, we

look forward to expanding the RLY-2608 development program, with

the initiation of a new triplet combination with Pfizer's novel

investigative selective-CDK4 inhibitor atirmociclib by the end of

the year,” said Sanjiv Patel, M.D., President and Chief Executive

Officer of Relay Therapeutics. “Looking further ahead, we are very

excited by the pre-clinical programs we unveiled in June, including

our first two genetic disease programs, which will be important in

driving our continued growth and diversification.”

Recent Corporate Highlights

RLY-2608 (ReDiscover study)

- RLY-2608 doublet: continued to

enroll patients with PI3Kα-mutant, HR+, HER2- locally advanced or

metastatic breast cancer in dose expansion cohorts of RLY-2608

400mg BID and 600mg BID in combination with fulvestrant

- The next data update is expected in

the fourth quarter of 2024 and will include approximately 100

patients across doses in the safety database and approximately 60

patients at the 600mg BID dose, including about 40 who have had the

opportunity to be on RLY-2608 for at least 6 months

- RLY-2608 triplet:

- CDK4/6: continued enrollment of

RLY-2608 + fulvestrant + ribociclib triplet combination in patients

with PI3Kα-mutant, HR+, HER2- locally advanced or metastatic breast

cancer

- CDK4: announced a clinical trial

collaboration to evaluate atirmociclib, Pfizer’s investigative

selective-CDK4 inhibitor, in combination with RLY-2608 and

fulvestrant in patients with PI3Kα-mutant, HR+, HER2- metastatic

breast cancer. The RLY-2608 + atirmociclib + fulvestrant triplet

combination is planned to begin by the end of 2024

- RLY-2608 monotherapy: continued to

enroll patients with unresectable or metastatic solid tumors with a

PI3Kα mutation in dose escalation portion of RLY-2608 monotherapy

arm and reported partial responses in multiple tumor types

Migoprotafib (GDC-1971)

- As previously disclosed, Genentech

has terminated the collaboration agreement for the development and

commercialization of migoprotafib

- The company will not continue

development of migoprotafib

Pre-Clinical Programs

- Disclosed three new pre-clinical

programs: vascular malformations, Fabry disease and NRAS

- Vascular Malformations

- PI3Kα is the most common driver

mutation among specific types of vascular malformations, which are

a series of rare syndromes that occur due to atypical development

of lymphatic and/or blood vessels and can become life-threatening,

depending on what vessel(s) are involved

- In the U.S., an estimated 170,000

people have one of the sub-types driven by a PI3Kα mutation, which

include PIK3CA-related overgrowth spectrum, lymphatic

malformations, venous malformations and cerebral cavernous

malformations

- A mutant selective PI3Kα inhibitor

provides the opportunity for greater target coverage, leading to

the potential for improved efficacy and better chronic

tolerability

- Relay Therapeutics plans to initiate

clinical development of RLY-2608 in vascular malformations in the

first quarter of 2025

- Fabry Disease

- In Fabry disease, harmful levels of

Gb3 accumulate in blood cells and tissues throughout the body, due

to insufficient αGal enzyme activity, which can lead to a range of

symptoms, including potentially life-threatening ones such as

kidney failure, heart failure and stroke. In the U.S.,

approximately 8,000 people have Fabry disease

- Relay Therapeutics has created the

first investigational non-inhibitory chaperone for Fabry disease,

which is designed to stabilize the αGal protein without inhibiting

its activity, thus enabling greater Gb3 clearance across

organs

- The company expects its

non-inhibitory chaperone to enter the clinic in the second half of

2025

- NRAS

- In the U.S., an estimated 28,000

people are diagnosed annually with mutated NRAS solid tumors, which

are a known oncogene driver in the RAS family and can lead to a

number of cancers, including melanoma, colorectal and

non-small-cell lung

- Relay Therapeutics has created the

first NRAS-selective inhibitor, which has been designed to address

the liabilities of current pan-RAS inhibitors by only binding to

NRAS, while sparing KRAS and HRAS

- The company expects to initiate

clinical development of its NRAS-selective inhibitor in the second

half of 2025

Anticipated Upcoming Milestones

- Breast Cancer

- RLY-2608 + fulvestrant data update

in the fourth quarter of 2024

- RLY-2608 + fulvestrant + ribociclib

initial safety data in the fourth quarter of 2024

- RLY-2608 + fulvestrant +

atirmociclib clinical trial initiation by the end of 2024

- RLY-2608 + fulvestrant potential

Phase 3 trial initiation in 2025

- Lirafugratinib: tumor agnostic data

and regulatory update in the second half of 2024

- Pre-clinical

- Vascular malformations: RLY-2608

clinical trial initiation in the first quarter of 2025

- Fabry disease: clinical start in the

second half of 2025

- NRAS: clinical start in the second

half of 2025

Second Quarter 2024 Financial Results

Cash, Cash Equivalents and Investments: As of

June 30, 2024, cash, cash equivalents and investments totaled

$688.4 million compared to $750.1 million as of December 31, 2023.

The company expects its current cash, cash equivalents and

investments will be sufficient to fund its current operating plan

into the second half of 2026.

R&D Expenses: Research and development

expenses were $92.0 million for the second quarter of 2024, as

compared to $88.2 million for the second quarter of 2023. The

increase was primarily due to additional external costs in

connection with the ReDiscover trial for RLY-2608.

G&A Expenses: General and administrative

expenses were $20.1 million for the second quarter of 2024, as well

as for the second quarter of 2023.

Net Loss: Net loss was $92.2 million for the

second quarter of 2024, or a net loss per share of $0.69, as

compared to a net loss of $98.5 million for the second quarter of

2023, or a net loss per share of $0.81.

About Relay

Therapeutics

Relay Therapeutics (Nasdaq: RLAY) is a

clinical-stage precision medicine company transforming the drug

discovery process by combining leading-edge computational and

experimental technologies with the goal of bringing life-changing

therapies to patients. As the first of a new breed of biotech

created at the intersection of complementary techniques and

technologies, Relay Therapeutics aims to push the boundaries of

what’s possible in drug discovery. Its Dynamo™ platform integrates

an array of leading-edge computational and experimental approaches

designed to drug protein targets that have previously been

intractable or inadequately addressed. Relay Therapeutics’ initial

focus is on enhancing small molecule therapeutic discovery in

targeted oncology and genetic disease indications. For more

information, please visit www.relaytx.com or follow us on

Twitter.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended, including,

without limitation, implied and express statements regarding Relay

Therapeutics’ strategy, business plans and focus; the progress and

timing of the clinical development of the programs across Relay

Therapeutics’ portfolio, including the expected therapeutic

benefits of its programs, potential efficacy and tolerability, and

the timing and success of interactions with and approval of

regulatory authorities; the timing and progress of doublet and

triplet combinations for RLY-2608, the timing and scope of clinical

updates for RLY-2608, the timing of a clinical data and regulatory

update for lirafugratinib; the timing of clinical initiation of

Relay Therapeutics’ various programs, including a potential pivotal

trial for RLY-2608, clinical development in vascular malformations,

clinical development of Relay Therapeutics’ non-inhibitory

chaperone, and clinical development of its NRAS-selective

inhibitor; the potential of Relay Therapeutics’ product candidates

to address a major unmet medical need; the cash runway projection;

the competitive landscape and potential market opportunities for

Relay Therapeutics’ product candidates; the expected strategic

benefits under Relay Therapeutics’ collaborations; and expectations

regarding Relay Therapeutics’ pipeline, operating plan, use of

capital, expenses and other financial results. The words “may,”

“might,” “will,” “could,” “would,” “should,” “plan,” “anticipate,”

“intend,” “believe,” “expect,” “estimate,” “seek,” “predict,”

“future,” “project,” “potential,” “continue,” “target” and similar

words or expressions, or the negative thereof, are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words.

Any forward-looking statements in this

press release are based on management's current expectations and

beliefs and are subject to a number of risks, uncertainties and

important factors that may cause actual events or results to differ

materially from those expressed or implied by any forward-looking

statements contained in this press release, including, without

limitation, risks associated with: the impact of global economic

uncertainty, geopolitical instability and conflicts, or public

health epidemics or outbreaks of an infectious disease on countries

or regions in which Relay Therapeutics has operations or does

business, as well as on the timing and anticipated results of its

clinical trials, strategy, future operations and profitability; the

delay or pause of any current or planned clinical trials or the

development of Relay Therapeutics’ drug candidates; the risk that

the preliminary results of its pre-clinical or clinical trials may

not be predictive of future or final results in connection with

future clinical trials of its product candidates; Relay

Therapeutics’ ability to successfully demonstrate the safety and

efficacy of its drug candidates; the timing and outcome of its

planned interactions with regulatory authorities; and obtaining,

maintaining and protecting its intellectual property. These and

other risks and uncertainties are described in greater detail in

the section entitled “Risk Factors” in Relay Therapeutics’ most

recent Annual Report on Form 10-K and Quarterly Report on Form

10-Q, as well as any subsequent filings with the Securities and

Exchange Commission. In addition, any forward-looking statements

represent Relay Therapeutics' views only as of today and should not

be relied upon as representing its views as of any subsequent date.

Relay Therapeutics explicitly disclaims any obligation to update

any forward-looking statements. No representations or warranties

(expressed or implied) are made about the accuracy of any such

forward-looking statements.

Contact:Megan

Goulart617-545-5526 mgoulart@relaytx.com

Media:Dan

Budwick1AB973-271-6085dan@1abmedia.com

|

|

|

|

Relay Therapeutics, Inc.Condensed Consolidated Statements of

Operations and Comprehensive Loss(In thousands, except share and

per share data)(Unaudited) |

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

License and other revenue |

|

$ |

— |

|

|

$ |

119 |

|

|

$ |

10,007 |

|

|

$ |

345 |

|

| Total

revenue |

|

|

— |

|

|

|

119 |

|

|

|

10,007 |

|

|

|

345 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

$ |

91,992 |

|

|

$ |

88,201 |

|

|

$ |

174,395 |

|

|

$ |

171,028 |

|

|

Change in fair value of contingent consideration liability |

|

|

(11,374 |

) |

|

|

(2,152 |

) |

|

|

(13,206 |

) |

|

|

(3,155 |

) |

|

General and administrative expenses |

|

|

20,139 |

|

|

|

20,120 |

|

|

|

39,938 |

|

|

|

39,699 |

|

| Total

operating expenses |

|

|

100,757 |

|

|

|

106,169 |

|

|

|

201,127 |

|

|

|

207,572 |

|

| Loss

from operations |

|

|

(100,757 |

) |

|

|

(106,050 |

) |

|

|

(191,120 |

) |

|

|

(207,227 |

) |

| Other

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

8,547 |

|

|

|

7,559 |

|

|

|

17,498 |

|

|

|

14,500 |

|

|

Other (expense) income |

|

|

(2 |

) |

|

|

(14 |

) |

|

|

23 |

|

|

|

(17 |

) |

| Total

other income, net |

|

|

8,545 |

|

|

|

7,545 |

|

|

|

17,521 |

|

|

|

14,483 |

|

| Net

loss |

|

$ |

(92,212 |

) |

|

$ |

(98,505 |

) |

|

$ |

(173,599 |

) |

|

$ |

(192,744 |

) |

| Net loss

per share, basic and diluted |

|

$ |

(0.69 |

) |

|

$ |

(0.81 |

) |

|

$ |

(1.32 |

) |

|

$ |

(1.59 |

) |

| Weighted

average shares of common stock, basic and diluted |

|

|

132,821,826 |

|

|

|

121,680,844 |

|

|

|

131,832,420 |

|

|

|

121,501,849 |

|

| Other

comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized holding (loss) gain |

|

|

(182 |

) |

|

|

(279 |

) |

|

|

(1,144 |

) |

|

|

4,339 |

|

|

Total other comprehensive (loss) income |

|

|

(182 |

) |

|

|

(279 |

) |

|

|

(1,144 |

) |

|

|

4,339 |

|

| Total

comprehensive loss |

|

$ |

(92,394 |

) |

|

$ |

(98,784 |

) |

|

$ |

(174,743 |

) |

|

$ |

(188,405 |

) |

|

|

|

Relay Therapeutics, Inc.Selected Condensed Consolidated Balance

Sheet Data(In thousands)(Unaudited) |

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

Cash, cash equivalents and investments |

|

$ |

688,415 |

|

|

$ |

750,086 |

|

| Working

capital (1) |

|

|

659,227 |

|

|

|

739,834 |

|

| Total

assets |

|

|

772,750 |

|

|

|

843,980 |

|

| Total

liabilities |

|

|

90,806 |

|

|

|

91,977 |

|

| Total

stockholders’ equity |

|

|

681,744 |

|

|

|

752,003 |

|

|

Restricted cash |

|

|

2,707 |

|

|

|

2,707 |

|

(1) Working capital is defined as current assets less current

liabilities.

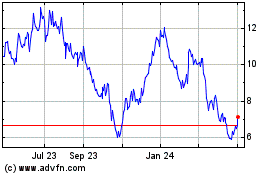

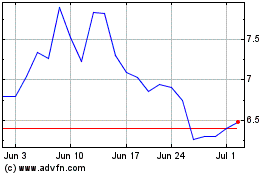

Relay Therapeutics (NASDAQ:RLAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Relay Therapeutics (NASDAQ:RLAY)

Historical Stock Chart

From Nov 2023 to Nov 2024