Lifetime Brands, Inc. (NasdaqGS: LCUT), a leading global designer,

developer and marketer of a broad range of branded consumer

products used in the home, today reported its financial results for

the quarter ended June 30, 2021.

Robert Kay, Lifetime’s Chief Executive Officer, commented, “We

are pleased to have sustained the momentum we created in the first

quarter of 2021 through the second quarter, with net sales up 24.3%

and an increase in income from operations of $6.7 million compared

to the second quarter of 2020. Demand for our products remains

strong, and in addition to delivering another consecutive quarter

of growth in our core U.S. business, our international operations

continued to improve, driven by the recovery in Europe, growth in

Asia and most notably the actions taken to restructure this

business unit during 2020. As geographies have reopened and brick

and mortar sales across both our U.S. and international businesses

have increased, we have continued to invest in inventory to meet

this growing demand and to deliver for our customers and consumers.

Additionally, we are taking action to mitigate the impacts of

supply chain challenges and increased shipping costs, which are

being felt across the industry. We believe we are well positioned

to navigate the current environment and we are confident in our

ability to continue driving growth and profitability.”

Mr. Kay continued, “While we are closely monitoring

macroeconomic headwinds, our outstanding results and execution give

us confidence in our outlook for the remainder of the year, and we

are pleased to be raising our full year 2021 net sales, net income

and EBITDA guidance. As we look ahead, we remain focused on

leveraging our strong cash flow and balance sheet to continue

investing in our strategic initiatives and delivering value for all

Lifetime Brands stakeholders.”

Second Quarter Financial Highlights:

Consolidated net sales for the three months ended June 30,

2021 were $186.6 million, representing an increase of $36.5

million, or 24.3%, as compared to net sales of $150.1 million for

the corresponding period in 2020. In constant currency, a non-GAAP

financial measure, consolidated net sales increased by $34.3

million, or 22.5%, as compared to consolidated net sales in the

corresponding period in 2020. A table which reconciles this

non-GAAP financial measure to consolidated net sales, as reported,

is included below.

Gross margin for the three months ended June 30, 2021 was

$66.2 million, or 35.4%, as compared to $54.2 million, or 36.1%,

for the corresponding period in 2020.

Income from operations was $11.0 million, as compared to $4.3

million for the corresponding period in 2020.

Net income was $5.8 million, or $0.26 per diluted share, as

compared to a net loss of $(4.0) million, or $(0.19) per diluted

share, in the corresponding period in 2020.

Adjusted net income was $6.1 million, or $0.28 per diluted

share, as compared to adjusted net loss, of $(3.1) million, or

$(0.15) per diluted share, in the corresponding period in 2020. A

table which reconciles this non-GAAP financial measure to net

income (loss), as reported, is included below.

Six Months Financial Highlights:

Consolidated net sales for the six months ended June 30,

2021 were $382.3 million, representing an increase of $87.1

million, or 29.5%, as compared to net sales of $295.2 million for

the corresponding period in 2020. In constant currency, a non-GAAP

financial measure, consolidated net sales increased by $84.0

million, or 28.1%, as compared to consolidated net sales in the

corresponding period in 2020.

Gross margin for the six months ended June 30, 2021 was

$132.2 million, or 34.6%, as compared to $107.1 million, or 36.3%,

for the corresponding period in 2020.

Income from operations was $20.2 million, as compared to a loss

from operations of $(20.9) million for the corresponding period in

2020. Excluding a $20.1 million non-cash charge for goodwill

impairment, and a $2.8 million non-cash charge for bad debt

reserves to establish a provision against potential credit problems

from certain retail customers due to the COVID-19 pandemic, income

from operations would have been $2.0 million, for the corresponding

period in 2020.

Net income was $8.9 million, or $0.40 per diluted share, as

compared to a net loss of $(32.1) million, or $(1.55) per diluted

share, in the corresponding period in 2020.

Adjusted net income was $8.9 million, or $0.41 per diluted

share, as compared to adjusted net loss, of $(8.8) million, or

$(0.42) per diluted share, in the corresponding period in 2020. A

table which reconciles this non-GAAP financial measure to net

income (loss), as reported, is included below.

Adjusted EBITDA, after giving effect to certain adjustments as

permitted and defined under our debt agreements, was $96.7 million

for the twelve months ended June 30, 2021. A table which

reconciles this non-GAAP financial measure to net income

(loss), as reported, is included below.

Full Year 2021 Guidance Update

For the full fiscal year ending December 31, 2021, the

Company is providing revised financial guidance:

|

|

Year Ended December 31, 2020 |

|

Guidance for the Year Ending December 31, 2021 |

| Net sales |

$769.2 million |

|

$870 to $890 million |

|

Income from operations |

$25.0 million |

|

$55 to $58.5 million |

| Adjusted income from

operations |

$47.9 million |

|

$55 to $58.5 million |

| Net (loss) income |

$(3.0) million |

|

$28.1 to $30.8 million |

|

Adjusted net income |

$20.2 million |

|

$28.1 to $30.8 million |

| Diluted (loss)

income per common share |

$(0.14) per share |

|

$1.28 to $1.40 per share |

|

Adjusted diluted income per common share |

$0.95 per share |

|

$1.28 to $1.40 per share |

|

Weighted-average diluted shares |

20.9 million |

|

22 million |

| Adjusted EBITDA |

$77.3 million |

|

$84 to $88 million |

This guidance is based on a forecasted GBP to USD rate of $1.35.

Net income and diluted income per common share were calculated

based on an effective tax rate of 30%. Tables reconciling non-GAAP

financial measures to GAAP financial measures, as reported, are

included below.

Dividend

On August 3, 2021, the Board of Directors declared a

quarterly dividend of 0.0425 per share payable on November 15,

2021 to shareholders of record on November 1, 2021.

Conference Call

The Company has scheduled a conference call for Thursday,

August 5, 2021 at 11:00 a.m. The dial-in number for the

conference call is (877) 876-9174 (U.S.) or (785) 424-1669

(International), Conference ID: LCUTQ221.

A live webcast of the conference call will be accessible

through:https://event.on24.com/wcc/r/3338822/E67971FE77F9A7A1474782ECB6E298D7

For those who cannot listen to the live broadcast, an audio

replay of the webcast will be available.

Non-GAAP Financial MeasuresThis earnings

release contains non-GAAP financial measures, including

consolidated net sales in constant currency, adjusted income from

operations, adjusted net income (loss), adjusted diluted income

(loss) per common share, and adjusted EBITDA.

A non-GAAP financial measure is a numerical measure of a

company’s historical or future financial performance, financial

position or cash flows that excludes amounts, or is subject to

adjustments that have the effect of excluding amounts, that are

included in the most directly comparable measure calculated and

presented in accordance with GAAP in the statements of income,

balance sheets, or statements of cash flows of a company; or,

includes amounts, or is subject to adjustments that have the effect

of including amounts, that are excluded from the most directly

comparable measure so calculated and presented. As required by SEC

rules, the Company has provided reconciliations of

the non-GAAP financial measures to the most directly

comparable GAAP financial measures.

These non-GAAP financial measures are provided because

management of the Company uses these financial measures in

evaluating the Company’s on-going financial results and

trends, and management believes that exclusion of certain items

allows for more accurate period-to-period comparison of the

Company’s operating performance by investors and analysts.

Management uses these non-GAAP financial measures as

indicators of business

performance. These non-GAAP financial measures

should be viewed as a supplement to, and not a substitute for, GAAP

financial measures of performance.

Forward-Looking StatementsIn this press

release, the use of the words “believe,” “could,” “expect,”

“intend,” “may,” “positioned,” “project,” “projected,” “should,”

“will,” “would” or similar expressions is intended to identify

forward-looking statements. Such statements include all statements

regarding the growth of the Company, our financial guidance, our

ability to navigate the current environment and advance our

strategy, our commitment to increasing investments in future growth

initiatives, our initiatives to create value, our efforts to

mitigate geopolitical factors and tariffs, our current and

projected financial and operating performance, results, and

profitability and all guidance related thereto, including

forecasted exchange rates and effective tax rates, as well as our

continued growth and success, future plans and intentions regarding

the Company and its consolidated subsidiaries. Such statements

represent the Company’s current judgments, estimates, and

assumptions about possible future events. The Company believes

these judgments, estimates, and assumptions are reasonable, but

these statements are not guarantees of any events or financial or

operational results, and actual results may differ materially due

to a variety of important factors. Such factors might include,

among others, the Company’s ability to comply with the requirements

of its credit agreements; the availability of funding under such

credit agreements; the Company’s ability to maintain adequate

liquidity and financing sources and an appropriate level of debt,

as well as to deleverage its balance sheet; the possibility of

impairments to the Company’s goodwill; the possibility of

impairments to the Company’s intangible assets; changes in U.S. or

foreign trade or tax law and policy; the impact of tariffs on

imported goods and materials; changes in general economic

conditions which could affect customer payment practices or

consumer spending; the impact of changes in general economic

conditions on the Company’s customers; customer ordering behavior;

the performance of our newer products; expenses and other

challenges relating to the integration of any future acquisitions;

changes in demand for the Company’s products; changes in the

Company’s management team; the significant influence of the

Company’s largest stockholder; fluctuations in foreign exchange

rates; changes in U.S. trade policy or the trade policies of

nations in which we or our suppliers do business; uncertainty

regarding the long-term ramifications of the U.K.’s exit from the

European Union; shortages of and price volatility for certain

commodities; global health epidemics, such as the COVID-19

pandemic; social unrest, including related protests and

disturbances; our expectations regarding the future level of demand

for our products; and significant changes in the competitive

environment and the effect of competition on the Company’s markets,

including on the Company’s pricing policies, financing sources and

ability to maintain an appropriate level of debt. The Company

undertakes no obligation to update these forward-looking statements

other than as required by law.

Lifetime Brands, Inc.Lifetime Brands is a

leading global designer, developer and marketer of a broad range of

branded consumer products used in the home. The Company markets its

products under well-known kitchenware brands, including

Farberware®, KitchenAid®, Sabatier®, Amco Houseworks®, Chef’n®

Chicago™ Metallic, Copco®, Fred® & Friends, Houdini™,

KitchenCraft®, Kamenstein®, La Cafetière®, MasterClass®, Misto®,

Swing-A-Way®, Taylor® Kitchen, and Rabbit®; respected tableware and

giftware brands, including Mikasa®, Pfaltzgraff®, Fitz and Floyd®,

Empire Silver™, Gorham®, International® Silver, Towle®

Silversmiths, Wallace®, Wilton Armetale®, V&A®, Royal Botanic

Gardens Kew® and Year & Day®; and valued home solutions brands,

including BUILT NY®, Taylor® Bath, Taylor® Kitchen, Taylor® Weather

and Planet Box®. The Company also provides exclusive private label

products to leading retailers worldwide.

The Company’s corporate website

is www.lifetimebrands.com.

Contacts:

Lifetime Brands, Inc.Laurence Winoker, Chief

Financial

Officer516-203-3590investor.relations@lifetimebrands.com

or

Joele Frank, Wilkinson Brimmer KatcherEd

Trissel / Andrew Squire / Rose Temple212-355-4449

LIFETIME BRANDS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands—except per share

data)(unaudited)

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Net sales |

$ |

186,636 |

|

|

$ |

150,140 |

|

|

$ |

382,289 |

|

|

$ |

295,210 |

|

| Cost of sales |

120,475 |

|

|

95,972 |

|

|

250,128 |

|

|

188,108 |

|

| Gross margin |

66,161 |

|

|

54,168 |

|

|

132,161 |

|

|

107,102 |

|

| Distribution expenses |

18,931 |

|

|

15,192 |

|

|

37,577 |

|

|

31,749 |

|

| Selling, general and

administrative expenses |

36,229 |

|

|

34,427 |

|

|

74,337 |

|

|

75,949 |

|

| Restructuring expenses |

— |

|

|

253 |

|

|

— |

|

|

253 |

|

| Goodwill and other

impairments |

— |

|

|

— |

|

|

— |

|

|

20,100 |

|

| Income (loss) from

operations |

11,001 |

|

|

4,296 |

|

|

20,247 |

|

|

(20,949 |

) |

| Interest expense |

(3,819 |

) |

|

(4,230 |

) |

|

(7,833 |

) |

|

(8,966 |

) |

| Mark to market gain (loss) on

interest rate derivatives |

46 |

|

|

(164 |

) |

|

544 |

|

|

(2,415 |

) |

| Income (loss) before income

taxes and equity in earnings (losses) |

7,228 |

|

|

(98 |

) |

|

12,958 |

|

|

(32,330 |

) |

| Income tax (provision)

benefit |

(1,832 |

) |

|

(3,031 |

) |

|

(4,248 |

) |

|

698 |

|

| Equity in earnings (losses),

net of taxes |

393 |

|

|

(848 |

) |

|

146 |

|

|

(509 |

) |

| NET INCOME

(LOSS) |

$ |

5,789 |

|

|

$ |

(3,977 |

) |

|

$ |

8,856 |

|

|

$ |

(32,141 |

) |

| BASIC INCOME (LOSS)

PER COMMON SHARE |

$ |

0.27 |

|

|

$ |

(0.19 |

) |

|

$ |

0.42 |

|

|

$ |

(1.55 |

) |

| DILUTED INCOME (LOSS)

PER COMMON SHARE |

$ |

0.26 |

|

|

$ |

(0.19 |

) |

|

$ |

0.40 |

|

|

$ |

(1.55 |

) |

LIFETIME BRANDS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands—except share data)

| |

June 30,2021 |

|

December 31,2020 |

| |

(unaudited) |

|

|

| ASSETS |

|

|

|

| CURRENT ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

33,345 |

|

|

$ |

35,963 |

|

|

Accounts receivable, less allowances of $16,901 at June 30,

2021 and $17,013 at December 31, 2020 |

120,494 |

|

|

170,037 |

|

|

Inventory |

218,184 |

|

|

203,164 |

|

|

Prepaid expenses and other current assets |

9,140 |

|

|

12,129 |

|

|

Income taxes receivable |

1,750 |

|

|

— |

|

|

TOTAL CURRENT ASSETS |

382,913 |

|

|

421,293 |

|

| PROPERTY AND EQUIPMENT,

net |

22,544 |

|

|

23,120 |

|

| OPERATING LEASE RIGHT-OF-USE

ASSETS |

92,517 |

|

|

96,543 |

|

| INVESTMENTS |

23,778 |

|

|

20,032 |

|

| INTANGIBLE ASSETS, net |

235,762 |

|

|

244,025 |

|

| OTHER ASSETS |

2,048 |

|

|

2,468 |

|

|

TOTAL

ASSETS |

$ |

759,562 |

|

|

$ |

807,481 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

Current maturity of term loan |

$ |

11,530 |

|

|

$ |

17,657 |

|

|

Accounts payable |

55,392 |

|

|

66,095 |

|

|

Accrued expenses |

78,067 |

|

|

80,050 |

|

|

Income taxes payable |

— |

|

|

4,788 |

|

|

Current portion of operating lease liabilities |

12,300 |

|

|

11,480 |

|

| TOTAL CURRENT LIABILITIES |

157,289 |

|

|

180,070 |

|

|

OTHER LONG-TERM LIABILITIES |

15,174 |

|

|

16,483 |

|

|

INCOME TAXES PAYABLE, LONG-TERM |

1,444 |

|

|

1,444 |

|

|

OPERATING LEASE LIABILITIES |

97,644 |

|

|

102,355 |

|

|

DEFERRED INCOME TAXES |

10,833 |

|

|

10,714 |

|

|

REVOLVING CREDIT FACILITY |

— |

|

|

27,302 |

|

|

TERM LOAN |

235,377 |

|

|

238,977 |

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

Preferred stock, $1.00 par value, shares authorized: 100 shares of

Series A and 2,000,000 shares of Series B; none issued and

outstanding |

— |

|

|

— |

|

|

Common stock, $0.01 par value, shares authorized: 50,000,000 at

June 30, 2021 and December 31, 2020; shares issued and

outstanding: 22,006,623 at June 30, 2021 and 21,755,195 at

December 31, 2020 |

220 |

|

|

218 |

|

|

Paid-in capital |

268,976 |

|

|

268,666 |

|

|

Retained earnings |

7,423 |

|

|

424 |

|

|

Accumulated other comprehensive loss |

(34,818 |

) |

|

(39,172 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY |

241,801 |

|

|

230,136 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

759,562 |

|

|

$ |

807,481 |

|

LIFETIME BRANDS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(in thousands)(unaudited)

| |

Six Months EndedJune 30, |

| |

2021 |

|

2020 |

| OPERATING

ACTIVITIES |

|

|

|

|

Net income (loss) |

$ |

8,856 |

|

|

$ |

(32,141 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

11,723 |

|

|

12,295 |

|

|

Goodwill and other impairments |

— |

|

|

20,100 |

|

|

Amortization of financing costs |

876 |

|

|

878 |

|

|

Mark to market (gain) loss on interest rate derivatives |

(544 |

) |

|

2,415 |

|

|

Non-cash lease expense |

(768 |

) |

|

2,020 |

|

|

Provision for doubtful accounts |

(146 |

) |

|

2,987 |

|

|

Stock compensation expense |

2,772 |

|

|

2,746 |

|

|

Undistributed equity in (earnings) losses, net of taxes |

(146 |

) |

|

509 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

49,943 |

|

|

12,661 |

|

|

Inventory |

(14,305 |

) |

|

2,398 |

|

|

Prepaid expenses, other current assets and other assets |

2,931 |

|

|

782 |

|

|

Accounts payable, accrued expenses and other liabilities |

(12,516 |

) |

|

39,430 |

|

|

Income taxes receivable |

(1,750 |

) |

|

(871 |

) |

|

Income taxes payable |

(4,795 |

) |

|

— |

|

|

NET CASH PROVIDED BY OPERATING ACTIVITIES |

42,131 |

|

|

66,209 |

|

| INVESTING

ACTIVITIES |

|

|

|

|

Purchases of property and equipment |

(2,497 |

) |

|

(1,380 |

) |

|

Acquisition |

(178 |

) |

|

— |

|

|

NET CASH USED IN INVESTING ACTIVITIES |

(2,675 |

) |

|

(1,380 |

) |

| FINANCING

ACTIVITIES |

|

|

|

|

Proceeds from revolving credit facility |

10,845 |

|

|

95,851 |

|

|

Repayments of revolving credit facility |

(38,131 |

) |

|

(99,134 |

) |

|

Repayments of term loan |

(10,478 |

) |

|

(7,583 |

) |

|

Payments for finance lease obligations |

(43 |

) |

|

(50 |

) |

|

Payments of tax withholding for stock based compensation |

(3,185 |

) |

|

(486 |

) |

|

Proceeds from the exercise of stock options |

735 |

|

|

— |

|

|

Cash dividends paid |

(1,957 |

) |

|

(937 |

) |

|

NET CASH USED IN FINANCING ACTIVITIES |

(42,214 |

) |

|

(12,339 |

) |

| Effect of foreign exchange on

cash |

140 |

|

|

(323 |

) |

| (DECREASE) INCREASE IN

CASH AND CASH EQUIVALENTS |

(2,618 |

) |

|

52,167 |

|

| Cash and cash equivalents at

beginning of period |

35,963 |

|

|

11,370 |

|

| CASH AND CASH

EQUIVALENTS AT END OF PERIOD |

$ |

33,345 |

|

|

$ |

63,537 |

|

LIFETIME BRANDS,

INC.Supplemental Information(in

thousands)

Reconciliation of GAAP

to Non-GAAP Operating Results

Adjusted EBITDA for the twelve months ended

June 30, 2021:

| |

Adjusted EBITDA for theFour Quarters EndedJune 30,

2021 |

| |

(in thousands) |

|

Three months ended June 30, 2021 |

$ |

18,166 |

|

| Three months ended March 31,

2021 |

16,830 |

|

| Three months ended December 31,

2020 |

32,458 |

|

| Three months ended September 30,

2020 |

29,228 |

|

| Adjusted EBITDA for the twelve

months ended June 30, 2021 |

$ |

96,682 |

|

| |

|

| |

Three Months Ended |

Twelve Months Ended June 30, 2021 |

| |

September 30, 2020 |

|

December 31,2020 |

|

March 31,2021 |

|

June 30,2021 |

| |

(in thousands) |

|

|

Net income as reported |

$ |

13,913 |

|

|

$ |

15,221 |

|

|

$ |

3,067 |

|

|

$ |

5,789 |

|

|

$ |

37,990 |

|

|

Undistributed equity losses (earnings), net |

(147 |

) |

|

(1,620 |

) |

|

247 |

|

|

(393 |

) |

|

(1,913 |

) |

|

Income tax provision |

3,711 |

|

|

6,853 |

|

|

2,416 |

|

|

1,832 |

|

|

14,812 |

|

|

Interest expense |

4,128 |

|

|

4,183 |

|

|

4,014 |

|

|

3,819 |

|

|

16,144 |

|

|

Mark to market gain on interest rate derivatives |

(99 |

) |

|

(172 |

) |

|

(498 |

) |

|

(46 |

) |

|

(815 |

) |

|

Depreciation and amortization |

6,090 |

|

|

6,279 |

|

|

5,958 |

|

|

5,765 |

|

|

24,092 |

|

|

Stock compensation expense |

1,575 |

|

|

1,630 |

|

|

1,444 |

|

|

1,328 |

|

|

5,977 |

|

|

Acquisition related expenses |

57 |

|

|

126 |

|

|

182 |

|

|

72 |

|

|

437 |

|

|

Restructuring expenses (benefit) |

— |

|

|

(42 |

) |

|

— |

|

|

— |

|

|

(42 |

) |

| Adjusted EBITDA |

$ |

29,228 |

|

|

$ |

32,458 |

|

|

$ |

16,830 |

|

|

$ |

18,166 |

|

|

$ |

96,682 |

|

Adjusted EBITDA is a non-GAAP financial measure which is defined

in the Company’s debt agreements. Adjusted EBITDA is defined as net

income, adjusted to exclude undistributed equity in losses

(earnings), income tax provision, interest expense, mark to market

gain on interest rate derivatives, depreciation and amortization,

stock compensation expense, and other items detailed in the table

above that are consistent with exclusions permitted by our debt

agreements.

LIFETIME BRANDS,

INC.Supplemental Information(in

thousands—except per share data)

Reconciliation of GAAP

to Non-GAAP Operating Results (continued)

Adjusted net income (loss) and adjusted diluted income

(loss) per common share (in thousands -except per share

data):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Net income (loss) as reported |

$ |

5,789 |

|

|

$ |

(3,977 |

) |

|

$ |

8,856 |

|

|

$ |

(32,141 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Acquisition related expenses |

72 |

|

|

55 |

|

|

254 |

|

|

102 |

|

|

Restructuring expenses |

— |

|

|

253 |

|

|

— |

|

|

253 |

|

|

Warehouse relocation |

— |

|

|

303 |

|

|

— |

|

|

1,093 |

|

|

Mark to market (gain) loss on interest rate derivatives |

(46 |

) |

|

164 |

|

|

(544 |

) |

|

2,415 |

|

|

Goodwill and other impairments |

— |

|

|

— |

|

|

— |

|

|

20,100 |

|

|

Foreign currency translation loss reclassified from Accumulated

Other Comprehensive Loss |

2,042 |

|

|

235 |

|

|

2,042 |

|

|

235 |

|

|

Gain on change in ownership in equity method investment |

(1,732 |

) |

|

— |

|

|

(1,732 |

) |

|

— |

|

|

Income tax effect on adjustments |

(6 |

) |

|

(162 |

) |

|

73 |

|

|

(889 |

) |

|

Adjusted net income (loss) |

$ |

6,119 |

|

|

$ |

(3,129 |

) |

|

$ |

8,949 |

|

|

$ |

(8,832 |

) |

|

Adjusted diluted income (loss) per common share(1) |

$ |

0.28 |

|

|

$ |

(0.15 |

) |

|

$ |

0.41 |

|

|

$ |

(0.42 |

) |

Adjusted net income and adjusted diluted income per common share

in the three and six months ended June 30, 2021 excludes

acquisition related expenses, mark to market (gain) on interest

rate derivatives, foreign currency translation loss reclassified

from Accumulated Other Comprehensive Loss and the gain on change in

ownership in equity method investment. The income tax effect on

adjustments reflects the statutory tax rates applied on the

adjustments.

Adjusted net (loss) and adjusted diluted (loss) per common share

in the three and six months ended June 30, 2020 excludes

acquisition related expenses, restructuring expenses, warehouse

relocation, mark to market loss on interest rate derivatives,

goodwill and other impairments, and foreign currency translation

loss reclassified from Accumulated Other Comprehensive Loss. The

income tax effect on adjustments reflects the statutory tax rates

applied on the adjustments.

(1) Adjusted diluted income (loss) per common share is

calculated based on diluted weighted-average shares outstanding of

21,965 and 20,824 for the three month period ended June 30,

2021 and 2020, respectively. Adjusted diluted income (loss) per

common share is calculated based on diluted weighted-average shares

outstanding of 21,903 and 20,784 for the six month period ended

June 30, 2021 and 2020, respectively. The diluted

weighted-average shares outstanding for the three and six month

period ended June 30, 2021 include the effect of dilutive

securities of 643 and 664, respectively.

LIFETIME BRANDS,

INC.Supplemental Information(in

thousands)

Reconciliation of GAAP

to Non-GAAP Operating Results (continued)

Constant Currency:

| |

As ReportedThree Months

EndedJune 30, |

|

Constant Currency

(1)Three Months EndedJune

30, |

|

|

|

Year-Over-YearIncrease

(Decrease) |

| Net

sales |

2021 |

|

2020 |

|

Increase(Decrease) |

|

2021 |

|

2020 |

|

Increase(Decrease) |

|

CurrencyImpact |

|

ExcludingCurrency |

|

IncludingCurrency |

|

CurrencyImpact |

|

U.S. |

$ |

166,583 |

|

|

$ |

132,591 |

|

|

$ |

33,992 |

|

|

$ |

166,583 |

|

|

$ |

132,662 |

|

|

$ |

33,921 |

|

|

$ |

(71 |

) |

|

25.6% |

|

25.6% |

|

0.0% |

| International |

20,053 |

|

|

17,549 |

|

|

2,504 |

|

|

20,052 |

|

|

19,672 |

|

|

380 |

|

|

(2,124 |

) |

|

1.9% |

|

14.3% |

|

12.4% |

|

Total net sales |

$ |

186,636 |

|

|

$ |

150,140 |

|

|

$ |

36,496 |

|

|

$ |

186,635 |

|

|

$ |

152,334 |

|

|

$ |

34,301 |

|

|

$ |

(2,195 |

) |

|

22.5% |

|

24.3% |

|

1.8% |

| |

As ReportedSix Months

EndedJune 30, |

|

Constant Currency (1)Six

Months EndedJune 30, |

|

|

|

Year-Over-YearIncrease

(Decrease) |

| Net

sales |

2021 |

|

2020 |

|

Increase(Decrease) |

|

2021 |

|

2020 |

|

Increase(Decrease) |

|

CurrencyImpact |

|

ExcludingCurrency |

|

IncludingCurrency |

|

CurrencyImpact |

|

U.S. |

$ |

342,764 |

|

|

$ |

261,799 |

|

|

$ |

80,965 |

|

|

$ |

342,764 |

|

|

$ |

261,865 |

|

|

$ |

80,899 |

|

|

$ |

(66 |

) |

|

30.9% |

|

30.9% |

|

0.0% |

| International |

39,525 |

|

|

33,411 |

|

|

6,114 |

|

|

39,525 |

|

|

36,462 |

|

|

3,063 |

|

|

(3,051 |

) |

|

8.4% |

|

18.3% |

|

9.9% |

|

Total net sales |

$ |

382,289 |

|

|

$ |

295,210 |

|

|

$ |

87,079 |

|

|

$ |

382,289 |

|

|

$ |

298,327 |

|

|

$ |

83,962 |

|

|

$ |

(3,117 |

) |

|

28.1% |

|

29.5% |

|

1.4% |

(1) “Constant Currency” is determined by applying the 2021

average exchange rates to the prior year local currency sales

amounts, with the difference between the change in “As Reported”

net sales and “Constant Currency” net sales, reported in the table

as “Currency Impact”. Constant currency sales growth is intended to

exclude the impact of fluctuations in foreign currency exchange

rates.

LIFETIME BRANDS,

INC.Supplemental Information

Reconciliation of GAAP

to Non-GAAP Guidance

Adjusted EBITDA guidance for the full fiscal year ending

December 31, 2021 (in millions):

|

Net income guidance |

$28.1 to $30.8 |

|

Add back: |

|

|

Income tax expense |

11.9 to 12.7 |

|

Interest expense |

15 |

|

Depreciation and amortization |

23.5 |

|

Stock compensation expense |

5 |

|

Other adjustments(1) |

0.5 to 1 |

| Adjusted EBITDA guidance |

$84 to $88 |

(1) Includes estimates for acquisition related expenses,

undistributed equity in (earnings) losses and other items that are

consistent with exclusions permitted by our debt agreements.

Adjusted income from operations, adjusted net income and

adjusted diluted income per common share guidance for the full

fiscal year ending December 31, 2021 :

With respect to the guidance for adjusted income from

operations, adjusted net income and adjusted diluted income per

common share, there were no adjustments to the GAAP financial

measures, therefore the amounts for adjusted income from

operations, adjusted net income and adjusted diluted income per

common share are consistent with the GAAP financial measures income

from operations, net income and diluted income per common

share.

Reconciliation of GAAP to Non-GAAP

Operating Results

Adjusted EBITDA for the year ended December 31,

2020:

| |

Three Months Ended |

|

Year Ended |

|

March 31,2020 |

|

June 30, 2020 |

|

September 30, 2020 |

|

December 31, 2020 |

|

December 31,2020 |

|

|

|

|

|

(in thousands) |

|

|

|

|

|

Net (loss) income as reported |

$ |

(28,164 |

) |

|

$ |

(3,977 |

) |

|

$ |

13,913 |

|

|

$ |

15,221 |

|

|

$ |

(3,007 |

) |

|

Undistributed equity losses (earnings), net |

(339 |

) |

|

848 |

|

|

(147 |

) |

|

(1,620 |

) |

|

(1,258 |

) |

|

Income tax (benefit) provision |

(3,729 |

) |

|

3,031 |

|

|

3,711 |

|

|

6,853 |

|

|

9,866 |

|

|

Interest expense |

4,736 |

|

|

4,230 |

|

|

4,128 |

|

|

4,183 |

|

|

17,277 |

|

|

Mark to market loss (gain) on interest rate derivatives |

2,251 |

|

|

164 |

|

|

(99 |

) |

|

(172 |

) |

|

2,144 |

|

|

Depreciation and amortization |

6,234 |

|

|

6,061 |

|

|

6,090 |

|

|

6,279 |

|

|

24,664 |

|

|

Goodwill and other impairments |

20,100 |

|

|

— |

|

|

— |

|

|

— |

|

|

20,100 |

|

|

Stock compensation expense |

1,326 |

|

|

1,420 |

|

|

1,575 |

|

|

1,630 |

|

|

5,951 |

|

|

Acquisition related expenses |

47 |

|

|

55 |

|

|

57 |

|

|

126 |

|

|

285 |

|

|

Restructuring expenses (benefit) |

— |

|

|

253 |

|

|

— |

|

|

(42 |

) |

|

211 |

|

|

Warehouse relocation expenses |

790 |

|

|

303 |

|

|

— |

|

|

— |

|

|

1,093 |

|

| Adjusted EBITDA |

$ |

3,252 |

|

|

$ |

12,388 |

|

|

$ |

29,228 |

|

|

$ |

32,458 |

|

|

$ |

77,326 |

|

Adjusted EBITDA is a non-GAAP financial measure which

is defined in the Company’s debt agreements. Adjusted EBITDA is

defined as net income (loss), adjusted to exclude undistributed

equity in (earnings) losses, income tax (benefit) provision,

interest expense, depreciation and amortization, mark to market

loss (gain) on interest rate derivatives, goodwill and other

impairments, stock compensation expense, and other items detailed

in the table above that are consistent with exclusions permitted by

our debt agreements.

LIFETIME BRANDS,

INC.Supplemental Information(in

thousands—except per share data)

Reconciliation of GAAP to Non-GAAP

Operating Results (continued)

Adjusted net income and adjusted diluted income per

common share (in thousands - except per share data):

| |

Year Ended December 31, |

| |

2020 |

|

Net loss as reported |

$ |

(3,007 |

) |

|

Adjustments: |

|

|

Acquisition related expenses |

285 |

|

|

Restructuring expenses |

211 |

|

|

Warehouse relocation expenses |

1,093 |

|

|

Mark to market loss on interest rate derivatives |

2,144 |

|

|

Goodwill and other impairments |

20,100 |

|

|

Foreign currency translation loss reclassified from Accumulated

Other Comprehensive Loss |

235 |

|

|

Income tax effect on adjustments |

(858 |

) |

| Adjusted net income |

$ |

20,203 |

|

| Adjusted diluted income per

share (1) |

$ |

0.95 |

|

(1)Adjusted diluted income per common share is calculated based

on diluted weighted-average shares outstanding of 21,179 for the

year ended December 31, 2020. The diluted weighted-average shares

outstanding for the year ended December 31, 2020 include the effect

of dilutive securities of 319 shares.

Adjusted income from operations (in

thousands):

| |

Year Ended December 31, |

| |

2020 |

| |

(in thousands) |

|

Income from operations |

$ |

24,970 |

|

|

Excluded non-cash charges: |

|

|

Goodwill and other impairments |

20,100 |

|

|

Bad debt reserve related to COVID-19 pandemic (1) |

2,844 |

|

|

Total excluded non-cash charges |

$ |

22,944 |

|

| Adjusted income from

operations |

$ |

47,914 |

|

(1) Bad debt reserve recorded in the first quarter of fiscal

2020 to establish a provision against potential credit problems

from certain retail customers who may have financial difficulty

that has been caused or increased due to the COVID-19 pandemic.

This reflects the Company's assessment of risk of not being able to

collect such receivables from certain customers in the U.S. that

are at risk of seeking or have already obtained bankruptcy

protection and our international customer base which has a higher

proportion of small and independent brick-and-mortar retailers.

This charge was taken in response to the Company's assessment of

the impact of the COVID-19 pandemic on these accounts

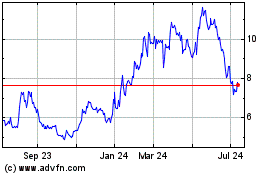

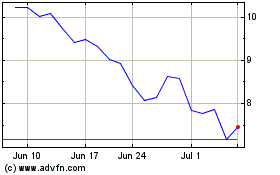

Lifetime Brands (NASDAQ:LCUT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lifetime Brands (NASDAQ:LCUT)

Historical Stock Chart

From Nov 2023 to Nov 2024