UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the

Registrant ¨ Filed by

a Party other than the Registrant x

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ¨ |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| x |

|

Soliciting Material Pursuant to §240.14a-12 |

TICC

CAPITAL CORP.

(Name of Registrant as Specified In Its Charter)

TPG Specialty Lending, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| x |

|

Fee not required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

|

Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

|

(4) |

|

Date Filed:

|

TPG Specialty Lending, Inc., together with the other

participants named herein (collectively, “TSLX”), intends to file a preliminary proxy statement and an accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes from the stockholders of TICC Capital

Corp. (“TICC”) to: (a) elect TSLX’s director nominee at TICC’s 2016 annual meeting of stockholders and (b) approve a proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between TICC and TICC

Management, LLC, as contemplated by Section 15(a) of the Investment Company Act of 1940, as amended.

On February 3, 2016, TSLX issued an investor

presentation, a copy of which is attached hereto.

Committed to Effecting Change and

Maximizing Value for TICC Stockholders February 2016 http://www.changeticcnow.com/

Disclaimers Forward-Looking Statements

Information set forth herein includes forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding TSLX’s proposed business combination transaction with TICC Capital Corp.

(“TICC”) (including any financing required in connection with the proposed transaction and the benefits, results, effects and timing of a transaction), all statements regarding TPG Specialty Lending, Inc.’s (“TSLX” or

the “Company”) (and TSLX and TICC’s combined) expected future financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions,

growth opportunities, plans and objectives of management, and statements containing the words such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,” “expect,”

“project,” “could,” “would,” “should,” “will,” “intend,” “may,” “potential,” “upside,” and other similar expressions. Statements set forth

herein concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or services line growth of TSLX (and the combined businesses of TSLX and TICC),

together with other statements that are not historical facts, are forward-looking statements that are estimates reflecting the best judgment of TSLX based upon currently available information. Such forward-looking statements are inherently

uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from TSLX’s expectations as a result of a variety of factors including, without limitation, those discussed below. Such

forward-looking statements are based upon management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which TSLX is unable to predict or control, that may cause TSLX’s plans with

respect to TICC, actual results or performance to differ materially from any plans, future results or performance expressed or implied by such forward-looking statements. These statements involve risks, uncertainties and other factors discussed

below and detailed from time to time in TSLX’s filings with the Securities and Exchange Commission (“SEC”). Risks and uncertainties related to the proposed transaction include, among others, uncertainty as to whether TSLX

will further pursue, enter into or consummate the transaction on the terms set forth in the proposal or on other terms, potential adverse reactions or changes to business relationships resulting from the announcement or completion of the

transaction, uncertainties as to the timing of the transaction, adverse effects on TSLX’s stock price resulting from the announcement or consummation of the transaction or any failure to complete the transaction, competitive responses to the

announcement or consummation of the transaction, the risk that regulatory or other approvals and any financing required in connection with the consummation of the transaction are not obtained or are obtained subject to terms and conditions that are

not anticipated, costs and difficulties related to the integration of TICC’s businesses and operations with TSLX’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from the

transaction, unexpected costs, liabilities, charges or expenses resulting from the transaction, litigation relating to the transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

In addition to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s Annual Report on Form 10-K and in its reports on Forms 10-Q and 8-K. Many of these factors are beyond

TSLX’s control. TSLX cautions investors that any forward-looking statements made by TSLX are not guarantees of future performance. TSLX disclaims any obligation to update any such factors or to announce publicly the results of any revisions to

any of the forward-looking statements to reflect future events or developments.

Disclaimers (continued) Third Party-Sourced

Statements and Information Certain statements and information included herein have been sourced from third parties. TSLX does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or

information. Except as expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support

from such third parties for the views expressed herein. All information in this communication regarding TICC, including its businesses, operations and financial results, was obtained from public sources. While TSLX has no knowledge that any such

information is inaccurate or incomplete, TSLX has not verified any of that information. TSLX reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. TSLX disclaims any obligation to update the data,

information or opinions contained herein. Proxy Solicitation Information The information set forth herein is provided for informational purposes only and does not constitute an offer to purchase or the solicitation of an offer to sell any

securities. TSLX intends to file a preliminary proxy statement with the SEC to be used to solicit votes at the 2016 annual meeting of stockholders of TICC in favor of (a) the election of its nominee to serve as a director of TICC and (b)

TSLX’s proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between TICC and TICC Management, LLC, as contemplated by Section 15(a) of the Investment Company Act of 1940, as amended. TSLX STRONGLY

ADVISES ALL STOCKHOLDERS OF TICC TO READ THE TSLX PROXY STATEMENT AND ITS OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH TSLX PROXY MATERIALS WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S

WEB SITE AT HTTP://WWW.SEC.GOV AND ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S PROXY

SOLICITOR AT TPG@MACKENZIEPARTNERS.COM. The participants in the solicitation are TSLX and T. Kelley Millet, and certain of TSLX’s directors and executive officers may also be deemed to be participants in the solicitation. As of the date

hereof, TSLX directly beneficially owned 1,633,660 shares of common stock of TICC. As of the date hereof, Mr. Millet did not directly or indirectly beneficially own any shares of common stock of TICC. Security holders may obtain information

regarding the names, affiliations and interests of TSLX’s directors and executive officers in TSLX’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 24, 2015, its proxy statement

for the 2015 Annual Meeting, which was filed with the SEC on April 10, 2015, and certain of its Current Reports on Form 8-K. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the

interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC

when they become available.

TSLX Encourages Fellow Stockholders to Take

Action to Preserve their Investment 1 Poor returns for stockholders TICC Capital Corp. (“TICC”) has consistently and dramatically underperformed the BDC sector since its IPO, delivering total returns of just 27.0% versus 188.8% for the

BDC Composite1 – 7.1 percentage points of average underperformance every year since 2003 Since its IPO, TICC stockholders would have more than doubled their returns by investing in U.S. Treasuries than through holding TICC stock This failure

is the result of several fundamental issues: As a fellow stockholder owning approximately 3%(3) of TICC, TPG Specialty Lending (“TSLX”) is taking the following steps to impel desperately needed change and preserve the value of our

investment: Nominating a highly-qualified, independent director to TICC’s Board Proposing termination of the existing advisory agreement between TICC and the external manager See slide 5 for further detail on calculation methodology See pages

titled “Reconciliation of Certain Non-GAAP Financial Measures” for a reconciliation to the most recent comparable financial measures presented in accordance with GAAP As of the date hereof, TSLX directly beneficially owned 1,633,660

shares of common stock of TICC Wells Fargo Securities Equity Research, September 22, 2015 Poor corporate governance Conflicted Board of Directors (the “Board”) that attempted to facilitate a transfer of value to other Board members at

the expense of TICC stockholders Found by a federal judge to have likely violated federal securities laws by failing to disclose the payments to be made to the interested directors of TICC in the proposed transaction Same Board composition for over

12 years since TICC’s IPO, with supposedly “independent” directors each collecting hundreds of thousands of dollars in compensation 2 Poor capital allocation Unsustainable dividend policy that has consistently eroded NAV Lack of

meaningful buybacks despite persistently trading below net asset value (“NAV”) Expanded fee-earning asset base, sometimes through dilutive equity offerings, while significantly underperforming 3 Poor and costly investment strategy Since

2012, for every $1 of Total Economics created, stockholders have incurred $0.84 of fees and expenses, the vast majority of which has gone to the external manager(2) TICC’s external manager is paid approximately 6x the fees it should properly

be entitled to given asset composition(4) 4

Poor Stewardship has Resulted in Drastic

Long-Term Underperformance Poor Returns for Stockholders 1 Poor Corporate Governance 2 Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 TICC Relative Underperformance Total Return (%)(¹) YTD 1Y 3Y

Since IPO(²) Since IPO Annualized(²) YTD 1Y 3Y Since IPO(²) Since IPO Annualized(²) TICC (17.6)% (18.5)% (29.5)% 27.0% 2.0% - - - - BDC Composite(³) (6.4) (7.6) (7.0) 188.8 9.1 (11.3)% (10.9)% (22.5)% (161.7)% (7.1)% S&P

500 (5.0) (0.7) 36.5 140.7 7.5 (12.6) (17.8) (66.0) (113.7) (5.5) U.S. Treasuries 2.2 0.4 6.4 64.3 4.2 (19.8) (18.9) (35.9) (37.3) (2.2) Investment Grade Debt (0.1) (3.8) 6.2 84.8 5.2 (17.5) (14.6) (35.7) (57.8) (3.2) High Yield Debt (1.3) (7.0) 0.3

92.6 5.5 (16.3) (11.4) (29.8) (65.6) (3.5) Total return calculation includes share price appreciation and cumulative dividends paid TICC and benchmark returns indexed to November 21, 2003. BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC,

GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD Note: Market data as of February 1, 2016 Source: Bloomberg, fixed income benchmark data from Markit iBoxx

Stockholders have Continued to Suffer Since

BSP Deal was Defeated Poor Returns for Stockholders 1 Poor Corporate Governance 2 Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 Total return indexed to December 22, 2015. Calculation includes share price appreciation and cumulative

dividends paid Note: Market data as of February 1, 2016. BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD Source: Bloomberg The widening discount to NAV expresses stockholder

belief in the continued failure of TICC and the Board 10.5 percentage points of underperformance since the BSP Deal was defeated, as the Board has failed to pursue available value-creating initiatives and failed to engage collaboratively with

stockholders (1)

Poor Returns for Stockholders 1 Poor

Corporate Governance 2 Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 TICC has Consistently Destroyed Stockholder Value by Eroding NAV TICC Net Asset Value per Share TICC’s NAV has declined sequentially in 8 of the last 10

quarters, resulting in a cumulative destruction of $2.21 per share of stockholder value since March 2013

“The pre-execution framework ...

serve[s] as a disconcerting example of the substantial risks and uncertainties associated with a narrow, conflict-laden review process motivated more by the preferences of senior management than the interests of the Company’s unaffiliated

shareholders” Glass Lewis & Co October 14, 2015 TICC’s use of “[v]ague descriptors such as ‘significant conflict’ and ‘substantial payments’ do not present the true nature of Cohen, Royce, and

Rosenthal’s multi-million dollar interests in the approval of a deal being presented to shareholders as in their best interests.” (emphasis in original) Judge Haight, US District Court for the District of Connecticut October 23, 2015 The

Board has Failed to Fulfill its Duties and has Sought to Mislead Stockholders The Board has consistently put enriching the management team ahead of its fiduciary responsibility to act in the best interests of TICC stockholders, going so far as to

purposely obfuscate the extent of these payments TICC’s Board approved the advisory agreement with management every year despite drastic underperformance and, according to certain independent analysts, paid the external manager approximately

6x the fees it should properly be entitled to given the composition of TICC’s portfolio1 TICC Board members stood to personally make millions of dollars by pursuing a transaction that delivered no value to stockholders and without meaningfully

considering viable alternatives It has been noted2 that an “independent” Board member charged with evaluating the transaction is paid $280,000 per year by other businesses associated with an owner of the external manager TICC refused to

be open with stockholders about the amount to be received by Board members in the conflicted transaction, and a federal judge declared that the failure to disclose this amount was “materially false or misleading and [was] thereby in

violation” of federal securities laws The exhibited misalignment with stockholders is a result of deep entrenchment. The same Board has overseen drastic underperformance and management enrichment for over 12 years without a single change to

its composition “We are concerned that the current Board of TICC may not be operating in a manner that is in the best long term interest of shareholders. We are also concerned that at least some of the independent members of that board may

have for a variety of reasons, lost their ability to be truly independent” Egan Jones October 13, 2015 Poor Returns for Stockholders 1 Poor Corporate Governance 2 Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 Wells Fargo

Securities Equity Research, September 4, 2015 Wells Fargo Securities Equity Research, October 7, 2015

Poor Returns for Stockholders 1 Poor

Corporate Governance 2 Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 The Board has Refused to Implement Any Changes to the Status Quo TICC’s Board has readily admitted that the incumbent management team has failed, but has

blatantly disregarded its fiduciary responsibilities to enact beneficial changes that are within its control While attempting to solicit stockholder support for the conflicted transaction, TICC readily admitted its own failure and the need for

positive change. However, the Board has failed to implement any of the improvements that are within its control: Refresh the Board with a new slate of independent directors Terminate the existing advisory agreement Thoroughly explore alternative

value-creating proposals The Board has neglected its fiduciary responsibility and punished stockholders with the failed status quo – higher fees, same failed adviser, same conflicted Board TICC’s Board has publicly admitted that the

existing advisory agreement is abysmal and not delivering results for stockholders TICC is telling its stockholders that they cannot be trusted with your investment TICC agrees that the existing advisory agreement should be terminated By failing to

meaningfully explore alternatives for value creation, TICC’s Board is blatantly disregarding its fiduciary responsibilities under Section 15(c) of the Investment Company Act of 1940 TICC acknowledges that it has failed stockholders with

incompetent performance. Why should you trust this board now? Actual Slide from TICC Presentation What This Means for TICC Stockholders

Poor Corporate Governance 2 Poor Returns

for Stockholders 1 TICC has Consistently Under-Earned its Dividend and Eroded NAV Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 Over the past four quarters, TICC has under-earned its dividend by a cumulative 31.6%, significantly

eroding NAV and harming the stock price TICC Dividend versus Net Investment Income Earned In Q1’15, TICC identified an accounting error that resulted in historical income being over-reported. As a result, net investment income incentive fees

were overstated by ~$2.4mm on a cumulative basis through 2014. Without this error, we believe TICC likely never truly “earned” its dividend Source: Public Filings Earnings likely overstated due to an accounting error(¹)

Poor Corporate Governance 2 Poor Returns

for Stockholders 1 TICC has Failed to Repurchase a Meaningful Amount of Stock Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 TICC Discount to NAV and Amount of Stock Repurchased TICC has failed to repurchase meaningful amounts of

stock, preserving fees to the external manager at the expense of stockholders. Since 2014, TICC has traded at a discount to NAV 426 days out of 505 days (84% of the time) but has only repurchased 3% of its market capitalization TICC Stock buybacks

as % of TICC Market Cap 2.9% calculated with data through December 3rd, 2015, which is the most recent publicly available share repurchase information. Note: Market data as of February 1, 2016

Poor Corporate Governance 2 Poor Returns

for Stockholders 1 Management has Taken a Disproportionate Share of Total Economics "Some BDC managers have perpetually delivered lackluster returns, leading to comparatively outsized fees for themselves. While we believe that shareholder focus on

this issue has led to a more friendly advisory fee construct over time, there are still many BDCs with generous base management fees and 'incentive fees' that do not incorporate credit losses.“ –Wells Fargo Equity Research, September 10,

2015 Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 Since 2012, TICC’s stockholders have paid over $105 million in fees & expenses, leaving only $20 million of Total Economics for TICC’s true owners Total Shareholder

Fees and Expenses as a Share of Total Economics Since 2012 (1) (2,3) Total Economics defined as Economic Profit + Shareholder Value Gained / (Lost) due to change in Premium / (Discount) to Average NAV. Economic Profit equals Net Increase in Net

Assets as a Result of Operations + Total Shareholder Fees & Expenses. Shareholder Value Gained / (Lost) due to change in Premium / (Discount) to Average NAV calculated as the change in premium (or discount) to NAV per share between the close of

the trading day following the filing of 12/31/2011 financial statements and the close of the trading day following the release of 9/30/2015 financial statements multiplied by the average NAV between those trading days (calculated as shares

outstanding on such trading day multiplied by the then-most recently reported NAV per share). See pages titled “Reconciliation of Certain Non-GAAP Financial Measures” for a reconciliation to the most recent comparable financial measures

presented in accordance with GAAP BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD. TSLX believes that Total Shareholder Fees & Expenses and Total Economics for each company in

the BDC Composite was calculated on a substantially equivalent basis to the methodology shown for TICC in “Reconciliation of Certain Non-GAAP Financial Measures,” including pro forma adjustments to exclude effects of any management or

incentive fee waiver, where applicable. Source: Company Filings. Capital IQ, Financial data as of 9/30/2015. (2)

Poor Corporate Governance 2 Poor Returns

for Stockholders 1 Management is Vastly Overcompensated Given Portfolio Composition Poor Capital Allocation 3 Poor and Costly Investment Strategy 4 TICC provides stockholders with exposure to assets that can otherwise be accessed significantly less

expensively, all in an effort to maximize management margins at the expense of stockholders Comparison of TICC Expense Ratio to Loan Mutual Funds and CLO Equity Investments TICC’s portfolio of broadly syndicated loans and CLO equity stakes,

largely devoid of proprietary or directly originated investments, is similar to portfolios owned by large mutual funds However, according to certain industry analysts, TICC has charged multiples of the fees it ordinarily would be entitled to for

managing these types of assets,(1) creating a significant drag on returns to stockholders Premium remuneration for commodity services rendered results, by one independent analyst’s estimate, in a 50–65%+ annual profit margin for the

external manager(2) “Nearly 96% of TICC’s loan portfolio was purchased off of the desk of a broker dealer and…even worse…the weighted average investment size of TICC’s investment in a specific deal is roughly 6.6% of

the total trance [sic]…roughly 97% of those loans were simply offered by large bank desks and TICC’s average hold size of each tranche is just 4.3%. Looking at the total universe of TICC’s loan portfolio, we find that nearly 96% of

this collateral was offered by large bank desks and TICC’s average hold size of each tranche is just 6.6%. In short, this collateral resembles the type of collateral that is owned by large mutual funds (who charge just 50bps). Thus, with

TICC’s average expense ratio of 280bps over the last two years, TICC investors have been paying nearly 6x the fee charged by large HY/Levered Loan mutual funds (i.e. 50-80bps).” Wells Fargo Securities September 22, 2015 Wells Fargo

Securities Equity Research, September 22, 2015 Wells Fargo Securities Equity Research, September 3, 2015 Annual expense ratio per the most recently publicly available prospectus or annual report Defined as senior and subordinate management fees on

par value of performing assets, adjusted for leverage in the equity tranche. Source: Intex Solutions Last twelve months for the period ended September 30, 2015. TICC Expense Ratio equals Total Shareholder Fees and Expenses, divided by average total

assets. See pages titled “Reconciliation of Certain Non-GAAP Financial Measures” for a reconciliation to the most recent comparable financial measures presented in accordance with GAAP. Investing in Floating Rate Loans Through Mutual

Funds Versus TICC Selected Floating Rate Loan Mutual Funds Expense Ratio(3) Franklin Floating Rate Daily Access 0.59% Neuberger Berman Floating Rate Inst 0.70% T. Rowe Price Inst Floating Rate Fund 0.55% Fidelity Floating Rate High Income Inst Fund

0.74% Comparable Fund Median Expense Ratio 0.65% TICC Expense Ratio(5) 2.81% TICC Expense Ratio vs. Comparable Fund Median 4.3x Investing in CLO Equity Directly Versus Through TICC Selected TICC CLO Equity Investments (As of 9/30) Expense Ratio(4)

Ares XXV CLO 4.71% Benefit Street Partners CLO II 4.32% Carlyle Global Market Strategies CLO 2014-4 5.65% Ivy Hill Middle Market Credit Fund VII 3.54% Comparable CLO Equity Median Expense Ratio 4.56% TICC Expense Ratio(5) 2.81% CLO Equity Median

Expense Ratio + TICC Expense Ratio 7.37% Investing in CLO equity through TICC is 62% more expensive per year than investing in those instruments directly

Where do TICC Stockholders Stand Today?

In August 2015, TICC’s Board approved a sale of TICC’s external manager that would have rewarded the failed incumbent manager and fellow Board members through a $60 million2 transfer of value while delivering no tangible benefits to

TICC’s long-suffering stockholders In September 2015, TSLX proposed an alternative transaction designed to deliver both immediate and long term value to TICC stockholders TSLX’s proposal received vigorous and widespread support from

equity research analysts, proxy advisory firms, and major stockholders Despite multiple attempts, the Board refused to engage meaningfully with TSLX and the clear and compelling offer to acquire TICC at a significant premium and proceeded to seek

stockholder approval for the conflicted proposal even after being found by a federal judge to likely have violated federal securities laws Only 35% of outstanding shares ultimately voted in favor of the transaction in December 2015 Those voting in

favor were desperate for a change in management. Those voting against were opposed to seeing a failed manager get rewarded in a conflicted transaction and demand better alternatives To date, the Board has failed to implement any of the changes it

previously advocated and has continued to refuse to engage with TSLX. Stockholders have been penalized for this failure with further value destruction Although TSLX reiterates its proposal to acquire all outstanding shares at 90% of TICC’s

NAV, it is clear that the entrenched and conflicted Board will continue to protect their own at the expense of stockholders. Therefore, to protect our investment as a 3% owner of TICC, we are nominating a replacement independent director to the

Board and proposing the termination of the existing advisory agreement See slide 5 for further detail on calculation methodology As reported by a Wells Fargo Securities Equity Research report dated September 3, 2015 TICC has consistently and

dramatically underperformed the BDC sector since its IPO, delivering total returns of just 27.0% versus 188.8% for the BDC Composite1 – 7.1 percentage points of average underperformance annually since 2003

Stockholders have Viable Avenues to

Preserve the Value of their Investment It is time for stockholders to take action. The time for change is now. TICC stockholders have delivered a clear mandate for change, and TSLX calls on fellow stockholders to exercise their rights as the true

owners of TICC At the annual meeting of stockholders to be held later this year, TSLX will solicit proxies for: A highly-qualified independent director The TICC incumbent director up for election sat on the committee that approved a transaction that

would have enriched a failed management team and fellow Board members without engaging on a superior offer to create value for long-suffering TICC stockholders The incumbent director has sat on the Board for over twelve years, overseeing dramatic

underperformance while collecting $730,000 in aggregate compensation TSLX believes that new representation is needed on the Board in light of the existing entrenchment and its past efforts to push a conflicted transaction Termination of the existing

management contract TICC itself has admitted that the management team has delivered abysmal returns to stockholders while taking a disproportionate share of total economics in fees The incumbent management team has exhibited problematic conflicts of

interest and has failed to pursue real strategic change The Investment Company Act of 1940 gives stockholders the power to terminate the investment advisory agreement at no cost to stockholders It is now directly in stockholders’ control to

drive value for their investment and terminate the management team that has overseen consistent value deterioration Visit http://www.changeticcnow.com/ for additional information and to see what independent analysts and fellow stockholders are

saying about TICC’s unacceptable and harmful behavior

Appendix Reconciliation of Certain

Non-GAAP Financial Measures

Reconciliation of Certain Non-GAAP

Financial Measures – Ratio of Shareholder Fees and Expenses to Total Economics Ratio of Shareholder Fees and Expenses as a portion of Total Economics of your investment, as set forth in this presentation, may be considered a non-GAAP financial

measure. TSLX provides this information to stockholders because TSLX believes it enhances stockholders’ understanding of the relative costs stockholders bear in relation to the assets generated by operations of TICC and comparable companies

included in the BDC Composite as defined above, respectively. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-GAAP financial measures as

used by TSLX may not be comparable to similarly titled amounts used by other companies. Total Economics = Economic Profit + Shareholder Value Gained / (Lost) due to the Change in Premium / (Discount) to Average NAV Economic Profit = Increase in Net

Assets Resulting from Operations + Total Shareholder Fees & Expenses Shareholder Value Gained / (Lost) Due to the Change in Premium / (Discount) to Average NAV calculated as the change in premium (or discount) to NAV per share between the close

of the trading day following the filing of 12/31/2011 financial statements and the close of the trading day following the release of 9/30/2015 financial statements multiplied by the average NAV between those trading days (calculated as shares

outstanding on such trading day multiplied by the then-most recently reported NAV per share). Page 18 illustrates the reconciliation of the net increase in net assets resulting from operations since 2012 to Economic Profit and the calculation of the

ratio of Total Shareholder Fees and Expenses to Total Economics for TICC. TSLX believes that Total Shareholder Fees & Expenses and Total Economics for each company in the BDC Composite was calculated on a substantially equivalent basis to the

methodology shown for TICC. For companies that reported management or incentive fee waivers in the periods subsequent to 12/31/2011, including AINV, FSC and NMFC, which are included in the BDC Composite, Total Shareholder Fees & Expenses and

Economic Profit are calculated pro forma as if (i) the fee waivers had not been applied and (ii) the corresponding reduction in pre-incentive fee net investment income resulted in a reduction in incentive fees (calculated by multiplying the amount

of management fees waived by the incentive fee rate for each company). No pro forma adjustments were made to NAV per share in the calculation of Shareholder Value Gained / (Lost) Due to Change in Premium / (Disc.) to Average NAV.

TICC 2012 2013 2014 2015 (through Sep

30) Cumulative Net Increase in Net Assets Resulting from Operations (GAAP) $ 68,323 $ 58,945 $(3,348) $ 1,122 $ 125,041 Shareholder Fees & Expenses: Compensation expense (GAAP) $ 1,183 $ 1,648 $ 1,861 $ 965 $ 5,657 Investment advisory fees

(GAAP) 11,223 19,096 21,150 15,574 67,043 Professional fees (GAAP) 1,874 1,996 2,150 2,331 8,351 Insurance (GAAP) 1 69 69 69 0 206 Directors' Fees (GAAP) 1 261 323 317 0 900 Transfer agent and custodian fees (GAAP) 1 129 229 284 0 642 General and

administrative (GAAP) 1,028 1,590 1,398 1,673 5,689 Net investment income incentive fees (GAAP) 5,460 6,581 5,604 (930) 16,715 Capital gains incentive fees (GAAP) 5,509 (1,192) (3,873) 0 444 Total Shareholder Fees & Expenses 26,735 30,339 28,959

19,614 105,646 Economic Profit (Net Increase in Net Assets Resulting from Operations + Total Shareholder Fees & Expenses) $ 95,058 $ 89,284 $ 25,611 $ 20,735 $ 230,688 TICC NAV Per Share 12/31/2011 (Released 03/15/2012) $ 9.30 TICC Share Price

03/16/2012 10.09 Premium / (Discount) to NAV 03/16/2012 9 % Shares Outstanding (millions) (as of 3/16/2012) 37 TICC NAV Per Share 9/30/15 (Released 11/9/2015) $ 7.81 TICC Share Price 11/10/2015 6.45 Premium / (Discount) to NAV 11/10/2015 (17)%

Shares Outstanding (millions) (as of 11/10/2015) 60 Change in Premium / (Discount) to NAV (26)% Shareholder Value Gained / (Lost) due to Change in Premium / (Disc.) to Average NAV $(105,534) Total Economics (Economic Profit + Shareholder Value

Gained / (Lost) due to Change in Premium / (Disc.) to Average NAV) $ 125,153 Ratio of Total Shareholder Fees & Expenses to Total Economics 84 % Reconciliation of Certain Non-GAAP Financial Measures – Ratio of Shareholder Fees and Expenses

to Total Economics For the nine months ended September 30, 2015, directors’ fees, insurance, and transfer agent and custodian fees, which previously had been separately reported, were included in “General and administrative.”

($ in thousands, except per share amounts and where noted)

Reconciliation of Certain Non-GAAP

Financial Measures – TICC Expense Ratio The TICC Expense Ratio, as set forth in this presentation, may be considered a non-GAAP financial measure. TSLX provides this information to stockholders because TSLX believes it enhances

stockholders’ understanding of the relative costs stockholders bear in relation to the assets in TICC’s portfolio. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information

presented in compliance with GAAP, and non-GAAP financial measures as used by TSLX may not be comparable to similarly titled amounts used by other companies. TICC Expense Ratio = Shareholder Fees & Expenses / Average Total Assets Page 20

illustrates the calculation of the TICC Expense Ratio

TICC Quarter Ended Dec-2015 Mar-2015

Jun-2015 Sep-2015 Cumulative Shareholder Fees & Expenses: Compensation expense (GAAP) $ 461 $ 479 $ 396 $ 90 $ 1,427 Investment advisory fees (GAAP) 5,386 5,010 5,308 5,256 20,960 Professional fees (GAAP) 548 606 905 819 2,879 General and

administrative (GAAP) (170) 455 729 489 1,504 Net investment income incentive fees (GAAP) 798 318 549 575 2,240 Total Shareholder Fees & Expenses: 7,023 6,869 7,889 7,228 29,009 Total Assets (millions) (GAAP) $ 1,043 $ 1,062 $ 1,047 $ 985 Total

LTM Shareholder Fees & Expenses: $29,009 Average Total Assets (millions) 1,034 LTM TICC Expense Ratio 2.81 % Reconciliation of Certain Non-GAAP Financial Measures – TICC Expense Ratio ($ in thousands, except per share amounts and where

noted)

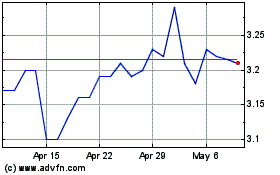

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

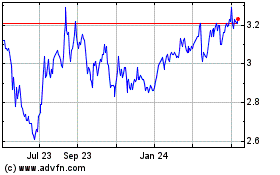

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jul 2023 to Jul 2024