For Immediate Release

Chicago, IL – February 16, 2012 – Zacks.com announces the list

of stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Applied Materials,

Inc. (AMAT), Lam Rearch (LRCX),

Novellus Systems, Inc. (NVLS), KLA-Tencor

Corporation (KLAC) and CA Technologies

(CA).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Wednesday’s Analyst

Blog:

Earnings Preview: Applied

Materials

Applied Materials, Inc. (AMAT) is scheduled to

announce its fiscal first-quarter 2012 results on February 16,

2012. We witness only one upward movement in analyst estimates in

the build-up to the release.

Prior-Quarter Synopsis

AMAT’s fourth quarter 2011 pro forma earnings were in line with

the Zacks Consensus Estimate as lower revenue and margins were

partially offset by strong opex management and a

lower-than-expected tax rate.

Revenue growth was weak across the Display and EES (solar)

segments, with the Silicon Systems Group (SSG) performing in line

with expectations. However, AMAT’s penetration in Asiadeepened

significantly, helping the Applied Global Services (AGS) segment

exceed expectations.

Orders in the quarter were down 33.0% sequentially due to order

declines in display (-91% sequentially) and EES (-3% sequentially).

The lower demand for TVs and mobile devices in the Display segment

and excess capacity in the EES segment were the main reasons for

the decline. Gross margins also declined sequentially to 39.6%

aslower volumes impacted cost absorption.

First Quarter Guidance

AMAT now projects first quarter revenue to decrease 5–15%

sequentially, with SSG (including Varian) increasing 5–20%

sequentially, AGS declining 10–20% (the combined effect of lower

200mm sales, lower utilization rates and the absence of thin film

revenue), and Display and EES also falling 40–60%.The non-GAAP EPS

is expected to come in at 8–16 cents a share. For the first

quarter, the Zacks Consensus Estimate is pegged at 12 cents.

(Detailed earnings results can be viewed in the blog titled:

Applied Offers Murky Outlook).

Agreement of Analysts

Out of the 17 analysts providing estimates for the first

quarter, none made any revisions in the last 30 days. For fiscal

2012, only 1 analyst made an upward revision over the same 30-day

time period.

A few analysts expect a decent first quarter with earnings and

revenue at the high end of the guidance but remain concerned about

gross margins due to the increased exposure to Samsung.

The analysts believe that Display and EES sales will fall, but

be in line with guidance, due to the ongoing solar and LCD panel

inventory glut. They believe that pressure in both Display and EES

will partially be offset by growth in Silicon, helping revenue to

come in modestly above the mid-point of guidance, consistent with

its peers including Lam Rearch (LRCX),

Novellus Systems, Inc. (NVLS) and

KLA-Tencor Corporation (KLAC).

Additionally, though analysts see upside potential for Silicon

orders, they do not anticipate an order recovery in Display or EES

segments in the to-be-reported quarter, indicating continued

sluggishness in these markets for some time.

However, a handful of analysts believe that the display business

will improve in the upcoming quarter, banking on investments in

LCD/OLED that they expect will enable recovery.

Magnitude of Estimate Revisions

In the past 30 days, there was no change to the Zacks Consensus

Estimate for the first quarter but it increased a penny to 80 cents

for fiscal 2012.

Over the 90-day period, the Zacks Consensus Estimate fell 6

cents to 12 cents for the first quarter and 22 cents for fiscal

2012.

The significant decline of 22 cents in the Zacks Consensus

Estimate for 2012 clearly indicates the uncertainties in the

semiconductor business and echoes the general pessimism for both

display and solar in 2012.

Our Recommendation

We do not expect a strong first quarter due to limited

visibility and lower overall semiconductor equipment spending

levels. Though we believe that there is potential in the solar

energy market over the long term, we remain cautious about the

company's efforts since management has already missed several

targets to bring its solar division to profitability.

We remain positive about Applied’s strong position in the

semiconductor market, the solar business in China, a vast portfolio

and strategic relationships, which will however be less effective

in the current market scenario.

Applied, which competes with other large equipment makers, such

as KLA-Tencor, Lam Research and Novellus Systems, holds a Zacks #3

Rank that translates into a short-term Hold rating.

CA Offers New Solutions

Computing major CA Technologies (CA) has

recently made some strategic moves, which reiterates the fact that

cloud computing and enterprise services are the two main areas of

development for the company. CA is leveraging its cloud computing

expertise and rolling out innovative solutions to grow its

business.

CA has recently integrated its new cloud offering CA AppLogic

turnkey platform with International Game Technology’s (IGT) IGT

Cloud for delivering advanced casino software and better gaming

experience to the end user.

IGT is trying to capitalize on the expertise of CA’s cloud

computing platform in order to enhance its operational efficiency,

and shift focus from infrastructure, maintenance and operations to

innovative product development.

The cloud computing segment of the company is slowly gaining

traction and the new orders in this segment include the Cal Credit

Card company, which deployed its "Safe Shopping" system deploying

CA Arcot TransFort for Issuers. This software provides 3-D secure

authentication and fraud prevention services for card processors

and issuers.

This cloud-based solution provides multiple layers of protection

and identity verification during a shopping transaction, where the

cardholder is not present physically. These solutions are

user-friendly and also time-saving and thus attract more companies

to implement them.

CA Inc.’s emerging opportunity in the virtualization/cloud

computing space is significant and could help accelerate growth

over the next 2-3 years. Cloud computing leads to increased service

and elevated security requirements for the companies that use them

and CA's product portfolio is well positioned to benefit from

it.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

APPLD MATLS INC (AMAT): Free Stock Analysis Report

CA INC (CA): Free Stock Analysis Report

KLA-TENCOR CORP (KLAC): Free Stock Analysis Report

LAM RESEARCH (LRCX): Free Stock Analysis Report

NOVELLUS SYS (NVLS): Free Stock Analysis Report

To read this article on Zacks.com click here.

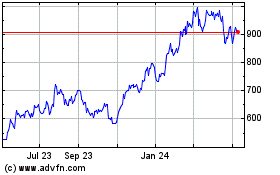

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

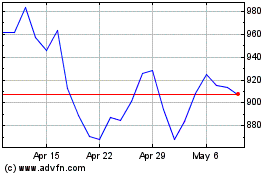

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2023 to Jul 2024