false

0000836690

0000836690

2023-12-20

2023-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 20, 2023

INNOVATIVE SOLUTIONS AND SUPPORT, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania |

0-31157 |

23-2507402 |

| (State or other jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

720 Pennsylvania Drive

Exton, Pennsylvania 19341

(Address of principal executive offices) (Zip Code)

(610) 646-9800

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

ISSC |

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On December 20, 2023, Innovative

Solutions and Support, Inc. issued a press release announcing its financial results for its fourth quarter and fiscal year ended

September 30, 2023. A copy of that press release and the attached financial schedules are attached as Exhibit 99.1 to this report

and incorporated herein by reference.

The information in this report

(including Exhibit 99.1) is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

INNOVATIVE SOLUTIONS AND SUPPORT, INC. |

| |

|

| Date: December 20, 2023 |

By: |

/s/ Relland Winand |

| |

|

Relland Winand |

| |

|

Interim Chief Financial Officer |

Exhibit

99.1

Innovative

Solutions & Support, Inc. Announces Fourth Quarter and Full Year Fiscal 2023 Financial Results

EXTON, Pa.

– December 20, 2023 – (BUSINESS WIRE) Innovative Solutions & Support, Inc. (“IS&S” or the “Company”)

(NASDAQ: ISSC) today announced its financial results for the fourth quarter and full fiscal year 2023, which ended September 30, 2023.

For the fourth

quarter of fiscal 2023, IS&S reported net sales of $13 million, up 79% from $7.3 million in the fourth quarter a year ago. The Company

reported net income of $2.6 million, or $0.15 per share, increases of 63% and 67%, respectively, compared to $1.6 million, or $0.09 per

share, in the fourth quarter of fiscal 2022.

Gross profit

in the fourth quarter of 2023 was $8.1 million, or 62% of sales, compared to $4.5 million, also 62 % of sales in the fourth quarter of

2022.

The increase

in sales and earnings in the fourth quarter of 2023 primarily reflects the impact of the previously announced addition of the product

lines acquired from Honeywell International, Inc. (“Honeywell”) pursuant to an exclusive license and asset acquisition that

closed in the third quarter of 2023.

Shahram Askarpour, Chief Executive Officer

of IS&S, said, “I am pleased to report our fifth consecutive year of both top and bottom-line growth as a result of one of

the best quarters in the Company’s recent history. The results include some customer-directed accelerated shipments of the acquired

Honeywell products to mitigate any impacts from potential delivery delays over the next two quarters as equipment and inventory are transferred

to IS&S. The ongoing integration of the Honeywell product lines is proceeding well, and we remain confident that annualized revenues

will increase by approximately 40% from pre-acquisition levels once operations have been fully integrated in fiscal 2024. The integration

of the Honeywell product lines enhances our current product offerings in the Air Transport, Military and Business Aviation Markets and

has provided us with an introduction to numerous operators with whom we did not previously have relationships, thereby opening a large

new market opportunity for our other products.”

For the fiscal year 2023, the Company

generated $2.1 million of cash flow from operations. The Company had $3.1 million of cash on hand as of September 30, 2023, which has

increased during the quarter ended December 31, 2023 because of the collection of receivables and the sale of the Company’s King

Air aircraft. As of December 19, 2023 the Company’s cash on hand is currently over $8 million.

New orders

in the fourth quarter of fiscal 2023 were approximately $12.7 million and were $36.5 million for the full fiscal 2023 year. Backlog as

of September 30, 2023, was $13.5 million. Only purchase orders in hand are included in our sales backlog, which primarily consists of

orders from our OEM customers that have long-term programs-- Pilatus PC-24, Textron King Air, Boeing T-7 Red Hawk and the Boeing KC-46A.

IS&S expects these programs to remain in production for approximately a decade and anticipates that they will continue to generate

future sales. Due to their nature, the products licensed from Honeywell do not typically enter into backlog.

Full

Year Fiscal 2023 Results

Total revenues

for the fiscal year ended September 30, 2023, were $34.8 million, up 26% from $27.7 million for the fiscal year ended September 30, 2022.

Net income for fiscal 2023 was $6.0 million, or $0.35 per share, compared to $5.5 million, or $0.32 per share, in fiscal 2022. Net income

in fiscal 2022 included a $1.1 million gain on the sale of an asset.

Conference

Call

The

Company will be hosting a conference call on Thursday, December 21, 2023 at 10:00 AM ET to discuss these results and the Company’s

business outlook and product development. Please use the following dial- in number to register your name and Company affiliation for

the conference call: 877-451-6152 and ask to join the Innovative Solutions & Support call. The call will also be carried live on

the Investor Relations page of the Company web site at www.innovative-ss.com.

About

Innovative Solutions & Support, Inc.

Headquartered

in Exton, Pa., Innovative Solutions & Support, Inc. (www.innovative-ss.com)

is a systems integrator that designs and manufactures flight guidance and cockpit display systems for Original Equipment Manufacturers

(OEMs) and retrofit applications. The Company supplies integrated Flight Management Systems (FMS), Auto-Throttle Systems and advanced

GPS receivers for precision low carbon footprint navigation.

FORWARD

LOOKING STATEMENT DISCLAIMER

In

addition to the historical information contained herein, this press release contains “forward-looking statements” within the

meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements are based on management’s current expectations and beliefs concerning future developments and their potential effects

on the Company including, without limitation, statements about future revenue, financial performance and profitability, future business

opportunities, , the integration of the Honeywell product lines, including how the product lines enhance our current product offerings

in the Air Transport, Military and Business Aviation Markets and have provided us with an introduction to numerous operators with whom

we did not previously have a relationship, creating a large new market for many of our other products, the impact of licenses, including

the Honeywell license, and the timing of our long-term programs remaining in production and expectations regarding a large new market

opportunity for our other products. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change

over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions,

risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors

that could cause results to differ materially from those expressed or implied by such forward-looking statements include, but are not

limited to, the Company’s ability to efficiently integrate acquired and licensed product lines, including the Honeywell product

lines, into its operations; a reduction in anticipated orders; an economic downturn; changes in the competitive marketplace and/or customer

requirements; an inability to perform customer contracts at anticipated cost levels; and other factors that generally affect the economic

and business environments in which the Company operates. Such factors are detailed in the Company's Annual Report on Form 10-K for the

fiscal year ended December 31, 2022, and subsequent reports filed with the Securities and Exchange Commission. Many of the factors that

will determine the Company’s future results are beyond the ability of management to control or predict. Readers should not place

undue reliance on forward-looking statements. The Company undertakes no obligation to revise or update any forward-looking statements,

or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

| Innovative Solutions and Support, Inc. |

| Consolidated Balance Sheets |

| (unaudited) |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | |

| ASSETS |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,097,193 | | |

$ | 17,250,546 | |

| Accounts receivable | |

| 9,743,714 | | |

| 4,297,457 | |

| Contract asset | |

| 487,139 | | |

| 162,742 | |

| Inventories | |

| 6,139,713 | | |

| 5,349,104 | |

| Prepaid inventory | |

| 12,069,114 | | |

| - | |

| Prepaid expenses and other current assets | |

| 1,073,012 | | |

| 1,142,470 | |

| Asset held for sale | |

| 2,063,818 | | |

| - | |

| | |

| | | |

| | |

| Total current assets | |

| 34,673,703 | | |

| 28,202,319 | |

| | |

| | | |

| | |

| Goodwill | |

| 3,557,886 | | |

| - | |

| Intangible assets, net | |

| 16,185,321 | | |

| 60,348 | |

| Property and equipment, net | |

| 7,892,427 | | |

| 6,292,189 | |

| Deferred income taxes | |

| 456,392 | | |

| 46,487 | |

| Other assets | |

| 191,722 | | |

| 103,980 | |

| | |

| | | |

| | |

| Total assets | |

$ | 62,957,451 | | |

$ | 34,705,323 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Current portion of lomg-term debt | |

$ | 2,000,000 | | |

$ | - | |

| Accounts payable | |

| 1,337,275 | | |

| 708,845 | |

| Accrued expenses | |

| 2,918,325 | | |

| 2,972,275 | |

| Contract liability | |

| 143,359 | | |

| 259,183 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 6,398,959 | | |

| 3,940,303 | |

| | |

| | | |

| | |

| Long-term debt | |

| 17,500,000 | | |

| - | |

| Other liabilities | |

| 421,508 | | |

| 15,065 | |

| | |

| | | |

| | |

| Total liabilities | |

| 24,320,467 | | |

| 3,955,368 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Shareholders' equity | |

| | | |

| | |

| | |

| | | |

| | |

| Preferred stock, 10,000,000 shares authorized, $.001 par value, of which | |

| | | |

| | |

| 200,000 shares are authorized as Class A Convertible stock. No shares issued | |

| | | |

| | |

| and outstanding at September 30, 2021 and 2020 | |

| - | | |

| - | |

| | |

| | | |

| | |

| Common stock, $.001 par value: 75,000,000 shares authorized, 19,543,441 and | |

| | | |

| | |

| 19,412,664 issued at September 30, 2023 and 2022, respectively | |

| 19,543 | | |

| 19,413 | |

| | |

| | | |

| | |

| Additional paid-in capital | |

| 54,317,265 | | |

| 52,458,121 | |

| Retained earnings (accumulated deficit) | |

| 5,668,713 | | |

| (359,042 | ) |

| Treasury stock, at cost, 2,096,451 shares at September 30, 2023 and at | |

| | | |

| | |

| September 30, 2022 | |

| (21,368,537 | ) | |

| (21,368,537 | ) |

| | |

| | | |

| | |

| Total shareholders' equity | |

| 38,636,984 | | |

| 30,749,955 | |

| | |

| | | |

| | |

| Total liabilities and shareholders' equity | |

$ | 62,957,451 | | |

$ | 34,705,323 | |

| Innovative Solutions and Support, Inc. |

| Consolidated Statements of Operations |

| (unaudited) |

| | |

Three months ended | | |

Twelve months ended |

|

| | |

September 30, | | |

September 30, |

|

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Sales | |

$ | 12,992,596 | | |

$ | 7,263,121 | | |

$ | 34,808,513 | | |

$ | 27,740,695 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 4,880,125 | | |

| 2,795,585 | | |

| 13,497,442 | | |

| 11,066,314 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 8,112,471 | | |

| 4,467,536 | | |

| 21,311,071 | | |

| 16,674,381 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 741,579 | | |

| 642,303 | | |

| 3,129,518 | | |

| 2,705,140 | |

| Selling, general and administrative | |

| 3,718,293 | | |

| 1,527,900 | | |

| 10,822,505 | | |

| 6,753,915 | |

| Total operating expenses | |

| 4,459,872 | | |

| 2,170,203 | | |

| 13,952,023 | | |

| 9,459,055 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 3,652,599 | | |

| 2,297,333 | | |

| 7,359,048 | | |

| 7,215,326 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest (expense) | |

| (393,281 | ) | |

| - | | |

| (393,281 | ) | |

| - | |

| Interest income | |

| 85,693 | | |

| 50,179 | | |

| 518,188 | | |

| 61,051 | |

| Other income | |

| 19,813 | | |

| 15,931 | | |

| 151,317 | | |

| 65,232 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 3,364,824 | | |

| 2,363,443 | | |

| 7,635,272 | | |

| 7,341,609 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| 730,202 | | |

| 761,468 | | |

| 1,607,517 | | |

| 1,817,831 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 2,634,622 | | |

$ | 1,601,975 | | |

$ | 6,027,755 | | |

$ | 5,523,778 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.15 | | |

$ | 0.09 | | |

$ | 0.35 | | |

$ | 0.32 | |

| Diluted | |

$ | 0.15 | | |

$ | 0.09 | | |

$ | 0.35 | | |

$ | 0.32 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 17,400,659 | | |

| 17,256,750 | | |

| 17,411,684 | | |

| 17,256,750 | |

| Diluted | |

| 17,451,314 | | |

| 17,257,871 | | |

| 17,427,278 | | |

| 17,257,871 | |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

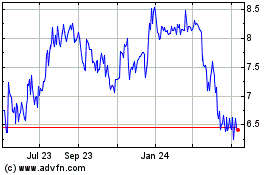

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2024 to May 2024

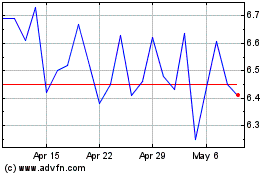

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From May 2023 to May 2024