Economy Down, Pawn Stocks Up - Investment Ideas

September 14 2011 - 8:00PM

Zacks

Anyone searching for a counter cyclical stock that benefits from

high unemployment and a weak credit market needs to start looking

at pawn and payday lenders. I'm sure images of toothless criminals,

shady back-alley deals and missing gold chains come to more than a

few minds. But a closer look at the group reveals a very legitimate

industry that has seen big gains over the last two years in the

weak consumer environment.

High Unemployment

At the very top, high unemployment rates have

forced consumers to get creative with their funding. That has many

people selling old possessions like musical instruments and jewelry

in order to fund their daily operations. That has pushed a huge

wave of business into the hands of the pawn stores, which provide a

regulated environment for the exchange of goods between two willing

participants.

Limited Credit

The battered credit market has also been a boon for

the industry, where its common to see payday lending services

paired with a pawn operation. In the old days, before the big

financial crisis of 2008, credit was much easier to come by,

providing a trusted source of liquidity for many households across

the country. But with the big banks paring down on their risk and

reigning in their credit exposure, many consumers who relied on

their credit card to get them through the end of the month were

simply out of luck. They have now turned to payday lending

services, where many people take a cash advance against a pending

paycheck in order to hold them over until payday.

Industry Consolidation

And finally, on a wave of impressive sales and

earnings growth, the industry has gone through an unprecedented

cycle of consolidation over the last few years. That has increased

the industry's domestic and international presence while reducing

costs through operational efficiencies, a powerful one-two punch

for sustained earnings growth.

So as you can see, there are more than a few

reasons to be seriously bullish on the pawn and payday lending

industry. Here are a few top names in the space.

Top Three Pawn Stocks

First Cash Financial Services (FCFS)

provides both pawn and payday lending services and has a market cap

of $1.56 billion. This Zacks #2 Rank stock has been on a tear in

2011, handily outperforming the market with a whopping 62% gain.

That movement has been supported by an average earnings surprise of

7% over the last four quarters and bullish 20% growth

projection.

EZCorp (EZPW) is involved in both pawning

and payday loans, operates in Canada, Mexico and the United States

and has a market cap of $1.66 billion. EZPW has an average earnings

surprise of 9% over the last four quarters and a bullish growth

projection of 20%. But in spite of solid 22% gain, shares still

have value, with a PEG ratio .6 well below the benchmark of 1 for

value.

And finally, we have Cash America International,

Inc. (CSH), a Zacks #2 Rank stock that is up more than 50% on

the year. The pure payday lender has an average earnings surprise

of 13% over the last four quarters and a bullish 15% growth

projection. And with a PEG ratio below 1 as well, CSH offers a nice

combination of growth and value.

Michael Vodicka is the Momentum Stock Strategist

for Zacks.com. He is also the Editor in charge of the Zacks

Momentum Trader Service.

CASH AM INTL (CSH): Free Stock Analysis Report

EZCORP INC CL A (EZPW): Free Stock Analysis Report

FIRST CASH FINL (FCFS): Free Stock Analysis Report

Zacks Investment Research

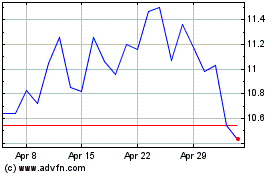

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Oct 2024 to Nov 2024

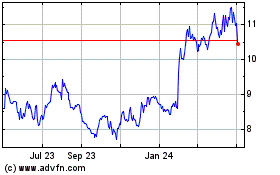

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Nov 2023 to Nov 2024