Current Report Filing (8-k)

March 11 2022 - 5:16PM

Edgar (US Regulatory)

0001362190

false

0001362190

2022-03-09

2022-03-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): March 9, 2022

AUDIOEYE, INC.

(Exact name of registrant as specified in charter)

| Delaware |

001-38640 |

20-2939845 |

| State of Other Jurisdiction of Incorporation |

Commission File Number |

IRS Employer Identification No. |

5210 E. Williams Circle, Suite 750

Tucson, Arizona 85711

(Address of principal executive offices / Zip Code)

(866) 331-5324

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act. |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.00001 per share |

|

AEYE |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

On March 9, 2022, AudioEye,

Inc. (the “Company”) entered into a Stock Purchase Agreement by and between the Company, as Buyer, Mark Shapiro, Kim Testa,

Garry Harstad, Ken Berquist and Betaspring Fund 100, LLC, a Delaware limited liability company (collectively “Sellers”), and

Mark Shapiro, as Sellers’ Representative (the “Purchase Agreement”).

Pursuant to the Purchase Agreement,

on March 9, 2022, the Company purchased all of the issued and outstanding equity securities of Bureau of Internet Accessibility Inc.,

a Delaware corporation (“BOIA”), from the Sellers (the “Acquisition”) for the cash purchase price of $5.0 million

(the “Purchase Price”). The Purchase Price is subject to customary adjustments for cash and indebtedness of BOIA as of the

closing, Acquisition expenses and BOIA’s net working capital. Based upon the performance of BOIA, Sellers may also be entitled to

(i) an additional payment in the aggregate amount of $1.0 million on or around the first anniversary of the closing of the Acquisition,

and (ii) certain earn-out consideration tied to BOIA’s revenue, calculated following the end of the 2022 and 2023 calendar years, with the total consideration payable to Sellers not to exceed $10.5 million, subject to the customary adjustments to the Purchase

Price mentioned above.

The

Purchase Agreement contains standard representations, warranties and covenants, and mutual indemnification provisions. Sellers,

except for Betaspring Fund 100, LLC, are subject to a five-year non-competition covenant and non-solicitation covenant.

The foregoing description

of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, a copy

of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

The representations, warranties

and covenants in the Purchase Agreement have been made only for the purposes of, and were and are solely for the benefit of the parties

to, the Purchase Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential

disclosures made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing

these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable

to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made

or at any other time, and investors should not rely on them as statements of fact. In addition, such representations and warranties were

made only as of the date of the Purchase Agreement or such other date as is specified in the Purchase Agreement. Accordingly, the Purchase

Agreement is included with this filing only to provide investors with information regarding the terms of the Purchase Agreement, and not

to provide investors with any factual information regarding the Company or BOIA or their respective businesses.

| Item 7.01 | Regulation FD Disclosure. |

On March 10, 2022, the Company

issued a press release announcing the matters described in Item 1.01 above. A copy of the Company’s press release is furnished herewith

as Exhibit 99.1.

The

information set forth in this Item 7.01 and in Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such section nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation

language in such filing, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

| Exhibit |

|

|

| Number |

|

Description |

| |

|

|

| 10.1 |

|

Stock Purchase Agreement dated as of March 9, 2022 by and between AudioEye, Inc., Mark Shapiro,

Kim Testa, Garry Harstad, Ken Berquist and Betaspring Fund 100, LLC, and Mark Shapiro, as Sellers’ Representative |

| |

|

|

| 99.1 |

|

Press Release issued March 10, 2022 |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| March 11, 2022 |

AudioEye, Inc. |

| |

(Registrant) |

| |

|

|

| |

By |

/s/ James Spolar |

| |

Name: |

James Spolar |

| |

Title: |

General Counsel and Secretary |

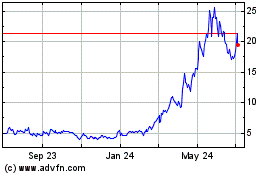

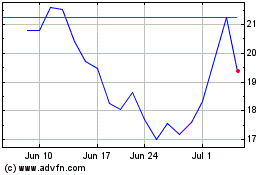

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From May 2024 to Jun 2024

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From Jun 2023 to Jun 2024