Illinois House Votes Down CME-CBOE, Sears Tax Breaks

November 30 2011 - 8:04AM

Dow Jones News

The Illinois House on Tuesday overwhelmingly shot down tax

breaks for Chicago's derivatives exchanges and a major retailer,

with headquarters in the Chicago suburbs.

Only eight House members voted in favor of the bill, which was

approved by the state Senate earlier in the day.

The rejection places in jeopardy legislative efforts to prevent

CME Group Inc. (CME), CBOE Holdings Inc. (CBOE), and Sears Holdings

Corp. (SHLD) from moving their headquarters to other states with

lower taxes.

CME and CBOE representatives declined comment. However, CME

Chairman Terry Duffy sought prompt action on the proposal, claiming

earlier this month that he didn't want to limit the options of

CME's board of directors.

Sears executives still plan to make a decision by year's end on

the site for its headquarters, which employs 6,100 people, said

spokesman Chris Brathwaite.

"We are disappointed that [Tuesday], the legislature was not

able to reach agreement and pass a package that will help us remain

an Illinois company," Brathwaite said in a prepared statement.

"It is our hope that lawmakers will achieve a compromise very

soon," said Brathwaite.

Sears would pay lower taxes through the renewal of a special

taxing district in the Chicago suburb of Hoffman Estates.

As it currently stands, the legislation would also allow CME and

the CBOE options exchange to be taxed on 27.54% of all electronic

trades, which account for the vast majority of the business

performed at the exchanges. The exchanges now pay taxes on 100% of

their electronic transactions.

The tax breaks wouldn't kick in for CME and CBOE until the start

of the next fiscal year, which begins July 1.

Some lawmakers have criticized CME, in particular, for

threatening to leave the fiscally troubled state even as it posts

healthy earnings. CME reported profit of $361.1 million in the

third quarter, up from $244 million in the same period a year

ago.

Rep. William Davis argued that low-income residents "should get

something out of this."

In an attempt to win political support, lawmakers expanded the

tax deal to provide relief to Illinois's small businesses and

individual workers.

Gov. Pat Quinn supported the Senate version's of the bill

providing low-to-middle income workers with a 10% increase in

earned income tax credits by fiscal year 2014.

"The Governor will continue to fight for working families," said

Quinn spokeswoman Brooke Anderson.

"From day one, we have insisted that any tax relief bill also

include help for working families and employers. It is clear that

the legislature is deeply divided over this issue," Anderson said

in a prepared statement.

Only the trading floors, located at the CME-owned Chicago Board

of Trade, would remain in the city, said CME's Duffy at a

legislative hearing earlier this month. Chicago trading-floor

activity represents less than 5% of CME's entire business,

according to Duffy.

CME and CBOE protested the state legislature's vote in January

to raise the state's corporate tax to 7%, from 4.8%.

Instead of providing the tax breaks, the legislature should

rescind the tax hike, House member Jack Franks urged his

colleagues.

The higher tax costs CME an extra $50 million per year,

according to Duffy.

It isn't acceptable, Duffy added, that CME pays 6% of all

corporate taxes collected by the Illinois government.

The CME chairman told the House committee earlier this month

that the exchange operator's directors are reviewing "very, very

lucrative" offers from other states.

-By Howard Packowitz, Dow Jones Newswires; 312-750-4132;

howard.packowitz@dowjones.com

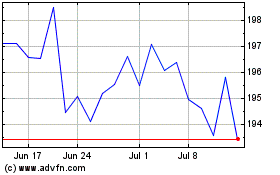

CME (NASDAQ:CME)

Historical Stock Chart

From May 2024 to Jun 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2023 to Jun 2024