2nd UPDATE: VMware 3Q Profit Surges; Issues Strong 4Q Revenue Target

October 18 2010 - 7:06PM

Dow Jones News

VMware Inc.'s (VMW) third-quarter profit more than doubled and

revenue topped the company's bullish expectations as the software

company benefited from the growing trend of virtualization and

cloud computing.

Disappointment over the Palo Alto, Calif., company's bookings

number, however, weighed on the fast-growing stock, which sold off

in after-hours trading Monday.

VMware dominates the market for virtualization software, which

makes data centers more efficient by running multiple computers'

operations on a single server. The technology is a priority for

many companies, which are resuming information-technology spending

after delaying purchases during last year's downturn.

But worries recently have emerged that enterprise spending on

virtualization and cloud computing is slowing down. Equinix Inc.

(EQIX), a telecommunications company that offers hosting services

for networks and Internet connectivity, earlier this month trimmed

its third-quarter and full-year revenue targets, sparking a

sell-off in stocks exposed to data management and cloud

computing.

VMware, majority-owned by EMC Corp. (EMC), didn't show too many

signs of a slowdown as it projected fourth-quarter revenue of $790

million to $810 million, above the $775 million average of analysts

polled by Thomson Reuters.

The company's shares, though, fell 7.1% in after-hours trading

to $72.80 as VMware's overall bookings disappointed investors. The

stock is up 85% in 2010.

"People were expecting a home run, and it was just a triple,"

said FBR Capital Markets analyst Daniel Ives. He said analysts were

looking for bookings of about $771 million, but VMware only

reported about $747 million. Still, he added that the overall

results show VMware is in the early innings of a "major growth

cycle."

VMware Chief Financial Officer Mark Peek said on the company's

conference call that he was "pleased" with the quarter from a

bookings perspective and that the company hit its goals for each of

the geographies.

"We carry a strong pipeline into the fourth quarter," he

said.

In addition, Peek said that 2011 will be a year of "significant"

investment and year-over-year comparables will be more difficult.

He said the company can deliver 20% revenue growth for 2011, but

that first-quarter revenue will be down sequentially from the

fourth quarter, or post just under 20% growth year-over-year. He

also said operating margins excluding items will slide from the

fourth quarter.

He said the slower growth is "consistent with cycles commonly

seen in enterprise software," and that the company is still

concerned about macroeconomic conditions, especially in Europe. He

also said the third-quarter average-selling price increases may not

continue into the fourth quarter.

Meanwhile, Chief Operating Officer Tod Nielsen said acquisitions

are an important part of VMware's growth strategy and that it could

make some more smaller purchases in 2011, though large purchases

are unlikely. The company in August moved to acquire two

venture-based startups that it said would help advance its role in

cloud computing.

VMware posted a profit of $84.6 million, or 20 cents a share, in

the third quarter, up from $38.2 million, or 9 cents a share, a

year earlier. Excluding items such as stock-based compensation,

per-share earnings rose to 39 cents from 24 cents. Analysts had

forecast 35 cents a share.

Revenue surged 46% to $714.2 million, topping the company's

upbeat July estimate of $680 million to $705 million.

Operating margin surged to 13.2% from 4.7% as revenue rose

faster than costs.

Revenue from services--which include subscriptions, consulting

and support--jumped 49%, while license revenue was up 43%. VMware's

services segment has picked up a larger share of revenue in recent

quarters, and has outpaced license sales the past three

quarters.

On Friday, investment firm Jefferies said it expected VMware's

results in the second half of the year to benefit from the

recognition of revenue related to second-quarter server shipments,

improvements in renewal pricing and new products. But the firm

expressed concern about the levels of growth next year, saying

server shipments growth is expected to decelerate over the next few

years.

-By Shara Tibken, Dow Jones Newswires; 212-416-2189;

shara.tibken@dowjones.com

(John Kell contributed to this report.)

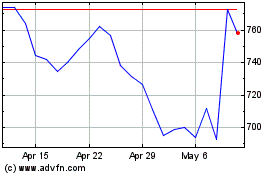

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Sep 2024 to Oct 2024

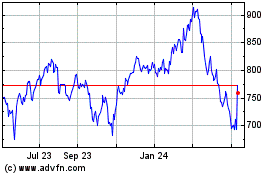

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Oct 2023 to Oct 2024