G-III Announces Share Buyback Plan - Analyst Blog

October 05 2011 - 9:10AM

Zacks

G-III Apparel Group, Ltd (GIII), the designer,

manufacturer, and distributor and licensor of various women’s and

men’s apparels in the United States, announced recently that its

board of directors has approved a share repurchase program worth $2

million.

The repurchase will be executed from time to time in the open

market as well as through privately-negotiated transactions based

on market conditions, stock price and other factors.

We appreciate G-III’s effort to bolster shareholders’ value over

the long term. Moreover, an increase in share buy back

authorization affirms the company’s optimistic outlook and reflects

strong growth going forward. However, we believe the strategic move

is aimed at capitalizing a relatively undervalued share price

arising from the volatility in the market and soft second-quarter

2011 results.

As of July 31, 2011, G-III had about 20.3 million shares trading

in the market. The stock had historically traded between $20.44 and

$45.38 over the last 12 months. Currently, the common shares of the

company are trading toward its lower range.

In the recently concluded quarter, G-III posted earnings per

share of 8 cents missing the Zacks Consensus Estimate of 20 cents

and the year-ago quarter earnings of 15 cents per share. The

lower-than-expected result was mainly due to 370 basis points fall

in gross margin.

However, G-III Apparel’s net sales surged 21.7% year over year

in the second quarter to $230 million. Sales growth was aided by

improved performances of wholesale licensed apparel (up 22%),

wholesale non-licensed segment (up 24.5%) and retail operations (up

19%).

For the third quarter of 2012, G-III expects earnings per share

in the range of $2.25–$2.35 and net sales to be $500 million.

Based on poor second quarter results, the company also trimmed

its earnings guidance for fiscal 2012. G-III now expects

earnings per share in the range of $3.05 to $3.15, down from the

earlier-guided range of $3.15 to $3.25 per share. However, the

company has raised its sales outlook to $1.25 billion from its

previous forecast of $1.20 billion.

Currently, we maintain our long-term Underperform recommendation

on the stock. Moreover, G-III holds a Zacks #4 Rank, which

translates into a short-term Sell rating. G-III peers include

Polo Ralph Lauren Corp. (RL) and CROCS

Inc. (CROX).

CROCS INC (CROX): Free Stock Analysis Report

G-III APPAREL (GIII): Free Stock Analysis Report

RALPH LAUREN CP (RL): Free Stock Analysis Report

Zacks Investment Research

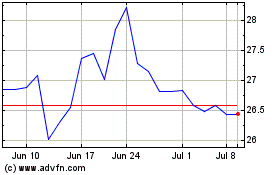

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From May 2024 to Jun 2024

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From Jun 2023 to Jun 2024