Current Report Filing (8-k)

December 07 2020 - 4:01PM

Edgar (US Regulatory)

false000093313600009331362020-12-072020-12-07

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 7, 2020

Mr. Cooper Group Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-14667

|

|

91-1653725

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

8950 Cypress Waters Blvd.

Coppell, TX 75019

(Address of Principal Executive Offices, and Zip Code)

469-549-2000

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

COOP

|

The Nasdaq Stock Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Mr. Cooper Group Inc. (the “Company”) announced today that it has reached a resolution of certain legacy regulatory matters with the Consumer Financial

Protection Bureau, the multi-state committee of mortgage banking regulators and various State Attorneys General, and the Executive Office of the United States Trustee, all of which involve findings from examinations and discussions that were

completed in 2014 and 2015, and relate to certain loan servicing practices which occurred during 2010 through 2015. Subsequent reviews demonstrated that management and the board had taken positive steps to address these issues, that the Company

had made significant governance and operational improvements, and that the Company had strengthened internal control systems to ensure that they were appropriate for the size and scope of its operations. The settlements include restitution the

Company provided to customers during the last six years. Additionally, the Company has mutually agreed to a resolution payment in the amount of $28.6 million consisting of remediation, penalties and fees, which the Company will make immediately

after the judgment is recorded. The Company has previously fully accrued for all costs associated with the settlement. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

Mr. Cooper Group Inc.

|

|

|

|

|

|

|

|

|

Date: December 7, 2020

|

|

|

|

|

By:

|

/s/ Christopher G. Marshall

|

|

|

|

Christopher G. Marshall

Vice Chairman & Chief Financial Officer

|

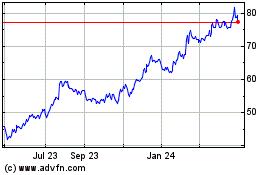

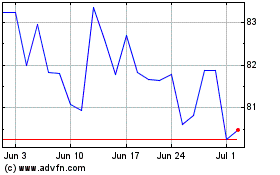

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Sep 2023 to Sep 2024