Applied Ups Buyback, Hikes Dividend - Analyst Blog

March 07 2012 - 8:00AM

Zacks

After reporting an encouraging

first quarter last month, Applied Materials Inc.

(AMAT), the leading producer of chip making equipment, has

authorized the repurchase of shares up to an additional value of

roughly $3.0 billion over the next three years. The company has

less than $1.0 billion available under the existing buyback plan

which was started in 2010.

Additionally, the company also

announced its decision to hike quarterly dividend by one cent to 9

cents per share. This translates into a 13% increase from the prior

dividend. The increased dividend will be paid on June 14, 2012, to

stockholders of record on May 24, 2012. Prior to this announcement,

Applied had been paying a quarterly dividend of 8 cents per

share.

We believe that continuous share

buybacks and a hike in dividend will inspire investor loyalty

through higher returns from the stock.

During the recently concluded first

quarter, Applied spent $200 million on share repurchases and $104

million on dividends. The cash and short-term investments balance

was $2.0 billion at quarter-end, having declined $4.2 billion

during the quarter due to the cash paid for the Varian acquisition

during the quarter. The debt cap ratio including long-term

liabilities and short-term debt was just 22.1%. We remain

encouraged by Applied’s strong cash position and its ability to

service its long-term debts.

Applied reported decent first

quarter results, with both revenue and earnings per share

surpassing our expectations. The company provided a strong revenue

outlook for the second quarter, which was up 5–15% sequentially.

Applied’s strong position in the semiconductor market, improving

business, both on account of stronger end markets and the Varian

acquisition, the solar business in China, its huge portfolio and

strategic relationships are all positives.

The regular share buybacks and

dividend hikes are a good way of encouraging investor confidence as

it returns shareholder value. The company expects to post better

results in the second quarter than estimated by the analysts. The

increase in dividend indicates that the company is heading toward

strong future growth.

Applied, which competes with other

large equipment makers, such as KLA-Tencor

Corporation (KLAC), Lam Research (LRCX)

and Novellus Systems, Inc.

(NVLS),holds a Zacks #3 Rank that

translates into a short-term ‘Hold’ rating.

APPLD MATLS INC (AMAT): Free Stock Analysis Report

KLA-TENCOR CORP (KLAC): Free Stock Analysis Report

LAM RESEARCH (LRCX): Free Stock Analysis Report

NOVELLUS SYS (NVLS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

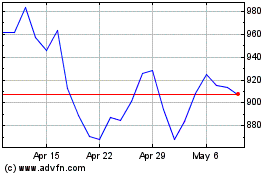

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

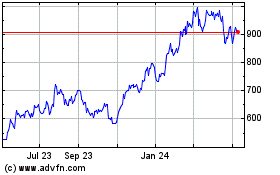

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2023 to Jul 2024