Filed by Office Properties Income Trust

Commission File No. 001-34364

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Diversified Healthcare Trust

Commission File No. 001-15319

Date: April 11, 2023

The following is the script for a conference call hosted by Christopher

J. Bilotto, President and Chief Operating Officer of Office Properties Income Trust, Jennifer F. Francis, President and Chief Executive

Officer of Diversified Healthcare Trust, Matthew C. Brown, Chief Financial Officer and Treasurer of Office Properties Income Trust, and

Richard W. Siedel, Jr., Chief Financial Officer and Treasurer of Diversified Healthcare Trust, on April 11, 2023.

Office Properties Income Trust & Diversified

Healthcare Trust

Merger Joint Conference Call Script

Tuesday, April 11 2023 at 8:30 AM

Operator:

Good morning and welcome to the Office Properties

Income Trust and Diversified Healthcare Trust conference call. [Operator instructions.] At this time for opening remarks and introductions,

I would like to turn the call over to Kevin Barry, Director of Investor Relations.

Speaker: Kevin Barry

Thank you, and good morning everyone. Thanks for

joining us today for OPI and DHC’s merger joint conference call. Discussing the merger, which was announced earlier today, will

be Chris Bilotto, OPI’s President and Chief Operating Officer; Jennifer Francis, DHC’s President and Chief Executive Officer;

Rick Siedel, DHC’s Chief Financial Officer and Treasurer; and Matt Brown, OPI’s Chief Financial Officer and Treasurer. Today's

call includes a presentation by management on the proposed OPI and DHC merger, followed by a question-and-answer session with sell-side

analysts. I would like to note that the transcription, recording and retransmission of today's conference call without the prior written

consent of OPI and DHC is strictly prohibited.

Both OPI and DHC have posted a joint presentation

on their websites’ homepages, opireit.com and dhcreit.com. We encourage you to open the presentation and follow along as our management

team will be referencing it in their prepared remarks.

Today's conference call will contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. These forward-looking

statements are based on OPI’s and DHC’s beliefs and expectations as of today, April 11, 2023. The companies undertake no obligation

to revise or publicly release the results of any revision to the forward-looking statements made in today's conference call. Actual results

may differ materially from those projected in any forward-looking statements. Additional information concerning factors that could cause

those differences is contained in our companies’ filings with the SEC. Investors are cautioned not to place undue reliance upon

any forward-looking statements.

In addition, our discussion regarding the proposed

merger of OPI and DHC does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of

any vote or approval. OPI expects to file with the SEC a registration statement on Form S-4 containing a joint proxy statement/prospectus

and other documents with respect to the merger, and other transactions with respect to both OPI and DHC. Investors are urged to read the

joint proxy statement/prospectus (including all amendments and supplements) if and when they become available and any other documents

to be filed with the SEC in connection with the merger or incorporated by reference in the joint proxy statement/prospectus because they

will contain important information about the merger. Information regarding potential participants and any proxy solicitation of OPI and

DHC shareholders, and a description of their direct and indirect interests by security holdings or otherwise, will be contained in the

joint proxy statement/prospectus filed in connection with the proposed merger.

I will now turn the call over to Chris.

Speaker: Chris Bilotto

Thank you, Kevin. Good morning everyone and

thank you for joining the call today. We are pleased to announce that Office Properties Income Trust and Diversified Healthcare

Trust have entered into a definitive agreement to merge our two companies, creating a $12.4 billion investment portfolio and a

leading diversified REIT with a broad portfolio of over 530 properties, geographic concentration with 42 percent of properties

located in sunbelt markets, a defensive tenant base and strong growth potential. For OPI shareholders, the combined company provides

strategic benefits to navigate the challenges facing the office sector, with a sustained dividend, cash flow stability through

diversification into medical office and life science properties, and an outsized growth outlook with the addition of senior living

properties in the midst of implementing a turnaround strategy. For DHC shareholders, the combined company provides immediate balance

sheet stability, an increase to its dividend and the ability to continue to participate in the growth of the Senior Housing

Operating Portfolio, or SHOP. Combined, we expect the transaction to be accretive to OPI’s Normalized FFO, CAD and leverage

during the second half of 2024.

Let’s start with the transaction overview

on slide 3.

This is an all-stock transaction where DHC shareholders

will receive 0.147 common shares of OPI for each common share of DHC they own. Recommended by each company’s special committee comprised

of independent trustees and unanimously approved by each company’s Board of Trustees, it was with the understanding that shareholders

from both companies would benefit from immediate and future value creation. OPI and DHC shareholders will own approximately 58 percent

and 42 percent of the combined company, respectively and based on yesterday’s closing price for OPI, the implied offer price to

DHC per share of approximately $1.70 represents a 20 percent premium to the weighted average price of DHC’s common stock, for the

30 trading days ended April 10th.

Beginning this quarter, OPI expects to reset its

annual dividend to a sustainable rate of $1.00 per share, or 25 cents per quarter, and plans to maintain this dividend post-merger.

In support of this merger, our manager, The RMR

Group, has agreed to waive its contractual termination fees under both the business management agreement and the property management agreement.

Lastly, the combined company will be led by OPI’s

executive management team including myself as President and COO and Matt Brown as CFO; and is subject to shareholders’ approval

by OPI and DHC. We expect to close the transaction during the third quarter of 2023.

Turning now to page 4…

There are several compelling reasons supporting

our view of this merger as a great strategic fit for OPI and its shareholders. We have experienced firsthand the benefits of diversification

as we successfully navigated downside risk with the global pandemic. On a go forward basis, the combined company will create greater synergies

to face the challenges with the structural office sector headwinds that will likely cause declining cashflows and therefore a current

dividend that is unstainable, declining asset values and increasing leverage in the future. Further, we are amidst a very challenging

financing environment for office properties and a business plan in need of increased capital going forward.

The merger with DHC provides the optimal solution

for a stronger cash flow outlook and value creation while resolving these challenges. Immediate benefits to OPI include increased scale

and diversity with more access to capital sources, including low-cost GSE and agency debt; a combined portfolio of attractive MOB, life

science and office properties providing cash flow stability; and exposure to an institutional quality portfolio of senior living communities

benefitting from growth through favorable healthcare sector tailwinds and a turnaround strategy currently underway, which will provide

outsized NOI growth over the next several years.

We expect the transaction to be accretive to OPI’s

Normalized FFO, CAD and leverage during the second half of 2024. The reset of our dividend to $1 per share provides a stable and sustainable

distribution with potential for growth in the future.

I will now turn it over to Jennifer to discuss

the strategic rationale for the merger from DHC’s perspective. Jennifer?

Speaker: Jennifer Francis

Thank you, Chris, and good morning everyone. Thank

you for joining us on this very exciting day for both OPI and DHC.

Turning to slide 5 of the presentation...

This merger provides a tremendous opportunity to

address the challenges confronting DHC. The company is currently restricted from issuing or refinancing debt due to debt incurrence covenants,

and we do not expect to be in compliance until mid-2024. We have $700 million of debt maturing in 2024 and no ability to refinance it,

and while the SHOP recovery is underway and gaining momentum, it requires considerable capital to support its turnaround, a turnaround

that is just not happening as quickly as is necessary, and we are faced with capital constraints and the potential of having to rely on

punitive and expensive rescue financing. And lastly, DHC’s current annual dividend of 4 cents per share is unlikely to increase

until 2025.

The merger with OPI provides the best solution

to address these challenges. The combined company will be immediately in compliance with its debt covenants and have greater scale and

diversity with more access to capital sources, including low-cost GSE and agency debt. The merger is immediately accretive to DHC leverage

and provides increased liquidity to fund the SHOP turnaround and capital improvement plan. It is also immediately accretive to Normalized

FFO and CAD for DHC shareholders and immediately increases the pro rata dividend for DHC shareholder by 267 percent.

In summary, this strategic merger solves the near

term challenges of DHC, and the long term challenges of OPI with the Combined Company scale, diversity, access to capital and by the recovery

and NOI growth expected in the senior living portfolio.

I will now turn the call back over to Chris.

Speaker: Chris Bilotto

Thank you, Jennifer. Slides 6 through 9 provide

an illustrative view into a few of the many compelling benefits of the combined company portfolio. Starting with slide 6, as Jennifer

said, the combined company has much greater scale and diversification with a resilient portfolio of 265 MOB, life science and office properties

totaling nearly 30 million square feet and occupancy close to 90 percent. The tenant base includes a mix of investment grade tenants representing

close to 58 percent of the portfolio and is leased to some of the country’s largest and most dynamic companies including, Bank of

America, Google, Lifetime Fitness, Sonoma Biotherapeutics, Advocate Aurora Health and the U.S. Government. The senior living portfolio

includes 264 properties with over 27 thousand senior living units. Over the past several years, the senior living portfolio has transitioned

away from the highest acuity and lower margin services with a focus on a continuum of care with independent living, representing 41 percent

of units in the portfolio and assisted living and memory care reflecting 53 percent of units, which Rick will expand on in more detail.

Turning to slide 7, the combined portfolio of properties

are located in many of the country’s prominent submarkets throughout 40 states and the District of Columbia, along with 42 percent

of the portfolio located within the highly desired sunbelt region, including several major metros throughout Florida, Texas, Arizona and

California.

Looking in more detail at the MOB, life science

and office segment on slides 8 and 9, we expect the stability of cash flows to be further supported by the breadth of industries and the

credit strength of the tenant base, in addition to a well-laddered lease expiration schedule. Life science and medical represent the top

industry exposure in the portfolio accounting for 25 percent of annualized rental income, followed by real estate and financial at approximately

15 percent and the U.S. Government at 14 percent. The top 20 tenants represent just 43 percent of the portfolio, which includes balanced

tenant exposure and limited concentration to any one or grouping of tenant.

I will now turn the call over the Rick to provide

more detail on DHC’s SHOP segment. Rick?

Speaker: Rick Siedel

Thanks Chris, and good morning everyone.

Turning to slide 10…

The senior living operating portfolio, or SHOP

segment, is comprised of over 230 senior living communities with over twenty-five thousand units located throughout the United States.

This portfolio of high-quality, private pay senior living communities is approximately 53% assisted living and memory care units, 41%

independent living and active adult apartments, and just over 5% skilled nursing units. In the fourth quarter of 2022, the portfolio was

76.3% occupied and generated $7.9 million of Net Operating Income.

Since the COVID-19 pandemic negatively

impacted the portfolio in 2020, we have taken meaningful steps to turn around the performance of our communities. In 2021, to

diversify our operator base, we transitioned the management of 107 communities to 10 new operators and have seen occupancy in these

communities increase 870 basis points from pandemic lows. In 2022, our largest operator, AlerisLife’s new management team

began implementing its turn-around strategy, while we have been investing capital into the communities.

We believe our SHOP recovery to pre-pandemic levels

and beyond is dependent on both continuing our planned investments into our communities and the strategic operational improvements our

operators are making in all of our communities every day.

At the bottom of slide 10, we illustrate a few

of the improvements that will positively impact our SHOP segment. The first is occupancy. Our fourth quarter 2022 occupancy of 76.3% was

still 850 basis points below our pro forma 2019 occupancy and we believe our stabilized occupancies will well exceed our 2019 baseline.

Next, our fourth quarter 2022 average monthly rates were 8.9% higher than the prior year. We expect to continue to see significant rate

growth as occupancies increase, as operators ensure they are charging for the level of services provided to our assisted living residents,

and as our capital investments enhance the market position of our communities. Lastly, there is substantial opportunity to expand our

margins. We expect to see margin expansion as these communities bring in additional residents and are better able to leverage fixed costs

as occupancy increases. Our operators are also very focused on labor efficiencies. Recruiting and retention are critically important,

but they are implementing new technologies to ensure employees are scheduled to adapt to changing resident needs.

Turning to slide 11…

This slide illustrates that the recovery in our

SHOP segment is consistent with the broader recovery of the senior living industry, which is supported by strong demographic trends and

favorable industry fundamentals. For example, an aging population across the United States, particularly growth in the key 80+ demographic,

combined with muted new supply should continue to increase demand and specifically our occupancy for years to come. It is also important

to note that in 2022, average asking rents for senior living grew at the fastest pace since NIC began reporting that data in 2006. We

also expect our SHOP segment’s indexed occupancy growth will continue to outpace the industry as we make up ground as our operators

focus on their strategic operational turn-around plans and we deploy redevelopment capital.

Overall, we believe senior living is supported

by strong tailwinds and we continue to be bullish on the outlook for our SHOP segment. We are confident our portfolio will recover and

exceed pre-pandemic levels, but the pace of the recovery is not moving as quickly as is necessary and DHC’s standalone balance sheet

will limit our ability to continue investing in the SHOP segment’s recovery.

I will now turn the call over to Chris.

Speaker: Chris Bilotto

Thank you, Rick.

Moving on to page 12…

We want to highlight that the combined

company brings together a successful track record of implementing high-quality developments, redevelopments and major renovations

that we believe enhance our competitive positioning in the market and provide significant value creation and future growth

opportunities. Most compelling to the combined company is the expected growth through the work being done in the senior living

portfolio. Anticipated stabilized-year returns within this segment are 25 percent, far outpacing most options for capital

deployment. Further, with over 40 senior living renovations completed through year-end 2022, and an additional 21 senior living

renovations currently in planning or under construction, we anticipate near-term benefits through increased occupancy and rental

growth.

I will now turn the call over to Matt to discuss

the financial aspects of this transaction.

Speaker: Matt Brown

Thanks Chris. Good morning, everyone.

Turning to page 13 on value creation and sources

and uses…

This transaction is expected to be accretive to

OPI’s Normalized FFO and CAD in the second half of 2024 and is immediately accretive to DHC shareholders. We expect limited integration

risk as both companies are under the common management of RMR, and we expect to realize annual G&A costs savings of $2 million to

$3 million by eliminating certain redundant public company costs.

The merger consideration will be a stock-for-stock

exchange, however there are certain cash needs at the time of closing. OPI has secured a commitment for a $368 million bridge loan facility

and estimates an additional $157 million of cash uses as a source to closing the transaction. These sources will be used to fund the repayment

of DHC’s $450 million credit facility at closing and $75 million of estimated transaction costs. The repayment of DHC’s credit

facility will release over $1.3 billion worth of encumbered assets based on the last appraised values completed in 2021.

While the bridge loan facility ensures that we

can close the transaction, we have multiple capital alternatives available to avoid use of the bridge loan at closing. In addition, OPI

intends to recast its existing $750 million revolving credit facility in connection with the merger and has commenced initial discussions

to move this forward. We believe the improved scale and diversification of the combined company will result in the successful recast of

OPI’s revolver.

OPI also expects to reset its annual dividend to

a sustainable level of $1.00 per share commencing this quarter and this reset will result in increased liquidity of approximately $60

million annually, which can be used for general business purposes, including to continue funding the SHOP capex program to support the

recovery.

Slide 14 shows the December 31, 2022 pro forma

capital structure of the combined company, resulting in net debt of approximately $4.9 billion. With the diversification of income sources

and continued recovery in the SHOP portfolio, the transaction is expected to be accretive to OPI leverage beginning in the second half

of 2024 and immediately accretive to DHC leverage. Looking ahead to 2024, the combined company has $600 million of senior notes maturing.

We believe this merger provides us with multiple alternatives to refinance this debt, including access to low cost GSE and agency debt.

We also have the financial flexibility to secure our large pool of unencumbered assets within the combined portfolio.

I will now turn the call back to Chris.

Speaker: Chris Bilotto

Thanks Matt.

In closing, this merger creates a stronger,

more diversified company that is better positioned to execute on its business plan going forward. We expect to maintain stable cash

flows from our high-quality MOB, life science and office properties, while we continue to invest in properties to maintain market

appeal. Through 2025, our focus is on increasing cash flows from the Senior Housing Operating Portfolio with the goal of matching

2019 proforma NOI by the second half of 2024. We intend to continue making high return capex investments in properties to maintain

market appeal and maximize cash flows. We expect the transaction to be accretive to OPI’s Normalized FFO, CAD and leverage

during the second half of 2024 and are targeting net debt to EBITDA of approximately 7 times by year end 2025, and the next

potential dividend increase to be during 2025. As highlighted, we are excited about the many opportunities, shared synergies and the

growth outlook for the combined company, and most importantly, the strategic benefit to shareholders from both companies with

immediate and future value creation.

That concludes our prepared remarks. Operator,

please open the lines for questions.

Operator: We will now begin the question-and-answer session.

[Operator Instructions.] The first question comes from Bryan Maher with B. Riley Securities. Please go ahead.

Q: Bryan Maher – Analyst, B. Riley Securities, Inc.

Good morning. A few questions for me on the deal. Can you give us a

little bit more color on the availability and advantages of the government-sponsored and agency debt, such as, is that simply related

to the SHOP assets? How deep is that pool that you could tap into relative to the underlying value of your SHOP assets? And what are the

advantages from an interest rate standpoint if you pursue that?

A: Matt Brown

Sure, Bryan. That’s a good question. I’ll take that. So

right now, with DHC’s restrictions, they can’t tap that market to issue debt in the SHOP portfolio. In addition to the SHOP

portfolio, there is another 27 or so senior living communities that are leased. So there’s a lot of access there that we immediately

can chase once the deal closes. Initially, we think there’s probably about $1 billion worth of debt financing available. And as

the SHOP portfolio continues to stabilize, more capital will be available there.

As we think about cost and comparisons, LTVs are probably closer to

70% in that portfolio as compared to maybe 50% for traditional office, so there’s a lot of advantages there. And then as it relates

to rate, we think issuing debt in this space is probably at least 200 basis points lower than alternative sources, such as unsecured bonds.

Q: Bryan Maher

Okay. And then as you think about raising debt, I mean, you’re

going to have a lot of assets here, some pretty attractive medical office building and life science assets still. Is it the preference

of management of newco to use the agency debt first? Or how are you thinking about potentially tapping the existing JV structures within

DHC to maybe place assets in there to raise capital?

A: Matt Brown

Yes. So right now, I’ll take the JV part first. While we have

great relationships at DHC with some sovereign wealth partners, sourcing additional JV capital is not a priority for the combined company.

Right now, we’re thinking that at closing, we will likely do a secured financing of a portfolio of office, medical office and life

science properties, some of which are collateral for the bridge, which, once again, we’re not planning on closing into, but we have

it available for closing. And then in ‘24, probably pivoting to more Fannie and Freddie Mae debt because that process will take

some time, and we can’t really start too early because this is subject to shareholder approval, etc.

Q: Bryan Maher

Okay. I mean, clearly this deal is near term advantageous to DHC and

long term advantageous to OPI, but it’s also clear this morning that the OPI shareholders are pretty disappointed with the scale

of the dividend cut. Can you talk to us about how you came up with that given that OPI probably does over $4 a share in FFO this year,

you probably had CAD around $2, $2.20. I got to believe that that’s going to weigh on this transaction. So can you give us a little

color on the thought process there?

A: Matt Brown

Yes. If we think about OPI as a stand-alone company, we were headed

towards a dividend cut with or without this transaction. We’re seeing tenant retention levels at 50% or so for 2023, as we’ve

highlighted on previous calls. We expect that trend to continue beyond 2023. And in ‘22 we had about $100 million of recurring capital.

We’re expected to have that number again in ‘23 and beyond.

So we are really seeing pressure on the dividend, and we are forced

with a cut no matter what, no different than what we’re seeing with other office REITs out there. We’ve seen several REITs

over the last several months cut their dividend. So the combined company really positions us to have a much more sustained dividend with

a growth profile as the SHOP segment continues to recover and really, I think, sets us up for growth in the future.

Q: Bryan Maher

Can you share with us what your pro forma expected CAD or CAD payout

ratio is at $1 per share?

A: Matt Brown

On a stand-alone basis or on a pro forma basis...combined….?

Q: Bryan Maher

Combined...

A: Matt Brown

What we said in our prepared remarks is that, in the second half of

‘24, we expect this to be accretive to Normalized FFO and CAD. Until then, we are still investing in our office portfolio, as well

as the SHOP portfolio. So we will overdistribute in the short term and then get to accretion in the back half of 2024.

Q: Bryan Maher

Okay. Maybe just two quick ones for me to close, and then I’ll

turn it over. What could derail this transaction? When we saw the TA deal recently, clearly between SVC and other ownership, that deal

was going to go through or it looks like it’s going to go through. Is there anything that you think could derail this merger? And

what exactly is baked into that $75 million of acquisition costs? Thank you.

A: Chris Bilotto

Well, just with respect to the first part of your question, Bryan,

I think that, look, overall, we feel like this is a very compelling opportunity for both companies for the highlighted reasons during

our prepared remarks and through some of this Q&A. And so we think the benefit to shareholders on both sides, both immediate and long

term, I think, are compelling. And so this transaction is subject to shareholder vote from both sides, and we feel good about the path

forward and getting to that point. But really, that’s the next step supporting this transaction.

A: Matt Brown

Yes. And as it relates to the transaction cost estimate, there’s

bankers that advise both sets of special committees that’s included in that number. There’s legal fees to support both sets

of special committees, the Boards and the companies, and then other customary transaction costs, accounting, other legal costs, transfer

tax estimates, etc.

Q: Bryan Maher

Okay. Thank you.

Operator: [Operator Instructions.] The next question comes from

Ronald Kamdem with Morgan Stanley. Please go ahead.

Q: Ronald Kamdem – Analyst, Morgan Stanley

Great. Just a couple for me going through the deck. So, number one

is just how do we think about sort of the – just simplistically the pro forma EBITDA? Because if I take the sort of OPI and I take

DHC, I get to sort of a $557 million number, and then you talk about $2 million to $3 million of synergies on G&A, so I can get to

sort of a $560 million, obviously backwards looking, right, or – and so forth, but just trying to get a sense, is that the right

range? And how do we think about what that EBITDA looks like as we go into ‘23? What are the puts and takes? Thanks.

A: Matt Brown

Yes, so as it relates to EBITDA, we’re assuming that the transaction

is to close in July of this year, we’ll get the benefit of half of DHC’s kind of pro forma EBITDA for 2023. And then EBITDA

will really start to ramp up in 2024 with the continued recovery of the SHOP portfolio in excess of the number you quoted is our current

forecast. And from a leverage standpoint, initially we expect it to be dilutive to OPI leverage as we take on DHC’s debt without

the corresponding SHOP stabilized NOI at this point. But in 2024, that will grow and it will continue growing into 2025 and beyond to

really continue reducing leverage over time.

Q: Ronald Kamdem

Got it. So I guess I take it so that $560 million is the right run

rate number. Is that your point? Or...

A: Matt Brown

Well, it’s – if you’re looking at 2024, $560 million

is probably about $100 million less than what we’re thinking about on the combined company. I think it’s better to look at

‘24 because that’s a full year of having the combined company EBITDA versus trying to pro forma ‘23 because it is dependent

on timing of closing.

Q: Ronald Kamdem

Got it. Okay. So 2024. Okay, that makes sense. So you can get to like

a $660 million number. Okay. Helpful. So then moving to recurring CapEx, right? So you talked about $100 million for OPI. What’s

the expectations for DHC on a recurring basis? And is there any sort of synergies or dissynergies? Just trying to get the combined company,

what’s the new recurring CapEx profile look like?

A: Matt Brown

Yes. So I’ll take CapEx kind of in aggregate, and just to level

set, what we said on our last quarter call for 2023 was about $100 million of recurring CapEx for OPI and then about $150 million of redevelopment

CapEx. When you put the combined companies together and once again, assuming a July 1 closing date, our aggregate capital is about $400

million to $450 million for 2023, pretty evenly weighted, slightly tilted towards redevelopment capital being higher. And then for 2024,

that range is a pretty good run rate of where we stand today.

Q: Ronald Kamdem

Got it. Okay. Helpful. If I could add, so for, if I just look at, sorry,

just to double click on that CapEx question. So if I look at your slide here on - CapEx, I see there’s probably $403 million less

of spend on the projects. So is that, is there anything else above in that beyond that planning to be spent on a CapEx basis? This is

number one, right? So I see $403 million left to be spent, and that’s on redevelopment projects, revenue enhancing CapEx. Is there

anything else contemplated? Or is that sort of it for the pipeline for now?

A: Chris Bilotto

So we’ll take it in two parts. So for the kind of the MOB, life

science and office side, this capital is probably a good indicator of where we would expect to spend kind of in the near term. A lot of

this is tied towards projects affiliated with OPI, in DC and Seattle and some kind of smaller projects, but nothing new being contemplated

for larger development despite opportunities across the portfolio.

For the SHOP segment, this is the projects that are kind of in progress

that we talked about with the 21 communities, and so we would expect that, as we continue to improve on the SHOP portfolio, additional

elevated capital will be spent, going through 2024. And I think it’s worth highlighting kind of the stabilized yields that we’re

expecting coming out of that, and you can see on this slide, kind of that 25% return on incremental costs.

Q: Ronald Kamdem

Got it. That’s helpful. And then, just remind me for DHC standalone,

what was the recurring CapEx number for that one?

A: Rick Siedel

DHC was expecting to spend between $300 million and $350 million of

capital this year. About $250 million or so was in the SHOP portfolio, and it’s pretty evenly split between repositioning or redevelopment

capital and kind of ongoing maintenance. On a go-forward basis, once we’ve kind of addressed the projects that are in the hopper

right now, normalized kind of maintenance capital is expected to be about $1,500 per unit per year. So, when you multiply that by the

25,000 units in the portfolio, it’s a sizable amount, but nowhere near the levels we’ve been spending recently.

Q: Ronald Kamdem

Got it, makes sense. And then does, just going to the secured financing,

which caught our attention. Maybe can you give some color in terms of what the size and what the rate could be? Because you talked about

putting some secured financing here. Just trying to get a sense of how far along that is?

A: Matt Brown

Yes, it’s underway. The goal is to have a secured financing in

place at closing, so we don’t have to draw on the bridge. We’re thinking size is probably somewhere around $300 million and

it’s really in early stages, so to give quotes on pricing, it’s too early right now to predict.

Q: Ronald Kamdem

Okay. Got it, makes sense. And then, I guess the last one I had was

just so when you sort of take a step back and you think about sort of this combined – business, combined sort of structure and so

forth, and you talked about sort of the – when you get to the end of, I guess, 2025, you can get to a net debt to EBITDA of 7x.

I’m just trying to get through, if you could just bridge us, how you get there from today where, if I sort of look at the combined

company EBITDA when the deal closes, maybe it’s sort of in the high 8s, if my math is correct. So maybe can you help us bridge how

you get from that to the 7x? Like how much of it is EBITDA growth or NOI growth and how much of it is debt pay down? Just trying to get

a sense of how you guys are thinking about that? Thanks.

A: Matt Brown

Yes. The main driver is really the recovery of SHOP. We’re expecting

some pretty sizable NOI increases in ‘24 and ‘25. So that is the major catalyst. And then as OPI’s two redevelopment

projects that we’ve talked about at length over the last several quarters, stabilize in ’24 and into ‘25, that’s

another driver of NOI growth to support where we expect to be at the end of 2025.

Q: Ronald Kamdem

Great. That’s all my questions. Very helpful. Thank you.

Operator: This concludes our question and answer session. I

would like to turn the conference back over to Chris Bilotto, President and Chief Operating Officer, for any closing remarks.

Speaker: Chris Bilotto

Thank you for joining us today. We’re excited to advance the

benefits of this merger and look forward to talking to you soon.

Operator: The conference has now concluded. Thank you for attending

today’s presentation. You may now disconnect.

[End]

Warning Concerning Forward-Looking Statements

This transcript contains statements that constitute

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Also,

whenever Office Properties Income Trust (Nasdaq: OPI), or OPI, and Diversified Healthcare Trust (Nasdaq: DHC), or DHC, use words such

as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”,

“will”, “may” and negatives or derivatives of these or similar expressions, they are making forward-looking statements.

These forward-looking statements are based upon OPI’s and DHC’s present intent, beliefs or expectations, but forward-looking

statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by OPI’s

and DHC’s forward-looking statements as a result of various factors, which include those that are detailed in each of OPI’s

and DHC’s Annual Reports on Form 10-K for the year ended December 31, 2022 and subsequent filings with the Securities and Exchange

Commission, or the SEC.

You should not place undue reliance upon any forward-looking

statements. Except as required by law, OPI and DHC do not intend to update or change any forward-looking statements as a result of new

information, future events or otherwise.

Important Additional Information About the Transaction

In connection with the proposed merger, OPI intends

to file a registration statement on Form S-4 with the SEC, which will include a preliminary prospectus and related materials to register

OPI’s common shares of beneficial interest, $.01 par value per share, to be issued in the merger. OPI and DHC intend to file a joint

proxy statement/prospectus and other documents concerning the merger with the SEC. The proposed transaction involving OPI and DHC will

be submitted to OPI’s and DHC’s shareholders for their consideration. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS

ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT ARE FILED OR

WILL BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT OPI, DHC AND THE MERGER. When available, the relevant portions of the

joint proxy statement/prospectus will be mailed to OPI’s and DHC’s shareholders. Investors will also be able to obtain copies

of the registration statement and the joint proxy statement/prospectus and other relevant documents (when they become available) free

of charge at the SEC’s website (www.sec.gov). Additional copies of documents filed with the SEC by OPI may be obtained for free

on OPI’s Investor Relation’s website at www.opicreit.com/investors or by contacting OPI’s Investor Relations department

at 1-617-219-1410. Additional copies of documents filed with the SEC by DHC may be obtained for free on DHC’s Investor Relation’s

website at www.dhcreit.com/investors or by contacting DHC’s Investor Relations department at 1-617-796-8234.

In addition to the registration statement and joint

proxy statement/prospectus expected to be filed, OPI and DHC file annual, quarterly and current reports and other information with the

SEC. OPI’s and DHC’s filings with the SEC are also available to the public from commercial document-retrieval services and

at the website maintained by the SEC at www.sec.gov.

No Offer or Solicitation

This transcript shall not constitute an offer to

sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval in any jurisdiction

with respect to the merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities

Act of 1933, as amended.

Participants in the Solicitation

OPI and certain of its trustees and executive officers,

DHC and certain of its trustees and executive officers, and The RMR Group LLC, the manager of OPI and DHC, and its parent and certain

of their directors, officers and employees may be deemed to be participants in the solicitation of proxies from OPI’s and DHC’s

shareholders in connection with the merger. Certain information regarding the persons who may, under the rules of the SEC, be deemed participants

in the solicitation of OPI’s and DHC’s shareholders in connection with the merger and a description of their direct and indirect

interests will be set forth in the registration statement and the joint proxy statement/prospectus when filed with the SEC. Information

about OPI’s trustees and executive officers is included in the proxy statement for its 2023 annual meeting of shareholders, which

was filed with the SEC on April 6, 2023. Information about DHC’s trustees and executive officers is included in the proxy statement

for its 2022 annual meeting of shareholders, which was filed with the SEC on March 29, 2022. Copies of the foregoing documents may be

obtained as provided above. Additional information regarding the interests of such participants and other persons who may be deemed participants

in the transaction will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they

become available.

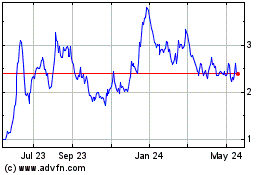

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

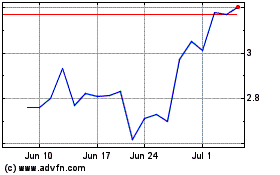

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Apr 2023 to Apr 2024