Liberty Global Ventures Announces Strategic Partnership With Avesta Capital

November 02 2021 - 9:00AM

Business Wire

Liberty Global Ventures to Invest $2 Million in Specialist

Positive Impact Investment Firm to Deliver Seed Funding to

Start-Ups Tackling the Global Challenges of Climate Change and

Economic Inequality

Liberty Global Ventures, the investment arm of Liberty Global

(NASDAQ: LBTYA, LBTYB and LBTYK), a world leader in converged

video, broadband and communications services, has struck a

strategic partnership with specialist impact investment firm Avesta

Capital which will see it initially invest $2 million to help

promote diversity and inclusion and tackle the global challenges of

climate change and inequality. With this close, Avesta Capital has

now raised over 80% of its target $20 million fund.

Avesta will use the capital to provide seed investment to

start-ups that specifically offer scalable solutions to issues such

as boosting economic opportunity or aiding the fight against

climate change. Avesta also has a policy of prioritizing support

for entrepreneurs from diverse backgrounds.

Avesta’s fund aims to bridge the technology start-up and impact

investing ecosystems, providing specialist expertise to help

technology companies that can have significant impact at scale

connect with impact investors. Start-ups backed by the Avesta Fund

include Line Financial, working to improve the financial well-being

and inclusion of people who work in the gig economy and WattBuy,

who help improve access to cheaper and cleaner electricity for

renters across America.

Liberty Global Ventures has investments in more than 75

companies and funds in the fields of content, technology and

infrastructure. The group’s technology investments are scalable

across international markets, with deals ranging in size from $5

million to $30 million. Its portfolio includes a number of

innovative and high growth companies such as Aviatrix, Lacework,

Pax8, Pensando and Plume.

Alongside the new strategic partnership with the Avesta Fund,

Liberty Global is a founding member of the European Green Digital

Coalition and also featured in the influential Dow Jones

Sustainability World index for the eighth year in 2020. The company

was also awarded leadership status by CDP Global (formerly known as

the Carbon Disclosure Project) in its most recent annual survey

into climate change and carbon emissions.

John Gowen, Managing Director, Liberty Global Ventures,

comments: “Building on our strong sustainability credentials, this

strategic partnership allows us to be early backers of companies

that are tackling some of the biggest and most pressing issues

facing society. We look forward to working with Avesta to help

support companies that will deliver lasting positive impact, as

well as superior financial returns.”

Soraya Loerts, Chief Diversity, Equity and Inclusion Officer,

Liberty Global, adds: “Driving equality of opportunity and

supporting diversity is core to life at Liberty Global. We’re

pleased to extend this to supporting start-ups that reflect our own

values around diversity, equity and inclusion, and working with

Avesta to encourage entrepreneurs from diverse backgrounds to scale

up and make a difference.”

Srikant Vasan, Managing Partner, Avesta Capital, adds: “Avesta

combines profit and purpose, a combination that we believe is a lot

more powerful, sustainable and scalable than pure philanthropy and

more meaningful than pure profit-making. By supporting

entrepreneurs from diverse backgrounds, we aim to reduce the

inequalities faced by those who have historically experienced

difficulties getting access to capital, while at the same time

delivering positive returns.”

ABOUT LIBERTY GLOBAL

Liberty Global (NASDAQ: LBTYA, LBTYB and LBTYK) is a world

leader in converged broadband, video and mobile communications

services. We deliver next-generation products through advanced

fiber and 5G networks that connect over 85 million subscribers

across Europe and the United Kingdom. Our businesses operate under

some of the best-known consumer brands, including Virgin Media-O2

in the UK, VodafoneZiggo in the Netherlands, Telenet in Belgium,

Sunrise UPC in Switzerland, Virgin Media in Ireland and UPC in

Eastern Europe. Through our substantial scale and commitment to

innovation, we are building Tomorrow’s Connections Today, investing

in the infrastructure and platforms that empower our customers to

make the most of the digital revolution, while deploying the

advanced technologies that nations and economies need to

thrive.

Our consolidated businesses generate annual revenue of more than

$7 billion, while our joint-ventures in the UK and the Netherlands

generate combined annual revenue of more than $17 billion.

Liberty Global Ventures, our global investment arm, has a

portfolio of more than 75 companies and funds across content,

technology and infrastructure, including strategic stakes in

companies like Plume, ITV, Lions Gate, Univision and the Formula E

racing series.

Revenue figures above are provided based upon 2020 results and

on a combined Virgin Media and O2 UK basis. For more information,

please visit www.libertyglobal.com.

ABOUT AVESTA CAPITAL

Avesta Capital helps address humanity’s biggest challenges of

inequality and climate change by bridging the tech startup and

impact investing ecosystems, while prioritizing diverse founders.

Avesta’s Seed Impact Investing at Scale model aims to deliver top

venture returns and measurable impact – by combining

data-driven investment approaches used by leading Seed-at-Scale

investors like Techstars and 500 Startups with best-practice impact

alignment methods used by leading impact investors like MacArthur

and Omidyar.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211102005772/en/

Investor Relations Michael Bishop +44 20 8483 6246 Steve

Carroll +1 303 784 4505

Corporate Communications Molly Bruce +1 303 220 4202 Matt

Beake +44 20 8483 6428

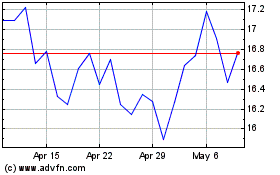

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Oct 2024 to Nov 2024

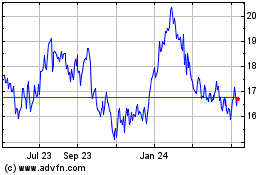

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Nov 2023 to Nov 2024