Earnings Preview: Check Point - Analyst Blog

April 12 2011 - 8:45AM

Zacks

Check Point Software

Technologies (CHKP) is scheduled to announce its first

quarter 2011 results on April 14, 2011, before market opens and we

see limited revisions in analyst estimates at this point.

Fourth Quarter

Overview

Check Point’s fourth quarter

revenue increased 17.1% from the year-ago period led by strong

Product revenues across all geographical regions. The quarter’s

revenue had surpassed the company’s guided range.

On a GAAP basis, net income per

share surged 25.5% year over year to 64 cents. Excluding the impact

of charges related to amortization of intangible assets, but

including stock-based compensation expense, adjusted net income per

share climbed 22.8% year over year to 70 cents.

Check Point delivered an impressive

fourth quarter, beating Zacks Consensus Estimates both in respect

of revenue and earnings per share. The outperformance was largely

based on continuous networking product adoption including the IP

series, Power-1, UTM-1 and Smart-1 solutions.

Check Point has earned a reputation

among customers and analysts for providing simple, all-in-one

security solutions that provide the highest level of protection to

small and mid-sized businesses and remote/branch offices. Hence, we

believe new product ramps will better serve the growing demand for

Check Point’s security products.

Agreement of

Analysts

Out of the ten and twelve analysts

providing estimates for the first quarter and fiscal 2011,

respectively, none revised their estimates upward in the past 30

days. Also, there was no estimate revision for fiscal 2012.

The limited number of changes to

estimates point to the fact that there was no major catalyst during

the quarter that could drive results. Consequently, most of the

analysts are sticking to the estimates they projected post fourth

quarter earnings.

The analysts are confident about

Check Point’s market share gain versus tech giant Cisco

Systems Inc. (CSCO) based on strong demand for its

high-end (Power-1) and mid-range (UTM-1) appliances. The analysts

are also optimistic about the improved enterprise information

technology spending environment.

Magnitude of Estimate

Revisions

There was no change to the Zacks

Consensus Estimates for the first quarter and fiscal 2011 over the

past 30 days. However, the first quarter estimate moved up a penny

in the past ninety days. Also, the Zacks Consensus Estimate for

fiscal 2011 increased 3 cents over the past ninety days. The reason

for the uptick could be the growing demand for Check Point’s

security products. The Zacks Consensus Estimate for fiscal 2012

witnessed a significant jump of 8 cents since the third quarter

results.

Recommendation

We remain encouraged by the steady

traction of Software Blade architecture (security solution) that

will likely lead to a solid fourth quarter. We believe this would

drive considerable upside to the shares. However, increased

competition from Juniper Networks Inc. (JNPR) and

Microsoft Corp. (MSFT) are concerns.

Currently, CheckPoint has a Zacks

Rank of #3 implying a short-term Hold recommendation.

CHECK PT SOFTW (CHKP): Free Stock Analysis Report

CISCO SYSTEMS (CSCO): Free Stock Analysis Report

JUNIPER NETWRKS (JNPR): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

Zacks Investment Research

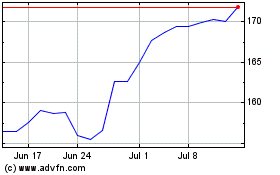

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

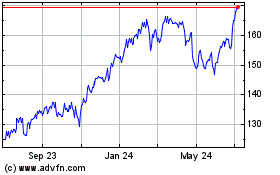

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024