JD.com, Inc. (NASDAQ: JD and HKEX: 9618 (HKD counter) and 89618

(RMB counter)), a leading supply chain-based technology and service

provider, today announced its unaudited financial results for the

three months ended September 30, 2023.

Third Quarter 2023

Highlights

- Net

revenues for the third quarter of 2023 were RMB247.7

billion (US$134.0 billion), an increase of 1.7% from the third

quarter of 2022.

- Income

from operations for the third quarter of 2023 was RMB9.3

billion (US$1.3 billion), compared to RMB8.7 billion for the same

period last year. Non-GAAP2

income from operations was RMB11.1 billion (US$1.5

billion) for the third quarter of 2023, as compared to RMB9.9

billion for the third quarter of 2022. Operating margin of JD

Retail before unallocated items for the third quarter of 2023 was

5.2%, maintained the same level as the third quarter of 2022.

- Net

income attributable to the company’s ordinary shareholders

for the third quarter of 2023 was RMB7.9 billion (US$1.1 billion),

compared to RMB6.0 billion for the same period last year.

Non-GAAP net income attributable to the company’s ordinary

shareholders for the third quarter of 2023 was RMB10.6

billion (US$1.5 billion), as compared to RMB10.0 billion for the

same period last year.

- Diluted

net income per ADS for the third quarter of 2023 was

RMB5.00 (US$0.69), compared to RMB3.57 for the third quarter of

2022. Non-GAAP diluted net income per ADS for the

third quarter of 2023 was RMB6.70 (US$0.92), compared to RMB6.27

for the same period last year.

-

Operating cash flow for the twelve months ended

September 30, 2023 was RMB58.4 billion (US$8.0 billion), compared

to RMB45.8 billion for the twelve months ended September 30, 2022.

Free cash flow, which excludes the impact from JD

Baitiao receivables included in the operating cash flow, for the

twelve months ended September 30, 2023 was RMB39.4 billion (US$5.4

billion), compared to RMB25.8 billion for the twelve months ended

September 30, 2022.

“We reported steady top-line performance for the

quarter with record profitability driven by our proactive efforts

on enhancing price competitiveness and platform ecosystem, as well

as our supply chain advantages,” said Sandy Xu, Chief Executive

Officer of JD.com. “We continue to be encouraged by the progress we

are making, as evidenced by further expanded merchant base and

improved user shopping behavior. With our clear strategy to deliver

value for users and business partners, and a value proposition that

is optimized for the future, I am confident that JD.com is well

positioned for long-term sustainable growth.”

“JD’s record profitability for the quarter and

healthy cash flow reflects our successful business evolvement and

supply chain strengths,” said Ian Su Shan, Chief Financial Officer

of JD.com. “We also see our core categories of home appliance and

electronics continued to expand market share, while general

merchandise gradually ramped up momentum in the quarter, as we

relentlessly focus on user experience. More importantly, China’s

consumers are increasingly seeing JD as the place to shop for a

great selection of quality products with the lowest prices and best

service. Looking ahead, we will continue to manage for high-quality

growth while investing in user experience and building a superior

ecosystem to drive sustainable growth for our merchants and

suppliers.”

Business Highlights

Environment, Social and

Governance

- In the 2023

Standard & Poor’s Global Corporate Sustainability Assessment

(“CSA”), JD.com showcased outstanding ESG performance with a

meaningful increase of 65% in the CSA score compared to the prior

year, ranking at an industry-leading level in China’s retail

sector. This achievement is mainly attributable to JD.com’s great

attention and unremitting efforts on ESG initiatives, including

establishing its board diversity policy and onboarding more female

directors, publishing a code of conduct for suppliers, enhancing

supply chain management, strengthening occupational health and

safety, and reinforcing its business ethics regime and training,

among others.

- In the third

quarter, JD.com dedicated itself to disaster relief to support

those affected by floods in Beijing, Hebei province and other

areas. JD Foundation donated RMB30 million worth of essential

supplies to the affected areas. Meanwhile, JD.com fully leveraged

its supply chain capabilities to ensure the efficient delivery of

necessities to help local enterprises and residents resume their

normal operations and daily lives. JD.com also provided tailored

services and exemption policies for businesses in the affected

areas.

- In the third

quarter, JD.com collaborated with Gree, Midea, Haier, Kingkoil,

Jomoo and other home appliances and home goods brands to launch the

Green Trade-in Alliance to accelerate the promotion and adoption of

trade-in programs and to inspire more consumers to embrace a

greener lifestyle. According to an assessment issued in August by

the Beijing Green Exchange, a professional market platform for

trading various environmental equities, from July 2022 to June

2023, JD.com cumulatively reduced carbon emissions of approximately

154,800 tons through trade-in services of eight home appliances and

home goods categories. The reduction is equivalent to saving about

60,000 tons of coal consumption or planting 20 million additional

trees for the earth.

- Driven by JD.com’s

unwavering commitment and unremitting efforts to creating more jobs

and making contribution to the society, the company’s total

expenditure for human resources, including both its own employees

and external personnel who work for the company, amounted to

RMB25.9 billion and RMB76.3 billion for the three months and the

nine months ended September 30, 2023, respectively.

JD Retail

- During the third

quarter, JD.com continued to make progress and achieved promising

preliminary results in its strategies of building a differentiated

platform ecosystem and improving price competitiveness, both of

which are realizing the company’s operating philosophy since its

foundation, namely, to achieve a high-quality sustainable growth

and value creation through relentless pursuit of “lower cost,

higher efficiency, and superior customer experience.” The company

witnessed accelerated expansion of onboarded and active merchants,

both reaching historical highs, along with continued year-on-year

growth in both 3P orders and 3P active customers in the quarter. In

addition, the company’s customer engagement further improved with

growing user order frequency, and its Net Promoter Score (NPS) also

increased year-on-year and sequentially in the quarter.

- In August, JD.com

announced the reduction of the threshold for free shipping services

for its 1P merchandise, with support of JD Logistics’s

capabilities. Under the new initiative, JD PLUS members now enjoy

unlimited free shipping when they purchase 1P merchandise, and

non-JD PLUS members’ free shipping minimum order value is lowered

to RMB59 from RMB99. As always, customers of JD.com will continue

to enjoy premium logistics services with same and next-day delivery

options.

- In the third

quarter, JD.com established a strategic partnership with the

leading Italian luxury brand GUCCI, which launched its official

flagship store on JD’s platform. DE BEERS, a high-end diamond

jewelry brand from London, also opened its official flagship store

on JD’s platform during the quarter. In addition, French luxury

fashion group SMCP officially onboarded JD’s platform, with its

fashion brands SANDRO, MAJE, and CLAUDIE PIERLOT opening flagship

stores on JD’s platform. JD.com also welcomed leading beauty and

cosmetics brands such as VALENTINO BEAUTY and URBAN DECAY in the

quarter. JD.com remains committed to providing consumers with

higher-quality and diversified products through continuous

expansion in its collaborative brand lineups, merchandise selection

and new product launch in the fashion field.

- In the third

quarter, JD.com announced to open three city-level home appliances

and electronics flagship stores in Shanghai, and launched two JD

MALLs in Ningbo and Wuhan, respectively. These efforts aim to bring

consumers a new one-stop shopping experience for home appliances

and home goods, and further invigorate “home scenario” consumption

market by fostering stronger synergies across the home appliances,

home goods, and home furnishings industries. In addition, JD.com

continued to strengthen its omni-channel strategy in 3C and

electronics category, promoting the launch of 47 JD Home and JD

Computer and Digital stores in the quarter.

JD Health

- In the third

quarter, JD Health continued to expand its healthcare service

offerings, providing users with a more comprehensive and online and

offline integrated experience. Its polyclinic center in Yizhuang,

Beijing officially commenced operations. Leveraging JD Health’s

digital capabilities, the polyclinic center integrates online and

offline services, offering users a completely paperless experience

with online medical examination report access and interpretation,

follow-up consultations and other professional medical advice.

JD Logistics

- In the third

quarter, a JD Airlines all-cargo aircraft smoothly landed at Tan

Son Nhat Airport in Ho Chi Minh City, Vietnam from Shenzhen

Airport, and returned with full cargo. This marked the inauguration

of JD Airlines’ new international all-cargo route between Shenzhen

and Ho Chi Minh City, a step further in its expansion of

international air cargo network.

- As of September 30,

2023, JD Logistics operated over 1,600 warehouses. Including

warehouse space managed through the Open Warehouse Platform, JD

Logistics’s warehouse network had an aggregate gross floor area of

over 32 million square meters.3

Dada

- In the third

quarter, JD.com released a “Three-kilometer Model” for its

on-demand retail services. This model is built upon three core

capabilities of digitalization, local supply chain integration and

instant delivery, and provides users within 3 to 5 kilometers with

a seamless experience of “online ordering, offline shipping, and

one-hour delivery”. In addition, a “Five-year Action Plan” was also

launched, under which JD.com’s on-demand retail services will

facilitate the digital transformation of over 2 million local small

and medium-sized offline stores, create over 10 million flexible

employment opportunities and collaborate with ecosystem partners to

generate over RMB1 trillion worth of consumption in the next five

years.

- In the third

quarter, JD Daojia (JDDJ), one of China’s largest local on-demand

retail platforms for retailers and brand owners, upgraded its

service and launched its delivery fee waiver campaign, covering

orders over RMB59 in more than 2,200 counties and cities across

China. The campaign provides consumers with a more affordable and

seamless on-demand shopping experience across all categories.

Third Quarter 2023 Financial

Results

Net Revenues. For the

third quarter of 2023, JD.com reported net revenues of RMB247.7

billion (US$34.0 billion), representing a 1.7% increase from the

same period of 2022. Net product revenues decreased by 0.9%, while

net service revenues increased by 12.7% for the third quarter of

2023, as compared to the same period of 2022.

Cost of

Revenues. Cost of revenues increased

by 0.8% to RMB208.9 billion (US$28.6 billion) for the third quarter

of 2023 from RMB207.3 billion for the third quarter of 2022.

Fulfillment

Expenses. Fulfillment expenses,

which primarily include procurement, warehousing, delivery,

customer service and payment processing expenses, increased by 6.1%

to RMB15.2 billion (US$2.1 billion) for the third quarter of 2023

from RMB14.4 billion for the third quarter of 2022. Fulfillment

expenses as a percentage of net revenues was 6.1% for the third

quarter of 2023, compared to 5.9% for the same period last year.

The increase was in relation to the adoption of lower threshold for

free shipping services.

Marketing

Expenses. Marketing expenses

increased by 4.6% to RMB8.0 billion (US$1.1 billion) for the third

quarter of 2023 from RMB7.6 billion for the third quarter of 2022,

marketing expenses as a percentage of net revenues was 3.2% for the

third quarter of 2023, compared to 3.1% for the same period last

year. The increase was mainly due to the increased spending in

promotion activities.

Research and Development

Expenses. Research and development

expenses decreased by 7.8% to RMB3.8 billion (US$0.5 billion) for

the third quarter of 2023 from RMB4.1 billion for the third quarter

of 2022. Research and development expenses as a percentage of net

revenues was 1.5% for the third quarter of 2023, compared to 1.7%

for the same period last year.

General and Administrative

Expenses. General and administrative

expenses decreased by 5.6% to RMB2.5 billion (US$0.3 billion) for

the third quarter of 2023 from RMB2.6 billion for the third quarter

of 2022. General and administrative expenses as a percentage of net

revenues was 1.0% for the third quarter of 2023, compared to 1.1%

for the same period last year.

Income from Operations and Non-GAAP

Income from Operations. Income from operations for

the third quarter of 2023 increased by 6.6% to RMB9.3 billion

(US$1.3 billion) from RMB8.7 billion for the same period last year.

Operating margin for the third quarter of 2023 was 3.8%, compared

to 3.6% for the third quarter of 2022. Non-GAAP income from

operations increased by 11.8% to RMB11.1 billion (US$1.5 billion)

for the third quarter of 2023 from RMB9.9 billion for the third

quarter of 2022. Non-GAAP operating margin for the third quarter of

2023 was 4.5%, compared to 4.1% for the third quarter of 2022.

Operating margin of JD Retail before unallocated items for the

third quarter of 2023 was 5.2%, maintained the same level as the

third quarter of 2022.

Non-GAAP EBITDA. Non-GAAP

EBITDA increased by 12.4% to RMB12.9 billion (US$1.8 billion) for

the third quarter of 2023 from RMB11.5 billion for the third

quarter of 2022. Non-GAAP EBITDA margin for the third quarter of

2023 was 5.2%, compared to 4.7% for the third quarter of 2022.

Others, net. Other

non-operating income was RMB1.8 billion (US$0.2 billion) for the

third quarter of 2023, as compared to a loss of RMB0.8 billion for

the third quarter of 2022. The change was primarily due to the

decrease in net losses arising from fair value change of investment

securities.

Net Income Attributable

to the Company’s Ordinary Shareholders and

Non-GAAP Net Income Attributable to the Company’s

Ordinary Shareholders. Net income

attributable to the company’s ordinary shareholders for the third

quarter of 2023 increased by 33.1% to RMB7.9 billion (US$1.1

billion) from RMB6.0 billion for the same period last year. Net

margin attributable to the company’s ordinary shareholders for the

third quarter of 2023 was 3.2%, compared to 2.4% for the third

quarter of 2022. Non-GAAP net income attributable to the company’s

ordinary shareholders for the third quarter of 2023 increased by

5.9% to RMB10.6 billion (US$1.5 billion) from RMB10.0 billion for

the same period last year. Non-GAAP net margin attributable to the

company’s ordinary shareholders for the third quarter of 2023 was

4.3%, compared to 4.1% for the third quarter of 2022.

Diluted EPS and Non-GAAP Diluted

EPS. Diluted net income per ADS for the third quarter

of 2023 increased by 40.3% to RMB5.00 (US$0.69) from RMB3.57 for

the third quarter of 2022. Non-GAAP diluted net income per ADS for

the third quarter of 2023 increased by 6.9% to RMB6.70 (US$0.92)

from RMB6.27 for the third quarter of 2022.

Cash Flow and Working Capital

As of September 30, 2023, the company’s cash and

cash equivalents, restricted cash and short-term investments

totaled RMB250.3 billion (US$34.3 billion), compared to RMB226.2

billion as of December 31, 2022. For the third quarter of 2023,

free cash flow of the company was as follows:

|

|

|

For the three months ended |

|

|

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

|

|

RMB |

RMB |

US$ |

|

|

|

(In millions) |

|

|

|

|

|

Net cash provided by operating activities |

|

9,151 |

|

15,004 |

|

2,056 |

|

| Less: Impact from JD Baitiao

receivables included in the operating cash flow |

|

(1,506 |

) |

(1,747 |

) |

(239 |

) |

| Less: Capital expenditures,

net of related sales proceeds |

|

|

|

|

|

Capital expenditures for development properties |

|

(3,784 |

) |

(3,013 |

) |

(413 |

) |

|

Other capital expenditures* |

|

(1,522 |

) |

(1,980 |

) |

(271 |

) |

| Free cash flow |

|

2,339 |

|

8,264 |

|

1,133 |

|

|

|

|

|

|

|

* Including capital expenditures related to the

company’s headquarters in Beijing and all other CAPEX.

Net cash provided by investing activities was

RMB15.0 billion (US$2.1 billion) for the third quarter of 2023,

consisting primarily of the decrease in short-term investments,

partially offset by the cash paid for capital expenditures.

Net cash used in financing activities was RMB4.5

billion (US$0.6 billion) for the third quarter of 2023, consisting

primarily of repayments of bank loans.

For the twelve months ended September 30, 2023,

free cash flow of the company was as follows:

|

|

|

For the twelve months ended |

|

|

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

|

|

RMB |

RMB |

US$ |

|

|

|

(In millions) |

|

|

|

|

|

Net cash provided by operating activities |

|

45,805 |

|

58,394 |

|

8,004 |

|

| (Less)/Add: Impact from JD

Baitiao receivables included in the operating cash flow |

|

(137 |

) |

451 |

|

62 |

|

| Less: Capital expenditures,

net of related sales proceeds |

|

|

|

|

|

Capital expenditures for development properties |

|

(15,274 |

) |

(13,618 |

) |

(1,867 |

) |

|

Other capital expenditures |

|

(4,551 |

) |

(5,831 |

) |

(799 |

) |

| Free cash flow |

|

25,843 |

|

39,396 |

|

5,400 |

|

| |

|

|

|

|

Supplemental Information

The company reports four segments, JD Retail, JD

Logistics, Dada and New businesses. JD Retail, including JD Health

and JD Industrials, among other components, mainly engage in online

retail, online marketplace and marketing services in China. JD

Logistics includes both internal and external logistics businesses.

Dada is a local on-demand delivery and retail platform in China.

New businesses mainly include JD Property, Jingxi and overseas

businesses.

The table below sets forth the segment operating

results:

|

|

For the three months ended |

|

For the nine months ended |

|

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

|

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

|

|

(In millions, except percentage data) |

| Net revenues: |

|

|

|

|

|

|

|

|

JD Retail |

211,923 |

|

212,059 |

|

29,065 |

|

|

671,004 |

|

677,697 |

|

92,886 |

|

|

JD Logistics |

35,771 |

|

41,663 |

|

5,710 |

|

|

94,394 |

|

119,424 |

|

16,368 |

|

|

Dada |

2,380 |

|

2,867 |

|

393 |

|

|

5,349 |

|

8,254 |

|

1,131 |

|

|

New businesses |

4,997 |

|

3,818 |

|

523 |

|

|

17,018 |

|

11,584 |

|

1,588 |

|

|

Inter-segment eliminations * |

(11,536 |

) |

(12,709 |

) |

(1,741 |

) |

|

(36,975 |

) |

(38,374 |

) |

(5,259 |

) |

| Total consolidated net

revenues |

243,535 |

|

247,698 |

|

33,950 |

|

|

750,790 |

|

778,585 |

|

106,714 |

|

|

|

|

|

|

|

|

|

|

| Operating income/(loss): |

|

|

|

|

|

|

|

|

JD Retail |

10,926 |

|

11,001 |

|

1,508 |

|

|

26,990 |

|

28,988 |

|

3,973 |

|

|

JD Logistics |

253 |

|

288 |

|

39 |

|

|

(372 |

) |

(325 |

) |

(45 |

) |

|

Dada |

(300 |

) |

(52 |

) |

(7 |

) |

|

(915 |

) |

(298 |

) |

(41 |

) |

|

New businesses |

276 |

|

(140 |

) |

(20 |

) |

|

(4,143 |

) |

764 |

|

105 |

|

|

Including: gain on sale of development properties |

1,229 |

|

— |

|

— |

|

|

1,229 |

|

1,481 |

|

203 |

|

| Total segment

operating income |

11,155 |

|

11,097 |

|

1,520 |

|

|

21,560 |

|

29,129 |

|

3,992 |

|

| Unallocated items** |

(2,427 |

) |

(1,794 |

) |

(245 |

) |

|

(6,665 |

) |

(5,129 |

) |

(703 |

) |

| Total consolidated

operating income |

8,728 |

|

9,303 |

|

1,275 |

|

|

14,895 |

|

24,000 |

|

3,289 |

|

|

|

|

|

|

|

|

|

|

| Operating margin: |

|

|

|

|

|

|

|

|

JD Retail |

5.2 |

% |

5.2 |

% |

5.2 |

% |

|

4.0 |

% |

4.3 |

% |

4.3 |

% |

|

JD Logistics |

0.7 |

% |

0.7 |

% |

0.7 |

% |

|

(0.4 |

)% |

(0.3 |

)% |

(0.3 |

)% |

|

Dada |

(12.6 |

)% |

(1.8 |

)% |

(1.8 |

)% |

|

(17.1 |

)% |

(3.6 |

)% |

(3.6 |

)% |

|

New businesses |

5.5 |

% |

(3.7 |

)% |

(3.7 |

)% |

|

(24.3 |

)% |

6.6 |

% |

6.6 |

% |

* The inter-segment eliminations mainly consist

of revenues from supply chain solutions and logistics services

provided by JD Logistics to JD Retail, on-demand delivery and

retail services provided by Dada to JD Retail and JD Logistics, and

property leasing services provided by JD Property to JD

Logistics.

** Unallocated items include share-based

compensation, amortization of intangible assets resulting from

assets and business acquisitions, effects of business cooperation

arrangements, and impairment of goodwill and intangible assets,

which are not allocated to segments.

The tables below set forth the revenue

information:

|

|

For the three months ended |

|

|

|

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

YoY%change |

|

|

|

RMB |

RMB |

US$ |

|

|

|

|

(In millions, except percentage data) |

|

|

Electronics and home appliances revenues |

119,284 |

119,316 |

16,354 |

0.0 |

% |

|

| General merchandise

revenues |

77,743 |

75,988 |

10,415 |

(2.3 |

)% |

|

| Net product revenues |

197,027 |

195,304 |

26,769 |

(0.9 |

)% |

|

|

|

|

|

|

|

|

| Marketplace and marketing

revenues |

18,954 |

19,529 |

2,677 |

3.0 |

% |

|

| Logistics and other service

revenues |

27,554 |

32,865 |

4,504 |

19.3 |

% |

|

| Net service revenues |

46,508 |

52,394 |

7,181 |

12.7 |

% |

|

|

|

|

|

|

|

|

|

Total net revenues |

243,535 |

247,698 |

33,950 |

1.7 |

% |

|

|

|

|

|

|

|

|

|

|

For the nine months ended |

|

|

|

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

YoY%change |

|

|

|

RMB |

RMB |

US$ |

|

|

|

|

(In millions, except percentage data) |

|

| Electronics and home

appliances revenues |

374,270 |

388,446 |

53,241 |

3.8 |

% |

|

| General merchandise

revenues |

253,193 |

236,277 |

32,384 |

(6.7 |

)% |

|

| Net product revenues |

627,463 |

624,723 |

85,625 |

(0.4 |

)% |

|

| |

|

|

|

|

|

| Marketplace and marketing

revenues |

57,372 |

61,100 |

8,374 |

6.5 |

% |

|

| Logistics and other service

revenues |

65,955 |

92,762 |

12,715 |

40.6 |

% |

|

| Net service revenues |

123,327 |

153,862 |

21,089 |

24.8 |

% |

|

| |

|

|

|

|

|

| Total net revenues |

750,790 |

778,585 |

106,714 |

3.7 |

% |

|

|

|

|

|

|

|

|

Adoption of 2023 Share Incentive Plan

As a renewal of the existing share incentive

plan (the “Existing Plan”), the company’s board of directors and

the compensation committee have approved the adoption of a 2023

Share Incentive Plan (the “2023 Plan”). Under the 2023 Plan, the

maximum aggregate number of Class A ordinary shares that may be

issued pursuant to the awards includes the unused balance of

223,666,717 shares as of October 31, 2023 under the Existing Plan

and the same mechanism of an annual increase by 1% of the total

number of ordinary shares outstanding of the company on the last

day of the immediately preceding fiscal year commencing with the

fiscal year ending on December 31, 2024. The 2023 Plan will become

effective on December 21, 2023 and will expire on the tenth

anniversary of its effective date.

Conference Call

JD.com’s management will hold a conference call

at 7:00 am, Eastern Time on November 15, 2023, (8:00 pm,

Beijing/Hong Kong Time on November 15, 2023) to discuss its

financial results for the three months ended September 30,

2023.

Please register in advance of the conference

using the link provided below and dial in 15 minutes prior to the

call, using participant dial-in numbers, the Passcode and unique

access PIN which would be provided upon registering. You will be

automatically linked to the live call after completion of this

process, unless required to provide the conference ID below due to

regional restrictions.

PRE-REGISTER LINK:

https://s1.c-conf.com/diamondpass/10034774-g1uv9e.html

CONFERENCE ID: 10034774

A telephone replay will be available for one

week until November 22, 2023. The dial-in details are as

follows:

|

US: |

+1-855-883-1031 |

|

International: |

+61-7-3107-6325 |

|

Hong Kong: |

800-930-639 |

|

Mainland China: |

400-120-9216 |

|

Passcode: |

10034774 |

Additionally, a live and archived webcast of the conference call

will also be available on the JD.com’s investor relations website

at http://ir.jd.com.

About JD.com

JD.com is a leading supply chain-based

technology and service provider. The company’s cutting-edge retail

infrastructure seeks to enable consumers to buy whatever they want,

whenever and wherever they want it. The company has opened its

technology and infrastructure to partners, brands and other

sectors, as part of its Retail as a Service offering to help drive

productivity and innovation across a range of industries.

Non-GAAP Measures

In evaluating the business, the company

considers and uses non-GAAP measures, such as non-GAAP

income/(loss) from operations, non-GAAP operating margin, non-GAAP

net income/(loss) attributable to the company’s ordinary

shareholders, non-GAAP net margin to the company’s ordinary

shareholders, free cash flow, non-GAAP EBITDA, non-GAAP EBITDA

margin, non-GAAP net income/(loss) per share and non-GAAP net

income/(loss) per ADS, as supplemental measures to review and

assess operating performance. The presentation of these non-GAAP

financial measures is not intended to be considered in isolation or

as a substitute for the financial information prepared and

presented in accordance with accounting principles generally

accepted in the United States of America (“U.S. GAAP”). The company

defines non-GAAP income/(loss) from operations as income/(loss)

from operations excluding share-based compensation, amortization of

intangible assets resulting from assets and business acquisitions,

effects of business cooperation arrangements, gain on sale of

development properties and impairment of goodwill and intangible

assets. The company defines non-GAAP net income/(loss) attributable

to the company’s ordinary shareholders as net income/(loss)

attributable to the company’s ordinary shareholders excluding

share-based compensation, amortization of intangible assets

resulting from assets and business acquisitions, effects of

business cooperation arrangements and non-compete agreements,

gain/(loss) on disposals/deemed disposals of investments and

others, reconciling items on the share of equity method

investments, loss/(gain) from fair value change of long-term

investments, impairment of goodwill, intangible assets and

investments, gain in relation to sale of development properties and

tax effects on non-GAAP adjustments. The company defines free cash

flow as operating cash flow adjusting the impact from JD Baitiao

receivables included in the operating cash flow and capital

expenditures, net of the proceeds from sale of development

properties. Capital expenditures include purchase of property,

equipment and software, cash paid for construction in progress,

purchase of intangible assets and land use rights. The company

defines non-GAAP EBITDA as non-GAAP income/(loss) from operations

plus depreciation and amortization excluding amortization of

intangible assets resulting from assets and business acquisitions.

Non-GAAP basic net income/(loss) per share is calculated by

dividing non-GAAP net income/(loss) attributable to the company’s

ordinary shareholders by the weighted average number of ordinary

shares outstanding during the periods. Non-GAAP diluted net

income/(loss) per share is calculated by dividing non-GAAP net

income/(loss) attributable to the company’s ordinary shareholders

by the weighted average number of ordinary shares and dilutive

potential ordinary shares outstanding during the periods, including

the dilutive effect of share-based awards as determined under the

treasury stock method. Non-GAAP net income/(loss) per ADS is equal

to non-GAAP net income/(loss) per share multiplied by two.

The company presents these non-GAAP financial

measures because they are used by management to evaluate operating

performance and formulate business plans. Non-GAAP income/(loss)

from operations, non-GAAP net income/(loss) attributable to the

company’s ordinary shareholders and non-GAAP EBITDA reflect the

company’s ongoing business operations in a manner that allows more

meaningful period-to-period comparisons. Free cash flow enables

management to assess liquidity and cash flow while taking into

account the impact from JD Baitiao receivables included in the

operating cash flow and the demands that the expansion of

fulfillment infrastructure and technology platform has placed on

financial resources. The company believes that the use of the

non-GAAP financial measures facilitates investors to understand and

evaluate the company’s current operating performance and future

prospects in the same manner as management does, if they so choose.

The company also believes that the non-GAAP financial measures

provide useful information to both management and investors by

excluding certain expenses, gain/loss and other items that are not

expected to result in future cash payments or that are

non-recurring in nature or may not be indicative of the company’s

core operating results and business outlook.

The non-GAAP financial measures have limitations

as analytical tools. The company’s non-GAAP financial measures do

not reflect all items of income and expense that affect the

company’s operations or not represent the residual cash flow

available for discretionary expenditures. Further, these non-GAAP

measures may differ from the non-GAAP information used by other

companies, including peer companies, and therefore their

comparability may be limited. The company compensates for these

limitations by reconciling the non-GAAP financial measures to the

nearest U.S. GAAP performance measure, all of which should be

considered when evaluating performance. The company encourages you

to review the company’s financial information in its entirety and

not rely on a single financial measure.

CONTACTS:

Investor RelationsSean Zhang+86

(10) 8912-6804IR@JD.com

Media Relations+86 (10)

8911-6155Press@JD.com

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates,” “confident” and

similar statements. Among other things, the quotations from

management in this announcement, as well as JD.com’s strategic and

operational plans, contain forward-looking statements. JD.com may

also make written or oral forward-looking statements in its

periodic reports to the U.S. Securities and Exchange Commission

(the “SEC”), in announcements made on the website of the Hong Kong

Stock Exchange, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about JD.com’s

beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: JD.com’s

growth strategies; its future business development, results of

operations and financial condition; its ability to attract and

retain new customers and to increase revenues generated from repeat

customers; its expectations regarding demand for and market

acceptance of its products and services; trends and competition in

China’s e-commerce market; changes in its revenues and certain cost

or expense items; the expected growth of the Chinese e-commerce

market; laws, regulations and governmental policies relating to the

industries in which JD.com or its business partners operate;

potential changes in laws, regulations and governmental policies or

changes in the interpretation and implementation of laws,

regulations and governmental policies that could adversely affect

the industries in which JD.com or its business partners operate,

including, among others, initiatives to enhance supervision of

companies listed on an overseas exchange and tighten scrutiny over

data privacy and data security; risks associated with JD.com’s

acquisitions, investments and alliances, including fluctuation in

the market value of JD.com’s investment portfolio; natural

disasters and geopolitical events; change in tax rates and

financial risks; intensity of competition; and general market and

economic conditions in China and globally. Further information

regarding these and other risks is included in JD.com’s filings

with the SEC and the announcements on the website of the Hong Kong

Stock Exchange. All information provided herein is as of the date

of this announcement, and JD.com undertakes no obligation to update

any forward-looking statement, except as required under applicable

law.

|

JD.com, Inc. |

|

Unaudited Interim Condensed Consolidated Balance Sheets |

|

(In millions, except otherwise noted) |

| |

|

|

| |

|

As of |

|

|

|

December 31,2022 |

September 30,2023 |

September 30,2023 |

| |

|

RMB |

RMB |

US$ |

|

ASSETS |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

78,861 |

115,971 |

15,895 |

|

Restricted cash |

|

6,254 |

7,897 |

1,082 |

|

Short-term investments |

|

141,095 |

126,382 |

17,322 |

|

Accounts receivable, net (including JD Baitiao of RMB3.1 billion

and RMB2.1 billion as of December 31, 2022 and September 30, 2023,

respectively)(1) |

|

20,576 |

20,705 |

2,838 |

|

Advance to suppliers |

|

3,838 |

3,388 |

464 |

|

Inventories, net |

|

77,949 |

64,638 |

8,859 |

|

Prepayments and other current assets |

|

15,156 |

13,995 |

1,918 |

|

Amount due from related parties |

|

6,142 |

4,632 |

635 |

|

Assets held for sale |

|

1,203 |

— |

— |

|

Total current assets |

|

351,074 |

357,608 |

49,013 |

|

Non-current assets |

|

|

|

|

|

Property, equipment and software, net |

|

55,080 |

66,649 |

9,135 |

|

Construction in progress |

|

11,161 |

9,760 |

1,338 |

|

Intangible assets, net |

|

9,139 |

8,156 |

1,118 |

|

Land use rights, net |

|

33,848 |

37,975 |

5,205 |

|

Operating lease right-of-use assets |

|

22,267 |

22,764 |

3,120 |

|

Goodwill |

|

23,123 |

23,123 |

3,169 |

|

Investment in equity investees |

|

57,641 |

57,893 |

7,935 |

|

Investment securities |

|

11,611 |

4,793 |

657 |

|

Deferred tax assets |

|

1,536 |

1,533 |

210 |

|

Other non-current assets |

|

18,770 |

27,139 |

3,721 |

|

Total non-current assets |

|

244,176 |

259,785 |

35,608 |

|

Total assets |

|

595,250 |

617,393 |

84,621 |

|

JD.com, Inc. |

|

Unaudited Interim Condensed Consolidated Balance Sheets |

|

(In millions, except otherwise noted) |

| |

|

|

| |

|

As of |

|

|

|

December 31,2022 |

September 30,2023 |

September 30,2023 |

| |

|

RMB |

RMB |

US$ |

|

LIABILITIES |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Short-term debts |

|

12,146 |

13,740 |

1,883 |

|

Accounts payable |

|

160,607 |

153,563 |

21,048 |

|

Advance from customers |

|

33,713 |

33,065 |

4,532 |

|

Deferred revenues |

|

3,351 |

2,275 |

312 |

|

Taxes payable |

|

5,926 |

9,206 |

1,262 |

|

Amount due to related parties |

|

488 |

159 |

22 |

|

Accrued expenses and other current liabilities |

|

42,570 |

42,333 |

5,802 |

|

Operating lease liabilities |

|

7,688 |

8,097 |

1,110 |

|

Liabilities held for sale |

|

72 |

— |

— |

|

Total current liabilities |

|

266,561 |

262,438 |

35,971 |

|

Non-current liabilities |

|

|

|

|

|

Deferred revenues |

|

1,107 |

1,026 |

141 |

|

Unsecured senior notes |

|

10,224 |

10,550 |

1,446 |

|

Deferred tax liabilities |

|

6,511 |

8,131 |

1,114 |

|

Long-term borrowings |

|

20,009 |

22,191 |

3,042 |

|

Operating lease liabilities |

|

14,978 |

15,280 |

2,094 |

|

Other non-current liabilities |

|

1,737 |

1,493 |

205 |

|

Total non-current liabilities |

|

54,566 |

58,671 |

8,042 |

|

Total liabilities |

|

321,127 |

321,109 |

44,013 |

|

|

|

|

|

|

|

MEZZANINE EQUITY |

|

590 |

603 |

83 |

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

Total JD.com, Inc. shareholders’ equity (US$0.00002 par value,

100,000 million shares authorized, 3,183 million shares issued and

3,147 million shares outstanding as of September 30, 2023) |

|

213,366 |

230,094 |

31,536 |

|

Non-controlling interests |

|

60,167 |

65,587 |

8,989 |

|

Total shareholders’ equity |

|

273,533 |

295,681 |

40,525 |

|

Total liabilities, mezzanine equity and shareholders’

equity |

|

595,250 |

617,393 |

84,621 |

|

|

|

|

|

|

| (1) JD Technology

performs credit risk assessment services for JD Baitiao business

and absorbs the credit risk of the underlying Baitiao receivables.

Facilitated by JD Technology, the company periodically securitizes

Baitiao receivables through the transfer of those assets to

securitization plans and derecognizes the related Baitiao

receivables through sales type arrangements. |

|

JD.com, Inc. |

|

Unaudited Interim Condensed Consolidated Statements of

Operations |

|

(In millions, except per share data) |

|

|

| |

For the three months ended |

|

For the nine months ended |

| |

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

| |

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

| Net

revenues |

|

|

|

|

|

|

|

|

Net product revenues |

197,027 |

|

195,304 |

|

26,769 |

|

|

627,463 |

|

624,723 |

|

85,625 |

|

|

Net service revenues |

46,508 |

|

52,394 |

|

7,181 |

|

|

123,327 |

|

153,862 |

|

21,089 |

|

| Total net

revenues |

243,535 |

|

247,698 |

|

33,950 |

|

|

750,790 |

|

778,585 |

|

106,714 |

|

|

Cost of revenues |

(207,339 |

) |

(208,947 |

) |

(28,639 |

) |

|

(645,254 |

) |

(662,383 |

) |

(90,787 |

) |

|

Fulfillment |

(14,354 |

) |

(15,225 |

) |

(2,087 |

) |

|

(46,148 |

) |

(47,275 |

) |

(6,480 |

) |

|

Marketing |

(7,605 |

) |

(7,955 |

) |

(1,090 |

) |

|

(25,787 |

) |

(27,023 |

) |

(3,704 |

) |

|

Research and development |

(4,116 |

) |

(3,794 |

) |

(520 |

) |

|

(12,527 |

) |

(12,052 |

) |

(1,652 |

) |

|

General and administrative |

(2,622 |

) |

(2,474 |

) |

(339 |

) |

|

(7,408 |

) |

(7,333 |

) |

(1,005 |

) |

|

Gain on sale of development properties |

1,229 |

|

— |

|

— |

|

|

1,229 |

|

1,481 |

|

203 |

|

| Income from

operations(2)(3) |

8,728 |

|

9,303 |

|

1,275 |

|

|

14,895 |

|

24,000 |

|

3,289 |

|

| Other

income/(expenses) |

|

|

|

|

|

|

|

|

Share of results of equity investees |

377 |

|

427 |

|

59 |

|

|

(2,308 |

) |

513 |

|

70 |

|

|

Interest expense |

(579 |

) |

(710 |

) |

(97 |

) |

|

(1,408 |

) |

(1,954 |

) |

(268 |

) |

|

Others, net(4) |

(816 |

) |

1,782 |

|

243 |

|

|

(1,128 |

) |

5,785 |

|

794 |

|

| Income before

tax |

7,710 |

|

10,802 |

|

1,480 |

|

|

10,051 |

|

28,344 |

|

3,885 |

|

|

Income tax expenses |

(1,751 |

) |

(2,579 |

) |

(353 |

) |

|

(3,581 |

) |

(6,999 |

) |

(959 |

) |

| Net

income |

5,959 |

|

8,223 |

|

1,127 |

|

|

6,470 |

|

21,345 |

|

2,926 |

|

| Net income/(loss) attributable

to non-controlling interests shareholders |

(4 |

) |

287 |

|

39 |

|

|

(886 |

) |

567 |

|

78 |

|

| Net income attributable to

mezzanine equity classified as non-controlling interests

shareholders |

— |

|

— |

|

— |

|

|

8 |

|

— |

|

— |

|

| Net income

attributable to the company’s ordinary shareholders |

5,963 |

|

7,936 |

|

1,088 |

|

|

7,348 |

|

20,778 |

|

2,848 |

|

|

|

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

Basic |

1.91 |

|

2.52 |

|

0.35 |

|

|

2.35 |

|

6.61 |

|

0.91 |

|

|

Diluted |

1.78 |

|

2.50 |

|

0.34 |

|

|

2.22 |

|

6.54 |

|

0.90 |

|

| Net income per

ADS: |

|

|

|

|

|

|

|

|

Basic |

3.81 |

|

5.04 |

|

0.69 |

|

|

4.71 |

|

13.22 |

|

1.81 |

|

|

Diluted |

3.57 |

|

5.00 |

|

0.69 |

|

|

4.43 |

|

13.09 |

|

1.79 |

|

|

JD.com, Inc. |

|

Unaudited Interim Condensed Consolidated Statements of

Operations |

|

(In millions, except per share data) |

|

|

| |

|

For the three months ended |

|

For the nine months ended |

| |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

| |

|

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

|

(2) Includes share-based compensation expenses as follows: |

|

Cost of revenues |

|

(40 |

) |

(35 |

) |

(5 |

) |

|

(100 |

) |

(99 |

) |

(14 |

) |

|

Fulfillment |

|

(257 |

) |

(239 |

) |

(33 |

) |

|

(684 |

) |

(570 |

) |

(78 |

) |

|

Marketing |

|

(174 |

) |

(112 |

) |

(15 |

) |

|

(472 |

) |

(330 |

) |

(45 |

) |

|

Research and development |

|

(416 |

) |

(203 |

) |

(28 |

) |

|

(1,156 |

) |

(690 |

) |

(95 |

) |

|

General and administrative |

|

(1,097 |

) |

(784 |

) |

(107 |

) |

|

(3,000 |

) |

(2,135 |

) |

(292 |

) |

|

Total |

|

(1,984 |

) |

(1,373 |

) |

(188 |

) |

|

(5,412 |

) |

(3,824 |

) |

(524 |

) |

|

|

|

|

|

|

|

|

|

|

|

(3) Includes amortization of business cooperation arrangement and

intangible assets resulting from assets and business acquisitions

as follows: |

|

Fulfillment |

|

(107 |

) |

(103 |

) |

(14 |

) |

|

(287 |

) |

(311 |

) |

(43 |

) |

|

Marketing |

|

(221 |

) |

(220 |

) |

(30 |

) |

|

(657 |

) |

(659 |

) |

(90 |

) |

|

Research and development |

|

(83 |

) |

(66 |

) |

(9 |

) |

|

(181 |

) |

(239 |

) |

(33 |

) |

|

General and administrative |

|

(32 |

) |

(32 |

) |

(4 |

) |

|

(128 |

) |

(96 |

) |

(13 |

) |

|

Total |

|

(443 |

) |

(421 |

) |

(57 |

) |

|

(1,253 |

) |

(1,305 |

) |

(179 |

) |

|

|

|

|

|

|

|

|

|

|

|

(4) Others, net are other non-operating income/(loss), primarily

consist of gains/(losses) from fair value change of long-term

investments, gains/(losses) from business and investment disposals,

impairment of investments, government incentives, foreign exchange

gains/(losses), interest income and gains/(losses) from fair value

change of short-term investments. |

|

JD.com, Inc. |

|

Unaudited Non-GAAP Net Income Per Share and Per ADS |

|

(In millions, except per share data) |

|

|

| |

|

For the three months ended |

|

For the nine months ended |

|

|

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

| |

|

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income

attributable to the company’s ordinary shareholders |

|

10,040 |

10,637 |

1,458 |

|

20,561 |

26,785 |

3,670 |

| |

|

|

|

|

|

|

|

|

| Weighted average

number of shares: |

|

|

|

|

|

|

|

|

| Basic |

|

3,129 |

3,147 |

3,147 |

|

3,122 |

3,143 |

3,143 |

| Diluted |

|

3,181 |

3,170 |

3,170 |

|

3,182 |

3,172 |

3,172 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income per

share: |

|

|

|

|

|

|

|

|

| Basic |

|

3.21 |

3.38 |

0.46 |

|

6.59 |

8.52 |

1.17 |

| Diluted |

|

3.14 |

3.35 |

0.46 |

|

6.43 |

8.43 |

1.16 |

| |

|

|

|

|

|

|

|

|

| Non-GAAP net income

per ADS: |

|

|

|

|

|

|

|

|

| Basic |

|

6.42 |

6.76 |

0.93 |

|

13.17 |

17.04 |

2.34 |

| Diluted |

|

6.27 |

6.70 |

0.92 |

|

12.86 |

16.87 |

2.31 |

|

JD.com, Inc. |

|

Unaudited Interim Condensed Consolidated Statements of Cash Flows

and Free Cash Flow |

|

(In millions) |

|

|

| |

|

For the three months ended |

|

For the nine months ended |

| |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

| |

|

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

9,151 |

|

15,004 |

|

2,056 |

|

|

39,333 |

|

39,908 |

|

5,470 |

|

| Net cash provided by/(used in)

investing activities |

|

(9,754 |

) |

14,964 |

|

2,051 |

|

|

(36,118 |

) |

3,529 |

|

484 |

|

| Net cash provided by/(used in)

financing activities |

|

4,029 |

|

(4,486 |

) |

(615 |

) |

|

5,415 |

|

(5,063 |

) |

(694 |

) |

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

1,799 |

|

(763 |

) |

(104 |

) |

|

4,466 |

|

338 |

|

45 |

|

| Net increase in cash, cash

equivalents and restricted cash |

|

5,225 |

|

24,719 |

|

3,388 |

|

|

13,096 |

|

38,712 |

|

5,305 |

|

| Cash, cash equivalents and

restricted cash at beginning of period, including cash and cash

equivalents classified within assets held for sale |

|

84,564 |

|

99,149 |

|

13,589 |

|

|

76,693 |

|

85,156 |

|

11,672 |

|

| Less: cash, cash equivalents,

and restricted cash classified within assets held for sale at

beginning of period |

|

— |

|

— |

|

— |

|

|

— |

|

(41 |

) |

(6 |

) |

| Cash, cash equivalents, and

restricted cash at beginning of period |

|

84,564 |

|

99,149 |

|

13,589 |

|

|

76,693 |

|

85,115 |

|

11,666 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

89,789 |

|

123,868 |

|

16,977 |

|

|

89,789 |

|

123,868 |

|

16,977 |

|

| |

|

|

|

|

|

|

|

|

| Net cash provided by operating

activities |

|

9,151 |

|

15,004 |

|

2,056 |

|

|

39,333 |

|

39,908 |

|

5,470 |

|

| Less: Impact from JD Baitiao

receivables included in the operating cash flow |

|

(1,506 |

) |

(1,747 |

) |

(239 |

) |

|

(1,438 |

) |

(743 |

) |

(102 |

) |

| Less: Capital expenditures,

net of related sales proceeds |

|

|

|

|

|

|

|

|

|

Capital expenditures for development properties |

|

(3,784 |

) |

(3,013 |

) |

(413 |

) |

|

(11,407 |

) |

(7,521 |

) |

(1,031 |

) |

|

Other capital expenditures |

|

(1,522 |

) |

(1,980 |

) |

(271 |

) |

|

(2,937 |

) |

(4,292 |

) |

(588 |

) |

| Free cash flow |

|

2,339 |

|

8,264 |

|

1,133 |

|

|

23,551 |

|

27,352 |

|

3,749 |

|

|

JD.com, Inc. |

|

Supplemental Financial Information and Business Metrics |

|

(In RMB billions, except turnover days data) |

|

|

|

|

|

Q3 2022 |

Q4 2022 |

Q1 2023 |

Q2 2023 |

Q3 2023 |

| Cash flow and turnover

days |

|

|

|

|

|

|

| Operating cash flow – trailing

twelve months (“TTM”) |

|

45.8 |

57.8 |

39.7 |

52.5 |

58.4 |

|

Free cash flow – TTM |

|

25.8 |

35.6 |

19.0 |

33.5 |

39.4 |

|

Inventory turnover days(5)– TTM |

|

31.7 |

33.2 |

32.4 |

31.7 |

30.8 |

|

Accounts payable turnover days(6)– TTM |

|

50.4 |

52.5 |

51.3 |

52.8 |

52.6 |

|

Accounts receivable turnover days(7)– TTM |

|

4.0 |

4.5 |

4.8 |

5.0 |

5.4 |

| |

|

(5) TTM inventory turnover days are the quotient of average

inventory over the immediately preceding five quarters, up to and

including the last quarter of the period, to cost of revenues of

retail business for the last twelve months, and then multiplied by

360 days. |

|

(6) TTM accounts payable turnover days are the quotient of average

accounts payable for retail business over the immediately preceding

five quarters, up to and including the last quarter of the period,

to cost of revenues of retail business for the last twelve months,

and then multiplied by 360 days. |

|

(7) TTM accounts receivable turnover days are the quotient of

average accounts receivable over the immediately preceding five

quarters, up to and including the last quarter of the period, to

total net revenues for the last twelve months and then multiplied

by 360 days. Presented are the accounts receivable turnover days

excluding the impact from JD Baitiao. |

|

JD.com, Inc. |

|

Unaudited Reconciliation of GAAP and Non-GAAP Results |

|

(In millions, except percentage data) |

| |

| |

|

For the three months ended |

|

For the nine months ended |

| |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

| |

|

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

8,728 |

|

9,303 |

|

1,275 |

|

|

14,895 |

|

24,000 |

|

3,289 |

|

| Add: Share-based

compensation |

|

1,984 |

|

1,373 |

|

188 |

|

|

5,412 |

|

3,824 |

|

524 |

|

| Add: Amortization of

intangible assets resulting from assets and business

acquisitions |

|

330 |

|

309 |

|

42 |

|

|

879 |

|

972 |

|

133 |

|

| Add: Effects of business

cooperation arrangements |

|

113 |

|

112 |

|

15 |

|

|

374 |

|

333 |

|

46 |

|

| Reversal of: Gain on sale of

development properties |

|

(1,229 |

) |

— |

|

— |

|

|

(1,229 |

) |

(1,481 |

) |

(203 |

) |

| Non-GAAP income from

operations |

|

9,926 |

|

11,097 |

|

1,520 |

|

|

20,331 |

|

27,648 |

|

3,789 |

|

| Add: Depreciation and other

amortization |

|

1,537 |

|

1,792 |

|

246 |

|

|

4,373 |

|

5,143 |

|

705 |

|

|

Non-GAAP EBITDA |

|

11,463 |

|

12,889 |

|

1,766 |

|

|

24,704 |

|

32,791 |

|

4,494 |

|

| |

|

|

|

|

|

|

|

|

|

Total net revenues |

|

243,535 |

|

247,698 |

|

33,950 |

|

|

750,790 |

|

778,585 |

|

106,714 |

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP operating

margin |

|

4.1 |

% |

4.5 |

% |

4.5 |

% |

|

2.7 |

% |

3.6 |

% |

3.6 |

% |

| |

|

|

|

|

|

|

|

|

| Non-GAAP EBITDA

margin |

|

4.7 |

% |

5.2 |

% |

5.2 |

% |

|

3.3 |

% |

4.2 |

% |

4.2 |

% |

|

JD.com, Inc. |

|

Unaudited Reconciliation of GAAP and Non-GAAP Results |

|

(In millions, except percentage data) |

|

|

| |

|

For the three months ended |

|

For the nine months ended |

| |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

|

September 30,2022 |

September 30,2023 |

September 30,2023 |

| |

|

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to the company’s ordinary shareholders |

|

5,963 |

|

7,936 |

|

1,088 |

|

|

7,348 |

|

20,778 |

|

2,848 |

|

| Add: Share-based

compensation |

|

1,668 |

|

1,078 |

|

148 |

|

|

4,575 |

|

3,073 |

|

421 |

|

| Add: Amortization of

intangible assets resulting from assets and business

acquisitions |

|

221 |

|

144 |

|

20 |

|

|

620 |

|

525 |

|

72 |

|

| Add: Reconciling items on the

share of equity method investments(8) |

|

81 |

|

301 |

|

41 |

|

|

911 |

|

1,002 |

|

137 |

|

| Add: Impairment of goodwill,

intangible assets, and investments |

|

361 |

|

384 |

|

53 |

|

|

1,618 |

|

1,772 |

|

243 |

|

| Add: Loss from fair value

change of long-term investments |

|

2,779 |

|

783 |

|

107 |

|

|

2,944 |

|

395 |

|

54 |

|

| Reversal of: Gain on sale of

development properties |

|

(1,010 |

) |

— |

|

— |

|

|

(1,010 |

) |

(1,120 |

) |

(154 |

) |

| (Reversal of) /Add: Net

(gain)/loss on disposals/deemed disposals of investments and

others |

|

(27 |

) |

(5 |

) |

(1 |

) |

|

3,491 |

|

(55 |

) |

(8 |

) |

| Add: Effects of business

cooperation arrangements and non-compete agreements |

|

113 |

|

112 |

|

15 |

|

|

363 |

|

333 |

|

46 |

|

| (Reversal of)/Add: Tax effects

on non-GAAP adjustments |

|

(109 |

) |

(96 |

) |

(13 |

) |

|

(299 |

) |

82 |

|

11 |

|

| Non-GAAP net income

attributable to the company’s ordinary shareholders |

|

10,040 |

|

10,637 |

|

1,458 |

|

|

20,561 |

|

26,785 |

|

3,670 |

|

| |

|

|

|

|

|

|

|

|

| Total net revenues |

|

243,535 |

|

247,698 |

|

33,950 |

|

|

750,790 |

|

778,585 |

|

106,714 |

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP net margin to

the company’s ordinary shareholders |

|

4.1 |

% |

4.3 |

% |

4.3 |

% |

|

2.7 |

% |

3.4 |

% |

3.4 |

% |

|

|

|

(8) To exclude the GAAP to non-GAAP reconciling items on the share

of equity method investments, and share of amortization of

intangibles not on their books. |

_____________________________

1 The U.S. dollar (US$) amounts disclosed in

this announcement, except for those transaction amounts that were

actually settled in U.S. dollars, are presented solely for the

convenience of the readers. The conversion of Renminbi (RMB) into

US$ in this announcement is based on the exchange rate set forth in

the H.10 statistical release of the Board of Governors of the

Federal Reserve System as of September 29, 2023, which was

RMB7.2960 to US$1.00. The percentages stated in this announcement

are calculated based on the RMB amounts.2 See the sections entitled

“Non-GAAP Measures” and “Unaudited Reconciliation of GAAP and

Non-GAAP Results” for more information about the non-GAAP measures

referred to in this announcement.3 The numbers also include

warehouses managed by Deppon Logistics Co., Ltd. (“Deppon”,

Shanghai Stock Exchange code: 603056) and its subsidiaries

(collectively, “Deppon Group”). In the third quarter of 2022, JD

Logistics completed the acquisition of the controlling interest in

Deppon and began to consolidate its financial results.

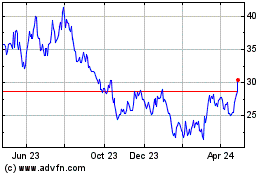

JD com (NASDAQ:JD)

Historical Stock Chart

From Mar 2024 to Apr 2024

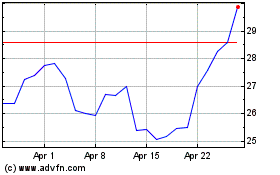

JD com (NASDAQ:JD)

Historical Stock Chart

From Apr 2023 to Apr 2024