| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | | | | | |

FORM 11-K |

| | | | | | | | |

x ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2023

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-16169

________________________

EXELON CORPORATION

EMPLOYEE SAVINGS PLAN

(Full title of the Plan)

________________________

EXELON CORPORATION

(a Pennsylvania Corporation)

10 South Dearborn Street

P.O. Box 805379

Chicago, Illinois 60680-5379

(800) 483-3220

(Name of the issuer of the securities held pursuant to the Plan and the address of its principal executive offices)

| | | | | |

| EXELON CORPORATION EMPLOYEE SAVINGS PLAN |

| |

| |

| INDEX TO FINANCIAL STATEMENTS |

| Page No. |

| |

| |

| |

| Financial Statements: | |

| |

| |

| |

| |

| |

| |

| |

| Supplemental Schedule: | |

| |

| |

| |

| |

| |

| |

| |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and the Administrator of the

Exelon Corporation Employee Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Exelon Corporation Employee Savings Plan (the “Plan”) as of December 31, 2023 and 2022, and the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes and schedules (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting or other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule of assets, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule of assets is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ MITCHELL & TITUS, LLP

We have served as the Plan’s auditors since 2019.

Chicago, Illinois

June 20, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EXELON CORPORATION EMPLOYEE SAVINGS PLAN |

|

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS |

| | | | | | | | | |

| | | | | | | December 31, |

| | | | | | | 2023 | | 2022 |

ASSETS | | | |

| | | | | | | | | |

Investments, at fair value | | | |

| Plan interest in the net assets of the Exelon Corporation Defined Contribution Retirement Plans Master Trust (see Note 3) | $ | 5,685,725,086 | | | $ | 5,051,344,894 | |

| | | | | | | | | |

| | | | | | | | | |

Receivables | | | |

| Participant contributions | 5,731,346 | | | 5,609,719 |

| Employer contributions | | | |

| Fixed contributions | 15,993,457 | | | 9,118,611 | |

| Profit-sharing contributions | 17,367,554 | | | 10,482,073 |

| Notes receivable from participants | 109,191,502 | | 102,815,135 |

| Total receivables | 148,283,859 | | 128,025,538 |

| | | | | | | | | |

| | | | | | | | | |

NET ASSETS AVAILABLE FOR BENEFITS | $ | 5,834,008,945 | | | $ | 5,179,370,432 | |

The accompanying Notes are an integral part of these Financial Statements.

3

| | | | | | | | | | | | | | | | | | | | | | | |

| EXELON CORPORATION EMPLOYEE SAVINGS PLAN |

|

| STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | Year Ended |

| | | | | | | December 31, 2023 |

| ADDITIONS | |

| Contributions | |

| Participant | $ | 225,546,449 | |

| Employer fixed match | 74,464,551 | |

| Employer non-discretionary fixed | 14,654,425 | |

| Employer profit-sharing match | 17,367,554 | |

| Rollover receipts | 18,439,732 |

| Total contributions | 350,472,711 |

| | | | | | | |

| Investment income | |

| | Plan interest in the net investment income from the Exelon Corporation Defined Contribution Retirement Plans Master Trust (see Note 3) | 758,551,016 | |

| | Interest income from notes receivable from participants | 7,919,443 | |

| Total investment income | 766,470,459 |

| Total additions | 1,116,943,170 |

| | | | | | | |

| DEDUCTIONS | |

| Participant withdrawals and distributions | 460,541,360 | |

| Administrative expenses | 3,607,229 |

| Total deductions | 464,148,589 |

| | | | | | | |

| Net increase before transfers | 652,794,581 |

| Net assets transferred from Constellation (see Note 8) | 1,843,932 |

| Net increase after transfers | 654,638,513 |

| | | | | | | |

| NET ASSETS AVAILABLE FOR BENEFITS | |

| Beginning of year | 5,179,370,432 |

| End of year | $ | 5,834,008,945 | |

The accompanying Notes are an integral part of these Financial Statements.

4

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1.Plan Description

The following description of the Exelon Corporation Employee Savings Plan (the “Plan”) is provided for general information purposes only. The official text of the Plan, as amended, should be read for more complete information.

General

The Plan was established by Commonwealth Edison Company, effective March 1, 1983, to provide a systematic savings program for eligible employees and to supplement such savings with employer matching contributions. On March 30, 2001, the Commonwealth Edison Employee Savings and Investment Plan was combined with the PECO Energy Company Employee Savings Plan to become the Exelon Corporation Employee Savings Plan. On July 1, 2014, the Constellation Energy Group, Inc. Employee Savings Plan was merged into the Plan. On July 1, 2015, the Employee Savings Plan for Constellation Energy Nuclear Group, LLC and Represented Employee Savings Plan for Nine Mile Point were merged into the Plan. On July 1, 2018, the BG New England Power Services, Inc. Union Retirement 401(k) Plan, BG New England Power Services, Inc. 401(k) Plan, BG Boston Services LLC Union Retirement 401(k) Plan, and Pepco Holdings Inc. Retirement Savings Plan were merged into the Plan. Exelon completed the spinoff of its generation business on February 1, 2022, creating Constellation Energy Corporation (“Constellation”), a new and separate publicly traded company (the “Separation”). Trust assets having a value equal to the account balances and accrued liabilities (including outstanding loans) of current and former employees who were assigned to Constellation Energy Corporation were spun off to the trust established under a newly created savings plan sponsored by Constellation Energy Generation, LLC, a subsidiary of Constellation Energy Corporation (the “Constellation Plan”). The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and the Internal Revenue Code of 1986, as amended (the “Code”). The Exelon Corporation Stock Fund, which is an investment option under the Plan, is invested primarily in Exelon Corporation common stock and is intended to be an Employee Stock Ownership Plan under Code Section 4975(e)(7).

Exelon Corporation (“Exelon”) is the sponsor of the Plan and, acting through Exelon’s Director of Employee Benefit Plans and Programs, the administrator of the Plan (the “Plan Administrator”). The Plan Administrator has the responsibility for the day-to-day administration of the Plan. Exelon, acting through the Exelon Investment Office, is responsible for the selection and retention of the Plan’s investment options and any investment manager that may be appointed under the Exelon Corporation Defined Contribution Retirement Plans Master Trust (the “Master Trust”). State Street Global Advisors is the independent investment manager for the common stock held in the Exelon Corporation Stock Fund. The Northern Trust Company is the Plan’s trustee (“Trustee”) and Northwest Plan Services, Inc. is the Plan’s recordkeeper (“Recordkeeper”).

Generally, any regular employee whose employment is subject to a collective bargaining agreement that provides for participation in the Plan and any regular non-represented employee of a subsidiary of Exelon that is designated by Exelon as participating in the Plan (such subsidiary referred to individually and collectively as the “Company”) is eligible to elect to participate in the Plan. Newly hired employees who are eligible to participate but do not make a participation election within 90 days after their date of hire will automatically be enrolled in the Plan as soon as administratively practicable after their 90th day of employment with a pre-tax deferral of 3% of eligible pay per pay period and 1% increase each March 1st, generally beginning with the second calendar year that begins after automatic enrollment first applies to the participant, until the deferral rate reaches 10%. A participant who is subject to automatic enrollment may elect within 90 days of the first automatic contribution, to withdraw all automatic contributions adjusted for any investment gains or losses. Such a withdrawal would be subject to federal income tax but not to any early withdrawal penalty. Additionally, the

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

participant will forfeit any employer matching contributions made with respect to such automatic contributions. Contributions to the Plan made by employees who did not file an investment election generally will be automatically invested in the custom target retirement fund that corresponds to the participant’s assumed retirement date (based on the participant’s birth date).

In accordance with the Setting Every Community Up for Retirement Enhancement Act of 2019 (the “SECURE Act”), participants who attain age 70½ after December 31, 2019 will begin receiving benefit payments no later than April 1 of the calendar year following the calendar year in which they attain age 72 (their “Required Beginning Date”).

In accordance with the Setting Every Community Up for Retirement Enhancement Act of 2022 (the “SECURE 2.0 Act of 2022”), participants who attain age 72 after December 31, 2022 will begin receiving benefit payments no later than April 1 of the calendar year following the calendar year in which they attain age 73.

Participant Contributions

The Plan generally permits salaried, non-represented hourly and participating represented employees to elect to contribute between 1% and 50% (percentage varies for some represented employees based on the applicable collective bargaining agreement) of eligible pay each pay period on a pre-tax basis, an after-tax basis, a Roth basis or a combination of the three, subject to certain Internal Revenue Service (“IRS”) limitations.

During any calendar year in which a participant attains age 50 or older, he or she generally may elect to make additional pre-tax contributions, called “catch-up” contributions, to the Plan. In order to be eligible to make catch-up contributions, the participant must anticipate that his or her pre-tax contributions to the Plan will reach the applicable annual IRS limit on that type of contribution or be contributing at the maximum base pay level. Catch-up contributions are not credited with the Company’s fixed or profit-sharing matching contributions.

Company Contributions

With respect to non-represented employees, except non-exempt craft and clerical employees assigned to Philadelphia Electric Company, Exelon provides both a fixed and annual profit-sharing match. Under the fixed match, Exelon matches 60% of the first 5% of a participant’s eligible pay contributed per pay period, by the employee for a maximum annual fixed match percentage of 3% of the participant’s eligible pay. Additionally, with respect to such employees, Exelon may make an annual profit-sharing match of up to 3% of eligible pay contributed per pay period by the employee, based on specified performance goals established by the Compensation Committee of Exelon’s Board of Directors (the “Committee”). Combined, the total employer match (fixed and profit-sharing) is an annual maximum of up to 6% of a participant’s eligible pay. Any profit-sharing match will be contributed to the Plan after the end of each calendar year. The 2023 profit-sharing match contributed in 2024 was $17,367,554. The 2022 profit-sharing match contributed in 2023 was $10,482,073. Generally, a participant must be employed on the last day of a calendar year to receive the profit-sharing match for that year. In the event a participant terminates employment during the calendar year due to death, long-term disability or retirement (age 50 and completion of 10 years of service with the Company) or in the event a participant terminates employment with the Company and receives benefits under the severance plan, the participant will be eligible to receive a profit-sharing match.

With respect to non-represented, non-exempt craft and clerical employees assigned to Philadelphia Electric Company, Exelon provides a fixed match of 100% of the first 5% of a participant’s eligible pay contributed per pay period.

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

With respect to non-represented, non-craft employees hired or rehired on or after February 1, 2018 by non-utility related employers and January 1, 2021 by utility-related employers, who are not eligible to participate in the Exelon Corporation Cash Balance Pension Plan under the Exelon Corporation Retirement Program, the Company provides an additional non-discretionary fixed contribution of 4% of eligible pay. Any non-discretionary fixed contribution will be contributed to the Plan after the end of each calendar year based on eligible pay determined as of the last day of the applicable plan year.

For represented employees, employer matching contributions and profit sharing or non-discretionary fixed contributions if applicable, vary based on the applicable collective bargaining agreement.

Investment Options

The Plan’s investments are held in the Master Trust, which was established in 2006, for the investments of the Plan and other savings plans sponsored by Exelon. The Plan's investments are fully participant-directed, and the Plan is intended to satisfy Section 404(c) of ERISA.

The investment options include a menu of funds that include twelve custom Target Date Fund options, three actively-managed custom funds, nineteen passively-managed funds, the Northern Trust U.S. Government Short-Term Investment Fund and the Exelon Corporation Stock Fund. Below is a brief description of each of the investment options available as of December 31, 2023 and 2022. These descriptions are not, and are not intended to be, complete descriptions of each investment option’s risk, objective and strategy.

Target Date Funds - Diversified funds managed by multiple investment managers that seek to provide investment return, shifting from an emphasis on capital appreciation to an emphasis on income and inflation protection as the fund approaches and passes its target retirement age. Target allocations of the funds are designed using certain assumptions, including that most Exelon plan participants receive a 401(k) company matching contribution under the Plan, either earn pension benefits over their careers or receive additional employer 401(k) contributions in lieu of pension benefits, and typically begin receiving retirement benefits around age 61. The funds reduce exposure to equity and real estate, and increase exposure to fixed income and certain other investments, as the target retirement date approaches, and for ten years thereafter.

Actively-managed custom funds - These funds use a multi-manager approach whereby the fund’s assets are allocated to several investment managers that act independently of each other and follow their own distinct investment style in investing in securities. The portfolios are principally managed using an active approach with the objective of collectively exceeding the record of the fund benchmark while maintaining an acceptable risk profile.

Passively-managed funds - These funds seek investment results that correspond generally to the price and yield performance, before fees and expenses, of a particular index.

Northern Trust U.S. Government Short-Term Investment Fund - This fund is an investment vehicle for cash reserves that offers a rate of return based on a portfolio of obligations of the U.S. Government, its agencies or instrumentalities, and related money market instruments. Principal preservation and liquidity management are the fund’s primary objectives.

Exelon Corporation Stock Fund - This fund primarily invests in Exelon common stock with some short-term liquid investments. The Exelon Corporation Stock Fund does not represent direct ownership of Exelon common stock. The fund's unit value is determined by dividing the total current fair value of the investments in the fund by the total number of units owned. This fund is intended to

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

generally track the performance of Exelon Corporation's publicly traded stock, net of fees and expenses and taking into account liquidity needs.

Notes Receivable from Participants

A participant may, upon application, borrow from the Plan. Only one loan is permitted to a participant in any calendar year with a maximum of three loans outstanding at any time (except as otherwise provided in the Plan document), and the amount of any loan shall not be less than $1,000. The aggregate amount of all outstanding loans may not exceed the lesser of (i) 50% of a participant’s vested balance in the Plan or (ii) $50,000 minus the excess of the highest outstanding balance of all loans from the Plan to the participant during the previous 12-month period over the outstanding balance of all loans from the Plan to the participant on the day the loan is made. For loans other than home loans, the maximum term is five years. For a home loan, the maximum term is fifteen years and the minimum is five years. The interest rate on all loans is the prime rate for commercial loans plus 1%. Principal and interest is paid ratably through monthly payroll deductions or direct payment, as applicable. No lump-sum or installment distribution from the Plan will be made to a participant who has received a loan, or to a beneficiary of any such participant, until the loan, including interest, has been repaid out of the funds otherwise distributable. In the event a participant defaults on the repayment of a loan, the loan will be considered a taxable distribution of the participant’s account and may be subject to an early withdrawal penalty.

Withdrawals by Participants While Employed

Generally, a participant may withdraw up to the entire balance of his or her after-tax contributions account once each calendar year. After making such a withdrawal, the participant must wait six months before making a new election to resume after-tax contributions to the Plan if the distribution is received by the participant before attainment of age 59½. A participant may also withdraw up to an amount equal to the balance in his or her rollover account.

Generally, a participant may make withdrawals from his or her before-tax, catch-up, matching, Roth, Roth catch-up and Roth rollover contributions accounts, but only if the participant has attained age 59½ or, prior to that age, only in an amount required to alleviate financial hardship as defined in the Code and regulations promulgated thereunder. Financial hardship withdrawals from a before-tax contributions account suspend the participant’s right to make contributions to the Plan for six months.

While any loan to the participant remains outstanding, the maximum amount available for withdrawal shall be the balance in such account less the balance of all outstanding loans.

Distributions upon Termination of Employment

Upon termination of employment, including the retirement, total disability or death of a participant, a participant is entitled to the distribution of his or her entire account balance. Such distribution will be made, as elected by the participant, in the form of either a single lump-sum payment, an ad hoc partial distribution, or in substantially equal annual, quarterly or monthly installments over any period of time specified by the participant, subject to meeting any restrictions required by applicable law, including but not limited to the minimum distribution requirements under the Code. If a participant elects installment payments, the participant can elect to change the amount, frequency and number of payments. A participant also may elect ad hoc partial withdrawals. A participant may elect to defer distributions until their Required Beginning Date. If the value of a participant’s account is $1,000 or less, the participant will receive a lump sum distribution from the Plan upon termination of employment. If the value of a participant’s account is greater than $1,000, the participant can leave his or her account in the Plan. Generally, distributions will be taxed as ordinary income in the year withdrawn and may also be subject to an early withdrawal penalty if taken before age 59½, unless eligible rollover distributions are rolled over to another qualified plan or an

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Individual Retirement Account (“IRA”). A 20% mandatory federal income tax withholding applies to withdrawals that are eligible for rollover, but which are not directly rolled over to another qualified plan or an IRA. If a participant does not specify the form and timing of the participant’s distribution, the benefit generally will be paid in installments beginning no later than April 1 of the calendar year following the calendar year in which the participant attains age 73.

Participant Accounts

Each participant’s account is credited with the participant’s contribution and allocations of (i) the Company’s corresponding contributions and (ii) account earnings and losses, and charged with an allocation of administrative fees and expenses. Allocations are based on participant elections or account balances, as applicable. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting of Participants’ Accounts

Participants are fully vested in their accounts at all times.

Investment Income

Dividends and earnings received on all funds, with the potential exception of the Exelon Corporation Stock Fund, are automatically reinvested in the fund to which those earnings apply.

Employee Stock Ownership Plan

If a participant invests any portion of his or her account in the Exelon Corporation Stock Fund and is eligible to receive dividend distributions from the Plan, then the participant is deemed to have elected to have the dividends reinvested in the Exelon Corporation Stock Fund. If the participant prefers to receive any such dividends in cash, he or she can so elect by contacting the Recordkeeper. Dividends distributed to the participant in cash from the Plan are subject to income tax as a dividend and not subject to an early withdrawal penalty.

2.Summary of Significant Accounting Policies

General

The Plan follows the accrual method of accounting, in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Withdrawals and distributions are recorded when paid.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Plan Administrator to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Accordingly, actual results may differ from those estimates.

Investment Valuation and Income Recognition

The Plan’s interest in the Master Trust is stated at fair value. Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The Plan presents, in the Statement of Changes in Net Assets Available for Benefits, the Plan interest in investment income from the Master Trust. See Note 3 — Fair Value of Interest in Master Trust for further information.

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Plan Expenses

A participant’s account balance will be charged with certain fees and expenses. Asset-based fees (e.g., management fees and other fund operating expenses) are used to cover the expenses related to running an investment fund, and are generally deducted directly from a participant’s investment returns. The asset-based fees relating to the target date and actively-managed custom funds are primarily presented within the investment and administrative fees of the Master Trust. See Note 3 — Fair Value of Interest in Master Trust for further information.

Plan administration fees, which may include certain direct expenses, cover the day-to-day expenses of administering the Plan and are covered by amounts deducted directly from participant accounts. Transaction-based fees also may be charged with respect to optional features offered under the Plan (e.g., loans) and are charged directly against a participant’s account balance.

Notes Receivable from Participants

Notes receivable from participants are valued at their unpaid principal balance plus accrued interest. No allowance for credit losses has been recorded as of December 31, 2023 or 2022.

3.Fair Value of Interest in Master Trust

The Plan established a Master Trust Agreement with the Trustee for the purpose of investing assets of the Plan and other savings plans sponsored by Exelon. As of February 1, 2022, the date of the consummation of the Separation, the Plan is the only participating plan within the Master Trust. Effective January 1, 2016, the Exelon Corporation Stock Fund was offered in Plan. The Master Trust is comprised of two master trust investment accounts (“MTIA”), one of which contains primarily real estate investments (“MTIA B”) and another for the remaining other investments (“MTIA A”). The real estate account within the Master Trust is comprised primarily of real estate assets that do not have an observable value (either directly or indirectly) on an established market, and therefore, is being reported separately for Form 5500 purposes. Interest and dividends along with net depreciation or appreciation in the fair value of investments are allocated to the Plan on a daily basis based upon the Plan’s equitable share of the various investment funds and portfolios that comprise the Master Trust. The Plan’s Statements of Net Assets Available for Benefits include its share of investments maintained in the Master Trust measured at fair value on a recurring basis.

The net assets of the Master Trust and Plan interest in the Master Trust as of December 31, 2023 and 2022 were as follows: | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 |

| MTIA A | MTIA B | Total Master Trust | | | | Total Plan Interest in Master Trust |

| ASSETS | | | | | | | |

Investments, at fair value | | | | | | | |

| Interest-bearing cash | $ | 350,671,874 | | $ | — | | $ | 350,671,874 | | | | | $ | 350,671,874 | |

| U.S. government securities | 490,708,092 | | — | | 490,708,092 | | | | | 490,708,092 | |

| Corporate debt instruments - preferred | 10,016,843 | | — | | 10,016,843 | | | | | 10,016,843 | |

| Corporate debt instruments - other | 410,243,938 | | — | | 410,243,938 | | | | | 410,243,938 | |

| Corporate stock - preferred | 314,865 | | — | | 314,865 | | | | | 314,865 | |

| Corporate stock - common | 1,201,220,058 | | — | | 1,201,220,058 | | | | | 1,201,220,058 | |

| Corporate stock - Exelon Corporation (1) | 163,382,300 | | — | | 163,382,300 | | | | | 163,382,300 | |

| Real estate | — | | 101,544,171 | | 101,544,171 | | | | | 101,544,171 | |

| Common/collective trust funds | 2,777,079,863 | | 382,224 | | 2,777,462,087 | | | | | 2,777,462,087 | |

| Registered investment company securities | 139,592,303 | | 45,939,075 | | 185,531,378 | | | | | 185,531,378 | |

| Other investments | 37,225,284 | | — | | 37,225,284 | | | | | 37,225,284 | |

| Total Master Trust investments | 5,580,455,420 | | 147,865,470 | | 5,728,320,890 | | | | | 5,728,320,890 | |

| | | | | | | | |

| Other Assets | | | | | | | |

| Cash | 2,571,952 | | — | | 2,571,952 | | | | | 2,571,952 | |

| Accrued dividend and interest | 13,124,949 | | — | | 13,124,949 | | | | | 13,124,949 | |

| Due from brokers for securities sold | 67,479,325 | | — | | 67,479,325 | | | | | 67,479,325 | |

| Pending foreign exchange purchases receivable | 12,589,042 | | — | | 12,589,042 | | | | | 12,589,042 | |

| Other | 5,445,646 | | — | | 5,445,646 | | | | | 5,445,646 | |

| Total other assets | 101,210,914 | | — | | 101,210,914 | | | | | 101,210,914 | |

| | | | | | | | |

Total Master Trust assets | 5,681,666,334 | | 147,865,470 | | 5,829,531,804 | | | | | 5,829,531,804 | |

| | | | | | | |

| LIABILITIES | | | | | | | |

| Accrued investment and administrative expenses | 8,408,738 | | 475,341 | | 8,884,079 | | | | | 8,884,079 | |

| Due to broker for securities purchased | 119,731,040 | | — | | 119,731,040 | | | | | 119,731,040 | |

| Pending foreign exchange purchases payable | 12,666,048 | | — | | 12,666,048 | | | | | 12,666,048 | |

| Other liabilities | 2,525,551 | | — | | 2,525,551 | | | | | 2,525,551 | |

Total Master Trust liabilities | 143,331,377 | | 475,341 | | 143,806,718 | | | | | 143,806,718 | |

| | | | | | | | |

Total Master Trust net assets | $ | 5,538,334,957 | | $ | 147,390,129 | | $ | 5,685,725,086 | | | | | $ | 5,685,725,086 | |

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

| | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 |

| MTIA A | MTIA B | Total Master Trust | | | | Total Plan Interest in Master Trust |

| ASSETS | | | | | | | |

Investments, at fair value | | | | | | | |

| Interest-bearing cash | $ | 386,623,708 | | $ | — | | $ | 386,623,708 | | | | | $ | 386,623,708 | |

| U.S. government securities | 416,762,361 | | — | | 416,762,361 | | | | | 416,762,361 | |

| Corporate debt instruments - preferred | 7,711,096 | | — | | 7,711,096 | | | | | 7,711,096 | |

| Corporate debt instruments - other | 392,940,877 | | — | | 392,940,877 | | | | | 392,940,877 | |

| Corporate stock - preferred | 218,680 | | — | | 218,680 | | | | | 218,680 | |

| Corporate stock - common | 1,029,667,435 | | — | | 1,029,667,435 | | | | | 1,029,667,435 | |

| Corporate stock - Exelon Corporation (1) | 188,854,362 | | — | | 188,854,362 | | | | | 188,854,362 | |

| Real estate | — | | 122,529,615 | | 122,529,615 | | | | | 122,529,615 | |

| Common/collective trust funds | 2,348,015,810 | | 335,611 | | 2,348,351,421 | | | | | 2,348,351,421 | |

| Registered investment company securities | 133,394,791 | | 12,371,093 | | 145,765,884 | | | | | 145,765,884 | |

| Other investments | 53,920,587 | | — | | 53,920,587 | | | | | 53,920,587 | |

| Total Master Trust investments | 4,958,109,707 | | 135,236,319 | | 5,093,346,026 | | | | | 5,093,346,026 | |

| | | | | | | | |

| Other Assets | | | | | | | |

| Cash | 480,778 | | — | | 480,778 | | | | | 480,778 | |

| Accrued dividend and interest | 11,173,244 | | — | | 11,173,244 | | | | | 11,173,244 | |

| Due from brokers for securities sold | 66,723,312 | | — | | 66,723,312 | | | | | 66,723,312 | |

| Pending foreign exchange purchase receivable | 27,713,143 | | — | | 27,713,143 | | | | | 27,713,143 | |

| Other | 10,465,319 | | — | | 10,465,319 | | | | | 10,465,319 | |

| Total other assets | 116,555,796 | | — | | 116,555,796 | | | | | 116,555,796 | |

| | | | | | | | |

Total Master Trust assets | 5,074,665,503 | | 135,236,319 | | 5,209,901,822 | | | | | 5,209,901,822 | |

| | | | | | | |

| LIABILITIES | | | | | | | |

| Accrued investment and administrative expenses | 8,740,275 | | 1,594,069 | | 10,334,344 | | | | | 10,334,344 | |

| Due to broker for securities purchased | 113,093,764 | | — | | 113,093,764 | | | | | 113,093,764 | |

| Pending foreign exchange purchase payables | 29,254,283 | | — | | 29,254,283 | | | | | 29,254,283 | |

| Other liabilities | 5,874,537 | | — | | 5,874,537 | | | | | 5,874,537 | |

Total Master Trust liabilities | 156,962,859 | | 1,594,069 | | 158,556,928 | | | | | 158,556,928 | |

| | | | | | | | |

| Total Master Trust net assets | $ | 4,917,702,644 | | $ | 133,642,250 | | $ | 5,051,344,894 | | | | | $ | 5,051,344,894 | |

(1) The Exelon Corporation Stock Fund held $163 million and $189 million of this investment as of December 31, 2023 and 2022, respectively. The actively-managed custom funds did not hold this investment as of December 31, 2023 or as of December 31, 2022.

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

The net investment income/(loss) of the Master Trust and Plan interest in the Master Trust for the year ended December 31, 2023 was as follows: | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| MTIA A | MTIA B | Total Master Trust | | | | Plan Interest in Total |

Corporate stock dividends | $ | 27,369,258 | | $ | — | | $ | 27,369,258 | | | | | $ | 27,369,258 | |

| Other interest and dividends | 54,068,221 | | 1,258,426 | | 55,326,647 | | | | | 55,326,647 | |

| | | | | | | |

| Net appreciation/(depreciation) in the fair value of investments | 690,517,558 | | (4,380,723) | | 686,136,835 | | | | | 686,136,835 | |

| | | | | | | |

| Total net investment income/(loss) | 771,955,037 | | (3,122,297) | | 768,832,740 | | | | | 768,832,740 | |

| | | | | | | |

| Investment and administrative expenses not directly allocated to the plans | (8,893,317) | | (1,388,407) | | (10,281,724) | | | | | (10,281,724) | |

| | | | | | | |

| Total Master Trust net investment income/(loss) | $ | 763,061,720 | | $ | (4,510,704) | | $ | 758,551,016 | | | | | $ | 758,551,016 | |

Recurring Fair Value Measurements

To increase consistency and comparability in fair value measurements, the FASB established a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

•Level 1 - unadjusted quoted prices in active markets for identical assets for which the Plan has the ability to access as of the reporting date.

•Level 2 - inputs other than quoted prices included within Level 1 that are directly observable for the asset or indirectly observable through corroboration with observable market data.

•Level 3 - unobservable inputs, such as internally-developed pricing models for the asset. The Plan does not have any financial assets utilizing Level 3 inputs.

The valuation methods for each investment category are described below.

Interest-bearing cash. Investments with original maturities of three months or less when purchased, including certain short-term fixed income securities and money market funds, are considered interest-bearing cash. The fair values are based on observable market prices and, therefore, have been categorized in Level 1 in the fair value hierarchy.

U.S. government securities. U.S. government securities are valued daily based on quoted prices in active markets. Investments in U.S. Treasury securities have been categorized in Level 1 because they trade in highly liquid and transparent markets. Investments in U.S. government affiliates are based on evaluated prices that reflect observable market information, such as actual trade information of similar securities, adjusted for observable differences and are categorized as Level 2.

Preferred and other corporate debt instruments. Corporate debt instruments are based on evaluated prices that reflect observable market information, such as actual trade information of similar securities, adjusted for observable differences and are categorized as Level 2.

Preferred, common corporate stock and Exelon Corporation stock. The Master Trust’s stock investments are primarily traded on exchanges that contain only actively traded securities, due to the volume trading requirements imposed by these exchanges. Preferred and common corporate stocks, including Exelon Corporation stock, rights and warrants, are valued daily based on quoted prices in active markets and are categorized as Level 1.

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Real estate. Income producing real estate funds are held in a separate account with liquid securities and are valued by the fund managers on a periodic basis. Fund values are based on valuation of the underlying investments which may include inputs such as operating results, discounted future cash flows and market-based comparable data. The valuation inputs are unobservable. Certain real estate investments are redeemable from the investment vehicle quarterly, with 30 days of notice and may be subject to certain restrictions. The fair value is determined using net asset value (NAV) or its equivalent as a practical expedient and are not classified within the fair value hierarchy.

Common/collective trust funds. Common/collective trust funds are maintained by investment companies and hold investments in accordance with a stated set of fund objectives. For common/collective trust funds which are not publicly quoted, the funds are valued using the NAV per fund share as a practical expedient, which is primarily derived from the quoted prices in active markets of the underlying securities, and are not classified within the fair value hierarchy. Common/collective trust funds can be redeemed monthly or more frequently, with 3 or less days of notice.

Registered investment company securities. Registered investment company securities are investment funds maintained by investment companies that hold investments in accordance with a stated set of fund objectives. For funds with values that are publicly quoted on a daily basis in active markets, the funds have been categorized as Level 1. For funds with values which are not publicly quoted, the funds are valued using the NAV per fund share as a practical expedient, which is primarily derived from the quoted prices in active markets of the underlying securities, and are not classified within the fair value hierarchy. The registered investment company securities can be redeemed daily.

Other investments. Other investments may include futures contracts, swap contracts, holdings in real estate investment trusts, and state, municipal and foreign government fixed income securities. Futures contracts are valued daily based on quoted prices in active markets and trade in open markets, and have been categorized as Level 1. Real estate investment trusts are valued daily based on quoted prices in active markets and have been categorized as Level 1. State, municipal and foreign government fixed income securities are valued daily using evaluated prices that reflect observable market information, such as actual trade information of similar securities, adjusted for observable differences, and are categorized as Level 2. Derivative instruments other than futures contracts are valued based on external price data of comparable securities and have been categorized as Level 2.

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

The following tables present assets measured and recorded at fair value on the Plan’s Statement of Net Assets Available for Benefits and in the Master Trust’s net assets on a recurring basis and their level within fair value hierarchy as of December 31, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2023 | | | | | | | | |

| | Level 1 | | Level 2 | | Not Subject to Leveling | | Total |

| Master Trust Investments: | | | | | | | | |

| | | | | | | | |

| Interest-bearing cash | | $ | 350,671,874 | | | $ | — | | | $ | — | | | $ | 350,671,874 | |

| U.S. government securities | | 252,041,590 | | | 238,666,502 | | | — | | | 490,708,092 | |

| Corporate debt instruments - preferred | | — | | | 10,016,843 | | | — | | | 10,016,843 | |

| Corporate debt instruments - other | | — | | | 410,243,938 | | | — | | | 410,243,938 | |

| Corporate stock - preferred | | 314,865 | | | — | | | — | | | 314,865 | |

| Corporate stock - common | | 1,201,220,058 | | | — | | | — | | | 1,201,220,058 | |

| Corporate stock - Exelon Corporation | | 163,382,300 | | | — | | | — | | | 163,382,300 | |

| Real estate | | — | | | — | | | 101,544,171 | | | 101,544,171 | |

| Common/collective trust funds | | — | | | — | | | 2,777,462,087 | | | 2,777,462,087 | |

| Registered investment company securities | | 131,375,287 | | | — | | | 54,156,091 | | | 185,531,378 | |

| Other investments | | 22,221,114 | | | 15,004,170 | | | — | | | 37,225,284 | |

| Total Master Trust investments | | $ | 2,121,227,088 | | | $ | 673,931,453 | | | $ | 2,933,162,349 | | | $ | 5,728,320,890 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 | | | | | | | | |

| | Level 1 | | Level 2 | | Not Subject to Leveling | | Total |

| Master Trust Investments: | | | | | | | | |

| | | | | | | | |

| Interest-bearing cash | | $ | 386,623,708 | | | $ | — | | | $ | — | | | $ | 386,623,708 | |

| U.S. government securities | | 226,027,140 | | | 190,735,221 | | | — | | | 416,762,361 | |

| Corporate debt instruments - preferred | | — | | | 7,711,096 | | | — | | | 7,711,096 | |

| Corporate debt instruments - other | | — | | | 392,940,877 | | | — | | | 392,940,877 | |

| Corporate stock - preferred | | 218,680 | | | — | | | — | | | 218,680 | |

| Corporate stock - common | | 1,029,667,435 | | | — | | | — | | | 1,029,667,435 | |

| Corporate stock - Exelon Corporation | | 188,854,362 | | | — | | | — | | | 188,854,362 | |

| Real estate | | — | | | — | | | 122,529,615 | | | 122,529,615 | |

| Common/collective trust funds | | — | | | — | | | 2,348,351,421 | | | 2,348,351,421 | |

| Registered investment company securities | | 90,689,547 | | | — | | | 55,076,337 | | | 145,765,884 | |

| Other investments | | 25,105,534 | | | 28,815,053 | | | — | | | 53,920,587 | |

| Total Master Trust investments | | $ | 1,947,186,406 | | | $ | 620,202,247 | | | $ | 2,525,957,373 | | | $ | 5,093,346,026 | |

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

4.Risks and Uncertainties

The Plan provides for various investment options in several investment securities and instruments. Investment securities are exposed to various risks, such as interest, market and credit risk. Due to the level of risks associated with certain investment securities and the level of uncertainty related to changes in the value of investment securities, it is at least reasonably possible that changes in values in the near term could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits and the Statement of Changes in Net Assets Available for Benefits.

From time to time, investment managers may use derivative financial instruments including futures, forward foreign exchange, and swap contracts. Derivative instruments may be used to mitigate exposure to foreign exchange rate and interest rate fluctuations as well as manage the investment mix in the portfolio. The Plan’s exposure is limited to the fund(s) utilizing such derivative investments. Risks of entering into derivatives include the risk of an illiquid market, inability of a counterparty to perform, or unfavorable movement in foreign currency exchange rates, interest rates, or the underlying securities.

Some investment managers may engage in securities lending programs in which the funds lend securities to borrowers, with the objective of generating additional income. The borrowers of fund securities deliver collateral to secure each loan in the form of cash, securities, or letters of credit, and are required to maintain the collateral at a level no less than 100% of the market value of the loaned securities. Cash collateral is invested in common/collective trust funds or collateral pools. Participation in securities lending programs involves exposure to the risk that the borrower may default and there may be insufficient collateral to buy back the security. Lenders of securities also face the risk that invested cash collateral may become impaired or that the interest paid on loans may exceed the amount earned on the invested collateral. The Plan’s exposure is limited to the funds that lend securities.

5.Income Tax Status

The Plan obtained its latest determination letter on May 25, 2017 in which the IRS stated that the Plan, as then designed, was in compliance with the applicable requirements of the Code. The Plan is qualified under Section 401(a) and 401(k) of the Code. The Plan has been amended since receiving the determination letter. However, the Plan Administrator believes that the Plan design remains in compliance with the applicable requirements of the Code. Therefore, it is believed that the Plan was qualified and the related Master Trust was tax-exempt as of the financial statement date.

GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the applicable authorities. The Company has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2023, there were no uncertain tax positions taken. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

6.Plan Termination

The Plan may be amended, modified or terminated by Exelon at any time. The Plan may also be terminated if the IRS disqualifies the Plan. Termination of the Plan with respect to a participating employer may occur if there is no successor employer in the event of dissolution, merger, consolidation or reorganization of such employer company. In the event of full or partial termination of the Plan, assets of affected participants of the terminating employer or employers shall remain 100% vested and distributable at fair market value in the form of cash, securities or annuity contracts, in accordance with the provisions of the Plan.

EXELON CORPORATION EMPLOYEE SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

7.Related Party Transactions

Investment options in the Plan include common/collective trust funds managed by the Trustee or its affiliates. The Master Trust also holds shares of Exelon Corporation common stock. These transactions qualify as exempt party-in-interest transactions, in accordance with ERISA. There have been no known prohibited transactions with a party-in-interest.

8.Plan Transfers

In 2023, there was residual net transfer activity totaling $1,843,932 to the Plan from the Constellation Plan related to the Separation as of February 1, 2022.

9. Excessive Fee Lawsuit

On December 6, 2021, seven current and former employees filed a putative ERISA class action suit in U.S. District Court for the Northern District of Illinois against Exelon, its Board of Directors, the former Board Investment Oversight Committee, the Corporate Investment Committee, individual defendants, and other unnamed fiduciaries of the Exelon Corporation Employee Savings Plan (Plan). The complaint alleged that the defendants violated their fiduciary duties under the Plan by including certain investment options that allegedly were more expensive than and underperformed similar passively-managed or other funds available in the marketplace and permitting a third-party administrative service provider/recordkeeper and an investment adviser to charge excessive fees for the services provided. The plaintiffs sought declaratory, equitable and monetary relief on behalf of the Plan and participants. On February 16, 2022, the court granted the parties’ stipulated dismissal of the individual named defendants without prejudice. The remaining defendants filed a motion to dismiss the complaint on February 25, 2022. On March 4, 2022, the Chamber of Commerce filed a brief of amicus curiae in support of the defendants’ motion to dismiss. On September 22, 2022, the court granted Exelon’s motion to dismiss without prejudice. The court granted plaintiffs leave until October 31, 2022 to file an amended complaint, which was later extended to November 30, 2022. Plaintiffs filed their amended complaint on November 30, 2022. Defendants filed their motion to dismiss the amended complaint on January 20, 2023. On September 29, 2023, the court again granted Exelon’s motion to dismiss but granted plaintiffs leave until October 20, 2023 to file a second amended complaint. Plaintiffs did not file an amended complaint by the deadline. On October 25, 2023, the parties filed a joint Stipulation of Dismissal, which provides that plaintiffs agreed that they will not initiate an appeal from the dismissal of this matter, and the parties agree that each side shall bear their own costs and attorneys’ fees. Plaintiffs also acknowledge in the Stipulation that defendants have neither paid nor agreed to pay or provide any monetary or equitable remedy in connection with the dismissal of this action. On October 27, 2023, the court entered final judgment dismissing the matter with prejudice.

10. Subsequent Events

The Plan’s management evaluated subsequent events through June 20, 2024, the date the financial statements were available to be issued and determined that there were no subsequent events to be recognized or disclosed in the financial statements.

| | | | | | | | | | | | | | | | | | | | |

| EXELON CORPORATION EMPLOYEE SAVINGS PLAN |

SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| As of December 31, 2023 |

Schedule H, Part IV, Item 4i of Form 5500 |

Employer Identification Number 23-2990190, Plan #003 |

| | | | | | |

| | | | (c) | | |

| | | | Description of Investment | | |

| | (b) | | Including Maturity Date, Rate | | (e) |

| | Identity of Issue, Borrower, Lessor, | | of Interest, Collateral | | Current |

| (a) | | or Similar Party | | Par or Maturity Value | | Value |

* |

| Interest in net assets of Master Trust, at fair value | | | | $ | 5,685,725,086 | |

| | | | | | |

* |

| Participant loans | | Interest rates: 3.25% - 10.0% | | 109,191,502 | |

| | | | | | |

| | Total investments | | | | $ | 5,794,916,588 | |

| | | | | | |

| * | Represents party-in-interest | | | | |

| Column (d), cost, has been omitted as investments are participant - directed. | | |

EXHIBIT INDEX

Exhibit filed with Form 11-K for the year ended December 31, 2023:

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized | | | | | | | | |

| | Exelon Corporation Employee Savings Plan |

| | |

| Date: June 20, 2024 | | /s/ Michelle Aubin |

| | Michelle Aubin |

| | Plan Administrator |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statements (Form S-8 Nos. 333-219037, 333-175162, 333-37082 and 333-49780) pertaining to the Exelon Corporation Employee Savings Plan of our report dated June 20, 2024, with respect to the financial statements and supplemental schedule of the Exelon Corporation Employee Savings Plan included in this Annual Report (Form 11-K) for the year ended December 31, 2023.

| | | | | | | | | | | |

|

| /s/ MITCHELL & TITUS, LLP |

| Chicago, Illinois | | | |

| June 20, 2024 | | | |

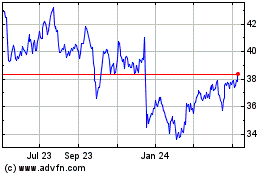

Exelon (NASDAQ:EXC)

Historical Stock Chart

From May 2024 to Jun 2024

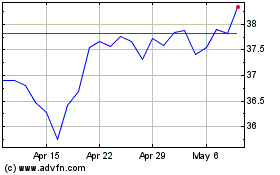

Exelon (NASDAQ:EXC)

Historical Stock Chart

From Jun 2023 to Jun 2024