UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| AMERISERV FINANCIAL, INC. |

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

KEITH R. MESTRICH

BETTY SILFA

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to file a preliminary proxy statement

and accompanying WHITE universal proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of

director nominees and certain business proposals at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania

corporation (the “Company”).

On February 1, 2024, Driver

issued the following letter to shareholders of the Company:

February 1, 2024

Dear Fellow AmeriServ Shareholders,

Driver Opportunity Partners I LP (together with its

affiliates, “Driver”, “we” or “us”) is a significant shareholder

of AmeriServ Financial, Inc. (“AmeriServ” or the “Company”).

In the coming months, you are going to hear a lot

from us about two interrelated topics: priorities and performance. Driver believes that priorities determine performance. We believe that

the priorities of the Company’s current board of directors (the “Board”) are entrenchment and the continuation of a

status quo that has benefited AmeriServ’s directors and senior management at the expense of its shareholders. Driver believes that

AmeriServ’s recent and long-term financial performance accurately reflects the Board’s priorities and that change in the Board’s

composition is sorely and urgently needed. Driver has nominated three highly qualified individuals for election to the Board at AmeriServ’s

2024 annual meeting of shareholders (the “Annual Meeting”).

Driver has also submitted several business proposals

to be voted on at the Annual Meeting relating to changes to AmeriServ’s bylaws that Driver believes would make meaningful improvements

in the Company’s corporate governance. Driver’s proposals, among other things, target certain of AmeriServ’s bylaws

that Driver believes serve no legitimate corporate purpose and operate only to further entrench incumbent directors. For example, Driver

has included a proposal to eliminate AmeriServ’s purported “Interlocks Bylaw,” which precludes anyone who serves (or

has served in the past five years) on the board of another depositary institution unless “approved” by the Board. Driver believes

that this bylaw—which the Company admits has nothing to do with any banking law or regulation—is intended to prevent individuals

with the most relevant experience (i.e., serving or having served on the board of directors of a bank), and who would therefore likely

be best positioned to identify what Driver believes is gross mismanagement and misconduct by AmeriServ’s Board and management team,

from being elected to the Board, unless the Board is confident that they will uphold the status quo.

AmeriServ recently reported a loss of $0.20 per share

for the year ended December 31, 2023, which included a loss of $0.31 per share for the fourth quarter of 2023 as a result of Rite Aid

Corporation (“Rite Aid”) filing for bankruptcy, an event that took almost no one by surprise.1

1

From AmeriServ’s fourth-quarter earnings release: “This net loss was caused by an increased provision for credit losses related

to commercial real estate loans that had Rite Aid as a tenant and our decision to execute an investment portfolio repositioning strategy.”

https://investors.ameriserv.com/news/news-details/2024/AMERISERV-FINANCIAL-REPORTS-EARNINGS-FOR-THE-FULL-YEAR-OF-2023-AND-ANNOUNCES-QUARTERLY-COMMON-STOCK-CASH-DIVIDEND/default.aspx.

Maybe it isn’t surprising that AmeriServ failed

to adequately anticipate Rite Aid’s bankruptcy filing. Maybe that is because the Board has been more focused this year on litigation

with current shareholders and a former employee. As evidence of where the current Board’s priorities lie, during 2023, AmeriServ

spent $2.2 million on litigation with Driver.2

Indeed, AmeriServ reported a $0.01 per share loss for the second quarter of 2023 as a result of litigation with Driver.3

Driver believes that there is no reason to expect that AmeriServ will not incur similar litigation expenses during 2024.

The bulk of AmeriServ’s litigation with Driver

stems from the Board’s decision to reject Driver’s nomination of three candidates for election to the Board at AmeriServ’s

2023 annual meeting of shareholders, which deprived all AmeriServ shareholders of a choice in electing directors. Given AmeriServ’s

performance in 2023, it is easy to see why the Board wouldn’t want AmeriServ’s shareholders to have the opportunity to elect

new directors.

However, it seems that AmeriServ’s focus isn’t

limited to preventing AmeriServ’s shareholders from having a choice in the election of directors, as AmeriServ is also suing both

Abbott Cooper, the managing member of Driver’s general partner, and Jack Babich, AmeriServ’s former Senior Vice President

of Human Resources, in connection with an arrangement pursuant to which AmeriServ paid Mr. Babich after his “retirement”

from AmeriServ to keep quiet about the existence of that arrangement and the events leading to Mr. Babich’s “retirement.”4

Between litigating to keep a former employee quiet

about whatever AmeriServ was paying him to keep quiet about and to suppress shareholder democracy, who could expect the Board to have

the time, energy or focus to adequately oversee AmeriServ’s business? Driver believes that AmeriServ’s 2023 performance accurately

reflects what it views as the current Board’s priorities – self-preservation and maintaining the status quo.

NBC News reported: Rite Aid's bankruptcy filing wasn't

a surprise, because the 60-year-old chain has been in dire financial shape for a long time. It has lost money in each of its last six

fiscal years, it had already been closing stores to cut spending, and it was looking at a $1 billion charge related to its role in the

opioid crisis. https://www.nbcnews.com/business/consumer/rite-aid-bankruptcy-means-pharmacies-will-keep-dwindling-rcna120637.

CNN reported: “The bankruptcy was not a surprise.”

https://www.cnn.com/2023/10/15/business/rite-aid-bankrupty-hnk-intl/index.html.

CFO Magazine reported: “The Chapter 11 filing

of the drugstore chain Rite Aid came as little surprise.” https://www.cfo.com/news/rite-aid-bankruptcy-merger-takeover-Walgreens-Albertsons/696746/.

The Philadelphia Inquirer reported: The news of Rite

Aid’s bankruptcy “doesn’t come as a surprise to many.” https://www.inquirer.com/news/nation-world/rite-aid-bankruptcy-restructuring-opioid-settlement-20231016.html#loaded.

2

From AmeriServ’s Fourth Quarter Earnings Release: “The rise in total non-interest expense for the full year is primarily due

to increased legal and professional fees related to the defense against an activist investor and a proxy contest relating to our 2023

annual meeting. These costs amounted to $2.2 million for the full year of 2023.”

3

From AmeriServ’s Second Quarter Earnings Release: “The net loss that AmeriServ Financial reported in the second quarter of

2023 was primarily attributable to legal and professional costs incurred to defend the company against an activist investor waging a proxy

contest for Board seats.” https://investors.ameriserv.com/news/news-details/2023/AMERISERV-FINANCIAL-REPORTS-EARNINGS-FOR-THE-SECOND-QUARTER-AND-FIRST-SIX-MONTHS-OF-2023/default.aspx.

4

Ameriserv Fin., Inc. v. Babich, No. CV 3:23-117, 2024 WL 218369, at *1 (W.D. Pa. Jan. 19, 2024).

It is worth noting that Mr. Babich has asserted that his agreement with AmeriServ is against public policy to the extent that it conceals

a crime and that Driver, as an AmeriServ shareholder, is entitled to any information shared with Driver by Mr. Babich. 2024 WL 218369,

at *4.

THE PATH FORWARD: ADDING NEW, INDEPENDENT, HIGHLY

QUALIFIED DIRECTOR CANDIDATES COMMITTED TO ACTING IN SHAREHOLDERS’ BEST INTERESTS

Driver has nominated three highly qualified individuals

for election to the Board at the Annual Meeting, whose paramount priority, if elected to the Board, will be to make AmeriServ a profitable,

healthy and growing financial institution capable of delivering superior returns to shareholders, meeting the needs of businesses and

consumers in the markets in which it operates, and providing an inclusive and respectful working environment that offers opportunities

for advancement to its employees. If elected, Driver’s nominees will prioritize AmeriServ’s performance, not preserving a

status quo that has seemingly only benefited AmeriServ’s directors and officers.

Driver has nominated Keith R. Mestrich, who has spent

his career at the intersection of the labor movement and finance, including serving as Chief Executive Officer of Amalgamated Financial

Corporation, the largest “union” bank in the United States, Betty Silfa, a lifelong banker with decades of experience as a

commercial lender, and J. Abbott R. Cooper, the managing member of Driver Management Company LLC (“Driver Management”) and

a current board member of The First of Long Island Corporation.

We believe our three nominees are uniquely qualified

to bring fresh perspectives to the boardroom and help catalyze meaningful change at the Company:

Keith R. Mestrich has served as a Managing

Director and Founding Member of Percapita Group, LLC, a digital company that provides access to products and services to help improve

financial wellness, since March 2021, where he also first served as the Chief Revenue Officer from March 2021 to June 2023 and currently

serves as the Chief Strategy Officer since June 2023. Mr. Mestrich also currently serves as an advisor to several small start-up corporations:

GoodChange, a technology company, since February 2023; Allectrify, PBC, a C-PACE platform for lenders, since March 2022; Savi Solutions

PBC, a social impact startup providing student loan advice to individual consumers, since July 2021; and HeyMirza, Inc., a FinTech platform

to deliver tax-efficient employer stipends to a network of caregivers, since June 2021. Mr. Mestrich previously served as President and

Chief Executive Officer of Amalgamated Financial Corporation (NASDAQ: AMAL) (“Amalgamated”), a commercial banking company

and the nation’s largest union-owned bank, from 2014 to January 2021, where he also served as Senior Vice President and directed

its Washington D.C. operation from 2012 to 2014. Mr. Mestrich served as Deputy Chief of Staff and Chief Financial Officer for the Service

Employees International Union (“SEIU”), a labor union, from 2008 to 2012. Mr. Mestrich served as Chief of Staff at Workers

United, a labor union that split off from UNITE HERE to join SEIU, from 2007 to 2008. Mr. Mestrich also served as Director of Corporate

Affairs and Executive Assistant to the International President of the UNITE (n/k/a UNITE HERE), a labor union, from 2002 to 2007. Earlier

in his career, Mr. Mestrich served in various capacities at the AFL-CIO, a democratically governed federation of 60 unions, from 1989

to 2002. Mr. Mestrich served on the board of directors of Amalgamated from 2014 to February 2021. Mr. Mestrich has served as the Advisory

Board Chair at Rose Lake Inc., a public benefit corporation, since March 2022. Mr. Mestrich currently serves as Treasurer and as a member

of the boards of directors of a number of non-profit organizations, including: the Old Bristol Historical Society since October 2022 and

the Frances Perkins Center since January 2021, where he will transition from Treasurer into the role of Chairman of its board of directors

in the end of January 2024. Mr. Mestrich has also served on the Advisory Board of Ownership Works, a non-profit organization advocating

for employee ownership, since April 2022. Mr. Mestrich also currently serves on the boards of directors of the following non-profit organizations:

National Trust for Local News since October 2023, Central Lincoln County YMCA since May 2023 and Coastal Maine Botanical Gardens since

August 2022. Mr. Mestrich served as a member on the Leadership Council of Habitat for Humanity New York City, a non-profit organization,

from 2017 to 2021. He has also previously served on numerous non-profit boards of directors, including: the Sidney Hillman Foundation,

The Roosevelt Institute, Democracy Alliance, The Progressive Congress Foundation, Capital & Main, The Workers Lab, Working America

Education Fund, The Public Utility Law Project of New York, Inc., the Union Health Center, Hot Bread Kitchen, and The Remember the Triangle

Fire Coalition. Mr. Mestrich was the Founder and served as Chair of the Amalgamated Charitable Foundation from 2018 to January 2021 and

currently serves as its Chair Emeritus since January 2021. Mr. Mestrich has represented the Lincoln County (ME) Democrats as a Delegate

to Maine Democratic Party Platform Committee Delegate since May 2023 and is a member of the Town of Bristol, Maine’s Budget Committee,

a position to which he was appointed by the Town’s Select Board. Mr. Mestrich has been a founding member of the Aspen Institute's

Finance Leaders Fellowship since 2016. Mr. Mestrich is also the co-author of Organized Money a history of progressive finance.

Mr. Mestrich graduated magna cum laude with a B.A. in Political Science and Public Policy from Kalamazoo College.

Betty Silfa has served as Director of

Development of A Haven, a nonprofit organization, since January 2024. Prior to this, Ms. Silfa served as Senior Vice President, Pennsylvania

Senior Commercial Lender at Malvern Bank, National Association, a former bank subsidiary of Malvern Bancorp Inc. (formerly NASDAQ: MLVF),

and now a division of First Bank (NASDAQ: FRBA), from March 2021 until January 2024. Previously, she served as Vice President and Commercial

Loan Officer at Mid Penn Bank, a community bank subsidiary of Mid Penn Bancorp, Inc. (NASDAQ: MPB), from September 2019 to March 2021.

Ms. Silfa served as Sales Manager and Vice President at The Bryn Mawr Trust Company, a commercial bank subsidiary of WSFS Financial Corporation

(NASDAQ: WSFS), from October 2018 to September 2019. She also previously served as Senior Relationship Manager, Vice President at M&T

Bank Corporation (NYSE: MTB), a bank holding company, from March 2018 to October 2018. Prior to that, Ms. Silfa served as Senior Relationship

Manager, Vice President at Santander Bank, N.A., an American bank operating as a subsidiary of Banco Santander, S.A. (d/b/a Santander

Group (NYSE: SAN)), from 2016 to February 2018. From 2015 to 2016, Ms. Silfa served as Senior Commercial Lender, Vice President at DNB

First, National Association, a community bank subsidiary of DNB Financial Corporation. Ms. Silfa joined Citibank N.A., the primary U.S.

banking subsidiary of Citigroup Inc. (NYSE: C), in 1998 and held several management positions, including serving as Senior Vice President,

Relationship Manager from 2007 until 2015. Ms. Silfa has served on the West Chester University Council of Trustees, the board of trustees

of a public university, since January 2021. She has served on the boards of directors at several nonprofit organizations, including Lionville

Community YMCA since January 2021, The PASSHE Foundation since January 2021, Chester County Futures since 2013, and the CareLink Foundation

since 2013. Additionally, Ms. Silfa has served as an instructor at the American Institute of Banking, a provider of specialized education

and training for the banking industry, since 1994, and she has also worked with several chambers of commerce, including Delaware County

Chamber of Commerce, Main Line Chamber of Commerce, West Chester Chamber of Commerce, Hispanic Chamber of Commerce and Chilean Chamber

of Commerce. Ms. Silfa received a Bachelor of Business Administration from Pace University and a Human Resource Management Certificate

from Villanova University.

J. Abbott R. Cooper is the Founder and

Managing Member of Driver Management, a value-oriented investment firm, since 2018. Mr. Cooper has been an attorney at Abbott Cooper PLLC,

a law firm dedicated to enforcing shareholder rights, since founding the firm in July 2023. Prior to founding Driver Management, Mr. Cooper

founded and was Senior Portfolio Manager of Financial Opportunity Strategy at Hilton Capital Management, LLC, an investment management

firm, from 2015 to 2018. Prior to that, Mr. Cooper was a senior investment banker covering depository institutions at Jefferies Financial

Group Inc. (NYSE: JEF), a financial services company, and Bank of America Corporation (NYSE: BAC), a multinational investment bank and

financial services company. Mr. Cooper began his career as a corporate lawyer, focusing on public and private company mergers and acquisitions,

corporate governance, contests for corporate control and capital markets. Mr. Cooper is a member of the board of directors of the First

of Long Island Corporation (Nasdaq: FLIC). Mr. Cooper earned a B.A. in History from the University of Virginia and a J.D. from the University

of Montana School of Law.

We are deeply disappointed by what we view

as the Board’s attempts to disenfranchise shareholders and insulate itself from accountability. We believe that the Board, as currently

constituted, is simply unable to effectively lead and improve financial results at the Company, and it is time for the Board to be reconstituted,

in order to ensure that the interests of shareholders - the true owners of AmeriServ - are appropriately represented in the boardroom.

We look forward to being in touch in the coming

weeks with more information and we thank you in advance for your consideration.

J. Abbott R. Cooper

Managing Member

Driver Management Company LLC

***

About Driver

Driver employs

a valued-oriented, event-driven investment strategy that focuses exclusively on equities in the U.S. banking sector. The firm’s

leadership has decades of experience advising and engaging with bank management teams and boards of directors on strategies for enhancing

shareholder value. For information, visit www.drivermanagementcompany.com.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to file a preliminary

proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission to be used to solicit votes for

the election of director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION

WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper,

Keith R. Mestrich and Betty Silfa.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 426,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 426,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the

426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date

hereof, neither Mr. Mestrich nor Ms. Silfa beneficially own any securities of the Company.

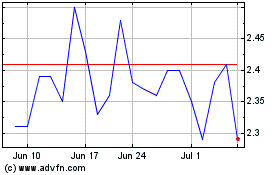

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

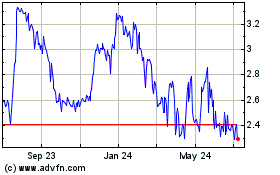

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024