Second quarter total revenue of $50.4 million

increases 39% year-over-year

CyberArk (NASDAQ: CYBR), the company that protects organizations

from cyber attacks that have made their way inside the network

perimeter, today announced financial results for the second quarter

ended June 30, 2016.

“The second quarter was another strong quarter for CyberArk,”

said Udi Mokady, CyberArk Chairman and CEO. “Our top line growth

demonstrates the increasing demand for our privileged account

security platform while our bottom line outperformance shows the

power of our business model. As we move into the second half of the

year, we plan to continue making thoughtful investments including

enhancing our technology platform and expanding market

presence.”

Financial Highlights for the Second Quarter Ended June 30,

2016

Revenue:

- Total revenue was $50.4 million, up 39%

year-over-year compared with the second quarter of 2015.

- License revenue was $30.0 million, up

35% compared with the second quarter of 2015.

- Maintenance and Professional Services

revenue was $20.4 million, up 45% from the second quarter of

2015.

Operating Income:

- GAAP operating income was $8.5 million

for the quarter, up from $6.5 million in the second quarter of

2015.

- Non-GAAP operating income was $13.6

million for the quarter, up from $8.2 million in the second quarter

of 2015.

Net Income:

- GAAP net income was $6.4 million, or

$0.18 per diluted share, compared to GAAP net income of $4.9

million, or $0.14 per diluted share, in the second quarter of

2015.

- Non-GAAP net income was $10.5 million,

or $0.29 per diluted share, compared to $6.5 million, or $0.19 per

diluted share, in the second quarter of 2015.

The tables at the end of this press release include a

reconciliation of GAAP to non-GAAP operating income and net income

for the three months and six months ended June 30, 2016 and 2015.

An explanation of these measures is also included below under the

heading “Non-GAAP Financial Measures.”

Balance Sheet and Cash Flow:

- As of June 30, 2016, CyberArk had

$259.0 million in cash, cash equivalents, marketable securities and

short-term deposits, compared to $238.3 million as of December 31,

2015.

- During the first six months of 2016,

the Company generated $21.4 million in cash flow from operations,

compared to $35.1 million in the first six months of 2015.

Business Outlook

Based on information available as of August 9, 2016, CyberArk is

issuing guidance for the third quarter and full year 2016 as

indicated below.

Third Quarter 2016:

- Total revenue is expected to be in the

range of $51.5 million to $52.5 million, which represents 29% to

31% year-over-year growth.

- Non-GAAP operating income is expected

to be in the range of $10.1 million to $11.0 million.

- Non-GAAP net income per share is

expected to be in the range of $0.21 to $0.23 per diluted share.

This assumes 36.0 million weighted average diluted shares.

Full Year 2016:

- Total revenue is expected to be in the

range of $210.5 million to $212.5 million, which represents 31% to

32% year-over-year growth.

- Non-GAAP operating income is expected

to be in the range of $48.4 million to $50.0 million.

- Non-GAAP net income per share is

expected to be in the range of $1.03 to $1.07 per diluted share.

This assumes 35.9 million weighted average diluted shares.

Conference Call Information

CyberArk will host a conference call on Tuesday, August 9, 2016

at 5:00 p.m. Eastern Time (ET) to discuss the company’s second

quarter financial results and its business outlook. To access this

call, dial +1 844-237-3590 (U.S.) or +1 484-747-6582

(international). The conference ID is 47864998. Additionally, a

live webcast of the conference call will be available via the

“Investor Relations” section of the company’s web site at

www.cyberark.com. A replay will be available for one week at +1

855-859-2056 (U.S.) or +1 404-537-3406 (international). The replay

pass code is 47864998. An archived webcast of the conference call

will also be available in the “Investor Relations” section of the

company’s web site at www.cyberark.com.

About CyberArk

CyberArk is the only security company focused on

eliminating the most advanced cyber threats; those that use insider

privileges to attack the heart of the enterprise. Dedicated to

stopping attacks before they stop business, CyberArk proactively

secures against cyber threats before attacks can escalate and do

irreparable damage. The company is trusted by the world’s leading

companies – including 45 percent of the Fortune 100 – to protect

their highest value information assets, infrastructure and

applications. A global company, CyberArk is headquartered in Petach

Tikvah, Israel, with U.S. headquarters located in Newton, Mass. The

company also has offices throughout EMEA and Asia Pacific and

Japan. To learn more about CyberArk, visit www.cyberark.com, read

the company blog, http://www.cyberark.com/blog/, follow on

Twitter @CyberArk or Facebook

at https://www.facebook.com/CyberArk.

Copyright © 2016 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Non-GAAP Financial MeasuresCyberArk believes that the use

of non-GAAP operating income and non-GAAP net income is helpful to

our investors. These financial measures are not measures of the

Company’s financial performance under U.S. GAAP and should not be

considered as alternatives to operating income or net income or any

other performance measures derived in accordance with GAAP.

- For the three and six months ended June

30, 2016, non-GAAP operating income is calculated as operating

income excluding share-based compensation expense and amortization

of intangible assets related to acquisitions. For the three and six

months ended June 30, 2015, non-GAAP operating income is calculated

as operating income excluding public offering and acquisition

related expenses as well as share-based compensation expense.

- For the three and six months ended June

30, 2016, non-GAAP net income is calculated as net income excluding

share-based compensation expense, amortization of intangible assets

related to acquisitions and the tax effects related to the non-GAAP

adjustments. For the three and six months ended June 30, 2015,

non-GAAP net income is calculated as net income excluding public

offering and acquisition related expenses as well as share-based

compensation expense and the tax effects related to the non-GAAP

adjustments.

Because of varying available valuation methodologies, subjective

assumptions and the variety of equity instruments that can impact a

company’s non-cash expense, the Company believes that providing

non-GAAP financial measures that exclude share-based compensation,

public offering and acquisition related expenses and amortization

of intangible assets related to acquisitions allows for more

meaningful comparisons of its period to period operating results.

Share-based compensation expense has been, and will continue to be

for the foreseeable future, a significant recurring expense in the

Company’s business and an important part of the compensation

provided to its employees. The Company believes that expenses

related to its public offerings, acquisitions and amortization of

intangible assets related to acquisitions do not reflect the

performance of its core business and impact period-to-period

comparability.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measures to evaluate its business.

Cautionary Language Concerning Forward-Looking

Statements

This release may contain forward-looking statements, which

express the current beliefs and expectations of CyberArk’s (the

“Company”) management. In some cases, forward-looking statements

may be identified by terminology such as “believe,” “may,”

“estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,”

“expect,” “predict,” “potential” or the negative of these terms or

other similar expressions. Such statements involve a number of

known and unknown risks and uncertainties that could cause the

Company’s future results, performance or achievements to differ

significantly from the results, performance or achievements

expressed or implied by such forward-looking statements. Important

factors that could cause or contribute to such differences include

risks relating to: changes in the rapidly evolving cyber threat

landscape; failure to effectively manage growth; near-term declines

in our operating and net profit margins and our revenue growth

rate; real or perceived shortcomings, defects or vulnerabilities in

the Company’s solutions or internal network system, or the failure

of the Company’s customers or channel partners to correctly

implement the Company’s solutions; fluctuations in quarterly

results of operations; the inability to acquire new customers or

sell additional products and services to existing customers;

competition from IT security vendors; the Company’s ability to

successfully integrate recent and or future acquisitions; and other

factors discussed under the heading “Risk Factors” in the Company’s

most recent annual report on Form 20-F filed with the Securities

and Exchange Commission. Forward-looking statements in this release

are made pursuant to the safe harbor provisions contained in the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are made only as of the date hereof, and

the Company undertakes no obligation to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

CYBERARK SOFTWARE LTD.Consolidated

Statements of OperationsU.S. dollars in thousands (except per share

data)(Unaudited)

Three Months EndedJune 30, Six Months

EndedJune 30, 2015 2016 2015

2016 Revenues: License $ 22,278 $ 29,965 $ 42,256 $

57,479 Maintenance and professional services 14,097 20,415 27,034

39,812 Total revenues 36,375 50,380

69,290 97,291 Cost of revenues: License 1,831 1,283 2,381

2,557 Maintenance and professional services 4,243 5,628 7,950

10,788 Total cost of revenues 6,074

6,911 10,331 13,345 Gross profit 30,301

43,469 58,959 83,946 Operating

expenses: Research and development 4,263 8,165 8,380 16,098 Sales

and marketing 15,449 21,837 28,909 43,500 General and

administrative 4,058 5,016 7,636 9,686

Total operating expenses 23,770 35,018 44,925 69,284

Operating income 6,531 8,451 14,034 14,662

Financial income (expenses), net 327 (94 )

(1,304 ) (27 ) Income before taxes on income

6,858 8,357 12,730 14,635 Taxes on income (1,936 )

(1,908 ) (3,642 ) (3,862 ) Net income $

4,922 $ 6,449 $ 9,088 $ 10,773

Basic net income per ordinary share $ 0.16 $ 0.19

$ 0.29 $ 0.32 Diluted net income per ordinary

share $ 0.14 $ 0.18 $ 0.26 $ 0.30

Shares used in computing net income per ordinary shares,

basic 31,530,242 33,547,975

31,049,379 33,457,149 Shares used in computing

net income per ordinary shares, diluted 35,001,262

35,787,574 34,896,092 35,740,107

Share-based Compensation

Expense: Three Months EndedJune 30, Six

Months EndedJune 30, 2015 2016 2015

2016 Cost of revenues $ 84 $ 285 $ 147 $ 526

Research and development 85 998 167 1,938 Sales and marketing 177

1,371 316 2,596 General and administrative 797

1,325 978 2,292 Total

share-based compensation expense $ 1,143 $ 3,979 $

1,608 $ 7,352

CYBERARK SOFTWARE

LTD.Consolidated Balance SheetsU.S. dollars in

thousands(Unaudited)

December 31,2015 June 30,2016

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 234,539 $ 178,420 Short-term bank deposits 3,713

45,850 Marketable securities - 12,386 Trade receivables 20,410

20,804 Prepaid expenses and other current assets 3,293

5,196 Total current assets 261,955

262,656 LONG-TERM ASSETS: Property and

equipment, net 3,584 4,366 Intangible assets, net 18,558 16,290

Goodwill 35,145 35,145 Marketable securities - 22,390 Severance pay

fund 3,230 3,187 Prepaid expenses and other long-term assets 1,954

2,005 Deferred tax asset 9,998 10,030

Total long-term assets 72,469 93,413

TOTAL ASSETS $ 334,424 $ 356,069

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables $ 2,530 $ 2,215 Employees and payroll

accruals 15,860 13,699 Deferred revenues 37,104 42,812 Accrued

expenses and other current liabilities 9,366

5,851 Total current liabilities 64,860

64,577 LONG-TERM LIABILITIES: Deferred revenues 17,285

20,004 Other long-term liabilities 188 236 Accrued severance pay

4,667 4,601 Deferred tax liabilities 754 595

Total long-term liabilities 22,894

25,436

TOTAL LIABILITIES 87,754

90,013 SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par

value 86 86 Additional paid-in capital 200,107 208,507 Accumulated

other comprehensive income (loss) (93 ) 120 Retained earnings

46,570 57,343 Total shareholders'

equity 246,670 266,056

TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY $ 334,424 $ 356,069

CYBERARK SOFTWARE

LTD.Consolidated Statements of Cash FlowsU.S. dollars

in thousands(Unaudited)

Six Months EndedJune 30,

2015

2016

Cash flows from operating activities: Net income $

9,088 $ 10,773 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and Amortization 459

3,126 Share-based compensation expenses 1,608 7,352 Tax benefit

related to share-based compensation (1,176 ) (411 ) Deferred income

taxes, net (731 ) (189 ) Decrease (increase) in trade receivables

4,965 (394 ) Increase in prepaid expenses and other current and

long-term assets (1,175 ) (1,672 ) Increase (decrease) in trade

payables 263 (179 ) Increase in short term and long term deferred

revenues 21,106 8,427 Decrease in employees and payroll accruals

(1,153 ) (2,161 ) Increase (decrease) in accrued expenses and other

current and long-term liabilities 1,586 (3,240 ) Increase

(decrease) in accrued severance pay, net 280

(23 ) Net cash provided by operating activities

35,120 21,409

Cash flows from

investing activities: Proceeds from short and long term

deposits 39,289 - Investment in short and long term deposits -

(42,149 ) Investment in marketable securities - (34,650 ) Purchase

of property and equipment (1,060 ) (1,777 )

Net cash provided by (used in) investing activities 38,229

(78,576 )

Cash flows from financing

activities: Issuance of shares, net 52,685 - Withholding

proceeds related to exercise of options 17,201 - Tax benefit

related to share-based compensation 1,176 411 Proceeds from

exercise of options 1,524 637

Net cash provided by financing activities 72,586

1,048 Increase (decrease) in cash and cash

equivalents 145,935 (56,119 ) Cash and cash equivalents at

the beginning of the period 124,184 234,539

Cash and cash equivalents at the end of the period $

270,119 $ 178,420

CYBERARK SOFTWARE LTD.Reconciliation of

GAAP Measures to Non-GAAP MeasuresU.S. dollars in thousands (except

per share data)(Unaudited)

Reconciliation of Operating Income to Non-GAAP

Operating Income: Three Months EndedJune

30, Six Months EndedJune 30,

2015

2016

2015

2016

Operating income $ 6,531 $ 8,451 $ 14,034 $ 14,662

Public offering related expenses 487 - 1,568 - Share-based

compensation 1,143 3,979 1,608 7,352 Amortization of intangible

assets - Cost of revenues - 355 - 710 Amortization of intangible

assets - Research and development - 478 - 956 Amortization of

intangible assets - Sales and marketing - 301 - 602 Acquisition

related expenses 88 - 88

- Non-GAAP operating income $ 8,249 $

13,564 $ 17,298 $ 24,282

Reconciliation of Net Income to Non-GAAP Net Income:

Three Months EndedJune 30, Six Months

EndedJune 30,

2015

2016

2015

2016

Net income $ 4,922 $ 6,449 $ 9,088 $ 10,773 Public

offering related expenses 487 - 1,568 - Share-based compensation

1,143 3,979 1,608 7,352 Amortization of intangible assets - Cost of

revenues - 355 - 710 Amortization of intangible assets - Research

and development - 478 - 956 Amortization of intangible assets -

Sales and marketing - 301 - 602 Acquisition related expenses 88 -

88 - Taxes on income related to non-GAAP adjustments (114 )

(1,066 ) (114 ) (1,579 ) Non-GAAP net

income $ 6,526 $ 10,496 $ 12,238 $ 18,814

Non-GAAP net income per share Basic $ 0.21 $

0.31 $ 0.39 $ 0.56 Diluted $ 0.19 $

0.29 $ 0.35 $ 0.53 Weighted average

number of shares Basic 31,530,242 33,547,975

31,049,379 33,457,149 Diluted

35,001,262 35,787,574 34,896,092

35,740,107

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160809006374/en/

CyberArkInvestor Contact:Erica Smith,

617-558-2132ir@cyberark.comorMedia Contact:Christy Lynch,

617-796-3210press@cyberark.com

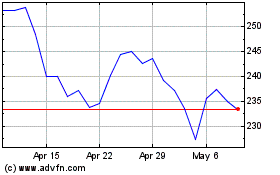

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

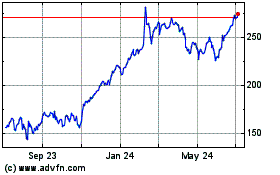

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Nov 2023 to Nov 2024