Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

December 08 2023 - 5:15PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(A) of

the Securities Exchange Act Of 1934

| Filed

by the Registrant |

|

☒ |

| Filed

by a Party other than the Registrant |

|

☐ |

Check

the appropriate box:

| ☐ |

|

Preliminary

Proxy Statement |

| ☐ |

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

|

Definitive

Proxy Statement |

| ☒ |

|

Definitive

Additional Materials |

| ☐ |

|

Soliciting

Material under §240.14a-12 |

Grid

Dynamics Holdings, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

|

No

fee required. |

| ☐ |

|

Fee

paid previously with preliminary materials. |

| ☐ |

|

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11. |

5000 Executive Parkway,

Ste 520, San Ramon, CA 94583, United States

Tel: 650.523.5000

www.griddynamics.com

We Urge You To Vote “FOR” Proposal

No. 3, “Say-on-Pay”

In our proxy statement filed with the Securities and Exchange Commission

on November 7, 2023, we included Proposal No. 3, our first advisory vote on the compensation of our named executive officers in the year

ended December 31, 2022, commonly known as a “say-on-pay” vote. This supplemental filing is intended to reinforce with our

shareholders important context about the executive compensation decisions made and our business results in Fiscal 2022 in light of the

war in Ukraine and urge you to vote “FOR” Proposal No. 3 for the following reasons:

| ● | The war in Ukraine significantly impacted our business and posed increased risks to our workforce and business operations.

Our operational response to the war was effective and decisive. We executed our business continuity plan and adapted to challenges in

real-time to protect the safety of our people and to handle potential impacts to our delivery infrastructure. This included moving affected

employees to safer locations in Western Ukraine and, where permissible, outside Ukraine, and reallocating work to other geographic regions

within our global footprint. We ceased operations in the Russian Federation and safely expedited relocations of the majority of our Russia

based employees. The stability and focus of our leadership team was vital to these efforts. |

Wars are always exceptional circumstances, but in the case

of Grid Dynamics, over two thirds of our workforce was located in Russia and Ukraine when war broke out. The magnitude of the resulting

disruption on business operations was totally unprecedented and had not been foreseen. It required immediate special action by management

and the Compensation Committee of the Board to ensure retention of key personnel during that period.

| ● | Our financial and operational results in 2022 were strong despite unprecedented business disruptions. Total revenue

was $310 million, an increase of 47% from 2021 and almost triple that of 2020, our first year of being a public company. We dramatically

improved our adjusted EBITDA from 2021. We added 13 new enterprise customers from organic business, closed the Mutual Mobile acquisition,

and expanded to a new European hub in Switzerland, opened new engineering offices in Armenia, Romania and Jamaica, and implemented workforce

expansion in India, a strategic new region. |

| ● | Performance share award (PSA) goal adjustments did not affect actual payouts. While we changed the potential payouts

for performance below target, above target performance goals and payouts remained unchanged. Despite the challenging conditions,

we achieved revenue of $310 million in 2022, an achievement that would alone result in the vesting of 300% of the target number of PSAs

awarded, and gross margin for revenue (as adjusted for certain items) of 40%, an achievement that would alone result in the vesting of

212% of the target number of PSAs awarded. Since we performed above target on both metrics, our PSA payouts were not affected by the adjustment.

In February 2023, our compensation committee and Board certified the achievement of the equally weighted performance metrics, resulting

in 256% of the target number of PSAs vesting. |

| ● | Service-based restricted stock units (RSUs) were critical to retaining talent and ensuring business continuity. On May

3, 2022, the Board granted service-based RSUs to our NEOs, which are the first equity grants that vest solely based on service since 2020.

These awards vest over two years and were intended to support our ongoing critical talent retention needs given that the ongoing war in

Ukraine will continue to impact our operations and our people. Accordingly, the size and terms of the RSU awards reflect such considerations. |

| ● | In 2023, we have only granted PSAs and no equity awards that vest based solely on continued service, and our stock-based compensation

expense has decreased from $42.6 million in the first nine months of 2022 to $27.7 million in the first nine months of 2023. The

Board and the executive leadership team have listened to investor concerns regarding the Company’s equity burn rate and stock-based

compensation charges and have taken actions to address those concerns. |

We appreciate the opportunity to reinforce our rationale for our executive

compensation decisions during these extraordinary times. For all these reasons and others set

forth in our proxy statement, the Board of Directors again urges you to vote “FOR” Proposal 3: Advisory Vote to Approve Named

Executive Officer Compensation.

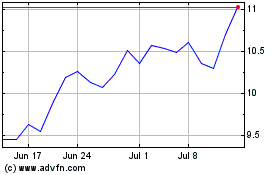

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From Apr 2024 to May 2024

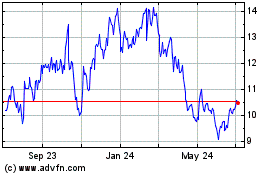

Grid Dynamics (NASDAQ:GDYN)

Historical Stock Chart

From May 2023 to May 2024