UPDATE: CME February Daily Trading Volume Down 13% Over Strong Year Ago

March 02 2012 - 9:31AM

Dow Jones News

CME Group Inc.'s (CME) daily trading volume fell 13% in February

over the year-earlier period that hosted particularly strong

trading volume due to a wave of unrest in the Middle East and North

Africa.

Daily volume at the world's largest futures market operator

averaged 12.8 million contracts last month, down from February 2011

although up 10% from January.

Daily volume for interest-rate futures, its largest product by

that metric, averaged roughly 6 million contracts a day in

February, down 19% from a year earlier and up 15% from January.

Equity index volume declined 14% and 1.2%, respectively.

CME has in recent months worked to rebuild confidence in its

operations after facing criticism for its handling of the failure

last year of MF Global Holdings (MFGLQ), one of the largest brokers

on its markets.

Daily volume at competitor IntercontinentalExchange Inc. (ICE)

averaged 1.7 million contracts in February, down 4% from a year

earlier and up 12% from January.

Its largest product, Brent crude futures and options, posted an

8.9% increase in daily volume over the year earlier while rising

10% from January. Volume in West Texas Intermediate crude futures

and options slumped 38% from February 2011 but rose 18% from

January.

Fourth-quarter earnings at ICE rose 28% as solid trading volume

in the exchange operator's futures contracts and over-the-counter

energy business boosted revenue.

Class A shares of CME closed Thursday at $289.54 and were

inactive in premarket trade. Shares of ICE closed at $139.80 and

were also inactive premarket.

-By Mia Lamar, Dow Jones Newswires; 212-416-3207;

mia.lamar@dowjones.com

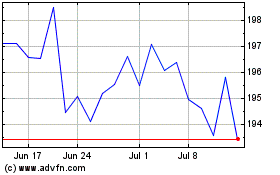

CME (NASDAQ:CME)

Historical Stock Chart

From Aug 2024 to Sep 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Sep 2023 to Sep 2024