The Semiconductor Industry serves as a driver, enabler and

indicator of technological progress. Developments in the industry

determine the way we work, transport ourselves, communicate,

entertain ourselves and respond to our environment. The PCs we work

on, the cars we drive, the phones we communicate with, the

electronic gadgets on which we watch movies, listen to music and

play games on, and the planes and weapons used to transport or

protect us use semiconductor devices.

As environmental issues have become more of a concern today,

semiconductor devices are being made to reduce power consumption,

reduce heat dissipation, capture solar energy, create more

efficient lighting solutions and so forth.

The past decade has seen big changes in the industry, with most

players streamlining operations and transferring more routine

production to low-cost locations. This led to the development of

the Asian market, where most memory production and backend

operations have shifted.

2011 Dampened by Natural Disasters

While 2010 benefited from pent-up demand, 2011 was expected to gain

from the growing popularity of mobile devices. However, growth in

the first half was tempered by the tsunami and earthquake in Japan,

while that in the second was affected by the flooding in

Thailand.

As a result, expectations continued to trend down right through the

year. The SIA was originally looking for a growth of around 6% in

2011, which dropped a notch to 5.4% by mid-year. However, in

December, growth expectations slipped to 1.3%.

The SIA stated that the industry grew modestly in the first half

(up 3.7%), naming the corporate refresh cycle, smartphone growth,

and increased spending on IT infrastructure as the main drivers

that were partially offset by cautious consumer spending and the

disaster in Japan. Increased use of semiconductors in all

end-markets and particularly in the automotive market will drive

semiconductor sales, according to the SIA.

However, the typical second-half pickup was not strong enough,

mainly because this generally comes from back-to-school and

holiday-driven spending for consumer and mobile computing devices.

However, consumers bought less enthusiastically this year than in

past years, due to fears of the recession continuing. Second,

Europe continued to disappoint. Third, the flooding in Thailand

impacted HDD manufacturers, and the ripple effect impacted PC

manufacturers and thereby, semiconductor manufacturers.

iSuppli also cut expectations significantly from 4.6% to 2.9%.

Gartner expects 2011 sales growth of just 0.9% compared to its

previous expectation of 5.1%. Other research firms, such as VLSI,

IDC and IC Insights took down their estimates to 2.3%, 3.4% and 5%,

respectively.

Computing and Consumer Markets Remain Biggest

Drivers

These two end-markets together consume around 60% of total

semiconductors sold. Therefore, they have the ability to

significantly influence total sector performance.

Computing

A number of factors, in combination, are bringing about a complete

turnaround in the computing market. Although developed markets

continue to show signs of maturing, worsened by commoditization and

corresponding pricing pressures, there are some points of

encouragement as well.

Microsoft Corp’s (MSFT) Windows 7 continues to

drive sales at enterprise customers, while Windows 8 is expected to

speed up adoption of mobile devices. Even with operating systems,

such as Apple Inc’s (AAPL) Macintosh platform

gaining popularity, and cloud alternatives such as Google

Inc.’s (GOOG) Chrome coming to market, Windows 7 adoption

rates have held up relatively well.

Second, Apple’s run of success is a big driver, since the Macintosh

OS runs on Apple devices alone, which means more hardware and

consequently, more semiconductor devices being sold. Third, with

the advent of less sophisticated and ultra mobile devices

(netbooks, tablets and now, ultrabooks), the market continues to

expand. Fourth, increased computerization in emerging markets, such

as China, India, Brazil and Russia is emerging as one of the

strongest drivers of growth in this market.

Perhaps the biggest driver of business is the growth in the data

center segment, which has increased focus on servers, storage and

networking equipment that consume semiconductors of the high-end

variety. The cost advantages of moving to the cloud are encouraging

many small and medium-sized businesses, as well as some large

organizations to transfer either a part or the whole of their

operations to the cloud. We expect this change to be a major driver

of growth for the industry in the foreseeable future.

The main negative for the computing market is the cannibalization

by tablets, which are in the nature of consumer devices with

computing functions. This is pulling down spending on core

computing (PCs, notebooks and netbooks).

Consumer Electronics

With ultra-portable computing devices gaining popularity, the

distinction between consumer and computing is blurring in some

cases. Of course, the consumer electronics market also includes

other gadgets such as LCD TVs, Blu-ray players and smartphones.

The problem with this segment being a major driver of revenue is

its inherently low margins. Competition is fierce and aggressive

pricing is the rule of the day. Since semiconductors made for

consumer goods are in the nature of components, there is

ever-increasing pressure on their prices that correspondingly

squeeze margins.

The Consumer Electronics Association (CEA) is not very optimistic

about consumer electronics sales this year. While it expects the

overall growth rate to be around 5%, most categories are expected

to slow down. Smartphones, with an expected growth rate of 22%, are

expected to save the day. Tablets and e-readers are expected to

help again this year with double-digit growth rates.

While the CEA did not provide details for all products, it did

mention that TVs would be relatively flat this year with growth if

any expected to come from emerging markets. Approximately 50% of

TVs sold in the U.S. will be connected compared to 12% in 2011.

Consumer confidence in the U.S. economy touched bottom in the

second half of 2010, although trends indicate that the recovery is

slow and very gradual. Despite the much lower unemployment rate,

consumers remained decidedly cautious in both the 2010 and 2011

holiday seasons. An offsetting factor has been the individual

buying habits that continue to favor electronic gadgets as holiday

gifts. The trend may be expected to continue, which is a positive

for semiconductors serving the market.

Other Markets

Communications infrastructure spending is not likely to exceed 3-4%

this year, as carriers cut investments despite growing traffic.

While technology upgrades should continue, carrier spending in

Europe will be impacted by fears of a recession, while in the U.S.,

growth could taper off following several years of strong spending.

Chinese players are likely to keep the pressure on the pricing

side.

Automotive chipmakers should see good growth over the next few

years. While the recession and natural disaster in Japan have

severely impacted these players in the last few years, there are

signs of growth in both the U.S. and Europe. However, we may see

some changes in days to come, since nearly a fifth of vehicle

production has moved to China and we may expect more to follow.

Perhaps the biggest driver of growth for automotive chip

manufacturers is the increasing electronic content per vehicle,

driven by the need for fuel efficiency, entertainment and automated

navigation. With electronic stability control becoming mandatory in

the U.S., there should be sustained demand for enabling

devices.

Additionally, microcontrollers for engine functions and

transmission controls are becoming more popular, since they

increase the efficiency of automobiles and make them more

eco-friendly. Infineon Technologies, Renesas Electronics, Freescale

Semiconductor and Texas Instruments are the major beneficiaries

here. Linear Technologies has also increased its exposure to the

automotive segment, so it should gain from the growth in the

market.

Medical Devices is an upcoming area and adoption of semiconductors

in this market may be expected to accelerate over time.

The aerospace and defense markets are considerably dependent on

government spending and policy making. The commercial aerospace

market (which lags an economic downturn or recovery) continues to

strengthen, as passenger and cargo traffic continue to

increase.

The outlook for defense spending, on the other hand, is not as

bright. The focus on terrorist activity remains, so spending on

intelligence systems and basic weaponry is stronger. A longer-term

driver for semiconductor manufacturers is the growing importance of

electronic weaponry. So semiconductor manufacturers serving these

markets continue to see mixed results, depending on the customers

served.

Near-Term Outlook

We see continued inventory rebalancing over the next few months,

which will negatively impact suppliers to the computing market.

Additionally, cannibalization of traditional computing devices

should continue through the year. Therefore, this end-market will

have a significant negative impact on the industry. Consumer

devices, such as TVs will be another area of softness.

However, other consumer devices, such as tablets and smartphones,

will consume a large number of ICs. The automotive market will be a

positive force this year.

Memory manufacturers should do well again this year, although it

will continue to be a difficult year for DRAM (currently in

oversupply). Logic should do well.

Ever Smaller & More Powerful

The demand for greater functionality in smaller and more power

efficient gadgets is leading to greater integration within the

semiconductor device. This is leading to increased demand for the

system-on-a-chip (SoC), which is a single device incorporating a

microprocessor, digital signal processor or graphics core, as well

as memory and logic.

Major Players

The major players in the industry may be broadly categorized into

chipmakers (OEMs-whether fabless or otherwise), equipment and

material suppliers, and foundries.

Chip-makers

According to preliminary estimates from IHS iSuppli, Intel

Corp (INTC) and Samsung remained the top two semiconductor

suppliers in 2011, while Texas Instruments (TXN)

overtook Toshiba Corp. to attain the number three position (helped

by the National Semiconductor acquisition).

Renesas remained at number 5, followed by Qualcomm

(QCOM), which moved up from the ninth position in 2010.

STMicroelectronics (STM) remained at number 7,

with Hynix, Micron Technologies (MU) and

Broadcom (BRCM) in the eighth, ninth and tenth

positions. Applied Micro Devices (AMD) crept up

from number 12 to number 11.

Equipment Makers

Gartner estimates that semiconductor equipment sales by the top ten

suppliers increased 2% in 2010, following a 38% decline in 2009,

accounting for 63.4% of total equipment sales. The overall

equipment market is estimated to have increased 143% to around $41

billion in 2010. Automated test equipment (ATE) was the strongest

segment (up 149%), wafer fab equipment (WFE) was close behind with

a growth rate of 145%, while packaging assembly equipment (PAE) was

third, having grown 127%.

The very strong growth may be traced to a particularly weak 2009,

when the recession impacted demand for semiconductors and capital

spending was minimized. In this environment also, Applied

Materials (AMAT) easily maintained its number one

position, followed by ASML Holdings N.V. (ASML)

and Tokyo Electron Ltd in that order. Lam Research

Corp (LRCX), KLA-Tencor (KLAC) Dainippon,

Teradyne, Inc (TER), ASM

International (ASMI) Nikon and Novellus Systems,

Inc. (NVLS) were the others in the top 10.

The 2011 estimates are not available yet. Exposure to the solar

market and acquisitions will account for most of the changes in the

top 10.

Foundries

The Foundry segment has undergone significant changes over the past

few years and the top five positions have changed again, according

to research from IC Insights. Although Taiwan Semiconductor

Manufacturing Company (TSM) remains the leader by far,

followed by Taiwan-based United Microelectronics

Corp (UMC), GlobalFoundries has now taken the third

position in the pureplay segment, pushing the Chinese foundry

Semiconductor Manufacturing International Corp

(SMI) to the fourth position.

Also, specialty foundry Tower Semiconductor (TSEM)

has jumped to the fifth position. A few clear leaders are emerging

in the foundry segment – Taiwan Semiconductor at the trailing edge,

GlobalFoundries at the leading edge and Tower Semiconductor in the

specialty category (analog). Additionally, Intel and Texas

Instruments’ foundries make them two strong contenders with leading

edge capabilities.

OPPORTUNITIES

Manufacturing digital ICs is expensive, as it requires

state-of-the-art technology and processes. On the other hand,

digital products are cheaper, so cost recovery is more difficult.

This has led to specialization in the industry and a greater

contribution from Asian manufacturers. However, a significant

portion of the intellectual property remains with the domestic

companies.

One of the primary beneficiaries of the growth in mobile phones,

tablets and the like is ARM Holdings (ARMH), with

its power-efficient low-performance chip architecture that

dominates the growing mobile phone and tablet markets. With new

versions of ARM chips coming to market, it is likely that the chips

will gradually spread to the server segment as well (probably not a

2012 phenomenon).

Others would be Qualcomm, Samsung and Texas Instruments, all of

which are big semiconductor manufacturers that also use ARM

architecture. As such, we remain relatively positive about these

companies in 2012.

We are also optimistic about Intel and AMD, given their focus on

the data center segment. Although we are a wee bit cautious on

Intel’s growth initiatives in mobile and believe that execution

will be key to delivering on its plans. The company’s market

position, cash balance, technology lead, and management strategy

and execution are positives in our opinion.

AMD is also worth watching, as management has been delivering on

its promises. Moreover, the company is seeing some real success in

its graphics business, which should complement initiatives targeted

at rationalizing its debt, increasing focus on R&D and

operation of a lower-cost model.

The analog and mixed-signal market is dependent on innovation.

Consequently, these products generate higher margins than digital

products. They are also more customized and have longer life

cycles. These advantages are not lost on U.S. players, so the

number of companies entering the market is on the rise.

Our favorites in this area include Texas Instruments,

Analog Devices (ADI) and ON

Semiconductor (ONNN). Also, while some companies, such as

Linear Technologies (LLTC), Semtech

Corp (SMTC), Intersil Corp (ISIL)

and Maxim Integrated Products (MXIM) will have

mixed performances given their varied dependence on the auto

market, they are, for the most part, highly diversified,

high-margin businesses.

Linear and Maxim have also reduced their dependence on the

computing market, which we see as a positive in the near term. We

believe these companies will generate moderate growth in 2012.

WEAKNESSES

We believe that 2012 will be a transitional year, with inventory

rebalancing and adjustment. Given the uncertainties in demand, we

think that semiconductor manufacturers will curtail investment in

capacity although technology purchases could continue. DRAM

inventory remains in excess although NAND and NOR are slightly

better off.

In this environment, we would avoid investment in equipment

companies, such as Applied Materials, KLA-Tencor, Lam Research,

etc. We particularly discourage investment in Applied Materials at

this time because of its exposure to solar, where there is

significant oversupply and resultant pricing pressure.

The foundry segment will also have a moderate year (at best). The

Thailand flooding and resultant weakness in the PC market and soft

consumer spending increases risks in our opinion. We therefore

continue to believe that investors should treat foundries, such as

Taiwan Semiconductor, United Microelectronics, and Semiconductor

Manufacturing International with caution.

We also remain cautious about companies with relatively weak

financials, such as Exar Corp (EXAR) and

FormFactor (FORM). For instance, FORM continues to

burn cash despite the relatively strong demand for its specialized

probe cards. It also has significant customer and market

concentration that increase execution risks.

APPLE INC (AAPL): Free Stock Analysis Report

APPLD MATLS INC (AMAT): Free Stock Analysis Report

ADV MICRO DEV (AMD): Free Stock Analysis Report

ASML HOLDING NV (ASML): Free Stock Analysis Report

BROADCOM CORP-A (BRCM): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

KLA-TENCOR CORP (KLAC): Free Stock Analysis Report

LAM RESEARCH (LRCX): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

MICRON TECH (MU): Free Stock Analysis Report

QUALCOMM INC (QCOM): Free Stock Analysis Report

STMICROELECTRON (STM): Free Stock Analysis Report

TERADYNE INC (TER): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

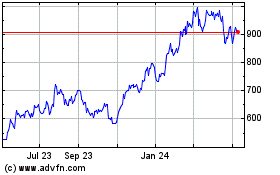

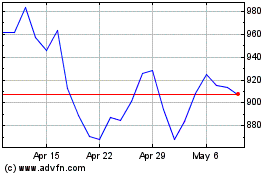

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2023 to Jul 2024