HONG KONG, Dec. 2 /PRNewswire-FirstCall/ -- CHINA NATURAL

RESOURCES, INC. (NASDAQ:CHNR), a company based in the People's

Republic of China, today released unaudited interim financial

statements for the three and six months ended June 30, 2009 as

follows: CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS) (UNAUDITED) FOR THE THREE AND SIX

MONTHS ENDED JUNE 30, 2009 AND 2008 (Amounts in thousands, except

share and per share data) Three Months Ended June 30

-------------------------- 2008 2009 2009 ---- ---- ---- RMB RMB

US$ NET SALES 29,722 12,999 1,903 COST OF SALES (12,141) (12,371)

(1,811) ------- ------- ------ GROSS PROFIT 17,581 628 92 SELLING,

GENERAL AND ADMINISTRATIVE EXPENSES, including share-based

compensation expense of RMB13,008 (US$1,904) for the six months

ended June 30, 2009 (2008: RMB13,008) and RMB6,504 (US$952) for the

three months ended June 30, 2009 (2008: RMB6,504) (9,157) (12,870)

(1,884) ------ ------- ------ OPERATING INCOME (LOSS) FROM

CONTINUING OPERATIONS 8,424 (12,242) (1,792) INTEREST INCOME 372 65

9 OTHER INCOME, NET 67 - - LOSS ATTRIBUTABLE TO INVESTMENT IN

UNCONSOLIDATED INVESTEE (2,306) (2,960) (433) ------ ------ ----

INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES 6,557

(15,137) (2,216) INCOME TAXES (4,304) (714) (105) ------ ---- ----

INCOME (LOSS) FROM CONTINUING OPERATIONS 2,253 (15,851) (2,321)

DISCONTINUED OPERATIONS INCOME (LOSS) FROM DISCONTINUED OPERATIONS

20,207 5 1 ------ --- --- NET INCOME (LOSS) 22,460 (15,846) (2,320)

OTHER COMPREHENSIVE INCOME (LOSS) Foreign currency translation

adjustments Attributable to CHNR Shareholders (3,504) (60) (9)

Attributable to non- controlling interests - - - --- --- ---

COMPREHENSIVE INCOME (LOSS) 18,956 (15,906) (2,329) Less

comprehensive loss attributable to non- controlling interests - 833

122 --- --- --- COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO CHNR

SHAREHOLDERS 18,956 (15,073) (2,207) ====== ======= ====== NET

INCOME (LOSS) ATTRIBUTABLE TO: CHNR Shareholders 22,460 (15,013)

(2,198) Non-controlling interests - (833) (122) --- ---- ----

22,460 (15,846) (2,320) ====== ======= ====== NET INCOME (LOSS)

ATTRIBUTABLE TO CHNR SHAREHOLDERS: Continuing operations 2,253

(15,016) (2,198) Discontinued operations 20,207 3 - ------ --- ---

22,460 (15,013) (2,198) ====== ======= ====== INCOME (LOSS) PER

SHARE: Basic Income (loss) from continuing operations 0.12 (0.71)

(0.10) Income (loss) from discontinued operations 1.05 - - ---- ---

--- Net income (loss) per share 1.17 (0.71) (0.10) ==== ===== =====

Diluted Income (loss) from continuing operations 0.10 (0.71) (0.10)

Income (loss) from discontinued operations 0.88 - - ---- --- ---

Net income (loss) per share 0.98 (0.71) (0.10) ==== ===== =====

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING Basic 19,323,416

21,123,416 21,123,416 ========== ========== ========== Diluted

22,926,151 21,123,416 21,123,416 ========== ========== ==========

Six Months Ended June 30 ------------------------ 2008 2009 2009

---- ---- ---- RMB RMB US$ NET SALES 38,268 17,563 2,571 COST OF

SALES (16,023) (16,268) (2,381) ------- ------- ------ GROSS PROFIT

22,245 1,295 190 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES,

including share-based compensation expense of RMB13,008 (US$1,904)

for the six months ended June 30, 2009 (2008: RMB13,008) and

RMB6,504 (US$952) for the three months ended June 30, 2009 (2008:

RMB6,504) (21,658) (26,409) (3,867) ------- ------- ------

OPERATING INCOME (LOSS) FROM CONTINUING OPERATIONS 587 (25,114)

(3,677) INTEREST INCOME 1,121 421 61 OTHER INCOME, NET 48 529 78

LOSS ATTRIBUTABLE TO INVESTMENT IN UNCONSOLIDATED INVESTEE (4,437)

(5,665) (829) ------ ------ ---- INCOME (LOSS) FROM CONTINUING

OPERATIONS BEFORE INCOME TAXES (2,681) (29,829) (4,367) INCOME

TAXES (4,941) (1,266) (185) ------ ------ ---- INCOME (LOSS) FROM

CONTINUING OPERATIONS (7,622) (31,095) (4,552) DISCONTINUED

OPERATIONS INCOME (LOSS) FROM DISCONTINUED OPERATIONS 24,451

(15,052) (2,204) ------ ------- ------ NET INCOME (LOSS) 16,829

(46,147) (6,756) OTHER COMPREHENSIVE INCOME (LOSS) Foreign currency

translation adjustments Attributable to CHNR Shareholders (15,753)

438 64 Attributable to non- controlling interests - - - --- --- ---

COMPREHENSIVE INCOME (LOSS) 1,076 (45,709) (6,692) Less

comprehensive loss attributable to non- controlling interests -

7,567 1,108 --- ----- ----- COMPREHENSIVE INCOME (LOSS)

ATTRIBUTABLE TO CHNR SHAREHOLDERS 1,076 (38,142) (5,584) =====

======= ====== NET INCOME (LOSS) ATTRIBUTABLE TO: CHNR Shareholders

16,829 (38,580) (5,648) Non-controlling interests - (7,567) (1,108)

--- ------ ------ 16,829 (46,147) (6,756) ====== ======= ====== NET

INCOME (LOSS) ATTRIBUTABLE TO CHNR SHAREHOLDERS: Continuing

operations (7,622) (29,549) (4,326) Discontinued operations 24,451

(9,031) (1,322) ------ ------ ------ 16,829 (38,580) (5,648) ======

======= ====== INCOME (LOSS) PER SHARE: Basic Income (loss) from

continuing operations (0.40) (1.42) (0.21) Income (loss) from

discontinued operations 1.29 (0.43) (0.06) ---- ----- ----- Net

income (loss) per share 0.89 (1.85) (0.27) ==== ===== ===== Diluted

Income (loss) from continuing operations (0.34) (1.42) (0.21)

Income (loss) from discontinued operations 1.10 (0.43) (0.06) ----

----- ----- Net income (loss) per share 0.76 (1.85) (0.27) ====

===== ===== WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING Basic

18,982,757 20,883,085 20,883,085 ========== ========== ==========

Diluted 22,235,670 20,883,085 20,883,085 ========== ==========

========== CONDENSED CONSOLIDATED BALANCE SHEETS AS OF JUNE 30,

2009 AND DECEMBER 31, 2008 (Amounts in thousands, except share and

per share data) December 31, June 30, June 30, 2008 2009 2009 RMB

RMB US$ (Unaudited) (Unaudited) ASSETS CURRENT ASSETS Cash 120,888

158,504 23,205 Trade receivables: Related parties 70,830 - - Others

4,157 1,755 257 Bills receivable 1,460 - - Note receivable 96,166 -

- Inventories 66,245 5,614 822 Deferred tax assets 5,470 966 141

Other assets 25,061 42,670 6,247 ------ ------ ----- 390,277

209,509 30,672 ASSETS CLASSIFIED AS HELD FOR SALE - 442,543 64,790

--- ------- ------ TOTAL CURRENT ASSETS 390,277 652,052 95,462

INVESTMENT IN UNCONSOLIDATED INVESTEES 22,210 17,489 2,560 ADVANCES

TO UNCONSOLIDATED INVESTEES, NET 39,290 38,346 5,614 PROPERTY AND

EQUIPMENT, NET 238,591 185,545 27,164 DEPOSITS FOR BUSINESS

ACQUISITIONS AND OTHER 119,741 48,119 7,045 ------- ------ -----

TOTAL ASSETS 810,109 941,551 137,845 ======= ======= =======

LIABILITIES AND EQUITY CURRENT LIABILITIES Bills payable - 10,000

1,464 Accounts payable 7,361 17,100 2,504 Advance from customers

15,261 2,781 407 Accrued liabilities 8,014 3,001 439 Income tax and

other taxes payable 12,368 1,192 175 Other payables 25,485 26,933

3,943 Current portion of related party capital lease obligation

9,977 - - Related party payable 18,316 168,396 24,654 ------

------- ------ 96,782 229,403 33,586 LIABILITIES ASSOCIATED WITH

ASSETS CLASSIFIED AS HELD FOR SALE - 107,174 15,690 --- -------

------ TOTAL CURRENT LIABILITIES 96,782 336,577 49,276 ------

------- ------ NON CURRENT LIABILITIES Related party capital lease

obligation, net of current portion 10,780 - - Long term loan -

100,000 14,640 Other payables 10,087 82,612 12,095 ------ ------

------ TOTAL NON-CURRENT LIABILITIES 20,867 182,612 26,735 ------

------- ------ TOTAL LIABILITIES 117,649 519,189 76,011 -------

------- ------ EQUITY China Natural Resources, Inc. equity:

Preferred shares, no par: Authorized -10,000,000 shares; - - -

Common shares, no par: Authorized -200,000,000 shares; Issued and

outstanding - 19,623,416 and 21,123,416 shares at December 31, 2008

and June 30, 2009, respectively 312,081 312,081 45,689 Reserves

7,331 7,331 1,073 Additional paid-in capital 228,752 288,159 42,187

Excess of purchase price over net asset value (7,149) (313,139)

(45,844) Retained earnings 173,087 134,507 19,692 Other

comprehensive loss (35,561) (35,123) (5,142) ------- ------- ------

TOTAL CHINA NATURAL RESOURCES, INC. EQUITY 678,541 393,816 57,655

NON-CONTROLLING INTERESTS 13,919 28,546 4,179 ------ ------ -----

TOTAL LIABILITIES AND EQUITY 810,109 941,551 137,845 =======

======= ======= Mr. Feilie Li, the Company's Chairman and CEO,

commented on the 2009 interim results "the first half of 2009

posted a challenge to the operation of China Natural Resources. The

global financial crisis caused the PRC economy to slow down

sharply. Base metal prices fell in general as compared to the first

half of 2008 amid slowing industrial production. However, China is

expected to recover at a faster pace than other countries, and our

mining operations are poised to benefit from the mainland's growth

prospects and supportive policies. The China economy grew 7.9% year

on year in the second quarter which suggests that the China economy

is expanding and steel demand from downstream customers is

recovering. We expect ore prices to rise in 2010 as demand for

steel recovers and a rebound in industrial production growth. We

remain committed to our strategy in expanding our coal and base

metal resources in the PRC." For the convenience of the reader,

amounts in Renminbi ("RMB") have been translated into United States

dollars ("US$") at the applicable rate of US$1.00 = RMB6.8305 as

quoted by Bloomberg Finance L.P. as of June 30, 2009. The Renminbi

is not freely convertible into foreign currencies and no

representation is made that the RMB amounts could have been, or

could be, converted into US$ at that rate, or at all. The condensed

consolidated statements of operations and comprehensive income

(loss) for the three and six months ended June 30, 2009 (unaudited)

and the condensed consolidated balance sheet as of June 30, 2009

(unaudited) have been prepared in accordance with generally

accepted accounting principles in the United States but omit

certain financial statements and note disclosure that would be

included in full financial statements prepared in accordance with

US GAAP. The condensed consolidated statements of operations and

comprehensive income (loss) for the three and six months ended June

30, 2009 (unaudited) and the condensed consolidated balance sheet

as of June 30, 2009 (unaudited) are derived from, and should be

read in conjunction with, the Company's unaudited condensed

consolidated financial statements for the three and six months

ended June 30, 2009 and 2008, which was filed with the Securities

and Exchange Commission on December 2, 2009 under cover of Form

6-K. The results of operations for the six months ended June 30,

2009 are not necessarily indicative of the results of operations

that may be expected for the year ending December 31, 2009. About

China Natural Resources, Inc. China Natural Resources, Inc., a

British Virgin Islands corporation, through its operating

subsidiaries in the People's Republic of China, is currently

engaged in (a) the acquisition and exploitation of mining rights,

including the exploration, mineral extraction, processing and sale

of iron, zinc and other nonferrous metals, extracted or produced at

mines primarily located in Anhui Province in the PRC, and (b) the

acquisition, exploration, development and production of coal

resources in Guizhou province in the PRC. This press release

includes forward-looking statements within the meaning of federal

securities laws. These forward-looking statements are based upon

assumptions believed to be reliable, but involve risks and

uncertainties that may cause actual results of operations to differ

materially from the forward-looking statements. Among the risks and

uncertainties that could cause our actual results to differ from

our forward-looking statements are our intent, belief and current

expectations as to business operations and operating results of the

Company, uncertainties regarding the governmental, economic and

political circumstances in the People's Republic of China, risks

and hazards associated with the Company's mining activities,

uncertainties associated with ore reserve estimates, uncertainties

associated with metal price volatility, uncertainties associated

with the Company's reliance on third-party contractors and other

risks detailed from time to time in the Company's Securities and

Exchange Commission filings. Although the Company's management

believes that the expectations reflected in forward-looking

statements are reasonable, it can provide no assurance that such

expectations will prove to be accurate. DATASOURCE: China Natural

Resources, Inc. CONTACT: Edward Wong, Chief Financial Officer,

+011-852-2810-7205 or

Copyright

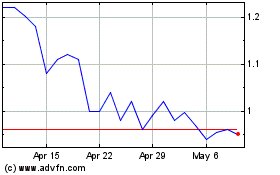

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From May 2024 to Jun 2024

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Jun 2023 to Jun 2024