The Securities and Exchange Commission is examining the behavior

of market professionals during the May 6 stock plunge to determine

whether they met their legal obligations to investors, SEC Chairman

Mary Schapiro said Thursday.

"If we identify any activity that violates the securities laws,

we will take appropriate action," Schapiro said in written

testimony prepared for the Senate Banking Committee's Subcommittee

on Securities, Insurance and Investment.

The SEC also is asking the major trading exchanges for a unified

plan for breaking trades during volatile market periods within two

weeks, Schapiro said during the hearing.

Thursday's congressional hearing is the second in as many weeks

on the market "flash crash," when the Dow Jones Industrial Average

sank nearly 1,000 points before staging a partial recovery. Policy

makers and market analysts are clamoring for information about what

happened and how to stop a similar event from occurring again.

"I am deeply concerned about the effects that this volatile

market had on investors, especially retail investors," Schapiro

said.

The SEC has received numerous complaints from investors who had

"stop-loss" orders in place to protect against falling markets, she

said. Those accounts were liquidated as stocks were plummeting on

May 6, "only to have stock prices close significantly above their

sale prices."

Schapiro said the exchanges' decision to break trades that

deviate 60% from prices outside of that day's critical 20-minute

time period seemed "arbitrary."

"Going forward, we need a process that is much more transparent,

provides certainty in advance about what trades will be broken and

which ones won't," Schapiro said.

To keep such a plunge from occurring again, the SEC and the

major trading exchanges will implement a cross-market "circuit

breaker" in June that will require a five-minute time-out for any

stock that sees a 10% change in price in the preceding five

minutes. Other fixes, such as a marketwide pause and unified

trade-cancellation policy, also are in the works.

Sen. Bob Corker (R., Tenn.) asked Schapiro why the time-out

should occur for stock prices that go up. Schapiro said five

stocks, including Apple Inc. (AAPL) and Hewlett-Packard Co. (HPQ),

traded at $100,000 during the market plunge and recovery.

People are disadvantaged when they buy a stock at $100,000 as

much as people who have sold a stock at a penny, Schapiro said.

"Fairness really dictates that the circuit breaker works in both

directions."

The SEC is asking whether the exchanges' decisions to break

trades that occurred during the volatile half-hour period were

applied "fairly and consistently among investors," Schapiro

said.

The SEC also is investigating market participants to ensure that

they met their "best execution obligations" during a mass selloff,

Schapiro said.

Preliminary findings from regulators about the flash crash

indicate it was caused by a "severe temporary liquidity failure"

and not any economic factor indicating that equities "truly could

drop and recover such a large amount in just a few minutes,"

Schapiro said.

Schapiro's testimony at the hearing echoed her comments given a

week earlier before a House panel when she said regulators found no

evidence that a "fat finger" typing error, hacker or terrorist

activity caused the flash crash.

Schapiro also referenced findings from a joint report on the

crash that the SEC issued earlier this week with the Commodity

Futures Trading Commission.

The Financial Industry Regulatory Authority is working closely

with the SEC and CFTC in its investigation. Finra Chairman Richard

Ketchum said in testimony that his staff is focusing on about 300

stocks that experienced the most dramatic declines during the

30-minute plunge-and-recover period. Those stocks coincided with

securities that were the subject of cancellations and reversals

after the incident, he said.

To make sure it has easier access to trade data, the SEC is

scheduled to vote May 26 on rules requiring national securities

exchanges to give regulators data for a consolidated audit trail

that collects and aggregates real-time market data, Schapiro

said.

The rule will direct all the exchanges, including the BATS

Exchange and Direct Edge, to come up with a plan to feed

consolidated market data to the SEC, Schapiro said.

The SEC will be taking a closer look at the May 6 activity

around exchange-traded funds, hybrid funds that have shares traded

throughout the day, Schapiro said.

ETFs were affected more than any other securities class by

broken trades, Schapiro said. The SEC is investigating

institutional investors' practice of shorting ETFs to hedge against

broad market exposures, asking whether those shorts contributed to

certain ETFs' dramatic intraday price swings.

The SEC also is looking into exchanges' "self-help" practices.

SEC rules require exchanges to route orders to the exchange that

has the best price. But an exchange can occasionally enter self

help and waive that rule if it perceives unusual activity at

another exchange, allowing it to stop sending orders to that

venue.

Nasdaq OMX Group Inc. (NDAQ) and BATS declared self help against

the NYSE Euronext's (NYX) electronic trading platform Arca for a

short period on the afternoon of May 6. Schapiro said the SEC is

looking into whether there needs to be "greater consistency in

exchange practices with respect to the self-help mechanism."

CFTC Chairman Gary Gensler and officials from the major

exchanges also were slated to testify. Gensler said in testimony

that an algorithm used when a single trader sold a large number of

stock index futures on May 6 may have caused an unintended impact

because the market lacked liquidity.

Eric Noll, executive vice president of transaction services for

Nasdaq, said the changes proposed by regulators will help the

exchanges be consistent in responding to market trends.

NYSE Chief Operating Officer Larry Leibowitz said regulators

shouldn't "point blame" at professional traders or certain

liquidity providers and should focus instead on the role of market

makers and alternate trading platforms such as "dark pools."

Terrence Duffy, executive chairman of CME Group Inc. (CME), a

futures market, said lack of consistency in equities markets

exacerbates problems in times of market stress.

-By Fawn Johnson, Dow Jones Newswires; 202-862-9263;

fawn.johnson@dowjones.com

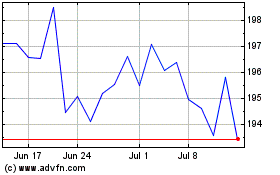

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024