UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

April 11, 2023

DIVERSIFIED HEALTHCARE TRUST

(Exact Name of Registrant as Specified in

Its Charter)

Maryland

(State or Other Jurisdiction of Incorporation)

| 001-15319 |

|

04-3445278 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts

02458-1634

(Address of Principal Executive Offices) (Zip Code)

617-796-8350

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title Of Each Class |

|

Trading Symbol(s) |

|

Name Of Each Exchange

On Which Registered |

| Common

Shares of Beneficial Interest |

|

DHC |

|

The

Nasdaq Stock Market LLC |

| 5.625%

Senior Notes due 2042 |

|

DHCNI |

|

The

Nasdaq Stock Market LLC |

| 6.25%

Senior Notes due 2046 |

|

DHCNL |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

In this Current Report on

Form 8-K, the terms “we”, “us” and “our” refer to Diversified Healthcare Trust.

Item 1.01. Entry into a Material Definitive Agreement.

Agreement and Plan of Merger

On April 11, 2023, we and Office Properties

Income Trust, or OPI, entered into an Agreement and Plan of Merger, or the Merger Agreement, pursuant to which, on the terms and subject

to the satisfaction or waiver of the conditions thereof, we will be merged with and into OPI, with OPI continuing as the surviving entity

in the merger, or the Merger.

Pursuant to the terms and subject to the

conditions and limitations set forth in the Merger Agreement, at the date and time the Merger becomes effective, or the Effective

Time, each of our common shares of beneficial interest, $0.01 par value per share, or the DHC Common Shares, issued and outstanding

as of immediately prior to the Effective Time will be automatically converted into the right to receive 0.147 (such ratio, the

Exchange Ratio) common shares of beneficial interest, $0.01 par value per share, of OPI, or the OPI Common Shares, subject to

adjustment for certain reclassifications, distributions, recapitalizations or similar transactions and other exceptional

distributions as described in the Merger Agreement, with cash paid in lieu of fractional shares. Other than as provided in the

Merger Agreement, the Exchange Ratio is fixed and will not be adjusted to reflect changes in the market price of the DHC Common

Shares or the OPI Common Shares prior to the Effective Time. The OPI Common Shares issued and outstanding immediately prior to the

Effective Time will remain issued and outstanding common shares of beneficial ownership of the surviving entity following the

Merger. OPI expects to change its name from “Office Properties Income Trust” to “Diversified Properties

Trust” at the Effective Time.

The transactions contemplated by the Merger

Agreement and the terms thereof were evaluated, negotiated and recommended to our Board of Trustees, or our Board, by a special

committee of our Board, or the DHC Special Committee, and to OPI’s board of trustees, or the OPI Board, by a special committee

of OPI’s Board, or the OPI Special Committee, each consisting of disinterested, independent trustees of us and OPI,

respectively. Following the recommendations of the DHC Special Committee and the OPI Special Committee, our Board and the OPI Board

each approved the Merger Agreement and the transactions contemplated thereby and resolved to recommend that the DHC and OPI

shareholders, respectively, vote in favor of approval of the Merger and the transactions contemplated thereby. Our shareholders will

be asked to vote on the approval of the Merger and related matters at a special meeting of our shareholders.

The

consummation of the Merger is subject to the satisfaction or waiver of certain closing conditions, including, among others: (1) the

approval of the Merger by the affirmative vote of at least a majority of all the votes entitled to be cast by holders of outstanding DHC

Common Shares at the meeting held for that purpose, or the DHC Shareholder Approval; (2) the approval of the Merger by the affirmative

vote of at least a majority of all the votes entitled to be cast by holders of outstanding OPI Common Shares at the meeting held for that

purpose; (3) the approval of the issuance of OPI Common Shares to be issued in the Merger, or the Share Issuance, by the affirmative

vote of at least a majority of all votes cast by holders of outstanding OPI Common Shares at the meeting held for that purpose (items

(2) and (3), together, the OPI Shareholder Approval); (4) the absence of any statute, rule or regulation by any governmental

entity of competent jurisdiction or any temporary, preliminary or permanent judgment, order or decree by any court of competent

jurisdiction which would prohibit or make illegal or prevent the consummation of the Merger or any of the transactions contemplated by

the Merger Agreement; (5) the effectiveness of the registration statement on Form S-4, or the Form S-4, to be filed by

OPI with the Securities and Exchange Commission, or the SEC, in connection with the Share Issuance; (6) the approval (subject to

notice of issuance) of the Nasdaq Stock Market LLC of the listing of the OPI Common Shares to be issued in the Merger; (7) the extension

or replacement of OPI’s existing revolving credit agreement, on terms that, among other things, would not be reasonably likely to

be materially adverse to the business, operations or financial condition of OPI after giving effect to the Merger and would not delay

or prevent the consummation of the Merger; (8) the receipt of certain tax opinions by us and OPI; and (9) the other party’s

representations and warranties being accurate (subject to certain customary materiality exceptions) and the other party having performed

or complied in all material respects with its agreements and covenants in the Merger Agreement.

The Merger Agreement contains certain

customary representations, warranties and covenants, including covenants providing that we and OPI will use reasonable best efforts

to conduct our and its respective businesses in all material respects in the ordinary course during the period between the execution

of the Merger Agreement and the earlier of the Effective Time or the termination of the Merger Agreement, and to refrain from taking

certain types of actions without the other party’s consent during the period between the execution of the Merger Agreement and

the earlier of the Effective Time or the termination of the Merger Agreement, subject in each case to specified exceptions.

We and OPI have agreed not to declare, set

aside or pay any dividend or other distribution without the prior written consent of the other party, except that (1) OPI may

declare and pay distributions at an annual rate not in excess of $2.20 per share (provided that OPI is required to pay annual

distributions at an annual rate of at least $1.00 per share) and (2) we may declare and pay distributions at an annual rate not

in excess of $0.04 per share. In addition, we and OPI may pay distributions to maintain our respective tax qualification as a real

estate investment trust or to eliminate or reduce certain taxes (subject to an adjustment of the Exchange Ratio provided for in the

Merger Agreement).

We and OPI have also agreed to certain non-solicitation

restrictions that require us and OPI not to, and to cause their respective subsidiaries and representatives not to, among other things,

(1) solicit proposals relating to certain alternative transactions, (2) engage in, continue or participate in discussions or

negotiations or provide information in connection with or for the purpose of encouraging or facilitating any proposal for any such alternative

transaction or (3) enter into any agreements (other than certain confidentiality agreements) with respect to any such alternative

transaction, subject to certain customary exceptions. Notwithstanding these restrictions, prior to obtaining the DHC Shareholder Approval

and the OPI Shareholder Approval, we or OPI, as applicable, may engage in discussions or negotiations and provide non-public information

to a third party that has made a written competing proposal that did not result from a material breach of the non-solicitation restrictions

and that the applicable board of trustees or special committee determines in good faith, after consultation with its financial advisor

and outside legal counsel, constitutes or is reasonably likely to result in a Superior Proposal (as defined in the Merger Agreement).

Prior to obtaining the DHC Shareholder Approval

or the OPI Shareholder Approval, the DHC Special Committee or the OPI Special Committee, respectively, may, in certain circumstances,

effect an Adverse Recommendation Change (as defined in the Merger Agreement), and our Board or the OPI Board and the respective special

committee may terminate the Merger Agreement to enter into an agreement with respect to a Superior Proposal, subject to complying with

specified notice requirements and other conditions set forth in the Merger Agreement, including paying a termination fee in specified

circumstances, as described below.

The

Merger Agreement may be terminated by us or OPI at the direction of the respective special committee or our Board or the OPI Board, respectively,

based on the recommendation of such special committee under certain other circumstances, including, among others, (1) if the Merger

has not been consummated on or before September 29, 2023, (2) if a judgment, order or decree or action by a governmental

authority of competent jurisdiction permanently restraining, enjoining or otherwise prohibiting the Merger or the actions contemplated

thereby has become final and non-appealable, (3) if the DHC Shareholder Approval is not obtained at a shareholder meeting at which

the approval of the Merger was voted upon or (4) if the OPI Shareholder Approval was not obtained at a shareholder meeting at which

the approval of the Merger and the Share Issuance was voted upon. In addition, subject to certain conditions, the Merger Agreement

may be terminated (a) by us or OPI, if, prior to obtaining the applicable shareholder approval, the other party effects an Adverse

Recommendation Change or fails to timely publicly reaffirm its recommendation, (b) by us if we determine to enter into an agreement

with respect to a Superior Proposal, (c) by DHC if DHC determines to enter into an agreement with respect to a Superior Proposal,

(d) by either us or OPI if the other party materially breaches, violates or fails to perform

its representations, warranties, covenants or agreements under the Merger Agreement such that there is a failure of certain conditions

to the Merger that is not curable or timely cured or (e) by us, on or after July 1, 2023, if OPI fails to comply with its covenant

in the Merger Agreement to extend the expiration date of the commitment letter described below (as permitted by such commitment letter).

We and OPI may also terminate the Merger Agreement by mutual written consent.

The Merger Agreement

provides that we will be required to make a payment of $5.9 million to OPI if we terminate the Merger Agreement to enter into an agreement

with respect to a Superior Proposal and in certain other circumstances. The Merger Agreement provides that OPI will be required to make

a payment of $11.2 million to us if OPI terminates the Merger Agreement to enter into an agreement with respect to a Superior Proposal and

in certain other circumstances.

The Merger is intended

to qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended.

The foregoing description

of certain provisions of the Merger Agreement is not complete and is subject to and qualified in its entirety by reference to the copy

of the Merger Agreement attached as Exhibit 2.1 to this Current Report on Form 8-K, and incorporated herein by reference.

In connection with the

execution of the Merger Agreement, OPI entered into a commitment letter, dated as of April 11, 2023, with JPMorgan Chase Bank, N.A.

(“JPM”), pursuant to which JPM has committed to provide, subject to the terms and conditions of the commitment letter, a senior

secured bridge facility to OPI in an aggregate principal amount of $368 million.

The Merger Agreement and above description have

been included to provide investors with information regarding its terms. It is not intended to provide any other factual information about

us, OPI, The RMR Group LLC, or RMR, or our or their respective subsidiaries or affiliates. The representations and warranties contained

in the Merger Agreement were made only for purposes of the Merger Agreement and as of specific dates, are solely for the benefit of the

parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties (including being qualified by confidential

disclosures made by the parties), may have been made for purposes of allocating contractual risk between the parties to the Merger Agreement

instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that

differ from those applicable to investors. Investors are not third-party beneficiaries to the representations and warranties contained

in the Merger Agreement and should not rely on the representations and warranties or any descriptions thereof as characterizations of

the actual state of facts or condition of the parties thereto or any of their respective subsidiaries or affiliates. Moreover, information

concerning the subject matter of representations and warranties may change after the date of the Merger Agreement, which subsequent information

may or may not be fully reflected in our or OPI’s public disclosures.

Letter Agreement

RMR serves as our and

OPI’s manager and will continue to manage the surviving entity following the Merger. Contemporaneously with the execution of the

Merger Agreement, we, OPI and RMR entered into a letter agreement, or the RMR Letter Agreement, pursuant to which, on the terms and subject

to conditions contained therein, we and RMR have acknowledged and agreed that, effective upon consummation of the Merger, we shall have

terminated our business and property management agreements with RMR for convenience, and RMR shall have waived its right to receive payment

of the termination fee pursuant to each such agreement upon such termination. The foregoing terminations and waivers apply only in respect

of the Merger and do not apply to any other transaction or arrangement, including any Competing Proposal or Superior Proposal (each as

defined in the Merger Agreement).

The foregoing description

of the RMR Letter Agreement is not complete and is subject to and qualified in its entirety by reference to the copy of the RMR Letter

Agreement attached as Exhibit 99.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Item 9.01. Financial Information and Exhibits.

(d) Exhibits

* Schedules

and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. We hereby undertake to furnish supplemental copies

of any of the omitted schedules or exhibits upon request by the SEC; provided that we may request confidential treatment pursuant to Rule 24b-2

of the Securities Exchange Act of 1934, as amended, for any schedules or exhibits so furnished.

Important Additional Information About the Transaction

In connection with the Merger, OPI intends to file

a registration statement on Form S-4 with the SEC, which will include a preliminary prospectus and related materials to register

the OPI Common Shares to be issued in the Merger. We and OPI intend to file a joint proxy statement/prospectus and other documents concerning

the Merger with the SEC. The proposed transaction involving us and OPI will be submitted to our and OPI’s shareholders for their

consideration. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT,

THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER

OR INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION ABOUT US, OPI AND THE MERGER. When available, the relevant portions of the joint proxy statement/prospectus will be mailed

to our and OPI’s shareholders. Investors will also be able to obtain copies of the registration statement and the joint proxy statement/prospectus

and other relevant documents (when they become available) free of charge at the SEC’s website (www.sec.gov). Additional copies of

documents filed by us with the SEC may be obtained for free on our Investor Relation’s website at www.dhcreit.com/investors/ or

by contacting our Investor Relations department at 1-617-796-8234.

In addition to the registration statement and joint

proxy statement/prospectus expected to be filed, we file annual, quarterly and current reports and other information with the SEC. Our

filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the

SEC at www.sec.gov.

No Offer or Solicitation

This Current Report on Form 8-K shall not

constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval

in any jurisdiction with respect to the Merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the

U.S. Securities Act of 1933, as amended.

Participants in the Solicitation

We and certain of our trustees and executive officers,

OPI and certain of its trustees and executive officers, and RMR and its parent and certain of their respective directors, officers and

employees may be deemed to be participants in the solicitation of proxies from our and OPI’s shareholders in connection with the

Merger. Certain information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation

of our and OPI’s shareholders in connection with the Merger and a description of their direct and indirect interests will be set

forth in the registration statement and the joint proxy statement/prospectus when filed with the SEC. Information about our trustees and

executive officers is included in the proxy statement for our 2022 annual meeting of shareholders, which was filed with the SEC on March 29,

2022. Information about OPI’s trustees and executive officers is included in the proxy statement for OPI’s 2023 annual meeting

of shareholders, which was filed with the SEC on April 6, 2023. Copies of the foregoing documents may be obtained as provided above.

Additional information regarding the interests of such participants and other persons who may be deemed participants in the transaction

will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available.

Warning Concerning Forward-Looking Statements

This Current

Report on Form 8-K contains statements that constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and other securities laws. Also, whenever we use words such as “believe”,

“expect”, “anticipate”, “intend”, “plan”, “estimate”,

“will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking

statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking

statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by

our forward-looking statements as a result of various factors. For example: (a) the closing of the Merger is subject to the

satisfaction or waiver of closing conditions, including the DHC Shareholder Approval, the OPI Shareholder Approval and the extension

or replacement of OPI’s existing revolving credit agreement, some of which are beyond our control, and we cannot be sure that

any or all of these conditions will be satisfied or waived. In addition, financing, consents or approvals required in connection

with the Merger may not be received or obtained within the expected timeframe, on the expected terms or at all, and OPI may not be

able to recast its existing revolving credit facility on favorable terms as expected in connection with the proposed transaction.

Accordingly, the Merger may not close on the contemplated terms or at all or it may be delayed; (b) our Board will consider

many factors when setting distribution rates, and future distribution rates may be changed and we cannot be sure as to the rate at

which future distributions will be paid, although the Merger Agreement restricts us from increasing our regular quarterly

distributions; (c) the transactions contemplated by the Merger Agreement and the terms thereof were evaluated, negotiated and

recommended to our Board by the DHC Special Committee and to the OPI Board by the OPI Special Committee, each comprised solely of

our and OPI’s respective disinterested, independent trustees, and were separately approved by our Independent Trustees and by

our Board and by OPI’s independent trustees and the OPI Board, and that BofA Securities, Inc. acted as exclusive

financial advisor to the DHC Special Committee and that JPM acted as exclusive financial advisor to the OPI Special Committee.

Despite this process, we and OPI could be subject to claims challenging the Merger or other transactions or our entry into the

Merger and related agreements because of the multiple relationships among us, OPI and RMR and their related persons and entities or

other reasons, and defending even meritless claims could be expensive and distracting to management; and (d) the Merger is

subject to various additional risks, including: the risk that the combined businesses will not be integrated successfully or that

the integration will be more costly or more time-consuming and complex than anticipated; the risk that cost savings and synergies

anticipated to be realized by the Merger may not be fully realized or may take longer to realize than expected; risks associated

with the impact, timing or terms of the Merger; the occurrence of any event, change or other circumstance that could give rise to

the termination of the Merger Agreement; the risk of shareholder litigation in connection with the proposed transaction, including

resulting expense or delay; risks related to future opportunities, plans and strategy for the combined company, including the

uncertainty of expected future financial performance, expected access to capital, timing of accretion, distribution rates and

results of the surviving entity following completion of the Merger and the challenges facing the industries in which we and OPI

currently operate and the surviving entity will, following the closing of the transaction, operate; risks related to the market

value of the OPI Common Shares to be issued in the Merger; the expected qualification of the Merger as a tax-free

“reorganization” for U.S. federal income tax purposes; risks associated with expected financing transactions undertaken

in connection with the Merger and risks associated with indebtedness incurred in connection with the Merger, including the potential

inability to access, or reduced access to, the capital markets or other capital sources or increased cost of borrowings, including

as a result of a credit rating downgrade; risks associated with the level of capital expenditures of us, OPI and the surviving

entity, including possible changes in the amount of timing of capital expenditures; risks associated with the impact of general

economic, political and market factors on us, OPI or the Merger; and other matters.

Our Annual Report on Form 10-K for the year

ended December 31, 2022, including under the caption “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations”, and our other filings with the SEC identify other important factors that could

cause differences from any forward-looking statements. Our filings with the SEC are available on the SEC’s website at www.sec.gov.

You should not place undue reliance upon any forward-looking

statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information,

future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DIVERSIFIED HEALTHCARE TRUST |

| |

|

| |

By: |

/s/ Richard W. Siedel, Jr. |

| |

Name: |

Richard W. Siedel, Jr. |

| |

Title: |

Chief Financial Officer and Treasurer |

Dated: April 12, 2023

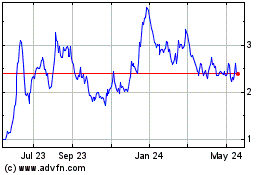

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

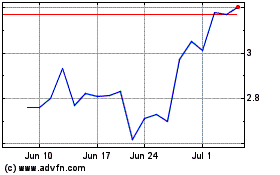

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Apr 2023 to Apr 2024