Asure Software Response to Schedule 13D Filed by Red Oak Partners, LLC on May 13, 2009

May 18 2009 - 9:00AM

Marketwired

Asure Software (NASDAQ: ASUR)

To: Stockholders of Record of Forgent Networks, Inc. d/b/a Asure

Software, as of April 13, 2009 (the "Record Date")

Re: Response to Schedule 13D Filed by Red Oak Partners, LLC on

May 13, 2009

Dear Stockholder:

This letter is being furnished to you in response to the

preliminary proxy statement filed by Red Oak Partners, LLC as part

of its Schedule 13D filing with the SEC on May 13th, 2009. Red

Oak's preliminary proxy statement is currently subject to SEC

review.

The Board of Directors and management of the Company have

carefully reviewed the arguments advanced by Red Oak and believe

them to be misleading and based on faulty reasoning. The Board of

Directors and management also believe that it is of critical

importance for each stockholder to be fully informed of the facts

and rationale behind this vote so as to understand why it is in

stockholders' best interest to vote FOR this proposal.

WE ARE IN FAVOR OF THE GOING PRIVATE PROPOSAL BECAUSE:

(1) The Company currently faces delisting from NASDAQ, which may reduce the

already limited liquidity for all stockholders, while preserving the

high cost of being public and lengthening the time to profitability.

(2) The Company will save an estimated $1 Million a year in costs

associated with being public and thus expects to achieve profitability

sooner.

(3) Paying a premium to buy out fractional stockholders in order to go

private is not only legal and fair to all stockholders, but also

common practice in such transactions.

The Company has a very experienced Board and management that

have spent months, along with outside experts, exhaustively

evaluating various alternatives that could bring the Company to

profitability sooner and increase stockholder value. The resulting

analysis was clear that: 1) the Company was spending over $1

Million a year just on the cost of being public, which is out of

proportion when compared to the Company's revenue from its early

stage software business. 2) The Company's stock currently has

limited liquidity due to the early stage of the Company and market

conditions. In addition, since the Company does not meet the $1.00

minimum bid requirement for NASDAQ it faces delisting. This would

further decrease liquidity for the stock but not reduce the cost

burden of being publicly traded. 3) The company has aggressively

cut costs and will continue to do so, but certain expenses such as

its non-terminable building lease are contractual obligations that

do not accommodate a short-term solution.

The Company has never considered going private in order to

escape or reduce public or regulatory scrutiny, transparency or

accountability. The Company has a demonstrated history of

compliance and financial transparency of which it is very proud and

it is the intent of the Board to continue these high standards as a

private company. The proposed going private transaction also in no

way diminishes the Company's legal standing and responsibilities as

a Delaware company under Delaware law.

THE COMPANY'S RESPONSE TO WHAT RED OAK WANTS:

-- The Company has for some time had a near term succession plan that

will reorganize management to be more streamlined and efficient after the

going private transaction.

-- The Company pays employees at all levels based upon salary survey data

drawn from companies of commensurate size and geographic region. In

addition, the Board has an independent Compensation Committee that approves

management's recommendations on compensation.

-- The Company already has plans to reduce service provider costs such as

auditing and legal, but only when the Company is private and no longer has

the stringent requirement of public reporting. To reduce provider quality

while a public company is risky and irresponsible.

-- The Company has studied the long-term stock performance of several

other companies who increased their stock price via a reverse stock split

in order to remain listed on NASDAQ. The Company has concluded that the

reverse stock split approach provides little assurance of a sustained

increased stock price.

-- The Company believes that a share repurchase at this time would have

little lasting effect upon the share price, would unwisely deplete the

Company's remaining cash, and would not be in the stockholders' best

interest.

-- The Company has always held its annual meetings in a timely,

consistent manner in accordance with Delaware law. Red Oak appears to be

motivated to hold an annual meeting before the going private transaction is

voted on in order to deny stockholders the right to choose.

-- The current Board of Directors and management is highly qualified and

well vested with beneficial ownership of 6.04% of the Company. We believe

that a Board with excessive stock ownership may not act with the same level

of independence or long-term perspective that best serves stockholder

interests.

The Company senior management and certain Board Members have met

with or spoken to representatives of Red Oak on multiple occasions

at their request. During those discussions the Company shared its

plans and rationale as described above. Red Oak has failed to

provide the Company with acceptable alternative plans.

WE URGE YOU TO VOTE FOR THE GOING PRIVATE PROPOSALS

Thank you for your consideration.

The Board of Directors of Forgent Networks, Inc.

d/b/a Asure Software

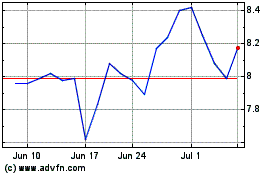

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From May 2024 to Jun 2024

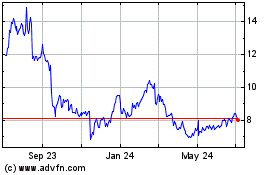

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024