Current Report Filing (8-k)

October 08 2020 - 5:10PM

Edgar (US Regulatory)

false 0001590895 0001590895 2020-10-06 2020-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

October 6, 2020

Date of Report (Date of earliest event reported)

Caesars Entertainment, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36629

|

|

46-3657681

|

|

(State of

Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

100 West Liberty Street, Suite 1150

Reno, Nevada 89501

(Address of principal executive offices, including zip code)

(775) 328-0100

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, $0.00001 par value

|

|

CZR

|

|

NASDAQ Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

In connection with its previously-announced proposed acquisition of William Hill plc (the “Acquisition”), on October 6, 2020, a subsidiary of Caesars Entertainment, Inc. (“Caesars” or the “Company”) entered into a £1,546.5 million interim facilities agreement (the “Interim Facilities Agreement”) with Deutsche Bank AG, London Branch and JP Morgan Chase Bank, N.A. (the “Arrangers”). Pursuant to the Interim Facilities Agreement, the Arrangers have made available to the Company: (a) a 540-day £1,043.9 million asset sale bridge facility and (b) a 60-day £502.6 million cash confirmation bridge facility (collectively, the “Facility”). The Facility may be used to finance or refinance the Acquisition, refinance or otherwise discharge the indebtedness of William Hill and its subsidiaries, pay transaction fees and expenses related to the foregoing and for working capital and general corporate purposes, among other things. The availability of the borrowings under the Facility is subject to the satisfaction of certain customary conditions. As of the date hereof, the Facility remains undrawn. If drawn upon, outstanding borrowings under the Facility will bear interest at a rate equal to the London interbank offered rate plus 3.50% per annum. The Company entered into the Interim Facilities Agreement in connection with its requirement under applicable United Kingdom law to demonstrate that it has “funds certain” to pay the entirety of the cash purchase price for the Acquisition.

A copy of the Interim Facilities Agreement is attached hereto as Exhibit 10.1 and is incorporated herein by reference. The foregoing description of the Interim Facilities Agreement is qualified in its entirety by reference to the full text of the Interim Facilities Agreement.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. You can identify these statements by Caesars’ use of the words “continue,” “may,” “will,” and similar expressions that do not relate to historical matters. All statements other than statements of historical fact are forward-looking statements. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors which are, in some cases, beyond Caesars’ control and could materially affect actual results, performance, or achievements. These forward-looking statements include the use of the Facility related to the Acquisition.

Although Caesars believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. Caesars cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Important risk factors that may affect Caesars’ business, results of operations and financial position are detailed from time to time in Caesars’ filings with the Securities and Exchange Commission. Caesars does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

*

|

Annexes, schedules and/or exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted attachments to the SEC on a confidential basis upon request

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CAESARS ENTERTAINMENT, INC.

|

|

|

|

|

|

|

Date: October 8, 2020

|

|

|

|

By:

|

|

/s/ Bret Yunker

|

|

|

|

|

|

|

|

Bret Yunker

|

|

|

|

|

|

|

|

Chief Financial Officer

|

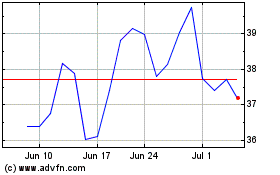

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Aug 2024 to Sep 2024

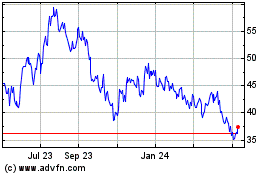

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Sep 2023 to Sep 2024