CBOE Leans On Index Options As 1Q Profit Slides 7%

May 05 2010 - 2:45PM

Dow Jones News

The Chicago Board Options Exchange is increasingly reliant upon

its stable of contracts tied to stock indexes, a key area of its

business that could be affected by a proposed cap on trading

fees.

The largest U.S. options exchange by volume said that index

options made up nearly a quarter of first-quarter activity, which

was up 2% from a year earlier.

CBOE reported higher revenue but lower profit in what could be

its final quarterly announcement before it details plans for an

initial public offering in June.

Revenue rose 3% to $101.1 million in the three months to March

31, with net profit down 7% at $22.7 million, weighed in part by

IPO-related expenses.

The exchange operator, which reported results late Tuesday via a

notice to member-owners, is pursing the estimated $300 million

float after resolving a long-running legal dispute in late 2009

over ownership rights in the company.

The planned conversion to a shareholder-owned entity comes after

peers in the U.S. exchange sector had already gone public and

consolidated in a flurry of mergers and acquisitions ahead of the

financial crisis in 2008.

Its progress has been closely watched by analysts and investors

seeking to gauge the value of the company, underpinned by a roster

of exclusive licenses to trade options on such benchmark stock

indexes as the S&P 500 and the Dow Jones Industrial

Average.

CBOE reported a $3.5 million rise in transaction fees for the

quarter thanks to higher trading volume and a rise in the average

fee paid per contract, helped by customers' increased use of

index-based products, which made up 24.4% of total contracts traded

for the quarter.

Those options represent CBOE's biggest profit center and a

commanding advantage over rivals, but they come with potential

risks. Growth in nonexclusive options contracts tied to stock

indexes has outpaced CBOE-specific products in recent years, and

the rival International Securities Exchange has launched legal

action to loosen CBOE's hold on the market.

Another potential headache is the 30 cents-per-contract limit on

options trading fees proposed by U.S. securities regulators. This

could cost CBOE between $14.2 million and $23.9 million in annual

revenue, according to estimates from the exchange and the

Securities and Exchange Commission.

The SEC, which proposed the rule in mid-April, aims to align the

cost of buying or selling options more closely with the price

quoted at an exchange.

The agency is seeking comment from the industry on the matter

until June 21. CBOE, alongside other options exchange operators,

plans to voice is opposition.

The price of memberships at the CBOE has come down following the

SEC's rule proposal, with a seat on Wednesday selling for $2.35

million, down from a recent high of $2.95 million following the

mid-March IPO filing.

CBOE said employee costs rose $2.9 million in the March quarter

from a year ago, partly due to higher severance expenses tied to

targeted staff reductions. Results also included a $1.5 million

rise in legal expenses related to the planned shift to a

shareholder-owned structure.

The rise in index options volume contributed to higher royalty

fees, which climbed $2.9 million for the quarter.

-By Jacob Bunge, Dow Jones Newswires; (312) 750 4117;

jacob.bunge@dowjones.com

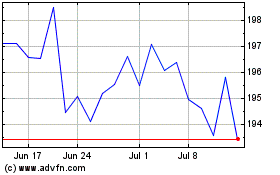

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024