|

|

|

|

|

SUMMARY PROSPECTUS – MAY 1, 2013, AS REVISED JULY 18, 2013

RS Low Duration Bond Fund

|

|

|

|

|

|

|

|

|

|

Share Class (Ticker):

Class Y (RSDYX)

|

|

|

|

Before you invest, you may want to review the Fund’s prospectus,

which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund, including the Fund’s Statement of Additional Information (SAI) and most recent reports to shareholders,

online at

www.RSinvestments.com/prospectus

. You can also get this information at no cost by calling 800-766-3863 or by sending an e-mail request to

prospectus@rsinvestments.com

. You can also get this information from your financial

intermediary. This Summary Prospectus incorporates by reference the Fund’s Prospectus, dated May 1, 2013, as supplemented June 3, 2013 and July 18, 2013, the Fund’s SAI, dated May 1, 2013, as revised May 20, 2013 and as supplemented July

2, 2013, and the financial statements included in the Fund’s annual report to shareholders, dated December 31, 2012.

|

Investment Objective

A high level of current income consistent with preservation of capital.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund. No sales loads are imposed on Class Y shares.

|

|

|

|

|

|

|

Annual Fund Operating Expenses

(expenses are deducted from Fund assets as a percentage of average daily net assets)

|

|

|

Share Class

|

|

Class Y

|

|

|

Management Fees

|

|

|

0.45%

|

|

|

Distribution (12b-1) Fees

|

|

|

N/A

|

|

|

Other Expenses

|

|

|

0.16%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

0.61%

|

|

Example

This

Example is intended to help you compare the cost of investing in the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated, whether or not you redeem at the end

of such periods. This Example also assumes that your investment earns a 5% return each year and that the Fund’s operating expenses remain the same as shown above. Although your actual costs may be higher or lower, based on these assumptions,

your costs would be:

|

|

|

|

|

|

|

|

|

Class Y

|

|

|

1 Year

|

|

$

|

62

|

|

|

3 Years

|

|

$

|

195

|

|

|

5 Years

|

|

$

|

340

|

|

|

10 Years

|

|

$

|

762

|

|

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for

you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio

turnover rate was 64% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies

The Fund

invests primarily in investment-grade securities, including corporate bonds, mortgage-backed and asset-backed securities, and obligations of the U.S. government and its agencies.

The Fund’s investment team allocates the Fund’s investments among various sectors of the debt markets by analyzing overall economic conditions within and among these sectors. The Fund normally allocates

its assets broadly among the debt securities markets but may emphasize some sectors over others based on what the investment team believes to be their attractiveness relative to one another.

Within sector allocations, the Fund’s investment team selects individual securities by considering the yield paid by the security, potential appreciation in the value of the security, the credit quality of the

issuer, maturity, and the degree of risk associated with a specific security relative to other securities in the sector.

RS LOW DURATION BOND FUND

The Fund tends to have an average duration within a range of one to three years and an average maturity between one and three years. The Fund seeks to maintain a low duration but may lengthen or shorten its

duration within that range to reflect changes in the overall composition of the short-term investment-grade debt markets. Duration is a measure of a bond price’s sensitivity to a given change in interest rates. Generally, the longer a

bond’s duration, the greater its price sensitivity to a change in interest rates. For example, the price of a bond with a duration of three years would be expected to fall approximately 3% if rates were to rise by one percentage point.

The Fund normally invests at least 80% of its net assets in debt securities, which may include, for example, corporate bonds, mortgage-backed and

asset-backed securities, loans, and obligations of the U.S. government and its agencies and instrumentalities. An investment-grade security is one that is rated by Moody’s Investors Service, Inc. or Standard & Poor’s Ratings Group Baa3

or BBB-, respectively, or higher or, if unrated, that has been determined by the Fund’s investment team to be of comparable quality. The Fund may invest in below investment grade debt securities, commonly known as “high-yield”

securities or “junk bonds”; normally, less than 20% of the Fund’s assets will be invested in below investment grade securities.

The Fund

may also invest up to 20% of the value of its net assets in foreign securities denominated in foreign currencies. In addition, the Fund may invest without limit in so-called Yankee securities, which include debt securities issued by non-U.S.

corporate or government entities but denominated in U.S. dollars.

The Fund may engage in dollar roll and reverse repurchase agreement transactions. The

Fund may enter into exchange-traded or over-the-counter derivatives transactions of any kind, such as futures contracts, options on futures, and swap contracts, including, for example, interest rate swaps and credit default swaps. The Fund also may

enter into exchange-traded or over-the-counter foreign currency exchange transactions, including currency futures, forward, and option transactions. The Fund may enter into any of these transactions for a variety of purposes, including, but not

limited to, hedging various risks such as credit risk, interest rate risk, currency risk, and liquidity risk; taking a net long or short position in certain investments or markets; providing liquidity in the Fund; equitizing cash; minimizing

transaction costs; generating income; adjusting the Fund’s sensitivity to interest rate risk, currency risk, or other risk; replicating certain direct investments; and asset and sector allocation.

The Fund may invest in loans of any maturity and credit quality. If the Fund invests in loans, the Fund’s investment team may seek to avoid the receipt of

material non-public information about the issuers of the loans being considered for purchase by the Fund, which may affect its ability to assess the loans as compared to investors that do receive such information.

Principal Risks

You may lose money by

investing in the Fund. The Fund may not achieve its investment objective. The principal risks of investing in the Fund, which could adversely affect its net asset value and total return, are as follows.

Debt Securities Risk

The value of a debt security or other income-producing security changes in response to various factors, including, by way of example, market-related

factors (such as changes in interest rates or changes in the risk appetite of investors generally) and changes in the actual or perceived ability of the issuer (or of issuers generally) to meet its (or their) obligations.

Foreign Securities Risk

Foreign securities are subject to political, regulatory, and economic risks not present in domestic investments. In addition, when the Fund buys securities denominated in a foreign currency, there are special risks

such as changes in currency exchange rates and the risk that a foreign government could regulate foreign exchange transactions. In addition, to the extent that investments are made in a limited number of countries, events in those countries will

have a more significant impact on the Fund.

Mortgage- and Asset-backed Securities Risk

During periods of falling interest rates, mortgage- and asset-backed securities may be called or prepaid, which may result in the Fund having to

reinvest proceeds in other investments at a lower interest rate. During periods of rising interest rates, the average life of mortgage- and asset-backed securities may extend, which may lock in a below-market interest rate, increase the

security’s duration, and reduce the value of the security. Enforcing rights against the underlying assets or collateral may be difficult, or the underlying assets or collateral may be insufficient if the issuer defaults.

High-yield/Junk Bond Risk

Lower-quality debt securities can involve a substantially greater risk of default than higher quality debt securities, and their values can decline significantly over short periods of time. Lower-quality debt

securities tend to be more sensitive to adverse news about the issuer, or the market or economy in general.

Portfolio Turnover Risk

Frequent purchases and sales of portfolio securities may result in higher Fund expenses and may result in more significant distributions of short-term capital gains to investors, which are taxed as ordinary income.

In recent periods, the Fund has experienced annual portfolio turnover in excess of 100% and will likely experience high portfolio turnover rates in the future.

Liquidity Risk

Lack of a ready market or restrictions on resale may limit the ability

of the Fund to sell a security at an advantageous time or price. In addition, the Fund, by itself or together with other accounts managed by Guardian Investor Services LLC, may hold a position in a security that is large relative to the typical

trading volume for that security, which can make it difficult for the Fund to dispose of the position at an advantageous time or price.

RS LOW DURATION BOND FUND

Derivatives Risk

Derivative transactions can create investment leverage and may be

highly volatile. It is possible that a derivative transaction will result in a loss greater than the principal amount invested, and the Fund may not be able to close out a derivative transaction at a favorable time or price. The counterparty to a

derivatives contract may be unable or unwilling to make timely settlement payments, return the Fund’s margin, or otherwise honor its obligations.

Currency Risk

Investments in foreign securities are often denominated and traded in

foreign currencies. The value of the Fund’s assets may be affected favorably or unfavorably by currency exchange rates, currency exchange control regulations, and restrictions or prohibitions on the repatriation of foreign currencies. To

attempt to protect against changes in currency exchange rates, the Fund may, but will not necessarily, engage in forward foreign-currency exchange transactions. The use of foreign exchange transactions to reduce foreign-currency exposure can

eliminate some or all of the benefit of an increase in the value of a foreign currency versus the U.S. dollar.

Loan Risk

Investments in loans are generally subject to the same risks as investments in other types of debt securities, including, in many cases,

investments in high-yield/junk bonds. They may be difficult to value and may be illiquid. If the Fund holds a loan through another financial institution, or relies on a financial institution to administer the loan, its receipt of principal and

interest on the loan may be subject to the credit risk of that financial institution. It is possible that any collateral securing a loan may be insufficient or unavailable to the Fund, and that the Fund’s rights to collateral may be limited by

bankruptcy or insolvency laws. There may be limited public information available regarding the loan. Transactions in loans may settle on a delayed basis, and the Fund may not receive the proceeds from the sale of a loan for a substantial period of

time after the sale.

Credit Derivatives Risk

The Fund may enter into credit derivatives, including credit default swaps and credit default index investments. The Fund may use these investments (i) as alternatives to direct long or short investment in a

particular security, (ii) to adjust the Fund’s asset allocation or risk exposure, or (iii) for hedging purposes. The use by the Fund of credit default swaps may have the effect of creating a short position in a security. These

investments can create investment leverage and may create additional investment risks that may subject the Fund to greater volatility than investments in more traditional securities.

Fund Performance

The bar chart and table provide some indication of the risks of investing

in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1 and 5 years and since inception compare with those of a broad measure of market performance. The

Fund’s past performance (before and after taxes) is not an indication of future performance. Updated performance information for the Fund is available at www.rsinvestments.com or by calling 800-766-3863.

|

|

|

Annual Total Return for Class Y Shares

1

(calendar year-end)

|

|

|

|

|

Best Quarter

Third Quarter

2009

2.24% Worst Quarter

Second Quarter 2004

-1.02%

|

|

1

|

|

Returns for the periods through May 12, 2009 reflect performance for the Fund’s Class A shares. Class A shares represent an investment in the same portfolio of securities as

Class Y shares. Annual returns for Class A and Class Y shares differ to the extent Class Y shares do not have the same expenses as Class A shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

(periods ended

12/31/12)

|

|

|

|

|

|

|

|

|

|

|

|

|

1

Year

|

|

|

5

Years

1

|

|

|

Since

Inception

1

(7/30/03)

|

|

|

Class Y Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

3.27%

|

|

|

|

3.76%

|

|

|

|

3.38%

|

|

|

Return After Taxes on Distributions

|

|

|

2.50%

|

|

|

|

2.74%

|

|

|

|

2.31%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

2.12%

|

|

|

|

2.62%

|

|

|

|

2.26%

|

|

|

Barclays U.S. Government 1-3 Year Bond Index (reflects no deduction for fees, expenses or

taxes)

|

|

|

0.51%

|

|

|

|

2.49%

|

|

|

|

2.89%

|

|

|

1

|

|

Returns for the periods through May 12, 2009 reflect performance for the Fund’s Class A shares. Class A shares represent an investment in the same portfolio of securities as

Class Y shares. Annual returns for Class A and Class Y shares differ to the extent Class Y shares do not have the same expenses as Class A shares.

|

RS LOW DURATION BOND FUND

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an

investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

The Fund commenced investment operations July 30, 2003, with the offering of Class A shares. Performance shown for Class Y shares reflects the performance

of the Fund’s Class A shares for periods through the Class Y shares’ inception on May 12, 2009. Blended class performance has been adjusted to take into account differences in sales load applicable to these share classes (Class A

shares charge a sales load and Class Y shares do not charge a sales load), but has not been adjusted to take into account differences in class-specific operating expenses (such as Rule 12b-1 fees; Class A shares pay a 12b-1 fee of 0.25% and

Class Y shares do not pay a 12b-1 fee). Because Class Y shares’ operating expenses are lower than Class A shares’ historical operating expenses, historical performance of Class A shares is likely lower than what the performance of

Class Y shares would have been during that period.

Management of the Fund

Investment Adviser

RS Investment Management Co. LLC

Investment Sub-Adviser

Guardian Investor

Services LLC

Investment Team

Robert J. Crimmins Jr., co-portfolio manager, has managed the Fund since 2004. Leslie Barbi and John Gargana, co-portfolio managers, have each managed the Fund

since July 2013.

Purchase and Sale of Fund Shares

Shares of the Fund are only available to investors that meet certain eligibility requirements. There is no minimum initial investment in the Fund. The minimum on subsequent investments is $100.

You may redeem your shares on any business day when the New York Stock Exchange is open by mail (Boston Financial Data Services, RS Low Duration Bond Fund, P.O. Box

219717, Kansas City, MO 64121-9717), by telephone (800-766-3863), or online (www.RSinvestments.com).

Tax Information

Fund distributions are generally taxable to you as ordinary income or capital gains, unless you are a tax-exempt investor or otherwise investing through

a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and Other

Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related

companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your financial intermediary’s website for more information.

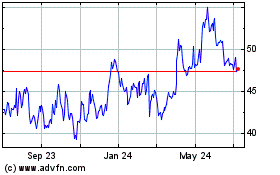

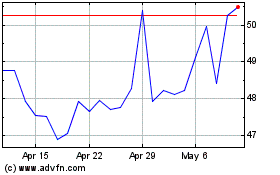

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Jul 2023 to Jul 2024