Amended Current Report Filing (8-k/a)

July 07 2015 - 4:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 20, 2014

Eagle Bancorp, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

0-25923 |

|

52-2061461 |

|

(State or other jurisdiction |

|

(Commission file number) |

|

(IRS Employer |

|

of incorporation) |

|

|

|

Number) |

|

7830 Old Georgetown Road, Bethesda, Maryland |

|

20814 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 301.986.1800

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

The sole purpose of this amended Current Report on Form 8-K/A is to file as Exhibit 10.1 hereto the Senior Executive Incentive Plan for 2014 performance in an unredacted form, including information that was previously omitted from the original report filed with the Securities and Exchange Commission (the “Commission”) on February 26, 2015, pursuant to a confidential treatment request submitted to the Commission. No other changes have been made to the original report.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors, Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) On August 20, 2014, the Compensation Committee of the Board of Directors of Eagle Bancorp, Inc. (the “Company”) approved the Senior Executive Incentive Plan for 2014 performance. The Senior Executive Incentive Plan is a non-equity incentive compensation plan pursuant to which participating officers may earn cash incentive awards if certain pre-determined targets, including overall Company level performance and individual performance targets are met. Awards under the Senior Executive Incentive Plan may also be paid in stock, through awards under the Company’s 2006 Stock Plan, in the discretion of the Compensation Committee. A redacted version of the plan, which does not disclose certain target goals and compensation levels for which confidential treatment has been requested, is attached as Exhibit 10.1 hereto.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Number |

|

Description |

|

10.1 |

|

2014 Senior Executive Incentive Plan |

2

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EAGLE BANCORP, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Ronald D. Paul |

|

|

|

Ronald D. Paul, President, Chief Executive Officer |

|

|

|

|

|

Dated: July 7, 2015 |

|

3

Exhibit 10.1

Eagle Bancorp, Inc.

Senior Executive Annual Incentive Plan

Performance Year 2014

Eagle Bancorp, Inc. and EagleBank

Executive Annual Incentive Plan

Plan Document and Administrative Guidelines

This Annual Incentive Plan is for the Executive Management Team of Eagle Bancorp, Inc. (“Company”) and EagleBank. The annual incentive plan is designed to compensate plan participants for the attainment of specified overall bank and individual goals. The objective is to align the interests of senior executives with the interests of the Bank in obtaining superior financial results.

The Plan operates on a calendar year basis (January 1st to December 31st). This same calendar year is the performance-period for determining the amount of incentive awards to be paid following year end.

PERFORMANCE CRITERIA

· Bank Performance - For all plan participants, a portion of the annual incentive will be based on overall bank performance. The Compensation Committee will approve bank wide goals for each senior staff member on an annual basis. In addition, they will review the Bank’s annual incentive programs to ensure they do not encourage risky behavior.

· Strategic Performance - All participants are encouraged to work towards our strategic plan, with certain participants rated on their participation. Those individuals will have a level of fifteen percent (15%) up to twenty-five percent (25%) of the annual incentive will be based on achievement of bank strategic goals.

· Individual Performance - For all participants, individual performance in meeting outlined expectations, as determined by annual performance evaluations, will represent at least fifteen percent (15%) of the plan participant’s incentive payout.

PERFORMANCE STANDARDS

For each performance factor (Overall Bank, and Individual), an appropriate standard of performance must be established with three essential performance points:

· Threshold Performance: That level of performance for each objective below which no award will be given. Threshold performance will be 85% of target expectations.

· Target Performance: The level of performance for each objective at budgeted goals. The budgeted, or expected, level of performance is based upon historical data, and management’s best judgment as to expected performance during the upcoming performance period. The Compensation Committee will approve bank wide goals on an annual basis.

· Target Plus Performance: The target plus performance level is not capped, and will be paid in proportion to the results achieved in excess of 15% above target; however we include it to show potential payouts if we exceed target goals by 15%.

· Peer Performance Factor: Assuming Target Plus Performance is achieved, and assuming individual performance warrants, an additional Peer Performance Factor will be applied to the bonus amount based on alignment with peer performance and compensation.

NOTE ON PEER PERFORMANCE FACTOR: The peer performance factor is an additional adjustment based on overall performance of Bank and Executive. Overall performance above the target performance levels will be measured against that of peers, so that participants are eligible to be compensated relative to peer performance within the construct of the SEIP. For example, participants who perform at the 75th percentile, relative to peers, will be eligible to be compensated at the 75th percentile as compared to peers, subject to individual performance. Likewise, participants who perform at the 90th percentile, relative to peers, will be eligible to be compensated at the 90th percentile as compared to peers, subject to individual performance. Peer performance will be measured on overall bank performance and/or specific performance metrics (e.g., NPA’s) for areas of primary responsibility.

PLAN PAYOUTS

The Net Operating Income, Threshold level, must be met for there to be any payment made for the Bank Performance and Strategic Performance categories. Participants will still be eligible to receive a payout for Individual Performance.

After all performance results are available at year-end, the awards will be calculated for each Plan participant and approved by the CEO, and Compensation Committee. The Compensation Committee has the discretion to pay out annual incentives in cash or awards of restricted stock under the 2006 Stock Plan.

The actual award payouts will be calculated using a ratable approach, where award payouts are calculated as a proportion of minimum, target and target plus award opportunities. If actual performance falls between a performance level, the payout will also fall between the pre-defined performance level on a pro-rated basis. A Plan participant must be an employee at the time of the award payout in order to receive a payout. The result of the performance criteria is calculated as a percent of base salary for participants during the current Plan year. Plan payouts will be made no later than 75 days after the year end.

EGBN has the right to recover any incentive payments that were made based on material misstatements or inaccurate performance metrics.

PLAN ADMINISTRATION

Responsibilities of the Compensation Committee: The Compensation Committee has the responsibility to approve, amend, or terminate the Plan as necessary. The actions of the Compensation Committee shall be final and binding on all parties. The Compensation Committee shall also review the operating rules of the Plan on an annual basis and revise these rules if necessary. The Compensation Committee also has the sole ability to decide if an extraordinary event(1) totally outside of management’s influence, be it a windfall or a shortfall, has occurred during the current Plan year, and whether the figures should be adjusted to neutralize the effects of such events. After approval by the Compensation Committee, management shall, as soon as practical, inform each of the Plan participants under the Plan of their potential award under the operating rules adopted for the Plan year.

Responsibilities of the CEO: The CEO of the Company administers the program directly and provides liaison to the Compensation Committee, including the following specific responsibilities: recommend the

Plan participants to be included in the Plan each year. This includes determining if additional employees should be added to the Plan and if any Plan participants should be removed from participating in the Plan. Provide recommendations for the award opportunity amounts at threshold, target and target plus for tiers II and below. The CEO will review the objectives and evaluations, adjust guideline awards for performance and recommend final awards to the Compensation Committee. Provide other appropriate recommendations that may become necessary during the life of the plan. This could include such items as changes to Plan provisions.

Amendments and Plan Termination: The Company has developed the Plan on the basis of existing business, market and economic conditions, current services, and staff assignments. If substantial changes occur that affect these conditions, services, assignments, or forecasts, the Company may add to, amend, modify or discontinue any of the terms or conditions of the Plan at any time with approval from the Compensation Committee. The Compensation Committee may, at its sole discretion, terminate, change or amend any of the Plan as it deems appropriate.

MISCELLANEOUS

Reorganization: If the Company shall merge into or consolidate with another company, or reorganize, or sell substantially all of its assets to another company, firm, or person such succeeding or continuing company, firm, or person shall succeed to, assume and discharge the obligations of the Company under this Plan. Upon the occurrence of such event, the term “Company” as used in this Plan shall be deemed to refer to the successor or survivor company.

Tax Withholding: The Company shall withhold any taxes that are required to be withheld from the benefits provided under this Plan.

Designated Fiduciary: The Company shall be the named fiduciary and Plan Administrator under the Plan. The named fiduciary may delegate to others certain aspects of the management and operation responsibilities of the Plan including the employment of advisors and the delegation of ministerial duties to qualified individuals.

No Guarantee of Employment: This Plan is not an employment policy or contract. It does not give the Plan participant the right to remain an employee of the Company, nor does it interfere with the Company’s right to discharge the Plan participant.

(1) An extraordinary event may include a merger, acquisition or divestiture that was not outlined in strategic plan, investment gains or losses, changes in capital cost structure, unplanned branch openings, unexpected and strong sales oriented addition to staff, and increase of 50% or more of collection expenses.

INCENTIVE RANGES AND AWARD OBJECTIVES

Eagle Bancorp, Inc.

|

Tier |

|

Name |

|

Position |

|

Proposed Incentive Ranges |

|

|

|

|

|

|

|

|

Threshold |

|

Target |

|

Target

Plus |

|

|

I |

|

Ron Paul |

|

Chairman and CEO |

|

30.0 |

% |

60 |

% |

120 |

% |

|

II |

|

Susan Riel |

|

Sr. EVP & COO of the Bank |

|

25.0 |

% |

50 |

% |

90 |

% |

|

III |

|

James Langmead |

|

EVP & Chief Financial Officer |

|

20.0 |

% |

40 |

% |

75 |

% |

|

III |

|

Antonio Marquez |

|

Chief Lending Officer — CRE |

|

20.0 |

% |

40 |

% |

75 |

% |

|

III |

|

Janice Williams |

|

EVP & Chief Credit Officer |

|

20.0 |

% |

40 |

% |

75 |

% |

|

IV |

|

Thomas Murphy |

|

President Community Banking |

|

12.5 |

% |

25 |

% |

50 |

% |

|

IV |

|

Larry Bensignor |

|

EVP & General Counsel |

|

20.0 |

% |

30 |

% |

60 |

% |

|

V |

|

Michael Flynn |

|

EVP & COO of Eagle Bancorp |

|

12.5 |

% |

25 |

% |

50 |

% |

|

V |

|

Steven Reeder |

|

EVP & Chief Deposit Officer |

|

12.5 |

% |

25.0 |

% |

50 |

% |

|

|

|

|

|

|

|

Percent of Salary |

|

NOTE: Threshold, target and target plus payout thresholds have been established for each tier in order to ensure competitive payouts and budget costs associated with this program.

2014 Senior Staff Incentive Goals

|

|

|

Paul |

|

Riel |

|

Murphy |

|

Flynn |

|

Marquez |

|

Langmead |

|

Williams |

|

Bensignor |

|

Reeder |

|

Target |

|

|

Net Income (available to common shareholders) |

|

35 |

% |

20 |

% |

|

|

15 |

% |

|

|

15 |

% |

|

|

|

|

|

|

$ |

51,289,602 |

|

|

NPAs |

|

|

|

|

|

|

|

|

|

15 |

% |

|

|

30 |

% |

|

|

|

|

$ |

37,348,012 |

|

|

Strategic Alignment |

|

25 |

% |

20 |

% |

|

|

15 |

% |

|

|

15 |

% |

|

|

20 |

% |

|

|

|

|

|

Total Loan Growth (Average Balance) |

|

|

|

|

|

|

|

|

|

30 |

% |

|

|

|

|

|

|

|

|

$ |

323,770,519 CRE |

|

|

Average Core Deposit Growth |

|

|

|

|

|

|

|

|

|

15 |

% |

|

|

|

|

|

|

|

|

$ |

428,562,913 |

|

|

DDA Deposit Growth |

|

|

|

|

|

25 |

% |

|

|

|

|

|

|

|

|

|

|

20 |

% |

$ |

122,676,592 |

|

|

MMA Deposit Growth |

|

|

|

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

20 |

% |

$ |

305,886,321 |

|

|

Non Interest Income |

|

|

|

|

|

15 |

% |

|

|

|

|

15 |

% |

|

|

|

|

20 |

% |

$ |

22,001,270 |

|

|

Efficiency Ratio |

|

|

|

15 |

% |

|

|

|

|

|

|

20 |

% |

|

|

|

|

|

|

49.01 |

% |

|

Non Traditional Fee Income (aggregate) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

% |

|

|

$ |

333,330 |

|

|

Non Interest Expenses |

|

|

|

20 |

% |

|

|

|

|

|

|

|

|

20 |

% |

|

|

20 |

% |

$ |

90,720,276 |

|

|

NIM |

|

|

|

|

|

|

|

|

|

20 |

% |

15 |

% |

|

|

|

|

|

|

4.32 |

% |

|

Average Annual Individual Deposits |

|

|

|

|

|

25 |

% |

25 |

% |

|

|

|

|

|

|

15 |

% |

|

|

|

|

|

Average Annual Individual Loans |

|

|

|

|

|

|

|

20 |

% |

|

|

|

|

|

|

15 |

% |

|

|

|

|

|

Charge Offs |

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

% |

|

|

|

|

$ |

9,235,908 |

|

|

Dept/Individual Performance |

|

40 |

% |

25 |

% |

15 |

% |

25 |

% |

20 |

% |

20 |

% |

20 |

% |

20 |

% |

20 |

% |

|

|

|

|

|

100 |

% |

100 |

% |

100 |

% |

100 |

% |

100 |

% |

100 |

% |

100 |

% |

100 |

% |

100 |

% |

|

|

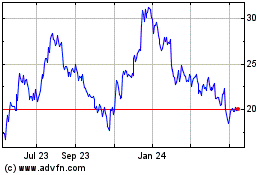

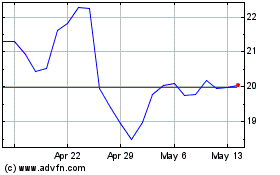

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Nov 2023 to Nov 2024