Equity Funds Bounce Back Strongly in October, Morningstar Canada Data Show

November 02 2011 - 7:00AM

PR Newswire (Canada)

TORONTO, Nov. 2, 2011 /CNW/ - After five consecutive months of

negative returns, equity funds in Canada produced strong gains in

October as general optimism seemed to return—albeit temporarily—to

the world's stock markets. All but one of the 22 Morningstar Canada

Fund Indices that track equity categories had positive returns for

the month, with 14 of them gaining 5% or more, according to

preliminary performance data released today by Morningstar Canada.

"Equity markets had one of their biggest months in years, with the

S&P/TSX Composite Index up over 5% and the S&P 500 up

nearly 11%. This was due to positive growth numbers at home, and

hopes that eurozone leaders had created a workable solution to the

Greek debt crisis," said Morningstar Fund Analyst Adam Fisch.

"However, the month ended on a sour note, as a selloff on Oct. 31

was followed by the surprising announcement of a Greek referendum

on the proposed bailout. That news, accompanied by disappointing

Chinese manufacturing numbers, sent stocks downward and cast doubts

over the prospect of sustained recovery in the equity market."

Foreign markets for the most part outperformed their Canadian

counterpart during the month, but for Canadian fund investors these

solid performances were tempered by currency effects, with the

Canadian dollar appreciating by more than 4 % against the U.S.

dollar and many Asian currencies. As a result, the returns of the

Morningstar Canada Fund Indices that measure foreign equity

categories were much lower than the corresponding market benchmarks

when expressed in local currency. Among the major diversified

foreign equity categories, the Morningstar U.S. Small/Mid Cap

Equity Fund Index had the best return with 9%, while the indices

that measure the Emerging Markets Equity, Greater China Equity and

U.S. Equity categories gained 8.1%, 8.1% and 7.3%, respectively.

The International Equity and Global Equity fund indices both gained

5.4% in October. The worst performer, and the only Morningstar

Canada equity fund index to lose ground last month was Japanese

Equity, which lost 4.1% despite positive results on Japanese stock

markets; this was due to the yen's depreciation of 5.6% against the

loonie. The best-performing fund index overall was Natural

Resources Equity, which gained 11.3%. "As fears subsided throughout

the month, oil and precious metals rose on hopes of higher demand,

buoyed by optimism in Europe. Production of oil in OPEC countries

and in the United States rose in the month to keep up with

anticipated increased demand, but the prospect of further

instability in Europe could derail those plans and give back many

of the month's gains," Fisch said. Among Canadian equity funds,

those that focus on smaller companies edged out the large-cap

offerings. The Morningstar Canadian Small/Mid Cap Equity and

Canadian Focused Small/Mid Cap Equity fund indices gained 7.1% and

6.4%, respectively, while the Canadian Focused Equity and Canadian

Equity fund indices were up 5.7% and 5.6%, respectively. For more

on October fund performance, go to www.morningstar.ca. Morningstar

Canada's preliminary fund performance figures are based on change

in funds' net asset values per share during the month, and do not

necessarily include end-of-month income distributions. Final

performance figures will be published on www.morningstar.ca next

week. About Morningstar Morningstar Research Inc. is a Canadian

subsidiary of Chicago-based Morningstar, Inc., a leading provider

of independent investment research in North America, Europe,

Australia, and Asia. The company offers an extensive line of

Internet, software, and print-based products and services for

individuals, financial advisors, and institutions. Morningstar

provides data on approximately 330,000 investment offerings,

including stocks, mutual funds, and similar vehicles, along with

real-time global market data on more than 5 million equities,

indexes, futures, options, commodities, and precious metals, in

addition to foreign exchange and Treasury markets. Morningstar also

offers investment management services and has more than $167

billion in assets under advisement and management as of Sept. 30,

2011. The company has operations in 26 countries. Morningstar

Research Inc. CONTACT: Adam Fisch, Fund Analyst, Morningstar

Canada, (416) 484-7815;ChristianCharest, Editor, Morningstar

Canada, (416) 484-7817

Copyright

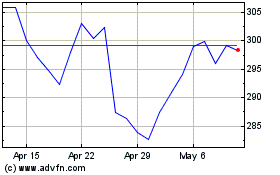

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Jun 2024 to Jul 2024

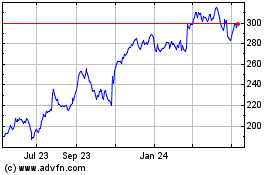

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Jul 2023 to Jul 2024