Strong High-Power Laser Sales Drive 18%

Increase in Materials Processing Business and Record Revenue

Results

IPG Photonics Corporation (NASDAQ:

IPGP) today reported financial results for the second quarter ended

June 30, 2014.

Three Months Ended June 30,

Six Months Ended June 30, (In

millions, except per share data) 2014

2013 % Change 2014 2013

% Change Revenue $ 192.2 $ 168.2 14 % $ 362.8 $ 310.0 17 %

Gross margin 54.2 % 53.5 % 53.3 % 53.4 % Operating income $ 68.7 $

59.9 15 % $ 126.5 $ 109.5 16 % Operating margin 35.8 % 35.6 % 34.9

% 35.3 % Net income attributable to IPG Photonics Corporation $

48.3 $ 41.7 16 % $ 88.8 $ 76.8 16 % Earnings per diluted share $

0.92 $ 0.80 15 % $ 1.68 $ 1.47 14 %

Management Comments

"IPG's record revenues of $192.2 million for the second quarter

resulted from a strong increase in high-power fiber laser sales for

materials processing applications," said Dr. Valentin Gapontsev,

IPG Photonics' Chief Executive Officer. "Materials processing sales

increased 18% year over year, driven by strength in cutting and

welding applications as well as growth in 3D printing, glass

cutting and cleaning applications. The increase in materials

processing, which accounts for 96% of our revenue, shows the

progress we continue to make in penetrating OEMs for key

applications that represent significant growth opportunities. The

70 basis point year-over-year increase in gross margins to 54.2%

and growth in net income of 16% demonstrated some leverage

returning to our operating model."

"We continue to see strong growth in high-power fiber laser

sales, which increased by 22%," said Dr. Gapontsev. "Sales for

medium-power lasers increased by 35% and QCW sales were up 44% year

over year. While pulsed laser sales declined as expected by 19%

year over year due to increased low-power competition in China, we

are encouraged by a 12% increase from the sequential first quarter.

We are also seeing fast-growing demand for our new generation of

picosecond high peak power fiber lasers and multi-hundred watt

average power pulsed lasers and where we have technological

advantages for new applications such as deep engraving, ablation

and cleaning."

"Geographically, we reported strong sales growth in Europe and

Asia," said Dr. Gapontsev. "In the U.S., sales and order flow

remain positive; however, we shipped some large advanced

applications and marking & engraving orders in Q2 2013 that

resulted in an unfavorable year-over-year comparison."

"We generated $33.5 million in cash from operating activities

and had cash and cash equivalents of $483.4 million after using

$34.3 million to finance capital expenditures during the second

quarter," Dr. Gapontsev said.

Business Outlook and Financial Guidance

"As we enter the second half of 2014, we remain focused on

generating profitable growth through expanding our business with

existing and new OEMs, developing new applications and introducing

new fiber laser-based products. Order flow in Q2 was strong and,

with a book-to-bill ratio of greater than one, we anticipate

sequential and year-over-year revenue growth for the third quarter.

We will continue to target margins in the range of 50% to 55% while

making strategic investments to enhance our product pipeline and

expand our worldwide infrastructure," concluded Dr. Gapontsev.

IPG Photonics expects revenue in the range of $190 million to

$205 million for the third quarter of 2014. The Company anticipates

earnings per diluted share in the range of $0.88 to $1.03 based on

52,769,000 diluted common shares, which includes 52,068,000 basic

common shares outstanding and 701,000 potentially dilutive options

at June 30, 2014.

As discussed in more detail in the “Safe Harbor” passage of this

news release, actual results may differ from this guidance due to

various factors including, but not limited to, product demand,

order cancelations and delays, competition and general economic

conditions. This guidance is subject to the risks outlined in the

Company's reports with the SEC, and assumes that exchange rates

remain at present levels.

Conference Call Reminder

The Company will hold a conference call to review its financial

results and business highlights today, July 29, 2014 at 10:00

a.m. ET. The conference call will be webcast live and can be

accessed on the “Investors” section of

the Company's website at www.ipgphotonics.com. The conference call also can

be accessed by dialing (877) 709-8155 or (201) 689-8881. Interested

parties that are unable to listen to the live call may access an

archived version of the webcast, which will be available for

approximately one year on IPG's website.

About IPG Photonics Corporation

IPG Photonics Corporation is the

world leader in high-power fiber lasers and amplifiers. Founded in

1990, IPG pioneered the development and commercialization of

optical fiber-based lasers for use in diverse applications,

primarily materials processing. Fiber

lasers have revolutionized the industry by delivering superior

performance, reliability and usability at a lower total cost of

ownership compared with conventional lasers, allowing end users to

increase productivity and decrease operating costs. IPG has its

headquarters in Oxford, Massachusetts, and has additional plants

and offices throughout the world. For more information, please

visit www.ipgphotonics.com.

Safe Harbor Statement

Information and statements provided by the Company and its

employees, including statements in this press release, that relate

to future plans, events or performance are forward-looking

statements. These statements involve risks and uncertainties.

Any statements in this press release that are not statements of

historical fact are forward-looking statements, including, but not

limited to, generating profitable growth through expanding the

Company's business with existing OEMs, finding new OEMs and

applications and introducing new fiber laser-based products;

anticipation of sequential and year-over-year revenue growth for

the third quarter; and achievement of target margins in the range

of 50% to 55%, making continued strategic investments to advance

IPG's technology and guidance for the third quarter of 2014.

Factors that could cause actual results to differ materially

include risks and uncertainties, including risks associated with

the strength or weakness of the business conditions in industries

and geographic markets that the Company serves, particularly the

effect of downturns in the markets served; uncertainties and

adverse changes in the general economic conditions of markets; the

Company's ability to penetrate new applications for fiber lasers

and increase market share; the rate of acceptance and penetration

of IPG's products; high levels of fixed costs from IPG's vertical

integration; the appropriateness of IPG's manufacturing capacity

for the level of demand; competitive factors, including declining

average selling prices; the effect of acquisitions and investments;

inventory write-downs; foreign currency fluctuations; intellectual

property infringement claims and litigation; interruption in supply

of key components; manufacturing risks; building and expanding

field service and support operations; inability to manage risks

associated with international customers and operations; and other

risks identified in the Company's SEC filings. Readers are

encouraged to refer to the risk factors described in the Company's

Annual Report on Form 10-K (filed with the SEC on February 28,

2014) and its periodic reports filed with the SEC, as applicable.

Actual results, events and performance may differ

materially. Readers are cautioned not to rely on the

forward-looking statements, which speak only as of the date hereof.

The Company undertakes no obligation to update the forward-looking

statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

IPG PHOTONICS CORPORATION

CONSOLIDATED STATEMENTS OF

INCOME

Three Months Ended June 30, Six Months Ended June

30, 2014 2013

2014 2013 (in

thousands, except per share data) NET SALES $ 192,204 $ 168,171

$ 362,779 $ 310,023 COST OF SALES 87,977 78,249

169,268 144,460 GROSS PROFIT 104,227 89,922

193,511 165,563 OPERATING EXPENSES: Sales and

marketing 8,047 6,845 15,212 12,713 Research and development 13,362

10,483 26,146 19,281 General and administrative 13,124 12,829

26,040 24,639 Loss (gain) on foreign exchange 945 (110 )

(425 ) (591 ) Total operating expenses 35,478 30,047

66,973 56,042 OPERATING INCOME 68,749 59,875

126,538 109,521 OTHER INCOME (EXPENSE), NET:

Interest expense, net — (35 ) (139 ) (88 ) Other income (expense),

net 239 (239 ) 573 (169 ) Total other income

(expense) 239 (274 ) 434 (257 ) INCOME BEFORE

PROVISION FOR INCOME TAXES 68,988 59,601 126,972 109,264 PROVISION

FOR INCOME TAXES (20,705 ) (17,881 ) (38,158 ) (32,417 ) NET INCOME

ATTRIBUTABLE TO IPG PHOTONICS CORPORATION $ 48,283 $ 41,720

$ 88,814 $ 76,847 NET INCOME ATTRIBUTABLE TO

IPG PHOTONICS CORPORATION PER SHARE: Basic $ 0.93 $ 0.81 $ 1.71 $

1.49 Diluted $ 0.92 $ 0.80 $ 1.68 $ 1.47 WEIGHTED AVERAGE SHARES

OUTSTANDING: Basic 52,068 51,462 52,019 51,435 Diluted 52,769

52,385 52,747 52,357

IPG PHOTONICS CORPORATION

SUPPLEMENTAL SCHEDULE OF STOCK-BASED

COMPENSATION

Three Months Ended June 30, Six Months Ended June

30, (In thousands) 2014 2013

2014 2013 Cost of sales $ 1,041 $ 806 $

1,931 $ 1,482 Sales and marketing 434 317 807 601 Research and

development 772 482 1,426 864 General and administrative 1,658

1,335 3,008 2,525 Total stock-based

compensation 3,905 2,940 7,172 5,472 Tax benefit recognized

(1,250

) (959 ) (2,295 ) (1,776 ) Net stock-based compensation $

2,655

$ 1,981 $ 4,877 $ 3,696

IPG PHOTONICS CORPORATION

SUPPLEMENTAL SCHEDULE OF ACQUISITION

RELATED COSTS IN COST OF SALES

Three Months Ended June 30, Six Months Ended June

30, (In thousands) 2014 2013

2014 2013 Cost of sales Step-up of

inventory (1) $ — $ 456 $ — $ 862 Amortization of intangible assets

(2) 156 180

312

643 Total acquisition related costs $ 156 $ 636

$ 312 $ 1,505

(1) Amount relates to Microsystems step-up adjustment on

inventory sold during the period(2) Amount relates to intangible

amortization expense during periods presented including

amortization of acquired patents

IPG PHOTONICS CORPORATION

CONSOLIDATED BALANCE SHEETS

June 30,

December 31,

2014 2013

(In thousands, except share and per

share data)

ASSETS CURRENT ASSETS: Cash and cash equivalents $ 483,432 $

448,776 Accounts receivable, net 124,144 103,803 Inventories

178,925 172,700 Prepaid income taxes and income taxes receivable

19,706 15,996 Prepaid expenses and other current assets 32,634

30,836 Deferred income taxes, net 15,251 14,232 Total

current assets 854,092 786,343 DEFERRED INCOME TAXES, NET 8,139

4,799 GOODWILL 455 455 INTANGIBLE ASSETS, NET 8,472 9,564 PROPERTY,

PLANT AND EQUIPMENT, NET 268,122 252,245

OTHER ASSETS

19,106 7,810 TOTAL $ 1,158,386 $ 1,061,216

LIABILITIES AND EQUITY CURRENT LIABILITIES: Revolving

line-of-credit facilities $ 2,724 $ 3,296 Current portion of

long-term debt 12,000 1,333 Accounts payable 15,059 18,787 Accrued

expenses and other liabilities 63,379 59,336 Deferred income taxes,

net 3,187 2,109 Income taxes payable 16,823 15,218

Total current liabilities 113,172 100,079 DEFERRED INCOME TAXES AND

OTHER LONG-TERM LIABILITIES 21,354 21,835 LONG-TERM DEBT, NET OF

CURRENT PORTION — 11,333 Total liabilities 134,526

133,247 COMMITMENTS AND CONTINGENCIES IPG PHOTONICS CORPORATION

STOCKHOLDERS’ EQUITY: Common stock, $0.0001 par value, 175,000,000

shares authorized; 52,121,222 shares issued and outstanding at June

30, 2014; 51,930,978 shares issued and outstanding at December 31,

2013 5 5 Additional paid-in capital 551,885 538,908 Retained

earnings 479,571 390,757 Accumulated other comprehensive loss

(7,601 ) (1,701 ) Total IPG Photonics Corporation stockholders’

equity 1,023,860 927,969 TOTAL $ 1,158,386 $

1,061,216

IPG PHOTONICS CORPORATION

CONSOLIDATED STATEMENTS OF CASH

FLOWS

Six Months Ended June 30, 2014

2013 (In thousands) CASH FLOWS FROM

OPERATING ACTIVITIES: Net income $ 88,814 $ 76,847

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 17,088 14,885 Provisions for

inventory, warranty & bad debt 12,207 10,255 Other 389 1,956

Changes in assets and liabilities that (used) provided cash:

Accounts receivable/payable (23,404 ) (18,704 ) Inventories (14,988

) (23,814 ) Other (3,231 ) (37,151 ) Net cash provided by operating

activities 76,875 24,274

CASH FLOWS FROM INVESTING

ACTIVITIES: Purchases of and deposits on property, plant and

equipment (45,781 ) (34,263 ) Proceeds from sales of property,

plant and equipment 254 166 Acquisition of businesses — (5,555 )

Other 42 407 Net cash used in investing activities

(45,485 ) (39,245 )

CASH FLOWS FROM FINANCING ACTIVITIES:

Line-of-credit facilities (535 ) (620 ) Principal payments on

long-term borrowings (667 ) (2,186 ) Tax benefits from exercise of

employee stock options 2,426 2,356 Exercise of employee stock

options and issuances under employee stock purchase plan 3,379

2,177 Net cash provided by financing activities 4,603

1,727 EFFECT OF CHANGES IN EXCHANGE RATES ON CASH AND

CASH EQUIVALENTS (1,337 ) (1,325 ) NET INCREASE IN CASH AND CASH

EQUIVALENTS 34,656 (14,569 ) CASH AND CASH EQUIVALENTS — Beginning

of period 448,776 384,053 CASH AND CASH EQUIVALENTS —

End of period $ 483,432 $ 369,484 SUPPLEMENTAL

DISCLOSURES OF CASH FLOW INFORMATION: Cash paid for interest $ 223

$ 165 Cash paid for income taxes $ 41,525 $

61,308

IPG Photonics CorporationTim Mammen, 508-373-1100Chief Financial

OfficerorSharon MerrillDavid Calusdian, 617-542-5300Executive Vice

President

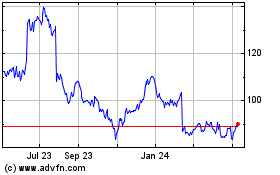

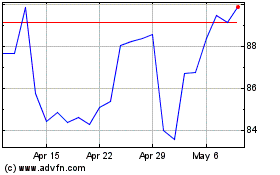

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Oct 2024 to Nov 2024

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Nov 2023 to Nov 2024