Current Report Filing (8-k)

December 14 2020 - 5:09PM

Edgar (US Regulatory)

0000033488

false

0000033488

2020-12-14

2020-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT Pursuant

to

Section 13 or 15(D) of the

Securities

Exchange Act of 1934

|

Date of report (Date of earliest event reported)

|

December 14, 2020

|

ESCALADE, INCORPORATED

(Exact Name of Registrant as Specified in

Its Charter)

Indiana

(State or Other Jurisdiction of Incorporation)

|

0-6996

|

13-2739290

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

817 Maxwell Ave, Evansville, Indiana

|

47711

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(812) 467-1251

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of Exchange on which registered

|

|

Common Stock, No Par Value

|

|

ESCA

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 – Entry into a Material Definitive Agreement

On December 14, 2020, Escalade, Incorporated

(the “Company”) and its wholly owned subsidiary, Indian Industries, Inc. (“Indian”), entered into the Third

Amendment dated as of December 14, 2020 (the “Third Amendment”) to the Amended and Restated Credit Agreement dated

as of January 21, 2019 among the Company, Indian, each of their domestic subsidiaries, and JPMorgan Chase Bank, N.A., as Administrative

Agent and as Lender (the “Lender”), as amended (the “Credit Agreement”). This Form 8-K describes the primary

changes made to the Credit Agreement upon entry into the Third Amendment.

Under the terms of the Third Amendment,

the maximum availability under the senior revolving credit facility increased to $75,000,000, up from $50,000,000. The maturity

date of the revolving credit facility was extended to December 14, 2023. The Company may prepay the Revolving Facility, in whole

or in part, and reborrow prior to the revolving loan maturity date.

In addition to the increased borrowing amount

and extended maturity date, other significant changes reflected in the Third Amendment include: increases in borrowing base availability

if the Company’s funded debt to EBITDA ratio is less than 1.75 to 1:00; increasing to $30,000,000 the total consideration

that the Company may use for acquisitions without obtaining the Lender’s consent; resetting the maximum authorized stock

repurchases at $15,000,000 for the period commencing upon entry into the Third Amendment; increasing the interest rate on borrowings

by twenty five basis points; increasing the unused facility fee by five basis points; and adding more specific provisions and procedures

for replacement of LIBOR if and when LIBOR would no longer be the benchmark for determining interest rates..

The Company’s indebtedness under the

Credit Agreement continues to be collateralized by liens on all of the present and future equity of each of the Company’s

domestic subsidiaries and substantially all of the assets of the Company (excluding real estate). Each direct and indirect domestic

subsidiary of the Company and Indian has secured its guaranty of indebtedness incurred under the revolving facility with a first

priority security interest and lien on all of such subsidiary’s assets. The obligations, guarantees, liens and other interests

granted by the Company, Indian, and their domestic subsidiaries continues in full force and effect.

Item 8.01 Other Events.

In connection with the Company and Indian entering into the

Third Amendment referred to in Item 1.01 above, the Company’s Board of Directors authorized resetting the aggregate limit

on the amount available to be expended for stock repurchases to $15,000,000 under the Company’s stock repurchase program.

The Company’s stock repurchases are conducted in accordance with its stock repurchase program as described in and previously

disclosed by the Company in its periodic filings with the SEC, including the Company’s Form 8-Ks, 10-Qs and 10-Ks. Under

the repurchase program, repurchases can be made from time to time using a variety of methods, including open market purchases,

all in compliance with SEC rules and other applicable legal requirements.

The Company’s stock repurchase program does not obligate

the Company to make additional stock repurchases. The program does not require the Company to acquire any specific number of shares,

and may be suspended or terminated at any time by the Company. There can be no assurances as to the number of shares, if any, that

may be purchased or as to the times, the prices, or any other terms of stock repurchases that the Company may make in the future.

Forward-looking statements

This report contains forward-looking statements relating to

present or future trends or factors that are subject to risks and uncertainties. These risks include, but are not limited to: specific

and overall impacts of the COVID-19 global pandemic on Escalade’s financial condition and results of operations; Escalade’s

plans and expectations surrounding the transition to its new Chief Executive Officer and all potential related effects and consequences;

the impact of competitive products and pricing; product demand and market acceptance; new product development; Escalade’s

ability to achieve its business objectives, especially with respect to its Sporting Goods business on which it has chosen to focus;

Escalade’s ability to successfully achieve the anticipated results of strategic transactions, including the integration of

the operations of acquired assets and businesses and of divestitures or discontinuances of certain operations, assets, brands,

and products; the continuation and development of key customer, supplier, licensing and other business relationships; the ability

to successfully negotiate the shifting retail environment and changes in consumer buying habits; the financial health of our customers;

disruptions or delays in our business operations, including without limitation disruptions or delays in our supply chain, arising

from political unrest, war, labor strikes, natural disasters, public health crises such as the coronavirus pandemic, and other

events and circumstances beyond our control; Escalade’s ability to control costs; Escalade’s ability to successfully

implement actions to lessen the potential impacts of tariffs and other trade restrictions applicable to our products and raw materials,

including impacts on the costs of producing our goods, importing products and materials into our markets for sale, and on the pricing

of our products; general economic conditions; fluctuation in operating results; changes in foreign currency exchange rates; changes

in the securities markets; Escalade’s ability to obtain financing and to maintain compliance with the terms of such financing;

the availability, integration and effective operation of information systems and other technology, and the potential interruption

of such systems or technology; risks related to data security of privacy breaches; and other risks detailed from time to time in

Escalade’s filings with the Securities and Exchange Commission. Escalade’s future financial performance could differ

materially from the expectations of management contained herein. Escalade undertakes no obligation to release revisions to these

forward-looking statements after the date of this report.

Item 9.01 Financial Statements and Exhibits

|

Exhibit

|

Description

|

|

10.1

|

Third Amendment dated as of December 14, 2020 to the Amended and Restated Credit Agreement dated as of January 21, 2019, as amended, among Escalade, Incorporated, Indian Industries, Inc., each of their domestic subsidiaries, and JPMorgan Chase Bank, N.A., as Administrative Agent (without exhibits and schedules, which Escalade has determined are not material).

|

|

104

|

Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, Escalade, Incorporated has duly caused this report to be signed on its behalf in Evansville,

Indiana by the undersigned hereunto duly authorized.

|

Date: December 14, 2020

|

ESCALADE, INCORPORATED

|

|

|

|

|

|

By: /s/ Stephen R. Wawrin

|

|

|

|

|

|

Vice President Finance, Chief Financial Officer and Secretary

|

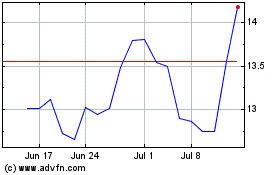

Escalade (NASDAQ:ESCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

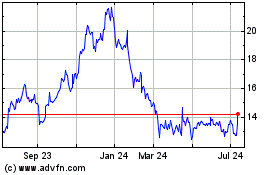

Escalade (NASDAQ:ESCA)

Historical Stock Chart

From Apr 2023 to Apr 2024