Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

September 14 2023 - 5:02PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| AmeriServ Financial, Inc. |

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT

COMPANY LLC

Driver Opportunity

Partners I LP

J. Abbott R.

Cooper

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to nominate, and to file a preliminary

proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of,

director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation (the “Company”).

On September 14, 2023,

Driver sent the following letter to Mr. J. Michael Adams, Chairman of the board of directors of the Company:

September 14, 2023

VIA EMAIL

J. Michael Adams

Chairman

Board of Directors

AmeriServ Financial, Inc.

216 Franklin Street

Johnstown, PA 15901

Mr. Adams,

Reference is made to my letter dated September 6, 2023; capitalized

terms used but not defined herein shall have the meaning given them in that letter.

The Interlocks Bylaw first appeared in the Bylaws in 2003. In

2008, Nedret Vidinli was appointed to the Board. Mr. Vidinli was then elected to the Board at AmeriServ’s 2009 annual meeting of

shareholders. When he was appointed to the Board and when he was elected to the Board, Mr. Vidinli was a director of First Keystone Financial,

Inc., the parent and sole shareholder of First Keystone Bank, a federally charted stock savings bank. First Keystone Bank’s primary

market area consisted of Delaware and Chester Counties in Pennsylvania.

Again, please provide the process for obtaining the “approval”

contemplated by the Interlocks Bylaws. Assuming the Board “approved” Mr. Vidinli, there must be a process in place for obtaining

that approval, along with objective criteria to be used in the Board’s determination to grant such approval. Given the fact that

the Board had previously approved Mr. Vidinli, the geographical distance of FLIC from AmeriServ, particularly relative to AmeriServ’s

distance from Delaware and Chester Counties, would suggest that there is no reasonable likelihood of any conflict of interest presented

by an individual simultaneously serving on the boards of AmeriServ and FLIC.

In addition, I note that your biography in AmeriServ’s

2011 proxy statement states “Mr. Adams currently serves as chairman of the committee which reviews applications and interviews candidates

for the U.S. District Court for the Western District of Pennsylvania.”1

Please disclose the dates of your service on that committee and whether you are still serving on that committee.

/s/ Abbott

1 https://www.sec.gov/Archives/edgar/data/707605/000119312511072422/ddef14a.htm.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to nominate, and to

file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes

for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”) and J. Abbott R.

Cooper.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 350,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 350,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the

350,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 350,503 shares of Common Stock directly beneficially owned by Driver Opportunity.

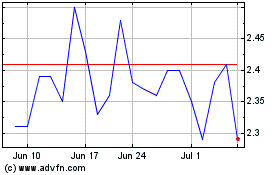

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

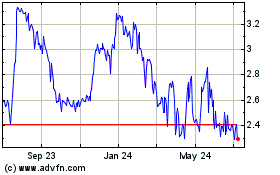

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024