UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| AmeriServ Financial, Inc. |

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT

COMPANY LLC

Driver Opportunity

Partners I LP

J. Abbott R.

Cooper

Keith R. Mestrich

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC (“Driver Management”), together with the other participants named herein (collectively, “Driver”), intends

to nominate, and to file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used

to solicit votes for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania

corporation (the “Company”).

On October 3, 2023, J.

Abbot R. Cooper, Managing Member of Driver Management, and Keith R. Mestrich, potential director nominee to the Company's board of directors,

were quoted in the following article published by American Banker:

Investor recruits veteran exec to end feud that's

cost Pa. bank millions

By John Reosti

Retired Amalgamated Financial Corp. CEO Keith Mestrich

believes he may be just the person to help break a bitter deadlock involving investor Abbott Cooper and the $1.35 billion-asset AmeriServ

Financial in Johnstown, Pennsylvania.

"I think I can help," said Mestrich, who

served as Amalgamated's CEO from 2014 to 2021.

Cooper, founder and managing member of Driver Management

in New York, disclosed Sept. 25 he intends to nominate Mestrich to serve as an AmeriServ director in 2024, when the company is scheduled

to hold elections for three open seats.

Cooper also intends to seek a board seat. Driver reported

owning more than 426,000 AmeriServ shares, about 2.5% of the total outstanding, in its latest report filed with the Securities and Exchange

Commission.

AmeriServ is among a handful of banks with unionized

employees. The $7.8 billion-asset, New York-based Amalgamated, founded in 1923 by the Amalgamated Clothing Workers of America, has deep

roots in the labor movement.

Amalgamated grew assets by 60%, to $6 billion, during

Mestrich's CEO tenure. That included the acquisition of the $353 million New Resource Bank in San Francisco in May 2018. Mestrich also

presided over Amalgamated's 2018 initial public offering, along with its return to profitability following several tough years in the

wake of the 2008 financial crisis. Amalgamated lost $50 million from 2010 to 2014 but has been profitable since 2015. Amalgamated reported

net income totaling $46.2 million in 2020, Mestrich's last full year as CEO.

"I think my voice and my perspective could help

here," Mestrich said. "Maybe there's a way to find a solution...The current set of litigation and divisiveness doesn't really

help anyone."

AmeriServe declined to comment and has yet to issue

any statement regarding Mestrich's proposed nomination. Last year, the company added Richard Bloomingdale, retired president of the Pennsylvania

AFL-CIO to its board.

Still, Cooper said the bank would be hard-pressed

to find reasons for rejecting Mestrich's candidacy. Mestrich "has been in organized labor his entire life and he was a CEO,"

Cooper said. "I don't know how anyone can object to his going on the board on a principled basis to begin with, but to not approve

him for the purposes of this ridiculous bylaw is silly."

The AmeriServ corporate bylaw Cooper to which Cooper

referred is one barring director candidates who currently serve as directors on other corporate boards or who have done so within the

past five years. Mestrich left the Amalgamated board in January 2021. The provision can be waived, a step AmeriServ's board has taken

at least once in the recent past when it named Nedret Vidinli, who had served on the board of First Keystone Financial, a director in

2008, Cooper noted.

With that precedent in mind, Cooper has requested

information to help Driver comply with the interlock bylaw, as well as with others. While the sides have exchanged a number of letters,

to date, AmeriServ has declined Cooper's information request.

Cooper described AmeriServ's resistance to his nominees

as "just wrong."

"It guts the notion that shareholders can elect

directors if the board can veto" nominations, Cooper said. "This is going to drag on potentially for another year…The

entrenchment and commitment to preserving the status quo at all costs demonstrated by the board borders on the pathological."

In an Aug. 31 letter to shareholders, AmeriServ stated

its bylaws "exist to protect the best interests of all shareholders...We take their requirements very seriously. Driver's disregard

of our bylaws and failure to present information essential for shareholders to make full assessments of its candidates' qualifications

and ability to serve on the Board should give everyone serious pause."

Mestrich's proposed nomination would represent Cooper's

second stab at effecting some kind of change to the composition of AmeriServ's nine-director board. Branding AmeriServ a longtime underperformer,

Cooper, in January, nominated Julius Rudolph, a prominent Johnstown developer, Brandon Simmons, an attorney and nonprofit executive, as

well as himself for board seats. However the company rejected those nominations in March, citing what it characterized in a press release

as "material defects" in the disclosures Cooper and Driver provided. AmeriServ also cited Cooper's service as a director for

the $4.2 billion-asset First of Long Island Corp. in Melville, New York as a cause for the rejections.

AmeriServ followed its decision by filing suit in

the Court of Common Pleas of Cambria County, Pennsylvania, seeking a declaratory judgment invalidating Driver's nominations. Driver sued

AmeriServ in the United States District Court for the Western District of Pennsylvania March 29. Driver's suit attacked the advance notice

bylaw AmeriServ used to disqualify its three director nominees. Driver also sought an injunction delaying AmeriServ's annual meeting until

its complaint could be adjudicated. While the court declined to postpone the annual meeting — it took place May 26 — arguments

on the merits of the advance notice bylaw, including pretrial discovery, continue.

The dispute has taken a toll on AmeriServ's bottom

line. The company reported a $187,000 second-quarter loss, attributing it to legal and professional fees incurred as part of the dispute

with Cooper, who it described as an "activist investor." In the Aug. 31 letter to shareholders, AmeriServ disclosed that it

spent $1.7 million in the first half of 2023 battling Cooper. AmeriServ claimed Cooper is "directly responsible for the costs we

have had to incur."

Cooper accused AmeriServ of using its corporate bylaws

as a tool to entrench the current board, adding that the company has refused to negotiate despite purported lackluster financial performance.

"Much of the time there's a settlement," Cooper said in reference to past proxy contests. "Even when there's no settlement,

there are settlement discussions. This hasn't been the case here at all…They're hellbent on who knows what."

For its part, AmeriServ stated in press release that

it "sought in good faith to...solicit Driver's views on director refreshment and contemplated governance enhancements," but

added Driver and Cooper were unwilling "to engage in a productive and private dialogue."

AmeriServ's legal and professional charges are likely

to continue mounting as the discovery process in his lawsuit unfolds, according to Cooper. "Here is my playbook: I'm not going anywhere,"

Cooper said. "It's not the end of the world to reach a settlement and get some change on the board."

Ironically, after the $12.8 billion-asset First Foundation

Inc. settled a similar dispute with Driver in April, permitting Allison Ball, a director candidate nominated by Driver, to stand for election

at First Foundation's annual meeting in June. Ball, failed to win a board seat.

"If there's any way I could [continue the] fight

with First Foundation, I'd be doing it, but we just lost," Cooper said.

If he does ultimately take a seat at the AmeriServ

board table, Mestrich said he would be an independent voice. While Cooper is proposing his nomination, "I don't work for Driver,"

Mestrich said. "It's an opportunity to be helpful for shareholders."

"I think I have always been someone who can represent

everybody and bring people together," Mestrich added. "Maybe I can contribute and help overcome a contentious situation; maybe

help the company do a little better and maybe, just maybe, be of some value for all the shareholders."

Cooper has not pressed AmeriServ to consider strategic

options, noting a merger would likely be difficult to negotiate in the current economic climate. "Certainly, if an offer came in

they should take it seriously, but I don't know that running a process or hanging out the for sale sign would be the best option,"

Cooper said. "It definitely could be a distraction that doesn't result in anything."

Cooper has called for shaking up AmeriServ's management

team, as well as adjusting the company's incentive policies. Current incentives are set too low, Cooper argued. "Incentives really

work and what [AmeriServ] is doing is incentivizing underperformance by setting targets that are 50% for those of peers."

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to nominate, and to

file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes

for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper

and Keith R. Mestrich.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 426,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 426,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the

426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date

hereof, Mr. Mestrich does not beneficially own any securities of the Company.

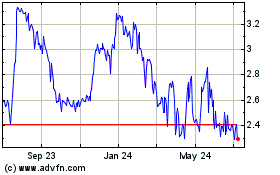

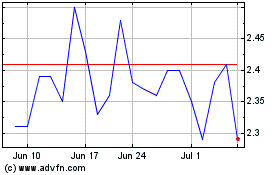

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024