Additional Proxy Soliciting Materials (definitive) (defa14a)

August 29 2016 - 8:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE

SECURITIES EXCHANGE ACT OF 1934

|

Filed by the Registrant

|

x

|

|

Filed by a Party other than the Registrant

|

¨

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

|

TICC Capital Corp.

(Name of Registrant as Specified in Its

Charter)

(Name of Person(s) Filing Proxy Statement

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously Paid:

|

|

|

(2)

|

Form, schedule or registration statement No.:

|

|

|

(3)

|

Filing party:

|

|

|

(4)

|

Date filed:

|

On August 29, 2016, TICC

Capital Corp. issued the following press release:

TICC Sends Letter to Stockholders Urging

Them to Vote White Proxy Card Today

GREENWICH, Conn.-- TICC Capital Corp. (NASDAQ: TICC) (the

"Company," "TICC," "we," or "our") today sent a letter to stockholders urging them to

protect the current distribution policy and their investment by voting “FOR” the Company’s proposals on

the WHITE proxy card.

The full text of the letter is as follows:

August 29, 2016

|

LAST

CALL: Act Now to Preserve TICC’s Current Distribution Policy

Vote WHITE proxy card

VOTE

FOR

PROPOSAL 1:

RE-ELECTION

OF TONIA L. PANKOPF

VOTE

AGAINST

PROPOSAL 4:

TERMINATION

OF THE INVESTMENT ADVISORY AGREEMENT

|

What

is at stake?

|

ü

|

DISTRIBUTION

:

TICC's distributions have increased from $0.60/share in 2009 to $1.14/share in 2015 –

a 92% increase.

TICC has consistently maintained its distribution policy despite market

volatility.

|

|

ü

|

RESULTS:

TICC has generated

323% total shareholder return

since the current strategy was adopted in 2009 – significantly higher than the 147% total shareholder return generated by TICC's BDC peers – and TICC has generated a 17.9% total shareholder return year to date.

(1)

|

|

ü

|

SUCCESS

:

TICC’s current strategy is working. In 2Q2016, NAV/share increased by

11%,

and GAAP Net Investment Income rose by

62%

compared to 1Q2016.

|

RISK

OF SUPPORTING TSLX

|

û

|

DISTRIBUTION POLICY THREATENED

:

TSLX has publicly criticized TICC's distribution policy. What will happen to TICC’s distributions if TSLX’s agenda is adopted?

|

|

û

|

MANAGEMENT VACUUM

:

TSLX wants to terminate TICC’s investment advisory agreement. Who will manage TICC if the current advisor is terminated? A leading independent research analyst agrees that terminating the current advisor is a bad idea, calling it a “major risk”.

(2)

|

|

|

û

|

NO TRANSPARENCY

:

TSLX has no clear plan – or worse, they just won’t disclose it. Their proposals may destroy stockholder value.

|

|

û

|

HIGHER ADVISORY FEES

:

TSLX pays higher advisory fees than TICC.

|

(1) Peers include externally-managed

BDCs with >$100MM market capitalization and pre-2009 IPOs, and externally-managed BDCs with $250-750MM market capitalization;

peers include AINV, ARCC, BKCC, FSC, GAIN, GLAD, GSBD. Total shareholder return through August 24, 2016.

(2) Source: National Securities

Research report August 23, 2016

VOTE

WHITE PROXY CARD

|

If

you have already voted the gold card, you can still change your vote today by simply

voting the enclosed WHITE proxy card.

|

If

you have any questions or need assistance in voting your shares, please call our proxy

advisor – Alliance Advisors –

toll

free at 855-601-2247

|

About TICC Capital Corp.

TICC Capital Corp. is a publicly-traded business development company principally engaged in providing capital to established businesses,

investing in syndicated bank loans and purchasing debt and equity tranches of collateralized loan obligations.

Additional

Information and Where to Find It

TICC has filed a definitive proxy statement on Schedule 14A and a WHITE proxy card with the U.S. Securities and Exchange Commission

(the “SEC”) in connection with the solicitation of proxies for TICC’s 2016 annual stockholder meeting (the “Annual

Meeting”). The Company has distributed the definitive proxy statement and a WHITE proxy card to each stockholder entitled

to vote at the Annual Meeting. TICC STOCKHOLDERS ARE URGED TO READ THE COMPANY’S PROXY MATERIALS (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD BECAUSE THESE MATERIALS CONTAIN IMPORTANT INFORMATION ABOUT TICC AND

THE ANNUAL MEETING. These documents, including any proxy statement (and amendments and supplements thereto) and other documents

filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (

http://www.sec.gov

), at TICC’s

investor relations website (

http://ir.ticc.com

), or by writing to TICC at 8 Sound Shore Drive, Suite 255, Greenwich, CT

06830 (telephone number 203-983-5275).

Participants

in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company's

stockholders with respect to the Annual Meeting. Information about the Company's directors and executive officers and their ownership

of the Company's common stock is set forth in the proxy statement on Schedule 14A filed with the SEC on July 12, 2016 (the “Schedule

14A”). To the extent holdings of such participants in TICC securities have changed since the amounts described in the Schedule

14A, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership

on Form 4 filed with the SEC.

Forward

Looking Statements

This press release contains forward-looking statements subject to the inherent uncertainties in predicting future results and conditions.

Any statements that are not statements of historical fact (including statements containing the words "believes," "plans,"

"anticipates," "expects," "estimates" and similar expressions) should also be considered to be forward-looking

statements. Certain factors could cause actual results and conditions to differ materially from those projected in these forward-looking

statements. These factors are identified from time to time in our filings with the Securities and Exchange Commission. We undertake

no obligation to update such statements to reflect subsequent events, except as may be required by law.

TICC

Contacts

Media

Emily Deissler/Nikki Ritchie/Ben Spicehandler

Sard Verbinnen & Co

212-687-8080

Stockholders

Alliance Advisors, LLC

855-601-2247

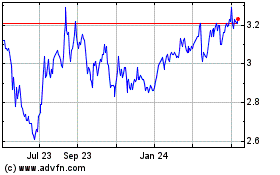

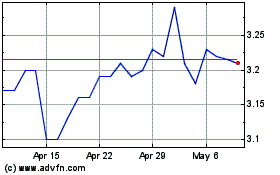

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jul 2023 to Jul 2024