Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

September 12 2023 - 4:17PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

AMERISERV FINANCIAL, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to nominate, and to file a preliminary

proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of,

director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation (the “Company”).

On September 12, 2023,

Driver sent the following letter to the Company’s counsel:

September 12, 2023

Ms. Stacey Scrivani

Stevens & Lee

111 N. Sixth Street

Reading, PA 19603

By email to stacey.scrivani@stevenslee.com

Stacey,

Reference is made to your letter dated August 21, 2023 and email

dated August 22, 2023, both sent in response to my letter of August 1, 2023 demanding that the board of directors (the “Board”)

of AmeriServ Financial, Inc. (“AmeriServ”) appoint a special litigation committee (“SLC”) to investigate

whether current and former members of the Board violated their fiduciary duties in connection with costly and ongoing litigation intended

to deny AmeriServ’s shareholders the opportunity to vote for those candidates (“Driver’s Nominees”) for

election to director nominated by Driver Opportunity Partners I LP (together with “Driver”) at AmeriServ’s 2023

annual meeting of shareholders (the “2023 Annual Meeting”).

The crux of our demand is that denying shareholders the right to

vote for Driver’s Nominees at the 2023 Annual Meeting did not serve any cognizable interest of AmeriServ the corporation (as opposed

to the personal interests of the Board by ensuring that only those candidates selected by the Board could be elected director) and that

the ongoing litigation to defend the Board’s determination to reject Driver’s notice of nomination (litigation that was responsible

for AmeriServ reporting an operating loss for the quarter ended June 30, 2023) has injured, and is continuing to injure, AmeriServ.

Given that the injury to the Corporation is ongoing, please confirm

that the SLC has been appointed and provide an estimated date for the completion of the SLC’s investigation. To the extent that

the SLC concludes that expending and continuing to expend corporate resources to defend the Board’s decision to deny shareholders

the opportunity to vote for Driver’s Nominees constitutes a breach of fiduciary duty and a violation of the Pennsylvania Business

Corporation Law and federal securities law, it would be better to reach that conclusion sooner rather than later and put an end to the

ongoing corporate waste.

In addition, you confirmed in your email that the SLC will be empowered

to engage its own counsel. Please confirm that the SLC has not and will not retain Stevens & Lee, who has been the primary beneficiary

of the complained of litigation, and disclose the name of any counsel retained by the SLC.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to nominate, and to

file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes

for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”) and J. Abbott R.

Cooper.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 350,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 350,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the

350,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 350,503 shares of Common Stock directly beneficially owned by Driver Opportunity.

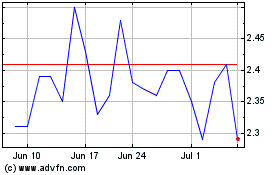

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

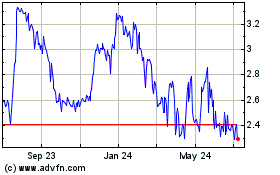

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024